The theme of the IPO has recently in Russia for hearing. This is especially connected with the IPO of such companies as Ozon (MCX: Ozondr; NASDAQ: OZON) and FIX Price. We reviewed which accommodations may occur in the next few years and how you can earn.

We consider the following accommodation in the most interesting:

- AFK System (MCX: AFKS) plans to place many of its assets. The mains are Segezha Group, Medsi and Steppe. This makes AFK system an interesting asset due to the disclosure of the value of the company's assets.

- The IPO of the Utonos can positively influence the ribbon quotes (MCX: LNTADR) when developing history with synergies between the two companies. It is also possible to care from Ozon shares due to the fact that investors will decide to search for the E-Commerce trend through one of the leaders of its segment, Lockosos.

- Victory and Yandex.Taxi can accommodate on a higher multiplier than maternal companies traded, which can become a short-term positive factor for Aeroflot (MCX: AFLT) and Yandex (MCX: YNDX), respectively.

Fix Price

Who! Chain stores for the whole family with a wide range of home products at low fixed prices.When? March 10 2021.

On the plans to hold an IPO in London Fix Price reported in mid-February. The company will also spend the secondary listing on the Moscow Exchange. Presented the company for IPO at $ 7- $ 11.5 billion in more detail about what we think about IPO Fix Price, you can read here.

Segezha Group.

Who! One of the leading timber-industrial holdings with a vertically integrated structure and a complete looping cycle and deep wood processing.

When? Pre-2021 year.

AFC Holding The system reported on the plans for the IPO portfolio company Segezha Group. The statement says that AFC is preparing the company's exit on the stock exchange in 2021, but so far no official decisions regarding IPO are accepted.

The company is the leader of the Russian and one of the leaders of the European paper packaging market (52% and 16.5%, respectively).

The company is focused on foreign markets, which allows it to have a large proportion of currency revenue, 70%.

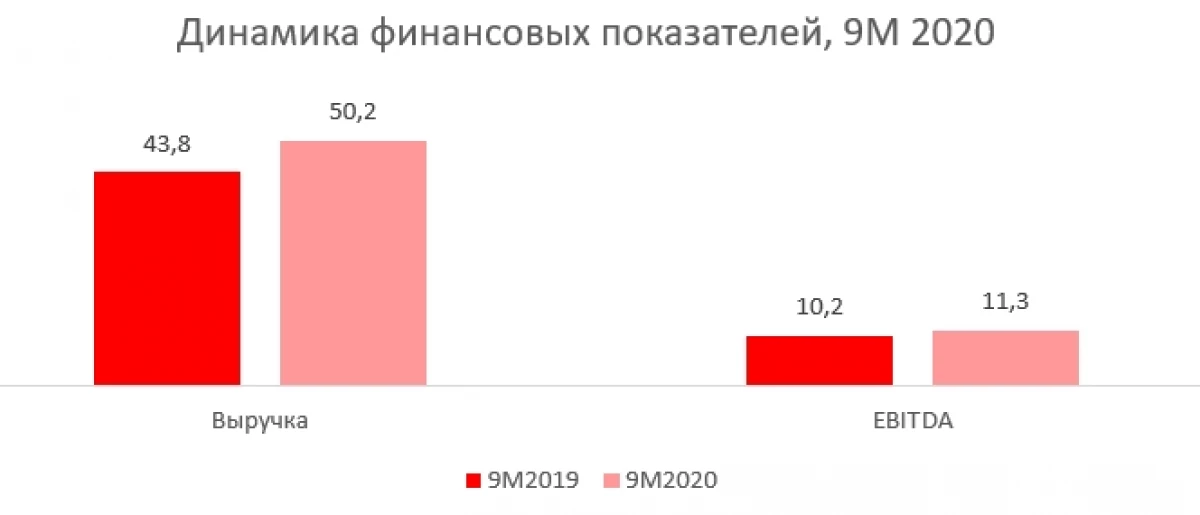

The company's revenue for 9 months 2020 amounted to 50.2 billion rubles. (+ 14.7% g / g), EBITDA was at the level of 11.3 billion rubles. (+ 11.0% g / g).

