The future looks not so optimistic as it seemed earlier.

If the stock market is ruled on the stock market, then currency traders are in the authorities of doubt. They do not allow EUR / USD quotes even against the background not the charter to rewrite the historical maxima of S & P 500 and the fall in the yield of treasury bonds of the United States. The future seems not so optimistic, as it seemed in November-December, and the refusal of the pharmaceutical giant Merck (NYSE: MRK) from the development of its own vaccine and the Astrazeneca statement (LON: AZN) that supplying the EU will be lagging behind forecasts; .

Message of the Netherlands Bureau of Economic Policy Analysis, which, on the outcome of 2020, the volume of international trade for the first time in a few months exceeded the levels that took place a year earlier (+ 1.5%), even more convinced me of loyalty to the assessment of what is happening on Forex. In November-December, the EUR / USD quotes grew against the background of optimism associated with the expected victory over COVID-19, the discovery of economies, the rapid growth of GDP and international trade. The main driver acceleration in the early winter was industrial production, the level of which in the eurozone was only 1.6% lower than at the end of 2019 (in the United States - by 5.4% lower).

In January, it became obvious that the introduction of vaccines is not as fast as we would like, European countries extend locodes, and the rapid growth of GDP is postponed until better times. The advanced indicators from Bloomberg signalize that economic activity slows down. Production pulls strap almost alone, while weak demand leads to the overload of warehouses. Where here to grow international trade!

Dynamics of economic activity

Dynamics of economic activitySource: Bloomberg.

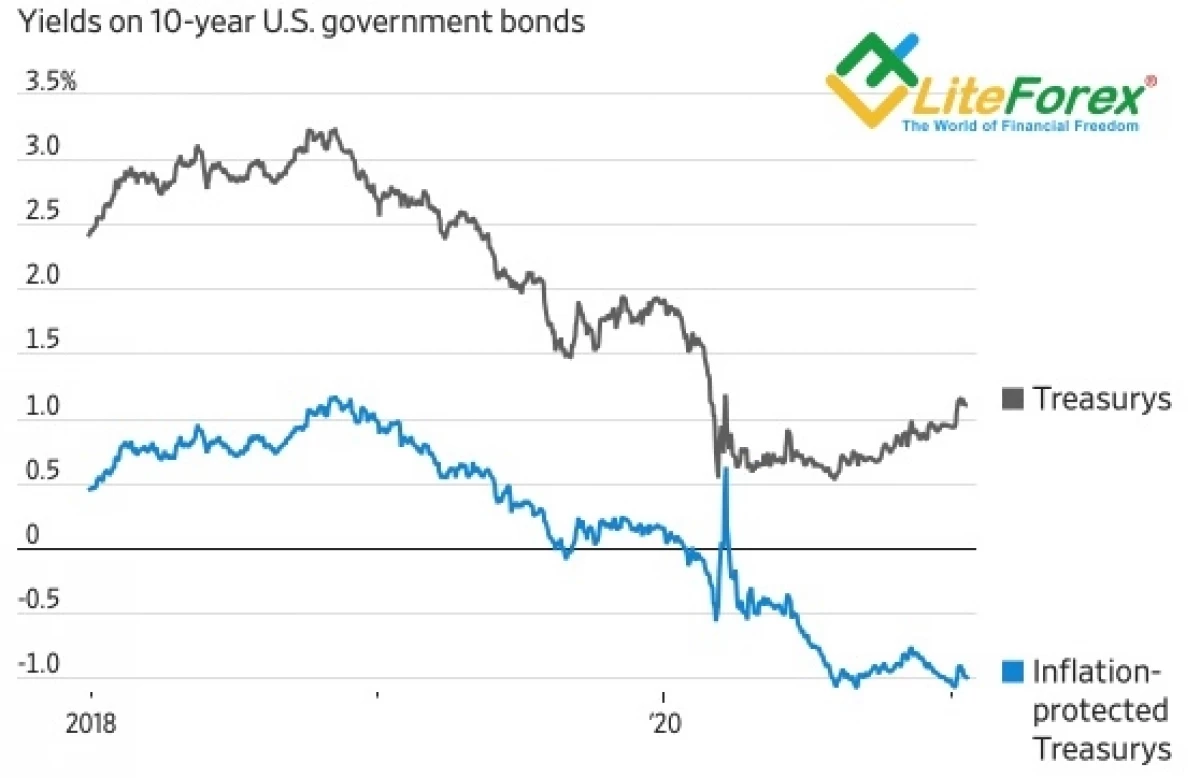

Thus, in November-December, the plan does not work in November-December. The euro stopped maintaining American stock indexes growing as on the yeast (they even began to walk jokes on the market, which "bear" is not the one who sells shares, but the one who has their share in the portfolio does not exceed 75%) and potentially weakening US dollar Falling yield Trezris. Investors buy bonds due to uncertainty in the rapid passage of the project of a fiscal incentive by $ 1.9 billion through Congress and doubts in the prospects of the US economy. At the same time, low rates on TIPS and growing inflationary expectations create a proven history favorable background for shares of technological companies.

Dynamics of yield of American bonds

Source: Wall Street Journal

Perhaps the only thing that is now holding back by the "bears" on EUR / USD is a potential "pigeon" rhetoric Fed. Jerome Powell will surely try to prove that statements of individual members of FOMC on folding QE are nothing more than an annoying misunderstanding. Surely none of them want to provoke a cone hysteria according to the 2013.

Do I believe that the euro will reach $ 1,25? Of course I believe! Humanity will win a pandemic, and the November and October plans will definitely embody. But a little later. In the meantime, the word incorrectly abandoned by Jerome Powell is a press conference on the results of the January meeting of the FOMC can return the EUR / USD quotes below the key support for 1.208-1.2085 and lead to the development of correction.

Dmitry Demidenko for LiteForex

Read Original Articles on: Investing.com