HMRC - Carefully biting dog!

HMRC is a UK governing body when it comes to taxation if you rephrase a quote from HMRC; We collect money that go to pay for public services in the UK, and help families and individuals address financial support.

As the popularity of bitcoins and other cryptoacivals grows over the years, the number of people earning money, investing in them or trading them. Although the UK relatively friendly applies to their citizens who have access to these assets, HMRC does not want to lose sight of. According to the HMRC rules, taxpayers who do not disclose income information, may encounter 20% capital gains plus any interest and fines of up to 200% of any taxes payable. In extreme cases, persons evading taxes threaten imprisonment.

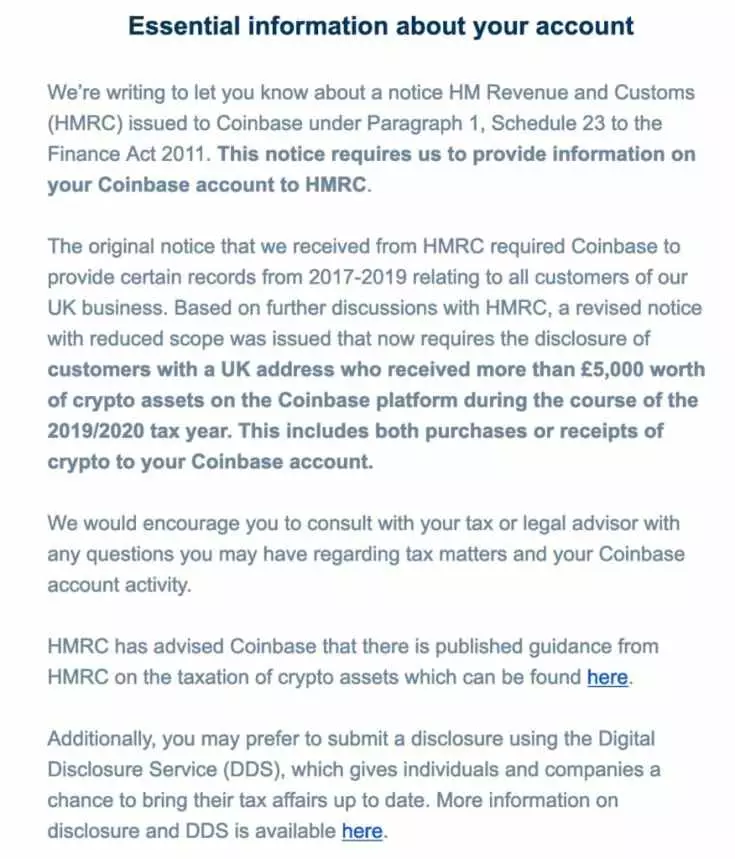

In October 2020, we witnessed one of the most aggressive steps from the HMRC on the control of cryptocurrency assets, using Annex 23 of Finance Law 2011; To legislatively consolidate the Coinbase casteal stock exchange to provide information about all users from the UK, whose wallets received more than 5,000 pounds in the tax year 2019-2020.

It is important to note that so far, it seems, Coinbase is the only exchange that was required to provide this information to HMRC on behalf of its customers. If you made a transaction with cryptocurrency assets outside the coinbase, it is possible that they were not reported in HMRC. That is, if you bought Bitcoin directly through your BINANCE account, it was not reported in HMRC.

In this section, with the help of assembly professionals, Cryptovaya Cryptovati ACCOINTING.COM, the best platform for tracking and taxation on the market, we will consider the functioning of taxation in various situations with cryptoactivities.

It depends on two different things: your tax rate and size of your profits.

- First, good news - you only need to pay capital gains from your total income, which is non-taxable in the amount of 12,300 pounds of sterling (at the time of writing, this is 0.5 Bitcoine).

- If you pay tax at a higher or additional rate, with your capital gains exceeding 12,300 pounds, 20% is charged.

- If you pay the tax on the base rate, it is a bit more complicated. Your tax rate will depend on your taxable income and profit size (after deducting any allowances). An example of this is described in detail below.

As we see on the example of the left, if you are a taxpayer for a base rate and your taxable income plus your capital gains minus annual exemption from taxes is equal to or less than 37,500 pounds, you will pay only 10% of capital gains tax. If the cost exceeds 37,500 pounds sterling, you must pay 20% of the capital gains exceeding 37,500 pounds.