The company's access to the stock exchange can be an important catalyst for AFC shares system that owns 98% of the company. This will take place at the expense of the company's market assessment. In addition, the exit to the stock exchange implies the possibility for free trade in shares, which means more liquidity. And liquidity makes assets more valuable and expensive.

Medsi.

Who! The country's largest Federal private network of medical and preventive institutions providing a full range of services.

When? Pre-2022 year.

Another of the profile assets of the system can conduct an IPO. In Nsei, AFK has 97% of the company. It was originally expected to be held in 2021. However, then, due to a pandemic, the company decided to change the strategy and enter the stock exchange in 2022, according to the director of commercial activities and Marketing Medussia Alla Kanunnikova.

Medisi revenue for the first half of the year fell to 10.5 billion rubles. (-1.9% g / g), and soon. EBITDA decreased to 2.3 billion rubles. (-9.8% g / g).

Since Medsi is also an asset system, the company's access to the stock exchange will have a positive effect on the capitalization of AFC. The main catalyst, as well as with the segments, will be obtaining a market assessment of the company and liquidity.

Steppe

Who! One of the largest agrarian companies in Russia.

When? Unknown.

The steppe is another AFC System Asset in this list, where the system is 85%. Initially, the placement of the asset was supposed in 2019. Then it was transferred to 2020, but due to the pandemic, the company's output on the stock exchange had to be canceled again. According to Vladimir Chirahov, President and Chairman of the Board of AFC System, the company is of great interest among investors, including international.

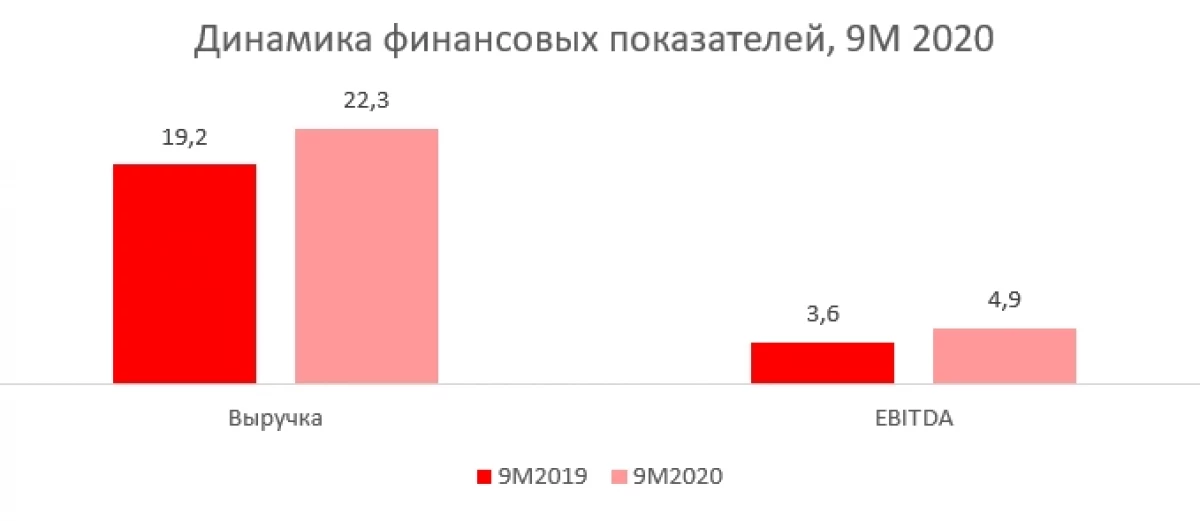

In the first nine months of 2020, the company's revenue increased by 16.3% y / y to 22.3 billion rubles, and EBITDA increased by 37.3% y / y and amounted to 4.9 billion rubles.

The steppe can be another asset that will help AFK system to reveal its market value.

Yandex.Taxi

Who! Services of taxi and food delivery aggregator, as well as mobile applications to them.When? Moved for an indefinite period.

On the plans for conducting IPO Yandex.Taxi, the company declared in early 2019. However, after that, in November 2020 Yandex refused to place a taxi.

