For the year, three Russian companies - "Sovcomflot", Developer "Airplane" and Ozon came out.

In 2020, three Russian companies held a primary public offering of shares. Shipping company "Sovcomflot", Developer "Airplane" and Marketplace Ozon went on the stock exchange in the fall.

Investors responded in different ways: the shares of the Sovkomflot fell in the first two hours, the "aircraft" prices for paper are stable, and Ozon has risen in price by more than 40%. We understand why companies hold an IPO during the economic crisis and as a pandemic affected their business.

"Sovcomflot"

"Modern Commercial Fleet" with headquarters in St. Petersburg was founded in 1988. The company is engaged in sea transportation of energy, liquefied gas, crude oil and petroleum products.

"Sovcomflot" announced plans to go on the stock exchange on September 15, 2020 and held an IPO on the Moscow Stock Exchange than in a month - October 7. Before placing the shares, the company was fully owned by the state.

How influenced pandemicDue to the pandemic, the demand for petroleum products and energy carriers in the whole world began to decline, which led to the fall in prices. For example, in April, the WTI oil cost of the WTI oil fell below $ 0 - to $ 37.63 per barrel by the end of the day. Crude oil futures became minus for the first time in history due to the filling of world storage facilities, explained Reuters.

As a result, the demand for maritime transport fell, but Sovcomflot, unlike the carriers of other products, was not very affected, the Expert "BCS Express" said Pavel Gavrilov. According to him, the company has helped the cost of chartering (with or renting vessels to fulfill certain work), as well as rental courts for floating oil, while oil in excess.

As a result, the company's revenue for the first half of the year 2020 increased by 19.8% to $ 951.3 million compared with the same period of 2019, and net profit increased almost 2.5 times - to $ 226.4 million.

"Sovcomflot" is not tied to the course of the ruble, so the change in the price of oil and other raw materials on the company's results does not have a negative impact. It is due to the revenue, which is fully expressed in US dollars, "adds Gavrilov.

How was the IPOThe assessment of Sovcomflot was $ 2.6-2.9 billion excluding additional emission. As part of the IPO, the company placed 17.2% of the shares to attract $ 550 million. Russia remained a majority shareholder with 82.8% of the shares. According to analyst Sberbank CIB Anton Malkov, it was the first IPO of the Russian company from the IT sector since 2017.

The demand from Russian and foreign investors during the IPO was approximately the same, retail investors provided 15% of demand, then reported "VTB Capital". 15% of the demand from individuals is a record share in the history of Russian public accommodation, argued by the Chairman of the Siller Mosbiri Oleg Vyugin. "This transaction is a sign of the capital market openness for large Russian companies," said Vyugin.

Despite the positive financial indicators, during the first two hours of placement of the Sovkomflot shares fell by 12.8% - from 105 rubles to 91.65 rubles. Prices began to recover on the same day and by October 12 reached 107.99 rubles, but since the beginning of November, the cost of one share ranges between 92 and 100 rubles. Capitalization of the company at the closure of trading on December 28 reached 216.67 billion rubles.

Group "Airplane"

