From the end of last year, Wildberries in Belarus began to work as a Russian online store. Even earlier, the playground began to charge the prepayment for all ordered goods. If the thing does not fit, the store returns money for it on the card. After all these innovations, Minsk resident Nikita noticed something interesting in the Personal Account on the Tax Site: in the automatically generated tax declaration, the returns for purchases on Wildberries are now marked as income from abroad. He wrote about this on his Facebook page. "It is clear that you can go to the tax, show write off from the card and explain that this is not an income, but a refund. But, again, this is the time you need to spend and how to justify before tax, "says Nikita, Tut.BY.

"In the tax declaration, these returns are counted to income"

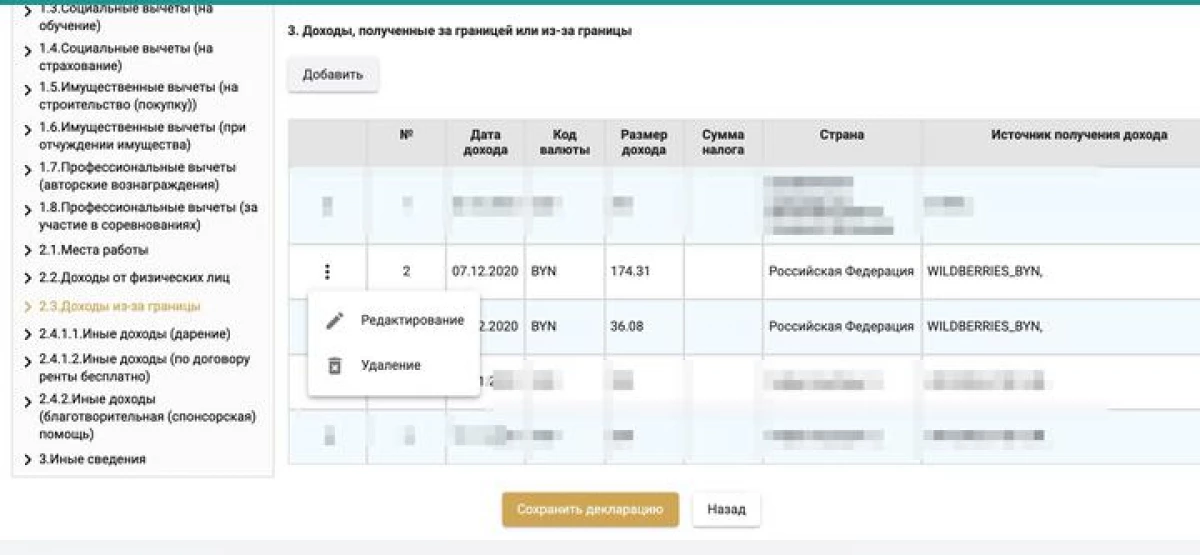

"I decided to check the declaration of an individual, soon because March, it is necessary to report. And what would you think: now the return of your own money is, it turns out that income from abroad. That is, you bought yourself on Wildberries pants, or panties, or something else, I paid for the online card online. Then you didn't like them, you did not take the goods, you made a refund, returned money in a couple of days to the same map you made a payment and ... Bingo! You got the "income" from abroad, be good to pay 13%, "writes in his post Nikita.

At the same time, Nikita says, in 2019 he was already asked to provide explanations in connection with income received from abroad in 2013, 2014, 2017, 2018 and 2019.

"So I learned that if you, for example, play poker and withdraw yourself money to the Belarusian card or make a translation from Russia, then this is considered income from abroad. You need to pay tax or provide documents (checks, something else), which will prove that this income is not taxed. Now it turned out that, buying things and making a refund on Wildberries, you get a refund from a legal entity from the Russian Federation. If you press the "Generate a Declaration on Available in Tax Data" in the Personal Account, then the list in which these returns are counted to income. It is clear that you can go to the tax, show write off from the card and explain that this is not an income, but a refund. But, again, this is the time you need to spend and, as it should be justified before the tax. It turns out: we have found income, you want - explain, do not want - pay 13%, - comments on Nikita's situation.

Return tax is not subject to, but a confirmation document is better to maintain. What does the tax consultant say

Banks, Mail, Money Transfer Services transfer information about all remittances from abroad, including returns to the tax authorities. One day, for example, Minsk shop was asked to report even for returning 1 dollars, which were written off when binding a card in Uber. The tax consultant Marina Grigorchuk emphasizes that the refund of own funds is not a tax facility.

- You do not need to pay tax with the amount of such a return, apply to the tax return with the indication of these revenues - too. But the system is arranged in such a way that the tax authorities accumulate all receipts of funds, and the person himself decides that from this it is necessary to enter into a declaration, and what is not, - comments on a specialist.

At the same time, it is possible that one day in the future, tax authorities may be interested in these unlauded translations and ask to give explanations. In this case, it will take proof that it was the return of funds.

- Tax authorities do not know what it is for the amount why she came. Therefore, just in case it is better to have confirming documents: for example, an extract from the card, information from the personal account on the store's website. All this can be stored just in case in electronic or paper form. If the tax authorities ask for explanations about these revenues, and a person will begin to say that he has no documents have been preserved, it will be his problems, "says Marina Grigorchuk.

The expert advises to keep confirming documents not only about the return of funds for the purchase, but also on other receipts due to the border, which are not the object of taxation.

- If you received money from abroad, it does not mean that only on the basis of this you have to pay tax. We have the Tax Code within which the general procedure for paying taxes is registered. Because of the border, translations from close relatives, money gifts, alimony can come. There are situations where, for example, people living abroad, send money to someone from acquaintances so that they could bring order on the graves of relatives. These translations will not be taxed, the tax declaration is not necessary, but just in case, to store confirmation documents - yes. It may be a written explanation from the people who sent you this translation - comments Marina Grigorchuk. Tut.BY.