Despite the crisis and a significant drop in rates, the Russians have increased savings: for the year of the population in banks rose by 2.4 trillion rubles. Especially the crop traditionally issued December: according to the Central Bank, the Russians brought 1.3 trillion rubles to banks. (excluding ESCRO accounts) and $ 3.2 billion Central Bank in the review "On the Development of the Banking Sector" explains such a significant influx of premiums and social payments at the end of the year. In addition, in front of the long weekend at this time, January salaries are paid in advance, reminds the main analyst of PSB Dmitry Monasthshin.

However, larger changes are hiding behind the numbers of annual growth: people change the approach to savings.

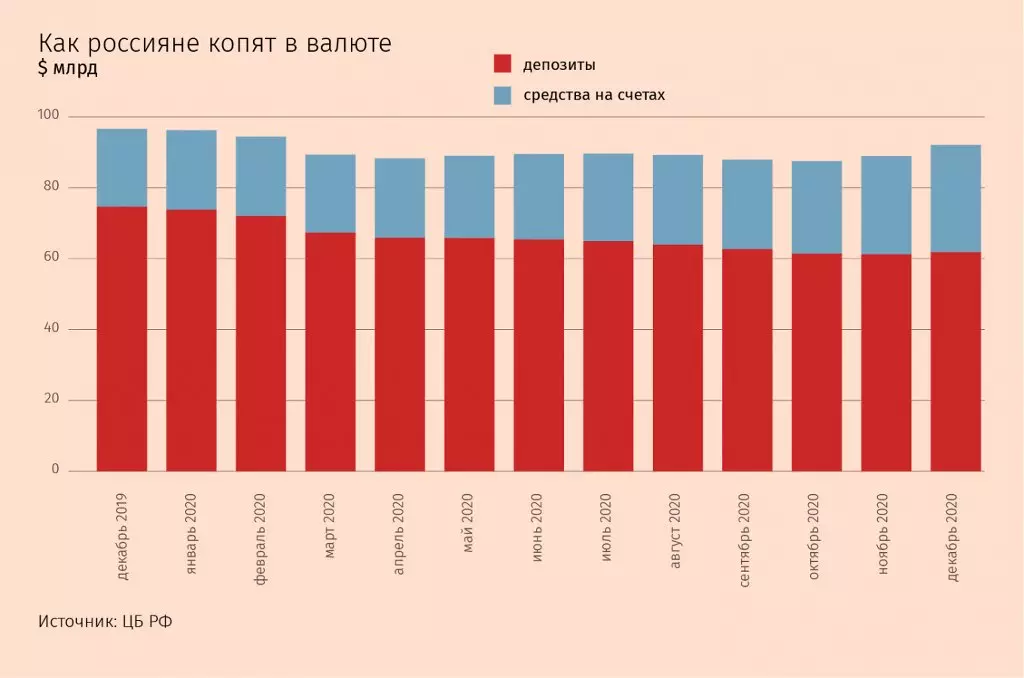

No savingsIn just last year, ruble funds of the population in banks rose by almost 1.6 trillion rubles. Currency accounts, on the contrary, decreased by $ 4.4 billion in dollar equivalent. However, due to a significant weakening of the ruble last year (by 19% to the dollar and 31% of the euro) in the ruble equivalent currency accounts even increased - by 825 billion rubles.

The cumulative portfolio of individuals of individuals in banks in all currencies in the ruble equivalent by the beginning of 2021 as a result reached 32.8 trillion rubles. Compared to the previous year, the growth of savings of citizens in banks slowed down almost twice: from 9.7 to 4.2% (with amendment for monetary revaluation). True, the Central Bank does not take into account Eskrow's bills, funds in which for the year increased by more than 1 trillion rubles.

The growth of deposits slowed down due to the fact that people began to take more cash (their volume in circulation increased by 2.8 trillion rubles per year), as well as to go into alternative tools due to the reduced return on deposits, explained the Central Bank. Brokerage accounts of private investors, for example, only from January to September added 1.2 trillion rubles.

The declined rates and the growth of inflation at the end of the year were expected to have played against the deposit market, states monastery. Thus, the average maximum rate in the top 10 banks in the size of deposits per year decreased from 6.01 to 4.86% per annum.