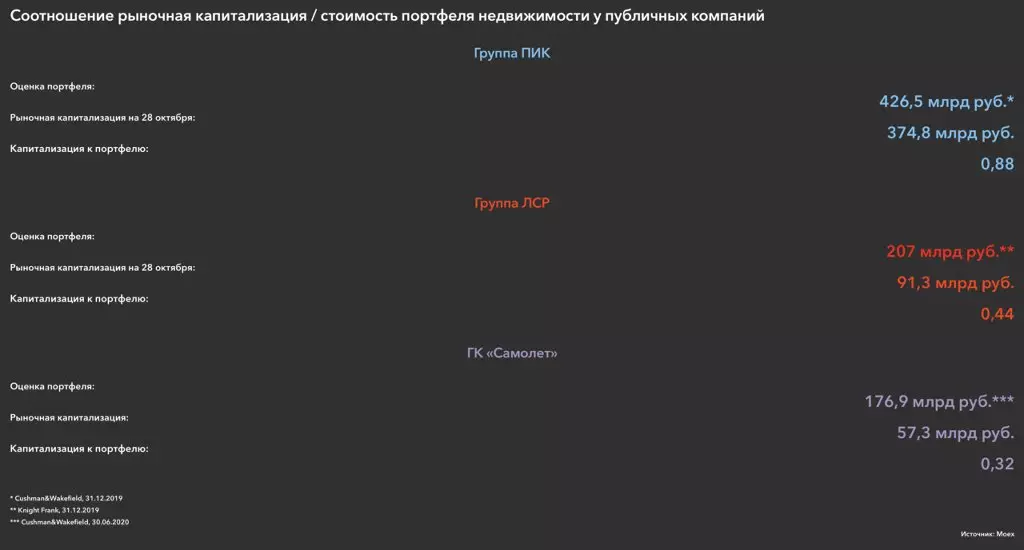

The second IPO for the year in the Russian market was held by the aircraft group of companies, the developer of the Moscow region. The company was established in 2012. At the end of June, the American company Cushman & Wakefield, engaged in commercial real estate operations, estimated the value of the group's assets in 201 billion rubles, passed Interfax.

The "Airplane" - the leader in Russia for ownership of land - 15.4 million m², wrote forbes. The company's revenue for 2019 increased by 32% to the year and amounted to 51.1 billion rubles, net profit - 864 million rubles, net debt - 12.3 billion rubles.

How influenced pandemicAccording to RBC, in the first nine months of 2020, the aircraft sold on 21% more real estate than for the same period of 2019 - by 41 billion rubles.

The demand for real estate, despite the pandemic, remained high due to the state program of the preferential mortgage, low mortgage rates in general, the expansion of the maternal capital and other social benefits. For example, according to "Best New Buildings", in April-May, the individuality signed about 2500 agreements in Moscow, by August - more than 5,000 contracts.

However, the company itself in the Memorandum to IPO noted one of the risks - the Renovation program in Moscow. In its framework, the Moscow authorities are planning to build about 40 million m² housing until 2032. According to the Memorandum, renovation can negatively affect the sales of developers, since in the future they will face a decrease in demand.

