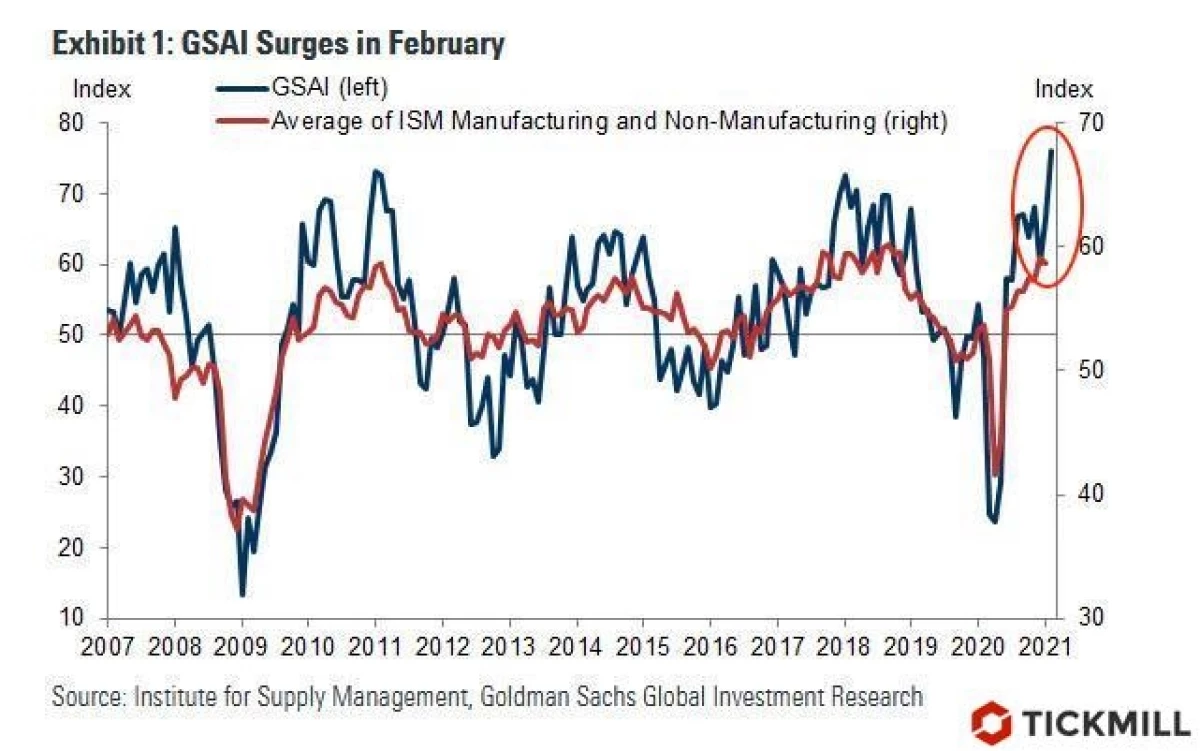

China very convincingly proves that the global economy is rapidly restored. Trade data has shown that exports increased to an impressive 60% yoy for January-February. The indicator significantly exceeded the forecast (40%). Figures for February are generally fantastic - 150% yoy. In many ways, this is the merit of trading partners, especially the United States, whose growth in February even survived the roaring 20th. This indicates, for example, a record value of a leading indicator of economic expansion from Goldman Sachs:

Blue Curve - Indicator of Economic Expansion from GS

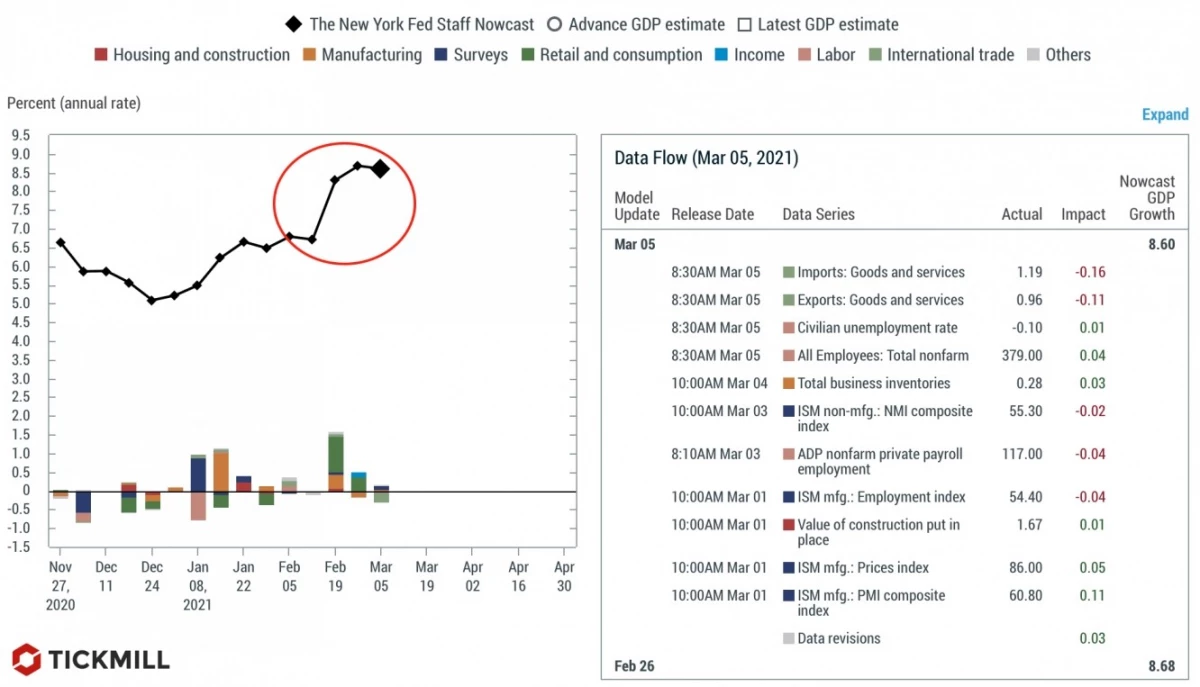

Or, for example, high-frequency US GDP forecast for the first quarter from NY FED:

The forecast climbed up due to strong incoming data and is now 8.5%. And it's still excluding incentives!

Congress approved support measures to 1.9 trillion dollars, but judging by the fact that futures are traded in the Red Zone, no surprise news has not imagined, and incentives are already taken into account in prices.

Equity under pressure, as the stress situation in Trezeris is not doing anywhere. Moreover, the events of the last week (Powell, NFP) only got a trend. I agree, the topic of rates nubilate the Oskomin, but the markets in a sense are now swimming for the buys - from the old Fed, which is sensitive to each tide and tide on the market, there is no trace there, so repeated shocks in the rates like recent are not excluded. They provoke a "whole range of sensations in stocks", once again about this in today's video border.

