For each adult, Kazakhstan today has 4 cards today, reports inbusiness.kz with reference to Ranking.kz.

The payment card market in Kazakhstan has become more affordable, and related banking services and suggestions are more diverse.

Relatively recently, the card was used mainly to cash out funds received - for example, salaries, "but today the card itself has become a convenient and reliable payment. Kazakhstanis increasingly refuse cash calculations and confidently go to non-cash payments.

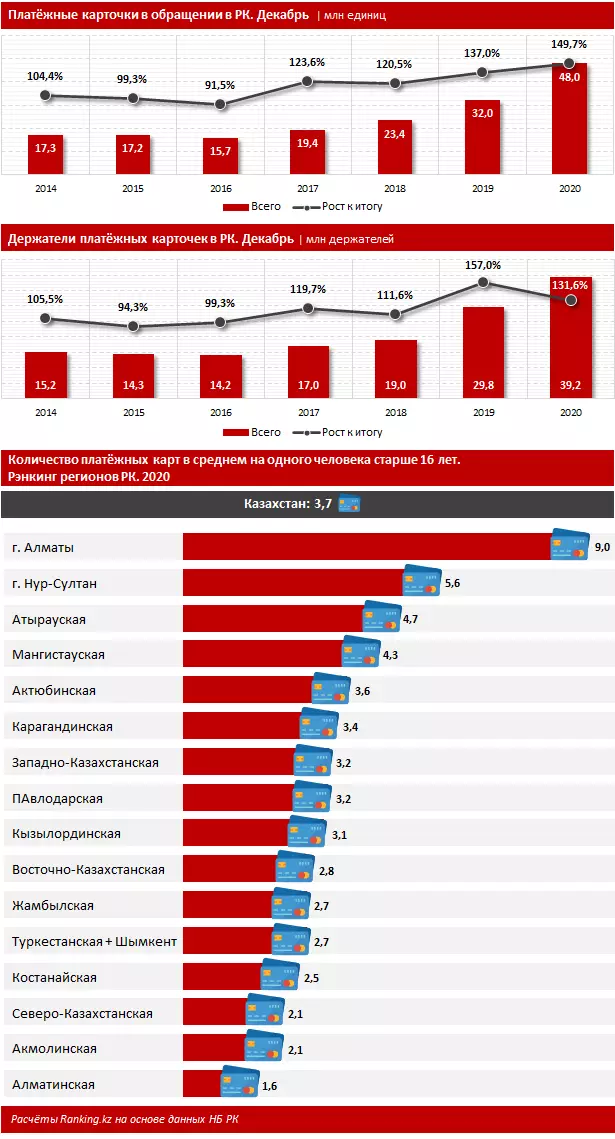

As of January 1, 2021, 48 million payment cards in circulation appeared in the Republic of Kazakhstan - at once 49.7% more than in the same period of the previous year (32 million). Over the past three years, the number of cards in circulation is growing on average by 35.7% per year. Accordingly, the number of holders of these cards is growing. So, in 2020 the indicator increased by 31.6%, to 39.2 million.

Today, for each adult, Kazakhstan (from 16 years and older) accounts for almost four payment cards, which ensures the demand for the continuous modernization of the banking distance infrastructure. The absolute leader in this indicator is the Fincentre, Almaty: Here each resident has an average of 9 cards. Meanwhile, for each resident of Nur-Sultan accounts for almost 6 cards. Payment maps and the relevant infrastructure make it possible to cover the entire population with digital services, including those in remote regions of the country.

International and local payment card systems operate on the territory of Kazakhstan. The main share of cards in circulation - more than 67% - traditionally falls on the international platform MasterCard and Visa. The use of products and services of international payment systems provides cardholders with the possibility of holding payment anywhere in the world.