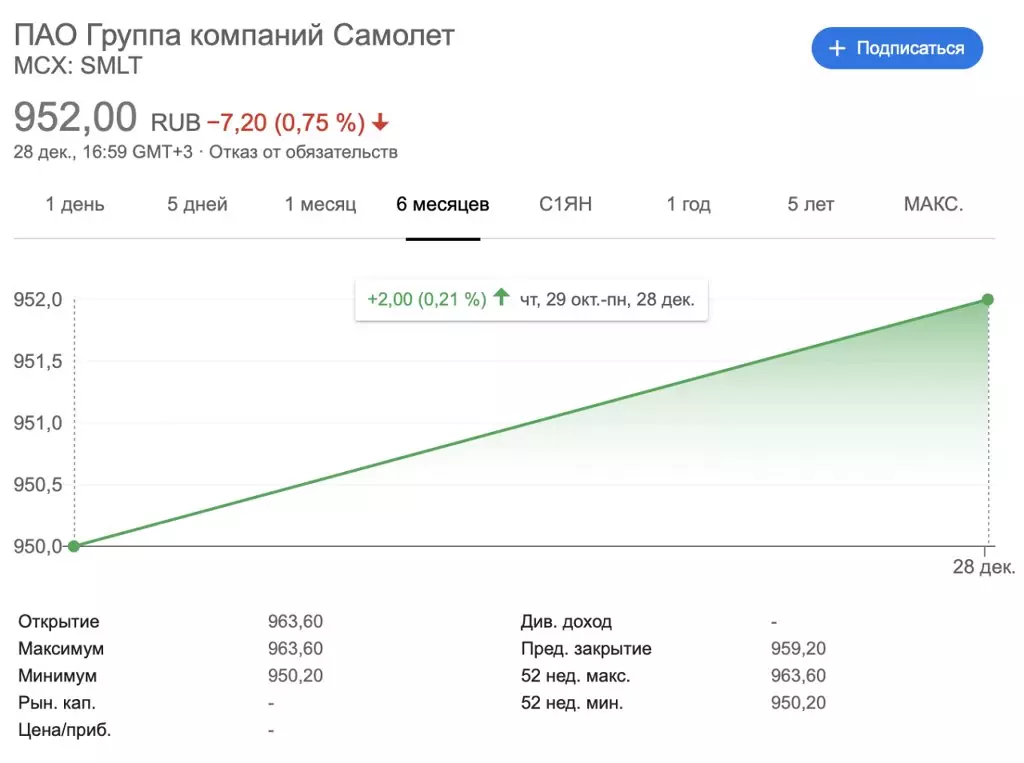

How was the IPOIPO Developer spent on October 29 at the Moscow Stock Exchange, placing 5.1% of the shares. The largest shareholders totally sold 2.5% of their shares, the rest - the additional issue. The capitalization of the "aircraft" at the beginning of the auction was 57 billion rubles, which corresponded to the assessment before the IPO.

The price range of shares was 950-1110 rubles per piece, the IPO passed at its lower boundary. Total company attracted 2.9 billion rubles. By 17:00 MSK on December 28, the company's shares went up by 0.21% - up to 952 rubles.

According to the management of the share capital of the share capital of VTB Capital, Boris Kvassov, in the main buyers, Russian investors were made, and 70% of demand had to retail investors.

The high demand for the shares of the "aircraft" from the retail investors of the sovereigns explained the recognition of the brand. The market is clear, and competitors are obvious, he added.

The "plane" was already going to go on the stock exchange in 2018, but postponed the IPO because of the "unfavorable market opportuncture", reminds Forbes. At the opening of the auction, the general director of the company Anton Elistratov called the behavior of the company "CONTRINTUTIVE": when everyone went from the real estate market after the crisis of 2014, the "plane" accumulated land areas, and now, when many are withdrawn their shares from the exchange, the company has placed securities.

Ozon.

The Russian online store was founded in 1998 by Alexander Egorov and Dmitry Rudakov. In 2000, the Baring Vostok Foundation together with partners bought out the Ozon stake for $ 3 million in 2003, Egorov and Rudakov left the company.

The company's revenue from January to September 2020 amounted to 66.59 billion rubles against 35.15 billion rubles a year earlier: 52.84 billion rubles - revenue from the sale of goods, 35.16 billion rubles - from services and services, including delivery and commissions with Sellers. The loss amounted to 12.85 billion rubles against 13.03 billion rubles a year earlier.

The spread of coronavirus and mass insulation "not just led in online natural buyers, but contributed to the formation of the habit of doing regular purchases in this channel," Ozon's financial director Daniel Fedorov said.

- For the first six months of 2020, Ozon turnover rose by 152% to the year and reached 77.4 billion rubles.

- Sales for the second quarter rose by 188% - up to 45.8 billion rubles.

- In April-May, the number of new Ozon buyers increased by 84% year by year.

According to analysts of the Association of Internet Trade Companies (Akit), in the first half of the year, the share of online purchases in Russia amounted to 10.9% of the total turnover of retailers - 1.6 trillion rubles. In 2019, online purchases occupied 6.1% of the turnover.

