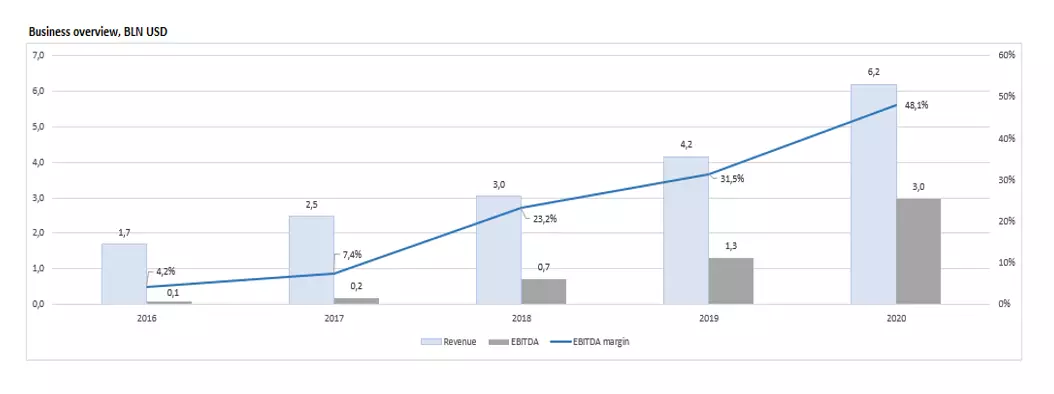

American Vertex Pharmaceuticals (Nasdaq: VRTX) is one of the fastest growing large biotech companies. Potential turnover increase of 2025 - 10% annually. The company specializes in developments in the field of rare genetic diseases and is actually the only one produces drugs from fibrosis (genetic disease of the respiratory organs). It provides an important competitive advantage, reliable cash flow and means for new projects.

Now the company is also trying to diversify the line of drugs and goes to other promising niche directions, for example, a sickle anemia.

At the end of 2019, the American Federal Agency for Products and Drug Control approved a new combination of drugs from fibrosis (TRIKAFTA / KAFTRIO). A new medicine is likely to become a big sales growth driver. It should allow replacing the three previous older preparations of the company and thereby expanding the permissible sample of patients on more than 1/3 (due to broader criteria).

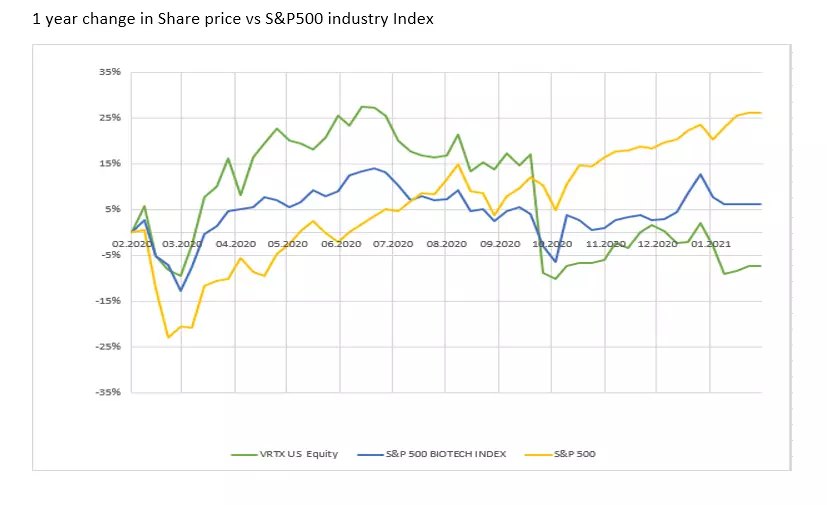

Results for the 4th quarter of 2020 disappointed investors, despite the general impressive indicators. Aggressive sales growth accompanied profit growth, but a slight backlog of EPS led to a serious drop in quotations due to high expectations. This may be repeated in the future.

The stocks asked for and confused the advantage over the market, since in October last year the company stopped developing the drug from the deficit of alpha-1-antitripsein. Nevertheless, Vertex is developing a different medicine from the same disease, whose clinical data is expected in the first half of 2021, which can lead to turn.

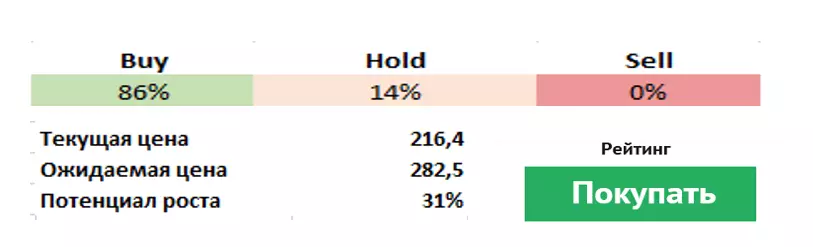

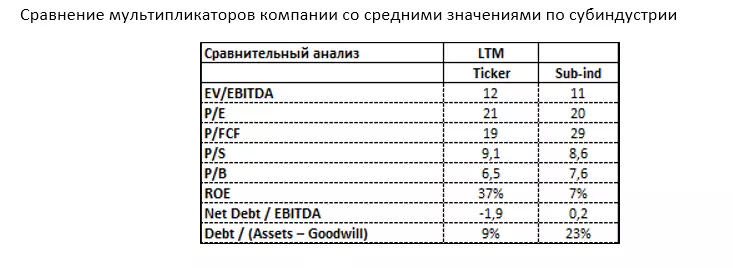

Compared with a sample of similar companies (Biotechnology subindustry), Vertex boasts considerable cash reserves (twice the company's debt level). ROE VERTEX is 37%, which is more than five times the average sampling rate. From the point of view of estimated indicators, it is worth highlighting the low P / FCF VERTEX against the sample (19 and 29, respectively), which means an attractive price tag with a good ability of the company to generate cash flow. In the remaining estimated indicators, the company trades in the area of average sampling values.

Evgeny Shatov, Governing Partner "Borselle"

Read Original Articles on: Investing.com