Sale in the markets of sovereign debt, which has grown into a spontaneous dump last week, noticeably slowed down, but did not stop. The yield of 10-year-old Trezeris bounced off the peak of 1.55%, but submits signs of growth on Monday. The situation is still fragile. Representatives of the Fed gave a dry comment on what is happening, leaving a lot of shortness. This week, a number of speeches of the Central Bank officials will be held, and, as expected, their detailed comments on the growth of market interest rates will become the main catalyst of the movement in risk assets.

Unlike the Fed, the European Central Bank did not remain aside and made verbal interventions, hinking the flexibility of the main assets' buying program - PEPP. Specific actions supported the debt market Bank of Australia, increasing the purchase of bonds. Given that global Central Bank usually synchronize their actions, there is a chance that the Fed also indicates the possibility, for example, to change the QE shopping composition (increasing the purchase of long-range bonds), which will be calming the sellers.

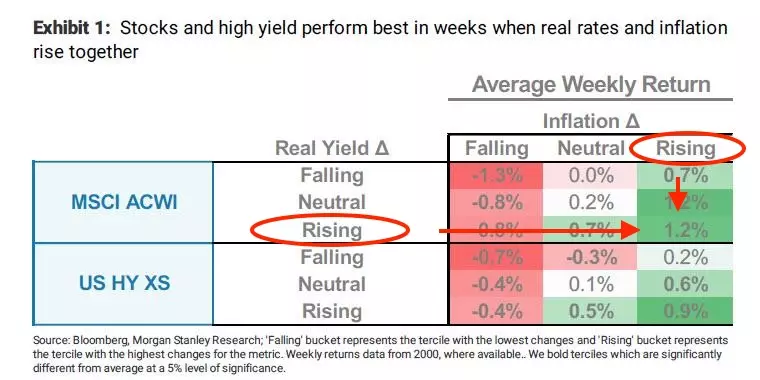

However, as in the United States, both inflation expectations and a real rate, dynamics on the debt market are growing, with the exception of shocks due to high volatility, should have a positive effect on world stock markets. At least the story indicates:

The weekly dynamics of the MSCI ACWI index (ETF to the global stock market) When in the US, both a real rate and inflationary expectations are growing.

Macroeconomic news on the United States last Friday as a whole had a positive shade - Consumer cost inflation (the main metric of Fed inflation) accelerated to 1.5% (1.4% forecast), consumer sentiment from W. Michigan more than paid forecasts. As for the economic calendar this week, the focus of labor statistics on the USA - the ADP report on the labor market, the employment component in the activity activity index in the service sector from ISM, and, of course, Non-Farm Payrolls for February on Friday.

Congress is in a hurry with approval of a new budget pulse. The Biden stimulation project was approved in the lower ward on Saturday. None of the Republicans voted "for", but their voices are not needed. Past stimulus measures had supporters in both parties, but this time a full split. It should be borne in mind that the main programs of extended social skins expire on March 14, that is, this date is probably an unofficial grandilage on the adoption of new incentives. The nail of the program - stimulating payments of 1,400 dollars per person (whose income below is $ 75k per year). The kind share of this money, as the last time leaving the stock market. The expectations of the upcoming positive shock of retail investments also pushed stock indexes up or at least do not allow them to greatly adjust.

Detailed analysis - in today's video border

Arthur Idiatulin, Tickmill UK Market Observer

Read Original Articles on: Investing.com