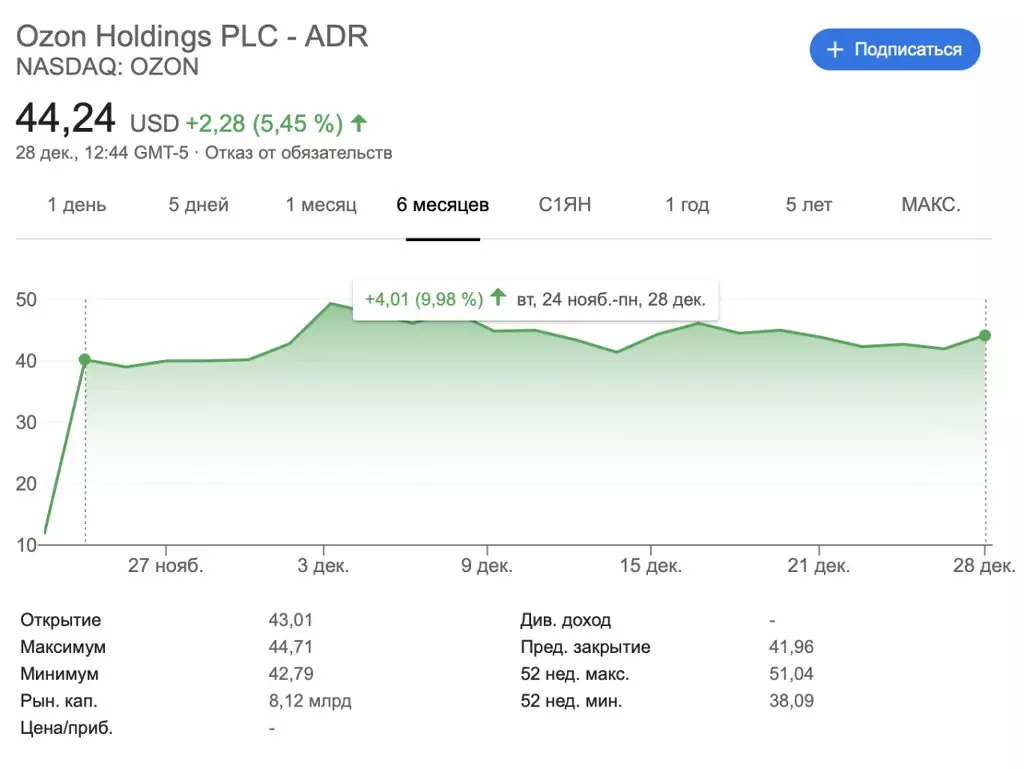

How was the IPOThe company held a primary public placement on November 24 - first on the Moscow Exchange, and then on American NASDAQ, calculating to attract $ 990 million. On the first day of trading on NASDAQ, Ozon shares rose by more than 40% per piece - with planned $ 30 to more than $ 42. At the start of the bidding on the Russian Stock Exchange, the company's securities cost 2674 rubles per piece, and at the maximum - 3192 rubles.

December 9 Ozon announced the results of the IPO. The company placed 42.45 million shares and attracted $ 1.2 billion. As a result, the Sistema share decreased from 42.99% to 33.1% (68.28 million shares), Baring Vostok - from 42.99% to 33% (68.7 million shares), other shareholders are summarized 15.7% (32.7 million shares). New investors received 18% - 37.95 million.

Almost a month, by December 28, the price of one share on NASDAQ increased by 9.98% - to $ 44.24. Capitalization amounted to $ 8.12 billion. At peak December 3, the cost of papers reached $ 49.33.

On the Mosbier in two months, the price rose to 3150 rubles at the closure on December 28.

As the desire of Russian companies to go out on the stock exchange explain analysts

In 2020, large Russian companies conducted an IPO due to the fact that after the first wave of crisis, the markets began to restore on the expectations of the creation of the vaccine, explained VC.RU analyst Raiffeisenbank Sergey Libin. It helped enough to quickly play the fall associated with Coronavirus, he noted.

