Despite the acceleration of inflation, most experts are not waiting for changes from the Central Bank. Nevertheless, in the event of preserving the parameters of monetary policy at the same level, the likelihood is high that Elvira Nabiullina will give the market a signal to raise the rate in the future.

This week, such signals have already begun to leak through the media. The Bloomberg Agency with reference to the source reported that the Bank of Russia ponders the raising rate of up to 5.5% already in the current 2021. Among the reasons - acceleration of inflation and concerns about the growth of budget expenditures

Such messages can often come from the regulator itself to study the market reaction. Shortly after this analyst Sbercib stated that they were waiting for raising now - at a meeting of March 19. The increase can be a quarter of a percentage point - from 4.25% to 4.5%.

It is worth noting that the central bank was the last time inflicted the key bet back in 2018. In the past, on the background of Lokdaunov and the crisis in the whole world economy, the regulator significantly reduced the bet - by 2 percentage points.

At the last meeting in February, the Central Bank clearly made it clear that the softening cycle came to an end.

"We believe that the softening cycle ended in our basic scenario. We will discuss the deadlines and the pace of transition to neutral policy as the situation will develop, "Elvira Nabiullina said at a press conference.

The market has already been prepared for the fact that the rates in the near future can only grow. The question is whenever this process begins, and how long it will turn out.

And here the most interesting begins - it is worth paying attention to one extremely important and very curious historical moment.

The dynamics of bond returns on the debt market of the country, as you know, actually repeats the dynamics of change in the key rate of the Central Bank and the market expectation for the future. That is, it is reflection.

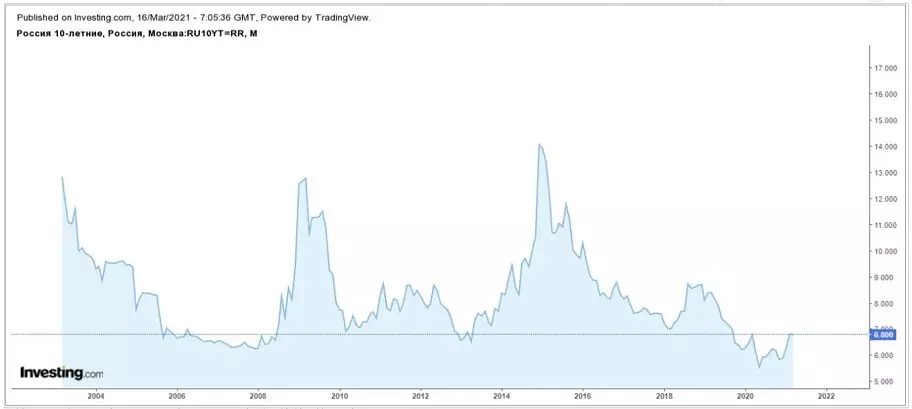

The fact is that throughout the modern history, when the yield of Russian government bonds descended so low - in the region of 6.5%, then something began to unfold, and dramatically.

For example, yields declined to this zone from 2006 to 2008, then in 2013 and in the recent past. At the same time, a new historical minimum was set last year, after which the gradual turn began. But it was rather Fors Major, since the central bank was forced to respond to crisis phenomena. By the way, since then the Central Bank did not change the rate, but the return of OFZ has already played the decline and returned to the level where they were at the beginning of 2020

If you rely on historical data, it can be assumed that now the central bank is on the verge of a long cycle of raising rates. And those signals that give the Central Bank, indirectly confirm this theory.

In addition, it is impossible not to noted that the main trend in the world is now the growth of inflation expectations and inflation itself. All this leads to an increase in rates in the debt market and in America, and in Europe, and in other countries.

It is possible that in the next few months, the raising signals will begin to give the largest central banks of the world, and this will mean a general change in the direction of monetary policy worldwide.

And since the Russian economy is an integral part of the world, the situation in our country will develop within the framework of this trend. Thus, if historical patterns persist, then, taking into account the aggregate of factors, the coming years are likely to become a period of growth in the profitability of governmentobaliations, as well as to increase rates on loans and deposits.