In 2021, tax rules changed greatly: canceled UNVD, expanded the scope of the application of a patent and added limits on a simplified tax system. Magazine "Delobanka" has already published news on canceling and a detailed review of the patent. It's time to deal with simplistic. We tell how limits changed, the rules for calculating payments and the delivery of declarations on USN.

If you want to know about all changes per minute, read a short review at the end of the material.

When ENVD was canceled, entrepreneurs began to move onto a patent, self-employment or simplified. But if the first two tax regimes can be selected at any time, then the transition term to the USN is limited.As a general rule, the company and IP are notified of the transition to simplifying until December 31. For this, they fill out the form number 26.2-1 and send it to the inspection of the FTS at the place of registration of the business. If you do not have time, then the IP is transferred to patent or self-employment, and legal entities remain on the general taxation system by the end of the year.

But there is one exception. If in the fourth quarter of 2020, business worked on UTII, it is possible to submit a notice until March 31. It is important that the income of the company or IP for the first nine months of 2020 does not exceed 112.5 million rubles.

Simplified is two types:

Revenues. Pay taxes on USN only from the income received. Earned 10 million rubles - paid 600 thousand rubles at a rate of 6%.

Revenues minus costs. Pay taxes only with profits. Earned 10 million rubles, they spent 5 million rubles - paid 750 thousand rubles at a rate of 15%.

We told in our article than different types and which one is better to choose. If you have not worked on the USN, but you plan to read it.

It is believed that the rate of UPN "income" is equal to 6%, and according to USN "revenues minus expenses" is equal to 15%. In Moscow, this is true. But in other regions, the rates differ. For example, in St. Petersburg, they take only 7% of the profits, and in the Ivanovo region only 4% of income. Colleagues from "1C: ITS" made a table with the rates of simplification for each region. Use!

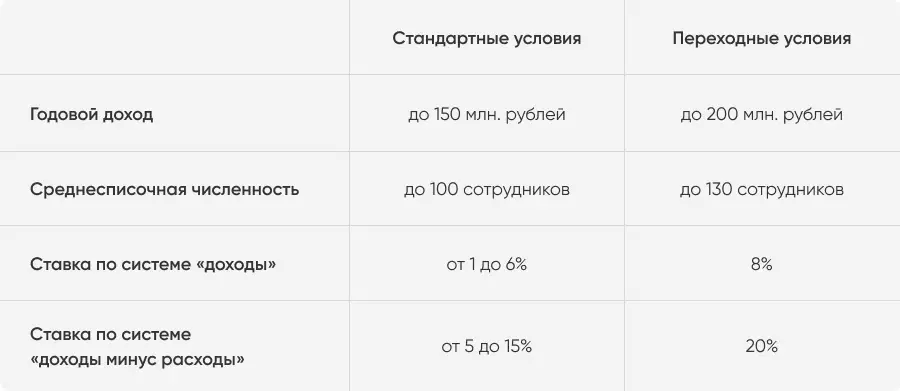

Work on USN can company and IP, which are followed by two limits:

annual income - no more than 150 million rubles;

The average staff number for the year is not more than 100 employees.

Previously, if at least one of the limits is exceeded, the organization was translated into a common tax system. But from 2021 the rules have changed a bit.

From January 1, 2021, the transitional tax regime is valid for "violators" of standard conditions. Limits will increase:

annual income - no more than 200 million rubles;

The average number is not more than 130 employees.

If entrepreneurs accept the work of the 101st employee or earn more than 150 million rubles, he will remain on simplifying. But will pay more: 8% from income or 20% from the difference between income and expenses.

Rates are united for all regions. They are used since the quarter, in which income or staff exceeded standard limits. If the entrepreneur does not break the limits of the transition mode, then from January 1 of the new year will automatically return to standard conditions. If violated - it will turn on it.

New rates are valid for the entire quarter, which happened.

The transition period does not affect the procedure for reporting. The only change is an updated declaration. She added rows and codes for the transition period. The order of filling and surrender did not change. In 2020, entrepreneurs hand over old declarations, but for 2021 only new ones will take.

Calculate on the example. Kazan entrepreneur Rifat owns a network of restaurants in Tatar cuisine. It works on simplifying and pays 10% from the difference between income and expenses. Suppose that in 2021, rifat will spend 140 million rubles for a business, and earn 180 million. This is how the income and expenses in the quarters will look like.

This means that counting advance payments on simplifying rifat will be so.

Note: In the third quarter, rifat business revenues will exceed 150 million rubles. This means that the transitional rate will spread to the entire income of the entrepreneur in the third quarter. The new rate will be valid until the end of the year. But since rifat did not exceed a total limit of 200 million rubles, then from 2022 it will return to the standard conditions for simplifying.

The general rule for entrepreneurs: a company or IP is automatically translated on the basis, if they exceed one of the transition limits of the simplification. For example, if you decide to work a 131 state customer or earn more than 200 million rubles. Therefore, entrepreneurs with big turns are important to control finances.

If there is no time to deal with accounting, you can connect the Delobank cloud accounting. The service will help trace the income and expenses, calculate all taxes, form and pass reporting. And if you have any questions, experienced Delobank accountants will help you deal with them.

Sometimes companies lose their rights to work on USN if the prohibitions of paragraph 3 of Article 346.12 of the Tax Code are violated. For the most part, they relate to the field of activity, so such companies FTS immediately refuses to transition to simplified. For example, banks, investment funds, pawnshops. But some factors may appear during the work:

The company opened a branch.

The company or IP began producing excisive goods.

The residual value of fixed assets exceeded 150 million rubles.

The company or IP began to extract and sell minerals.

More than 25% of the authorized capital passed to the property of another organization.

The company goes to the overall taxation system in the quarter, when one of the factors arose. If by the end of the year it will disappear, you can return to simplistic again.

In 2020, they extended the tax holidays on simplifying for some entrepreneurs. Now they will end only January 1, 2024. Do not pay taxes during the first two years of work can entrepreneurs who:

For the first time registered as an IP.

It works in a social, scientific, manufacturing sector or provides household services.

Gets in these areas no less than 70% of the total income.

A specific list of activities according to which the tax holidays are given, regional authorities establish. Like the opportunity to get the tax holidays. For example, Samara and Ryazan regions, Mordovia and the Chuvash Republic have already canceled vacation. But the authorities of St. Petersburg, the Sverdlovsk and Chelyabinsk regions have retained.

View the list of regions and find a list of activities by reference information "ConsultantPlus".

If entrepreneurs exceeded standard income limits in 150 million rubles or a state of 100 people, they pay taxes on the transitional regime. For USN "Revenues" - at a rate of 8%, "Revenues minus costs" - at a rate of 20%.

The transition mode is valid from the quarter in which one of the limits was exceeded. If the business does not exceed the limits of 200 million rubles on income and 130 people on staff, it will return to the standard conditions from the new year.

Usually, you can only go to USN on the new year. But if in the fourth quarter of 2020, the business worked on UNVD, it is possible to submit a notice until March 31, 2021.

Entrepreneurs will hand over a new declaration for 2021. She added rows and codes for the transition mode.

If IP was first recorded and began working in a social, scientific or production sector, it will receive tax holidays until the end of 2023. Types of activity and conditions depend on the region.