Asian indices grow on Wednesday in the morning, adding 0.6% by MSCI Asia-Pacific without Japan; 0.5% rises and Nikkei225.

Such strengthening is partially related to reports that China's People's Bank poured into a financial system of liquidity by 10 billion yuan ($ 1.55 billion). This reduced the nervousness of investors after yesterday's statements about bubbles in the markets of assets and real estate from the representative of the Central Bank. In addition, the reports were positively that the US Senate can take a package of incentives by 1.9 trillion already in the upcoming Friday or Saturday.

The Chinese yuan and OSKI are strengthened against the US dollar, which also reflects the demand for risky assets. At the same time, the Japanese yen and the Swiss franc continue to take positions, additionally cementing the restoration of Kerry Trejd.

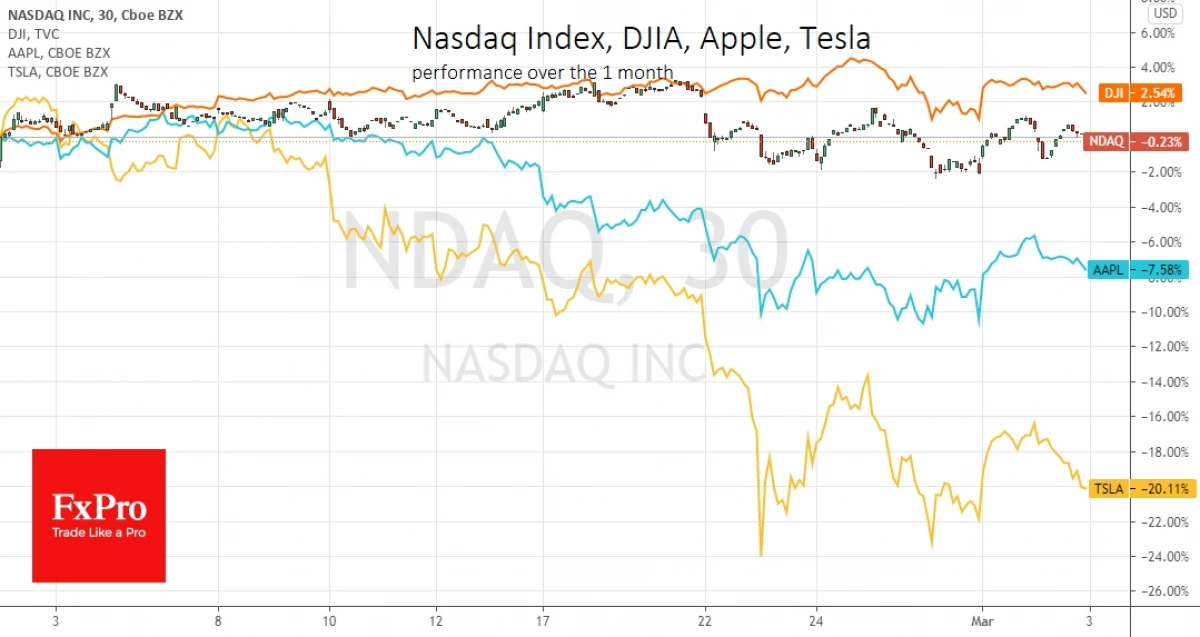

At the same time, we continue to celebrate very concerned trends. So, on the eve of the NASDAQ 100 index lost 1.9% by sales in the technological sector against the decline in Dow Jones by 0.45%. TESLA (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) are again soldered, losing more than 2% and 4.4%, respectively. All these are signs of restoring a trend for overbought in the strongest sectors of last year, that so scarecrow investors at the end of February.