In terms of revenue reduction, many have moved from saving to their expenditure to current consumption, the director of banking ratings "Expert RA" Lyudmila Keltaein said. Negative to the amount of deposits affected the high growth rates of mortgage lending, it says: part of the savings was spent on the initial contributions on the mortgage, as well as flowed to Escrow's accounts during transactions for the purchase of apartments.

Nevertheless, savings are still growing, which indicates the preservation of high confidence in the Russians, the monastery is convinced. Although some of this growth brought capitalization of interest on deposits, it recognizes: with an average ruble rate of 4.8% and about a third of currency accounts and demand accounts with nearleval rates, capitalization could provide up to 3.5% growth.

Large players and did not even feel the slowdown in the influx of citizens. In Sberbank, Fishetian funds were increased by 15.3% to 15.7 trillion rubles last year, he reported in mid-January. Excluding currency revaluation, the growth is slightly modest, but also noticeably above the market - 11.6%. In Raiffeisenbank, the funds in accounts (both current and urgent) increased by 28%, the head of the Client Happiness and Monetization of Cyril Matveyev was transferred.

Replacing depositsThe remaining savings in the banks last year also migrated - between different types of accounts:

1. From currency in ruble: currency accounts last year decreased by $ 4.4 billion in dollar equivalent. Motivation to keep money in the currency gradually decreases, explains monasteryers: "Rates on such accounts are near zero, and the course of the course, for general expectations, left behind and this year the ruble should move to strengthening. Under these conditions, it does not make sense to hold on for currency deposits. " Now there are practically no dollar deposits on the market with a bet above 0.8%, and often rates do not exceed 0.5% per annum.

If not the end of the year, currency accounts would decrease even more. In November - December, the population brought into banks currency for $ 4.6 billion. The ruble strengthening has affected during this period, Vtimes explained experts. Partly to the growth of purchases could also bring the New Year bonuses that people immediately translated into the currency, says S & P Analyst Roman Fishing.

2. From urgent contributions to current accounts. Ruble deposits last year decreased by more than 1.6 trillion rubles, while current accounts added more than 3.2 trillion rubles. Similar dynamics and currency savings: deposits decreased by $ 12.8 billion, current accounts - increased by $ 8.3 billion.

Experts explain the increase in the popularity of current and cumulative accounts with great convenience and opportunity to quickly reach the money. If earlier the rates on such accounts were on the near-theulic level, now they are almost not inferior to deposit rates, with the possibility of maneuver the holder of such an account more, indicates monastery. This is especially important now when the rates in the system are generally located in historical minima, but there are expectations that after a while they will return to growth, he notices.

Raiffeisenbank last year also observed the influx of funds for accumulative accounts and, moreover, customers actively replenished brokerage accounts, confirms Matveyev.

Inflation at the end of 2020 reached a three-year high of 4.9% and continued to accelerate in January, indicates monasteryers. If in February, inflation will reach 5.5%, banks will most likely have to raise deposit rates even with a constant key rate to keep customers, he believes. In addition, the demand of banks on liquidity is growing due to the fact that the Ministry of Finance began to withdraw money from the banking system, continues the expert: by the end of January, the remnants on his accounts decreased from 2 trillion to just over 800 billion rubles. Because of this, banks had to be increasing loans from the Central Bank, but still they will have to gradually replace the means of the population and companies in the accounts, the monastery is sure.

Nevertheless, the main trends have passed the year and in 2021, analysts say. Kotorin is waiting for a flow of funds from deposits to current accounts, and the Senior Analyst of the NKR Agency Egor Lopatin - what will continue to flow on the stock market. But it will not have a significant impact on the market, since the contributions are one of the most accessible, habitual and at the same time conservative ways to invest money for the population, he emphasizes.

The head of the management of the "savings" VTB Maxim Podchikna is a bit different position: the end of the second wave of a pandemic together with vaccination and adaptation of citizens and business to new realities will lead to more confident behavior of the savings, and therefore - to an increase in the placement of cash and reverse reorientation from the accumulative Accounts for deposits are given in the release of a bank of his words. And the rigid position of the regulator about the proposal of unqualified investors of complex investment products slows down this market and will lead to the return of the part of the funds and accumulative accounts, it believes.