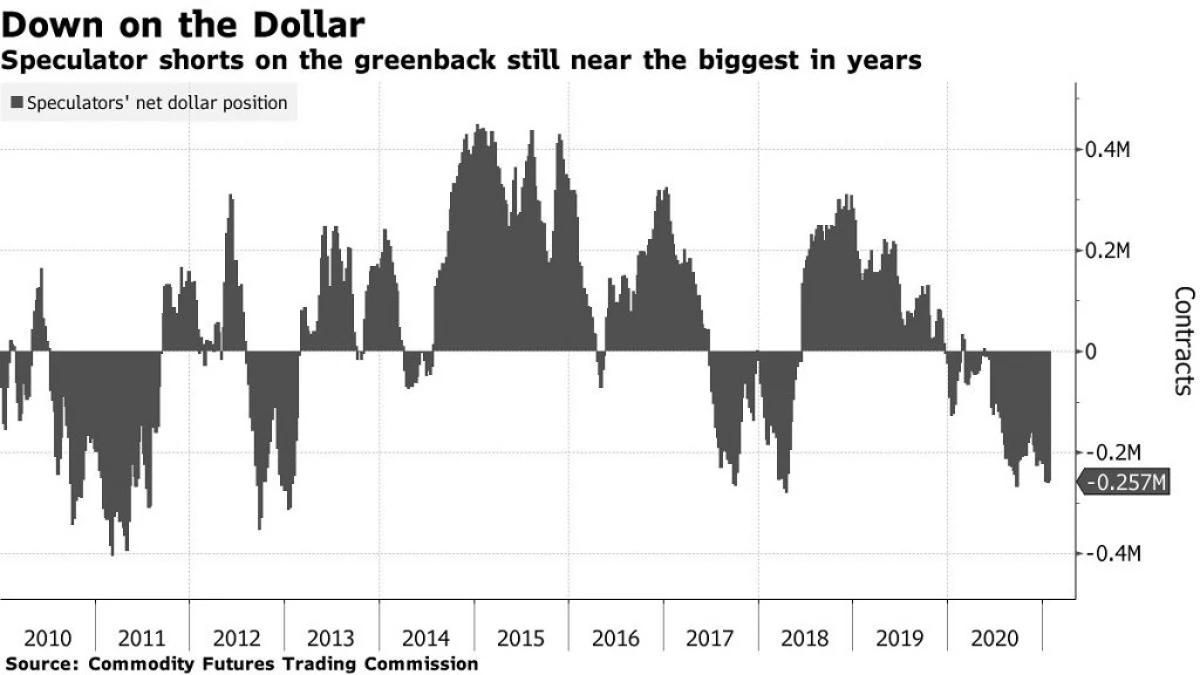

Active stimulation of the American economy led to unprecedented consequences: in 2020, a quarter of all US dollars were printed. Investors began to look for ways to play down the dollar, which led to many years of high-inflation tools and growth of such low-inflationary tools as Bitcoin.

Despite this, the Russian ruble lost almost 20% over the past 12 months, and in the near future the situation is aggravated.

Politics and economics are strongly interconnected. February 2 will be a trial of Alexey Navalny. Prior to that, Navalny had a suspended period, but now it can be replaced with real. Western countries condemned the arrest of the oppositionist, and the tightening of punishment will lead to new sanctions against Russia. This is even stronger by the investment attractiveness of the country in the international arena.

The tendency is without that negative. According to the EGRUL, the number of firms opened by foreign persons over the past two years has been shrinking.

Further tightening of domestic policies will reduce foreign investment capital. This will reduce the demand for the ruble, which is necessary for performing operations within the country.

The main article of the budget revenues of the Russian Federation is the sale of oil and gas. The country's economy is dependent on global mineral consumption. Because of the pandemic, the demand for energy was collapsed: according to the International Economic Agency (IEA), in 2020, a total reduction was 8.8 million b / s. The demand for gasoline in the current year will practically recover to the level of 2019, but the aviation fuel will remain low. The global economy is restored slowly, and for universal vaccination is not enough drugs. These circumstances will restrain the global demand and prices for oil, respectively, Russia may again encounter a budget deficit in 2021 (as a result of last year, the deficit was 3.8% of GDP).

Even more economy of Russia we will weaken the sanctions of Western countries. The ECHR has already sent Russia's questions about a possible violation of human rights when refusing to initiate a criminal case on Navalny poisoning. The exacerbation of the situation can slow down the construction of the "Northern Flow-2", which was planned to be completed in 2021. If the events described above occur, the ruble expects further devaluation, despite the decline in the dollar index by 6% at the end of last year.

Analytical group Forex Club - Partner of Alfa Forex in Russia

Read Original Articles on: Investing.com