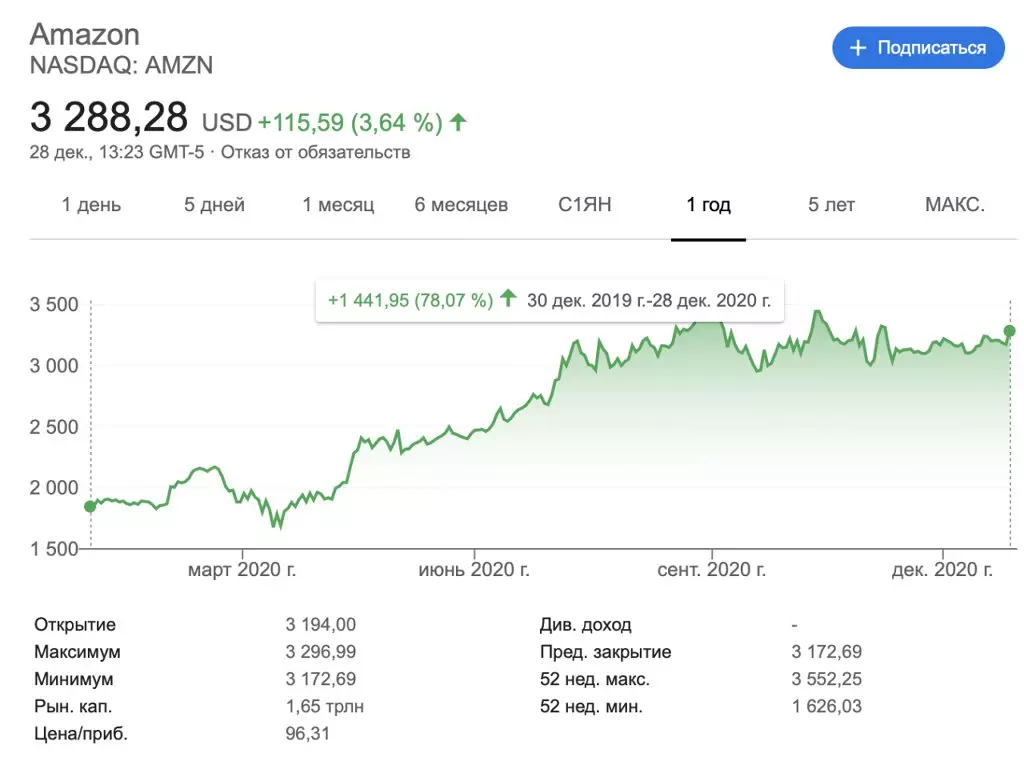

Some branches, in particular, e-commerce, even won a pandemic, told Libin. According to him, it is emphasized not only by the success of the IPO of companies of this sector (Ozon and Doordash), but also the dynamics of the value of companies in the secondary market, the bright example is Amazon. For the year, from December 30, 2019 to December 28, 2020, retailer shares went up by 78.07% - to $ 3288.

"Sovcomflot" has long planned to go to the stock exchange, in general, for all successful time, but there was no such hype in demand, as in other sectors, "Libys added.

Increasing the number of IPO of Russian companies can be expected if the favorable conjuncture in the market will continue, the Raiffeisenbank analyst has concluded.

According to analyst Sberbank CIB Anton Malkova, a significant influx of money on the stock market was provided by the economy stimulating programs around the world. First of all, these funds received the company "New Economy": in Russia - Ozon, in the west of recent transactions - Airbnb, he stated VC.ru.

The analyst also reminded that at 2021 some companies have already planned IPO:

- In October, The Bell sources reported on Mail.Ru Group plans to bring their own game division My.Games to the stock exchange with an estimate of $ 2.5-3 billion. The IPO should allegedly take place on the American stock exchange in 2021.

- An online cinema IVI also planned the exit to NASDAQ in 2021 and has already filed a request, reported on November 25 RBC with reference to sources.

- On November 26, at X5 Retail Group stated that the company discusses the IPO of its online services for two to three years.

- On November 30, Sberbank announced a possible IPO of its non-financial services.

#IPO #Ozon # investment # stock exchange # results2020

A source