Greg Abovsky, Operational and Financial Director of Yandex, said: "We see that such a Yandex platform, which we created, becomes better because of their integrity. Therefore, the taxi service IPO is not considered. "

In the case of the placement of Yandex.Taxi there is a high probability that it will be on a higher score than the market is currently laid in Yandex shares. Against this background, Yandex quotes may grow. However, due to the transfer of an IPO for an indefinite period, it is not worth using it as an investment thesis.

Ivi.

Who! The market leader online cinemas in Russia.

When? Moved for an indefinite period.

Founder IVI, Oleg Tumanov, has repeatedly spoke about the possible exit of the company on the stock exchange. As a result, the company was preparing to enter the market at the beginning of 2021: at the end of November 2020, it became known about the plans to go to NASDAQ.

Then the placement was postponed due to the bill of deputy of Anton Gorelkin on the limitation of the share of foreigners in online cinemas. According to the draft law made by the deputy on December 18, 2020, if the share of foreigners in online cinemas will exceed 20%, then the company is obliged to explain the feasibility of its ownership structure on the Government Commission.

The company occupies a leading position in the online cinema market with a share of 23% in 6 months 2020. At the same time, the company has increased revenue faster than the market grew, which implies an increase in market share in the first 6 months of 2020. Thus, the IVI revenue increased by 58% y / y for 6 months 2020, reaching 4.3 billion rubles.

The company is the market leader and shows great growth. At the same time, she succeeds in keeping positions, even despite the competition of heavyweights in OKKO's face (Sberbank asset (MCX: Sber)) and film discs (Yandex asset). Such strong positions will make the company a very welcome asset on the primary market.

Business output on the IPO would give investors the opportunity to invest in a strong growth company operating in the Russian market. There are not so many such players now.

Platypus

Who! The leader of the market in the field of food delivery and related goods of the Russian E-Commerce.

When? There are no specific plans.

Until April 2020, the company was an unconditional leader of the online food delivery market, but then the WKonos was shocked for the third position X5 Retail Group (MCX: FiveDR) and SberMarket. The shares of Utona, X5 and Sbermarket are 10%, 12% and 11%, respectively.