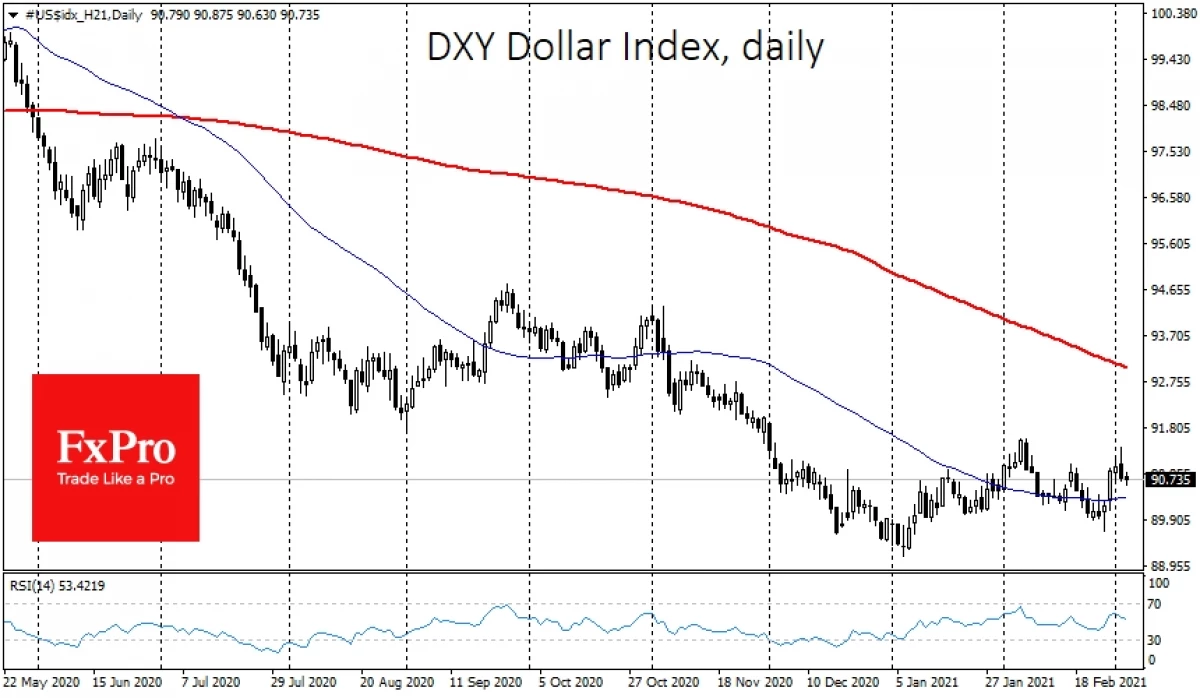

Currency and debt markets, in contrast to Asia today, also call for caution. The dollar index on Wednesday morning remains almost unchanged and loses 0.5% of Tuesday's peaks. The weakness of the yen and the franc pull the upward index, while the rebound of the euro from the level 1.2000 causes local pressure on the dollar. The pound is gently adds, reciprocating to 1.4000 after touching 1.3850 on Monday.

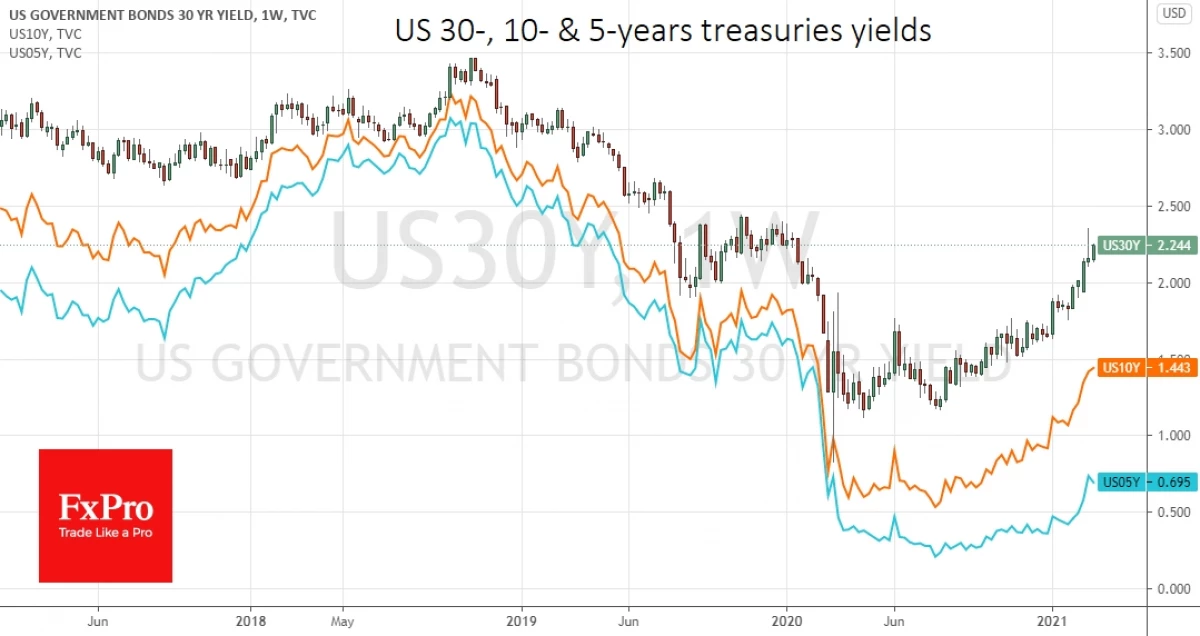

However, these attempts of rebound of euro and pound look very unstable and can only be a breather before the new weakening twist. The whole thing in the profitability of the US long-term bonds, which today increased 30-pilot to 2.22% against 2.11% on Friday. At the same time, 10-pilots stabilized in 1.4%.

Such yields attract customers Treasuries, causing pressure on the former flagships of the market, as well as euros, yen, franc and pound. It seems that only divergence in politics can change this trend: if the Fed concentrates on the control over short-term profitability, and Europe and Japan promise to keep the yield of long-term bonds under control.

Team of analysts FXPRO.

Read Original Articles on: Investing.com