Now, if you have not bought 1 bitcone or equivalent cryptoacive, moved it to your secure wallet, and then never participated in another transaction until the day you got rid of the asset, it is unlikely to be so easy to calculate your capital gain tax .

Specialty in the UK - Association of SharesThe sales price of sale is easy to find out, but if you have acquired more than one (or many different assets) of the same asset, it may be much more difficult to calculate the purchase price, and you may need accounting. Professional to help you. This is calculated using a pool of shares. The idea of association of shares is to averaged the cost of all acquired assets you currently own.

An example of a common pool:

- January 1, Sarah buys 1 Bitcoin for 2,000 pounds.

- On February 1, Sarah buys 1 Bitcoin for 3000 pounds sterling.

- On March 1, Sarah buys 1 Bitcoin for 4,000 pounds.

- At the moment, Sarah has a pool of 3 bitcoins with an average cost of acquiring 3000 pounds each.

- On April 10, Sarah sells 1 Bitcoin for 5,000 pounds.

The growth of Sarah capital will be 2,000 pounds sterling.

If Sarah bought 1 Ethereum and 1 Litecoin into each of the above dates, a separate pool would be created for these digital assets. Thus, you put every asset in a separate pool.

In addition to the general pool, shown above, there are two more rules that you need to remember. This is a rule of one day and a rule of 30 days (also known as a rule over the night and breakfast). None of these rules applies to Sarah, however, if you regularly sell assets, they will most likely be applied to you.

The idea underlying these rules is to prevent the sale of selling when the asset owner is getting rid of the asset, the cost of which decreased, and then soon redeems it back. Such types of sale were very profitable for investors, as it was a loophole to reduce their tax accounts. The rule of one day and the rule of 30 days was introduced in 1998 to prohibit this type of evasive behavior.

Let's first take a rule of one day:

If you sell cryptocurrency and buy another cryptoacive of the same type on the same day, the basis of the value of your sale will be the cost of purchasing cryptocurrencies that you bought on the same day. It will be so, even if the cryptocurrency will be purchased before the sale - provided that they are both in the same day.

Rule 30 days is exactly the same concept: any cryptocurrency you will get within 30 days after the sale will be used as a basis for calculating the cost.

How do these rules work when calculating capital growth?The rules of comparisons mean that during the disposal of the sold assets are compared with other assets acquired in the following order:

- Cryptoacivities purchased on the same day as the disposal ("the rule of the same day")

- Cryptoacivities purchased within 30 days after the day of sale

- All other cryptoaculations for average cost using a pool of shares

Example:

Harry bought 50 Ethereum for 500 pounds in 2016. The current cost of its holding is 25,000 pounds. Harry really wants to take advantage of his exemption from taxes this year.

- The market value of each ETH is 500 pounds sterling.

- The cost of each ETH is 10 pounds sterling.

- The increase in capital in the calculation on this is 490 pounds of sterling.

- Harry sells 25.1 Eth on March 21, 2020 (490 pounds sterling × 25.1 Eth), which fully uses its allowance for capital gains for the tax year.

(Note: At the moment, Harry has successfully used its capital gain for the year and has no tax on his disposal ... However, Harry cannot buy an ETH for another 30 days if he wants to preserve the benefit benefit.)

What happens if Harry buy back to Eth for 30 days?A week later, Harry decides to redeem 25.1 Eth, but in the meantime, ETH went up by 10 pounds sterling. The price for ETH is now 510 pounds.

As a result of the purchase of ETH within 30 days, Harry will need to recalculate capital gains from the sale. Instead of using the price of a starting date of sale, ETH is compared with the newly acquired ETH.

Receipts from sales 25.1 Eth x 500 pounds sterling (March 24) 12550 pounds sterling

Cost 25.1 ETH x 510 pounds sterling (March 31) 12801 pound sterling

Loss £ 251.

As a result of the repurchase of ETH shares during the 30-day period, Harry's sales could not crystallize profits, as expected. This means that he no longer used his capital benefit, and instead created a loss of 251 pound sterling.

All these rules and norms may be tired. In the fuss of everyday life, many people do not want to do their taxes. It is quite understandable! There is a solution on the market that life simplifies you: Accointing.com. This is the best platform for tracking and taxation cryptocurrency in the market. You can easily create tax reports that can be used directly for your tax declaration. In addition to the United States, Germany and other countries, the tool also supports tax reports for the UK.

This article is intended only for informational purposes and should not be perceived as a tax on tax or investment. If you are not sure how many taxes you need to pay, you should consult with the tax consultant or accountant.