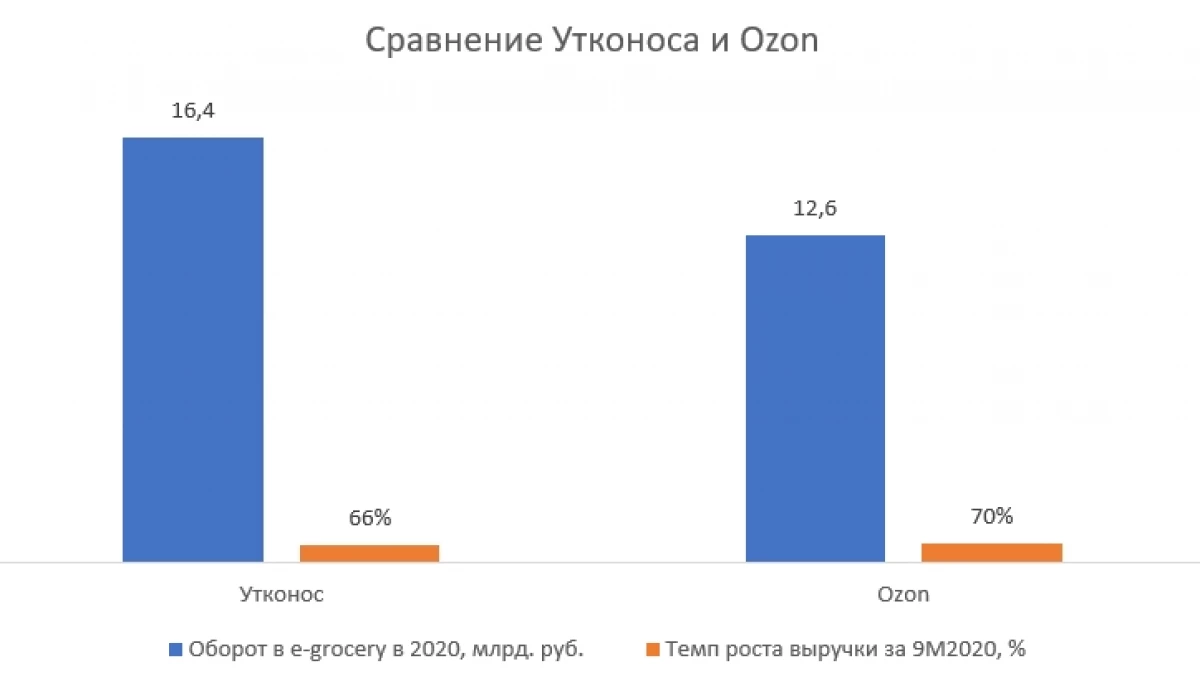

WKONKOS increased the turnover in the first nine months of 2020 to 11.6 billion rubles. (+ 66% g / g) against 7.0 billion rubles. For 9 months 2019. The director of the company stated that by 2023 the company could reach break-even. Or maybe earlier.

The Director-General of Utonos said in November 2020 that now the company does not plan to go on the stock exchange. In the future, such an opportunity can be discussed, but today there are no such plans.

The company's output on the stock exchange can be a positive driver for ribbon shares. This will happen if the market will perceive the story of a partially joint business of the Blood and Ribbon. This story is likely to be given a lot of attention during the placement, due to synergies, which can be brought to both companies.

In the event that the merger or development of the joint venture (joint venture) between the ribbon and the waterproof occurs before the placement, the placement of the aircraft will have an even greater effect on the tape. It will be associated with the disclosure of the value of the wall. To a large extent, this will be caused by the fact that online retailers are traded at more expensive multipliers than ordinary.

Also, the company may impose Ozon competition for investor money. WKONKOS is a larger player in the Food Retail market, processing a 30% more orders than Ozon. However, in general, Ozon is a larger player due to the absence of specialization in the same market. Despite this, close growth rates (+ 66% g / g against + 70% y / y per 9 months 2020 Ozon), together with leadership positions, can cause why some investors will solve Ozon in favor of the shares of the Uzonos. This will lead to a minor fall of Ozon shares.

Victory

Who! The largest airline-lourogenger in Russia.When? Delayed indefinitely.

In 2019, Aeroflot CEO stated that Aeroflot plans to hold an IPO of 25% of victory capital. However, from the moment the company has changed the Director General. Recently, he made a statement that at the moment IPO victory is not considered.

SIBUR

Who! SIBUR - the largest integrated oil and gas chemistry company of Russia.

When? Unknown.

Rumors about the exit of Sibur on the IPO have been twisted for a long time. SIBUR was ready for the IPO back in 2018, but since that time the decision to enter the transaction was not accepted. In February 2019, Konov said that after launching the Zapsibneftech plant, there would be more incentives for the IPO, and in the summer of 2020, it was considered time for the transaction inappropriate, given the coronavirus pandemic.

After the appointment of Peter O'Brien, the former Top Manager of Morgan Stanley (NYSE: MS), to the position of Financial Director of Sibur in September last year, it seems that the company's IPO is inevitable. In September 2020, the head of Sibur Dmitry Konov emphasized that the company is waiting for a favorable portion of three factors: financial statements, the state of markets - industrial and financial.

The company's revenue for 9 months of 2020 amounted to 369.4 billion rubles. (-6.6% y / y), EBITDA amounted to 122.0 billion rubles. (-3.3% g / g).

Datville

Who! Network stores for healthy food.

When? Pre-2021 year.

Another Russian company, which plans to enter the American stock exchange, is a chain of shops of thieves. According to Andrei Krivenko, the founder of the company, the final decision has not yet been accepted, but the placement is considered on New York and Moscow stocks.

It is worth noting that the Thawilla is now at the next peak of its development. First, during a pandemic and quarantine, the company increased online trading turnover from 1% to 15% and entered the top five largest product online retailers in Russia, and the revenue increased by 47% y / y in the first half of 2020.

