On the eve of the reporting of Danone (PA: Dano) (scheduled for February 19), the major shareholder of the French group, the American investment fund Artisan Partners (NYSE: APAM) pointed to the problems in the company and asked to revise the course. InvestFond called on Danone directors to dismiss the Chairman and Chief Executive Director of Emmanuel Faber, to stop the planned reorganization of the group he defended, and sell inefficient brands that are 15% of revenue. The fund, according to its own data, is the third largest Danone shareholder with approximately 3 percent participation.

According to Artisan Partners, Danone lost the culture of innovation, reduced advertising costs, that is, "does not invest enough funds in their brands" and loses market share.

Risks and challenges

Danone was founded in 1919 in Barcelona, during the Second World War moved to New York, and since 1954 her headquarters is located in France. At about the same time, the company came up and brought to the market a new product - yogurt with fruit filling. By the beginning of the 1990s, the company turned into a giant with a large number of diverse brands of Procter & Gamble (NYSE: PG). Danone produced yogurts, cheese, beer, mineral water, baby food, champagne, pasta, biscuits, toasts, various painful products and much more.

She strengthened her position so much that could absorb his competitor, Nestle, but the deal did not take place. Now the company is engaged in the production of dairy products, specialized baby food and drinking water, which are sold in more than 120 countries. Its staff exceeds 100 thousand people working in 55 countries.

The main risks of this company are that sales growth will not correspond to forecasts (inability to increase sales of lactic acid products), it is possible to slow down the growth of the Chinese market against the background of the high base last year, and indicators in emerging markets may be worse than expectations. Highly high leverage makes a company vulnerable to a decrease in EBITDA. In addition, the preservation of restrictions caused by a pandemic can negatively affect the sales of bottled water (closing of cafes and restaurants).

Now the company is reviewing the development strategy for adapting to the changing market needs, so 2021 can become transitional. Danone develops new regions, revises product line, but this process is slow enough, investors want to see faster rates (the company has already defined the Argentine division and brand of vegetable protein cocktails VEGA as potential candidates for sale), sold a share in the Chinese dairy company Yakult for 470 million euros. Among the anti-crisis measures is also a complete strategic analysis of brands, SKUs and assets in order to rationalize the portfolio, which may mean an exception to 30% of its articles. The plans - doubling the sales volumes of the largest brands.

Strengths

The main organizational and managerial changes are related to the departure of the Cecilian Cecilis Cecilis and Francisco Camacho (executives with 40-year-old experience in Danone). Appointment of macro-regional general directors (Danone International 80% sales and Danone North America 20% sales) for making decisions at the local level.

According to our forecasts, the adjusted portfolio of goods should be relatively resistant to the burst of the second wave of COVID-19. This preceded:

1) the introduction of measures to improve efficiency and cost control, among which the potential reduction of costs and portfolio optimization.

2) the active development of electronic sales channels and successful innovation.

3) It is expected that the company's sales growth will continue to consistently improve. Danone puts medium-term goals for profitable sales by 3-5% (some brands - Silk, SO Delicious, Horizon, Actimel and Alpro are growing at a double-digit rate).

4) Danone increased the number of innovations in his dairy business to encourage consumers to try new, more expensive vegetable products products, and the growth of sales of these products begins to increase.

Nearest competitor

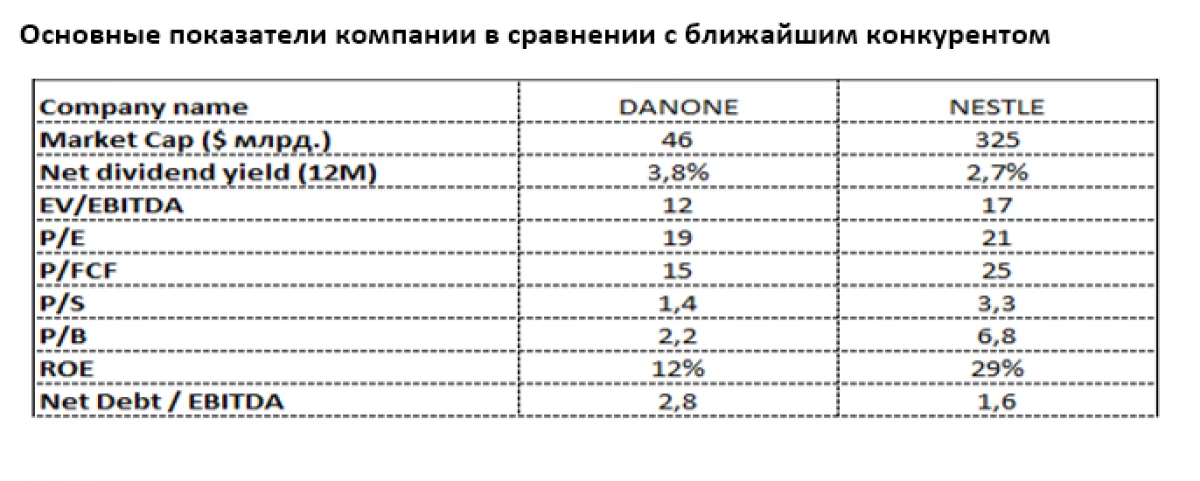

The nearest comparable from the Danone company is the Swiss food giant Nestle (SIX: NESN) also with a strong presence in the dairy industry, but with much greater diversification. The prospects for premium dairy products remain attractive due to the greater attention of the riching population of the Earth to the quality of products, especially children's.

Now Nestle is much more generously appreciated by the market, despite the greater yield of Danone dividends (3.8% in the euro against 2.7% from Nestle). A significant danone lag from Nestle is particularly pronounced in terms of P / B (2.2 versus 6,8), p / s (1.4 against 3.3) and P / FCF (15 against 25). Despite the big debt burden than Nestle, the net duty of Danone remains moderate X2.8 EBITDA. The relatively low ROE (12% against 29% Nestle) indicates the potential to improve the yield of Danone, which is already a priority of management in the short term.

Evgeny Shatov, Governing Partner "Borselle"

Read Original Articles on: Investing.com