Infinera and two other often overlooked stocks should like the technological investors looking for value.

Concerns about the growth of bond returns, higher interest rates and fuzzy market estimates have recently provoked a wide range of shares of technological companies and rotation in cheaper stocks.

But instead of panicing and reset all its technological promotions, investors must translate the spirit and notice the cheap alternative in this expensive sector. Today we will look at three often overlooked companies that have a promising growth potential, are traded with a low P / E coefficient and can be bought in less than $ 20 per share.

1. Infinera Corporation

Infinera Corporation Optical products (NASDAQ: INFN) allow communication operators to expand the bandwidth of their current networks without laying additional fiber. This is achieved by separating existing signals on additional wavelengths.

Fiber optic networks of the current generation transmit data at a speed of 100 to 200 Gb / s long distances and at a speed of 400 to 600 Gb / s for shorter distances. Many service providers are currently tested by 800G connections.

Infinera, Ciena (NYSE: Cien) and Huawei are three leading players in the 800G market. But "black lists" and sanctions do not allow many operators to buy Huawei products, which leaves Infinera and Ciena with the best options for choosing outside China.

Most carriers do not want to focus on one company, so they will most likely share their 800G contracts between Infinera and Ciena. Infinera recently introduced a mixed report for the fourth quarter, which did not meet expectations of analysts on revenue, but its growth should accelerate in the second half of the year, when the company will begin the delivery of its products 800G ICE6.

In the 2020 fiscal year, Infinera revenue increased by 3% with a smaller pure loss. But in the 2021 fiscal year, analysts expect her revenue to grow by 5% with return to profitability. Based on these estimates, Infinera is trading with 22-fold forward profit and 1,2-fold sales this year, which is a fairly low estimate for shares on the threshold of cyclic turnover.

2. Ericsson.

Ericsson (NASDAQ: Eric) - the third largest manufacturer of telecommunication equipment in the world after Huawei and Nokia (NYSE: NOK). All three companies are currently helping operators to expand their new 5G networks, but Ericsson is probably stronger than two of their larger competitors for several reasons.

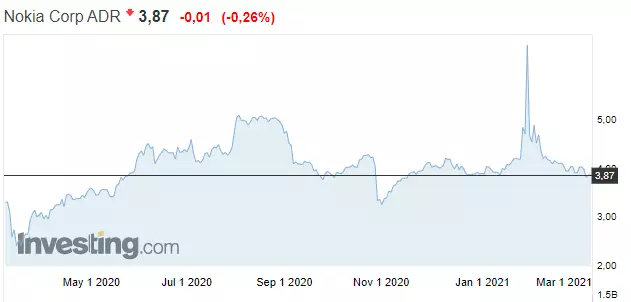

The Huawei business of 5G equipment is facing the same "black lists" and sanctions that cause damage to the 800G business. Meanwhile, the acquisition of Alcatel Lucent (IS: AlCTL) Nokia for 16.6 billion dollars in 2016 made it strongly focus on reducing costs. As a result, the company was lagging behind Huawei and Ericsson on investment in 5G and still struggles with these consequences.

Nokia also lost some major contracts for 5G in China because of the trade war and suspended the payment of dividends to free up more money for their investments in 5G. Nokia's general director Rajiv Suri also resigned last year.

For comparison: Ericsson retained its contracts in China, continued to pay dividends and did not change the sharp director in the midst of an unprecedented crisis.

This year, analysts expect that Ericsson income and profit will increase by 15% and 16%, respectively, as the company sells more 5G products and benefits from the regulatory requirements of Huawei and problems with Nokia. These are confident growth rates for stocks, which are traded with profit 14 times more. Ericsson also pays a decent forward yield of 1.7%.

3. LG Display

LG Display (NYSE: LPL) is one of the world's largest LCD and OLED panel manufacturers. The long list of the South Korean company's clients includes Apple (NASDAQ: AAPL) and Huawei, and its main competitor is Samsung (KS: 005930).

LG Display struggled with sluggish sales of smartphones and televisions in 2019. Nevertheless, the company's revenue increased by 3% in 2020, since home-based trends led to a rise in prices for new panels for PC monitors, mobile devices and televisions. Apple orders also accelerated, since the technical giant increased the production of the iPhone 12 - its first family of 5G devices.

More importantly, LG showed a net profit in the third quarter of 2020, which was its first profitable quarter for seven districts, and remained in the fourth quarter. The company explained this growth to higher market prices and full-scale production of OLED screens at its new factory in Guangzhou, which significantly increased the effect of scale.

Wall Street expects the LG Display revenue will grow by 14% and will bring profit for the year. Based on these forecasts, stocks are traded with less than 10-fold forward profit.

Output

Investors should never consider shares "cheap" only on the basis of their prices - for this we need prices for profits and prices for sales. But if you are looking for shares at a lower price that is easier to buy round lots, and not odd, these three shares should easily meet all requirements.

Read Original Articles on: Investing.com