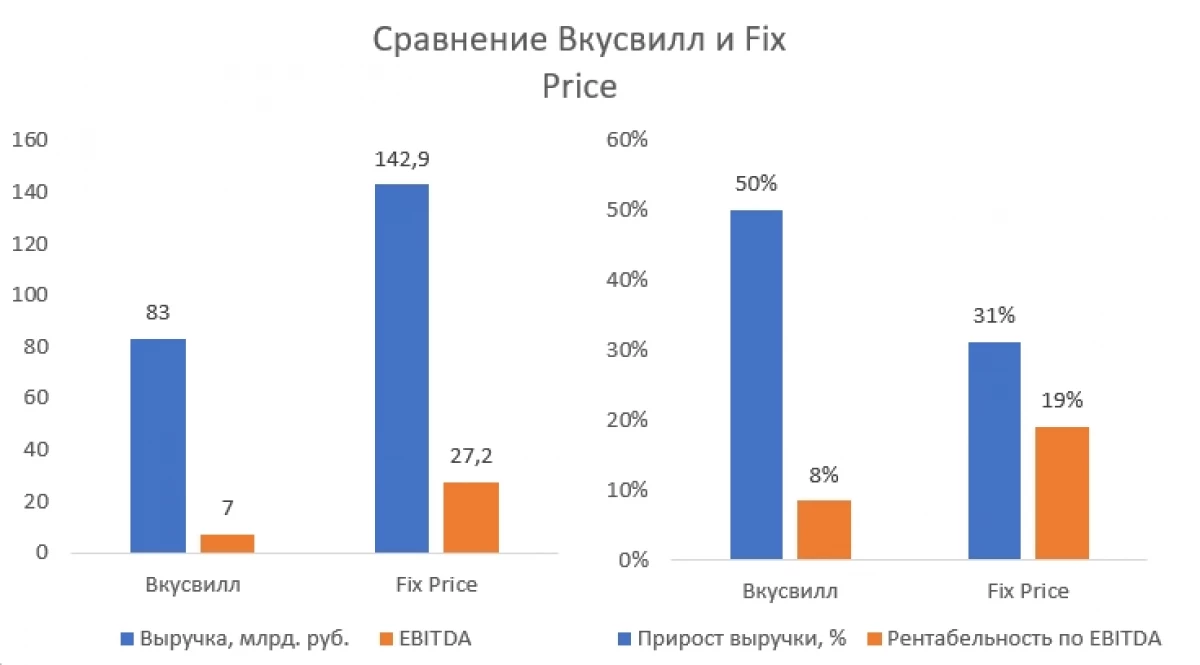

At the same time in absolute sizes, the company is slightly lagging behind another producer of the retail industry conducted by IPO - FIX Price. So, at Dvorville, revenues in 2019 amounted to 83 billion rubles. against 142.9 billion rubles.

In addition, the company is currently actively entering Western markets: the store has already been working in Paris, another in Amsterdam, the opening of offline points in Europe and China is also discussed.

Interestingly, in 2019 the company received 3 billion rubles. net profit at 82.5 billion rubles. Revenue and sent 2 billion rubles. on the payment of dividends. The company has been working for 5 years without unprofitable years.

Sovcombank

Who! The third largest assets of the private bank in Russia.

When? Pre-2021 year.

The company is going to IPO since 2018. In February 2020, Reuters reported that Sovcombank is preparing for an IPO in the middle of the year and has already chosen Goldman Sachs, JP Morgan and Morgan Stanley as the placement organizers, and Mosbierzhu - as a platform for accommodation.

However, the crisis prevented these plans, and in April First Deputy Chairman of the Board of the Bank spoke about the IPO: "This year - there is definitely no, next year - we do not exclude, that is, there may be such a scenario in which the next year there may be windows for IPO. "

The company shows a fairly rapid growth for public Russian banks. Thus, the number of retail clients has grown to 8.1 million customers by the end of the 9 months 2020 (+ 29% by December 31, 2019). Sorrow The profits for the first 9 months of 2020 increased by 21% y / y and amounted to 22 billion rubles, and in 2019 increased by 70%: from 17.5 billion rubles. up to 30.1 billion rubles.

In our opinion, the most interesting ideas on the upcoming accommodations are the following:

- AFC system can show significant growth in the next few years due to the placement of many of its assets. The main ones are Segezha Group, Medsi and Steppe.

- The IPO of the Airpoint can positively affect the ribbon quotes in the development of history with synergies between the two companies. It is also possible to care from Ozon shares due to the fact that investors will decide to play the e-commerce trend through the leader of its segment.

The article is written in collaboration with analytics Nikolai Chikvashvili

Read Original Articles on: Investing.com