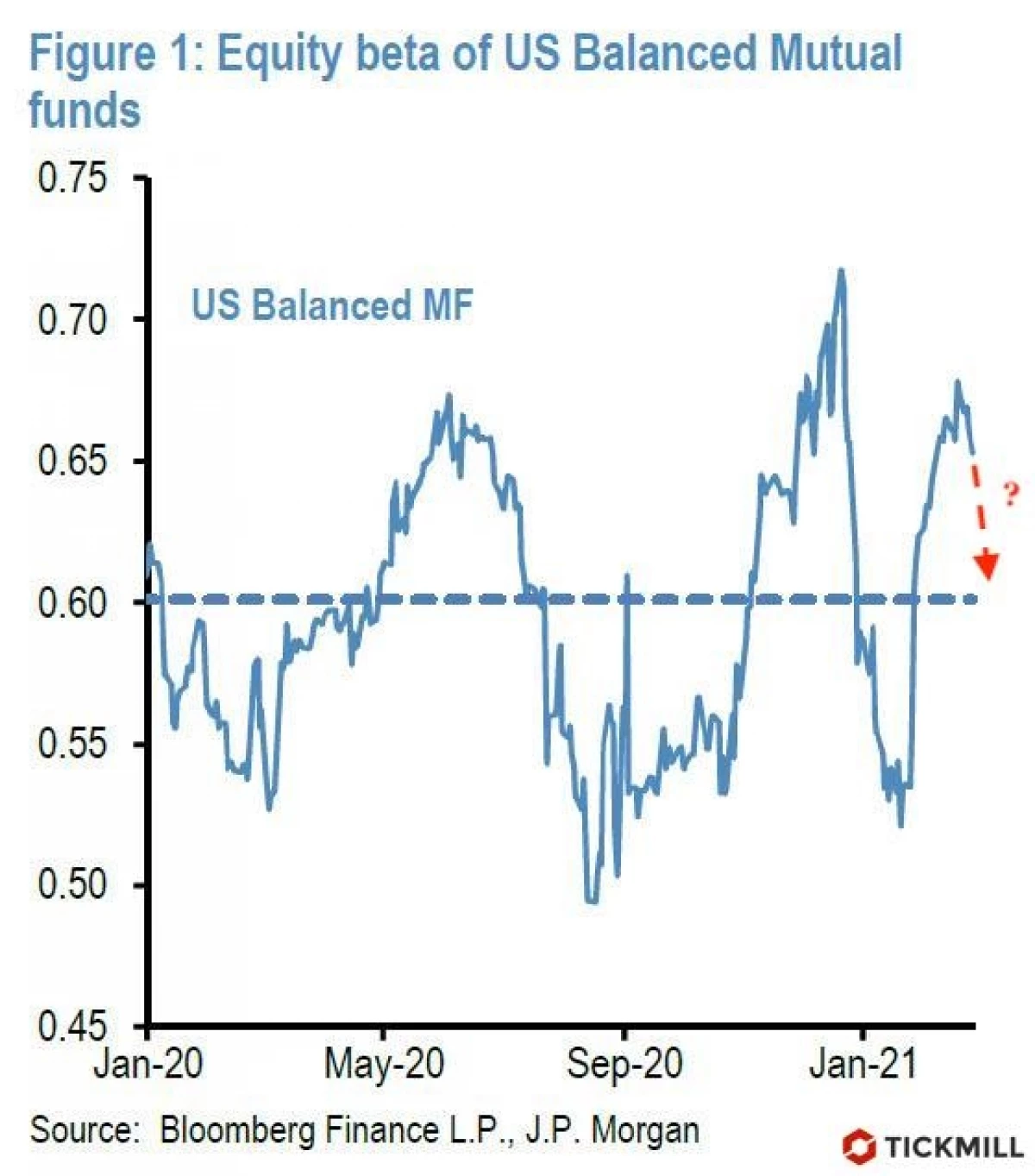

JP Morgan discovered another line of influence of the recent sale in Trezerris on the stock market - rebalancing of large pension and mutual funds. They most likely significantly adjust the proportions of assets in the portfolio, since, firstly, they have advantages in stocks, and secondly, the shares rose well, and the bonds fell well.

There are 4 major players, whose movements need to follow - balanced mutual funds (60:40), US Pension Funds, Norwegian Oil Fund, Japan Pension Fund. They are shifted with different periodicity between the class of assets, but since some of them have been postponed by the procedure, everyone suits the time plus-minus at the end of this quarter. For example, among the US mutual funds today formed a noticeable advantage in the Equity, which sooner or later will have to be adjusted:

JP Morgan appreciates the cumulative potential outflow from stocks caused by sales of these funds at $ 316 billion. Since the event (rebalancing) is more or less likely (the strategy of funds periodically requires this procedure), the remaining market participants may be inclined to try to beat whales that can Press the Fund.

Key events that need to be monitored this week:

According to euro - published today, a report on the assets of assets within the framework of the PEPP ("Pandemic QE", the key program of buying) - will the ECB respond to the growth of profitability in local bonds? If the purchases have increased, the effect for tvro is moderately negative, because The signal that the ECB is concerned. On Thursday - the meeting of the ECB, and again the question is that the regulator thinks about recent movements in Bonds?

On USD - on Wednesday and Thursday are large auctions of 10- and 30-year-old Trezeris. The auction failure will strengthen the pressure on Trezeris, and vice versa, if they open well, risky assets will experience relief. Report on inflation in the United States for February, release is scheduled to Wednesday. Taking into account the latest NFP data, a positive surprise is likely that will support ascending USD correction.

Arthur Idiatulin, Tickmill UK Market Observer

Read Original Articles on: Investing.com