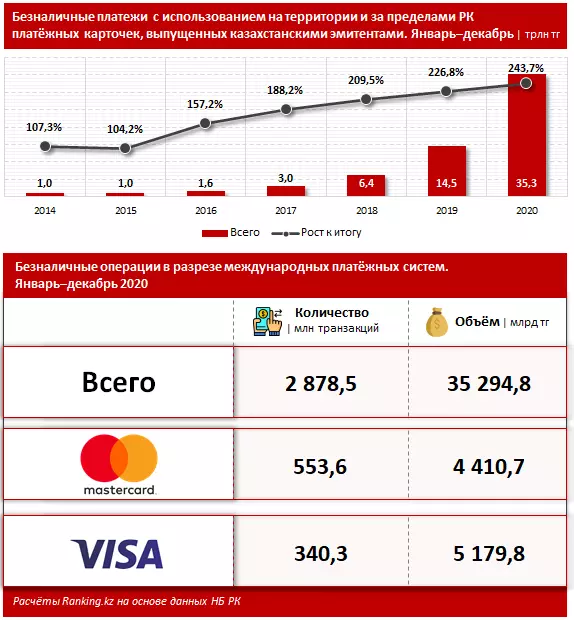

The convenience and advantages of payment cards increase their demand among consumers of financial services. So, in 2020, 2.9 billion non-cash transactions totaling 35.3 trillion tg was carried out using payment cards. During the year, the amount of non-cash payments rose at once 2.4 times.

In 2020, a Pandemic COVID-19 was a significant impact on the transition to a non-cash format of calculations. Worldwide consumers in order to comply with the social distance are transmitted to non-contact and online methods for obtaining services. The main share of non-cash operations in the territory of the Republic of Kazakhstan in 2020 was carried out online - 81.4% of the total amount of non-cash payments. Today, 20 banks in the country have mobile banking service for users of IOS and Android systems. During the year, the number of users of online services of banks increased by 45.8%, to 28.7 million (a year earlier - 19.7 million users).

The growth of non-cash payments is also due to the establishment of the infrastructure of shopping POS-terminals, access to the markets of Kazakhstan Apple Pay and Samsung Pay, stimulating banks and payment systems of customers through bonuses and cacheki, as well as the active use of non-cash payment in all types of public transport. The introduction of international payment systems of innovative technologies to the Kazakhstan market, such as contactless payment, TAP on Phone, etc. The contactless payment method acquires a special meaning from a hygienic point of view during a coronavirus pandemic, allowing the buyer and the seller to minimize physical contact when transaction and thus reduce the risk of transmission of infection. TAP on Phone allows us to turn the usual smartphone to a full-fledged POS terminal by receiving non-cash contactless payment anywhere where there is a mobile Internet. This reduces the costs of merchants, profitable for banks, very convenient for buyers and in general contributes to the reduction of the shadow economy.

In the context of international payment systems, more than any non-cash transaction in 2020 in Kazakhstan was held through the MasterCard Worldwide system payment cards: 553.6 million transactions in the amount of 4.4 trillion TG. This is 19.2% of the total number of non-cash operations. In turn, 340.3 million non-cash transactions in the amount of 5.2 trillion TG were held through the VISA International payment system cards.

Financial technologies allow you to expand access to financial services and carry many positive points. Digitalization makes the provision of financial services available for suppliers and users. In general, digital channels reduce low-income customer service costs, speed, safety and transaction transparency increase. The country's population estimated the simplicity and convenience of non-cash payments. Now online can be held a lot of various payments, reducing temporary and financial costs. For example, without leaving the house, you can replenish the balance of your mobile phone, pay for the Internet, TV and utility services, convert currencies, repay loans and much more.

Another important point: digitalization and technological solutions in the payment card market allowed to level the negative effects of a pandemic that touched the country's trading sector. So, on a general background of a decrease in retail trade in the country by 7.3%, the proportion of electronic commerce showed a record growth. In general, the volume of electronic commerce in the structure of retail trade in 2020 increased almost 3 times - from 3.8% to 9.7%.

The increase in retail activity through the Internet occurred during the outbreaks of morbidity and associated quarantine. By the end of 2020, 108.2 thousand entrepreneurs were received on the territory of Kazakhstan in Kazakhstan - by 12.2% more compared to the previous year. For five years, the number of such companies increased by 2.5 times. Thus, the positive global trend of the transition to more transparent and safe non-cash payments today is confident and Kazakhstan.