After Bitcoin closed the highest day candle yesterday in his story, the price was priced to remain very close to a new historical maximum of $ 48,200. While Ilon Mask began a rally from buying bitcoins by $ 1.5 billion, the chain indicators indicate the expansion of the upward trend.

Effect "Ilona Mask"

When the purchase was published, BTC rose by about 12%, which allowed him to overcome the resistance of $ 40,000, as the analytical company Santiment noted. The amount of BTC entering the stock exchange platforms recorded the largest growth in 19 days.

Source: https://twitter.com/santimentfeed/status/1359044747076247552/photo/1.

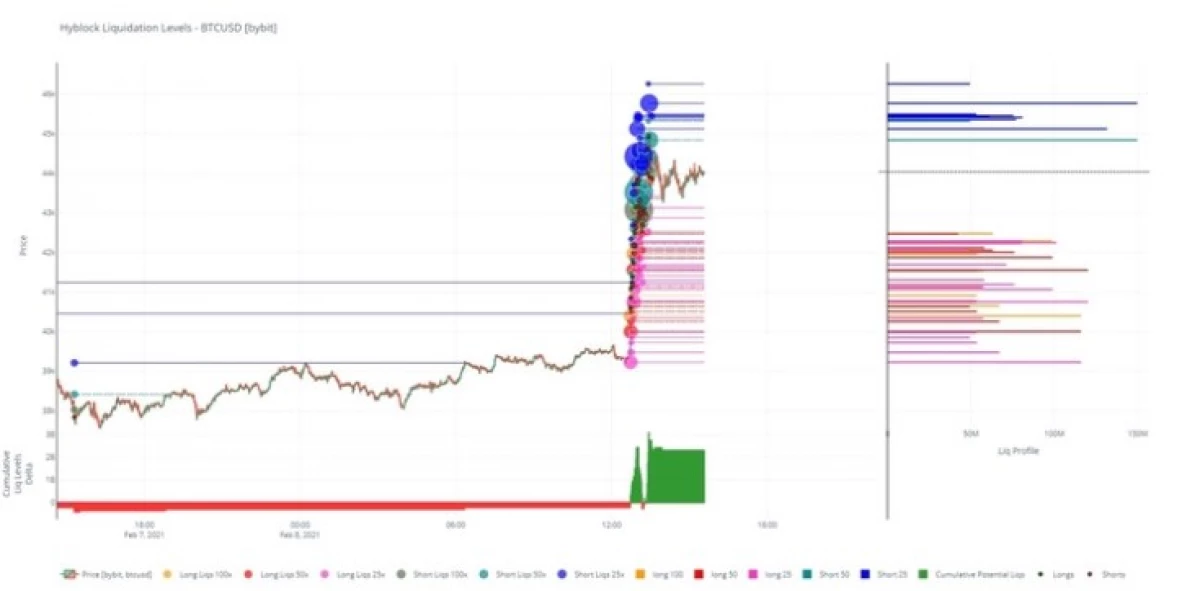

Initially, investors have formed a sale wall at about $ 42,700, but it was broken very quickly when the Asian market woke up and responded to Ilona Mask news. As a result, with the help of the Asian market, the price of BTC managed to grow to the current level above 46,000 dollars.

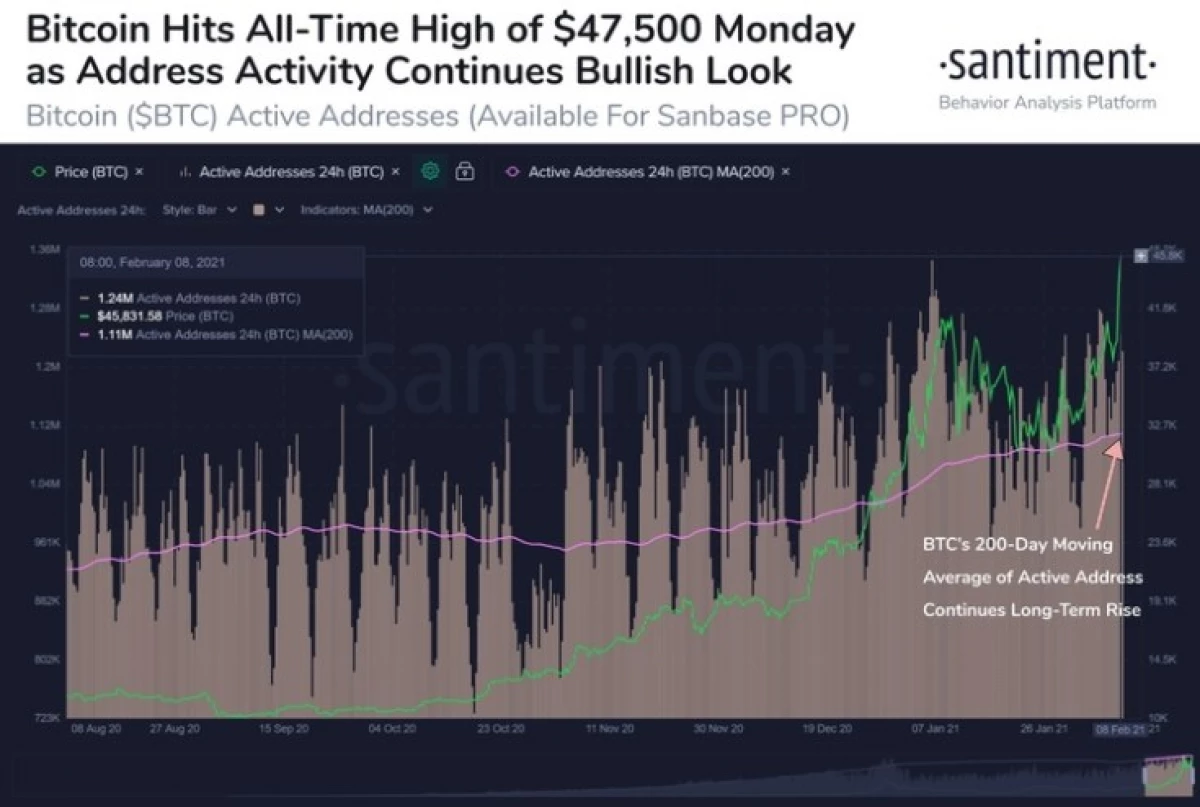

Santiment believes that the rally is also associated with the strong fundamental indicators of Bitcoin, especially if you look at the average address of addresses in the last 200 days. As shown in the diagram below, the number of active BTC addresses is steadily growing along with the Bitcoan price from November 2020.

According to an analytical company, the daily number of active addresses is a strong indicator of bullish sentiment among market participants and strengthens the thesis that the news about Tesla was just a growth catalyst.

Source: https://twitter.com/santimentfeed/status/1358953941002821632/photo/1.

The data shared by the "Byzantine General" merchant seems to confirm this thesis. In the tweet series, the trader stated that the BTC outflow from the stock exchange exceeds the influx, and added:

Like Santiment, the data on the blockchain, represented by the trader, also indicate the growth of whale activity, which moved the BTC to stock exchange platforms after the price has risen above $ 40,000. As mentioned above, these investors received a profit, but could not stop the price increase of BTC. Byzantine General said:

Source: https://twitter.com/byzgeneral/status/1358805121149374464/photo/1.

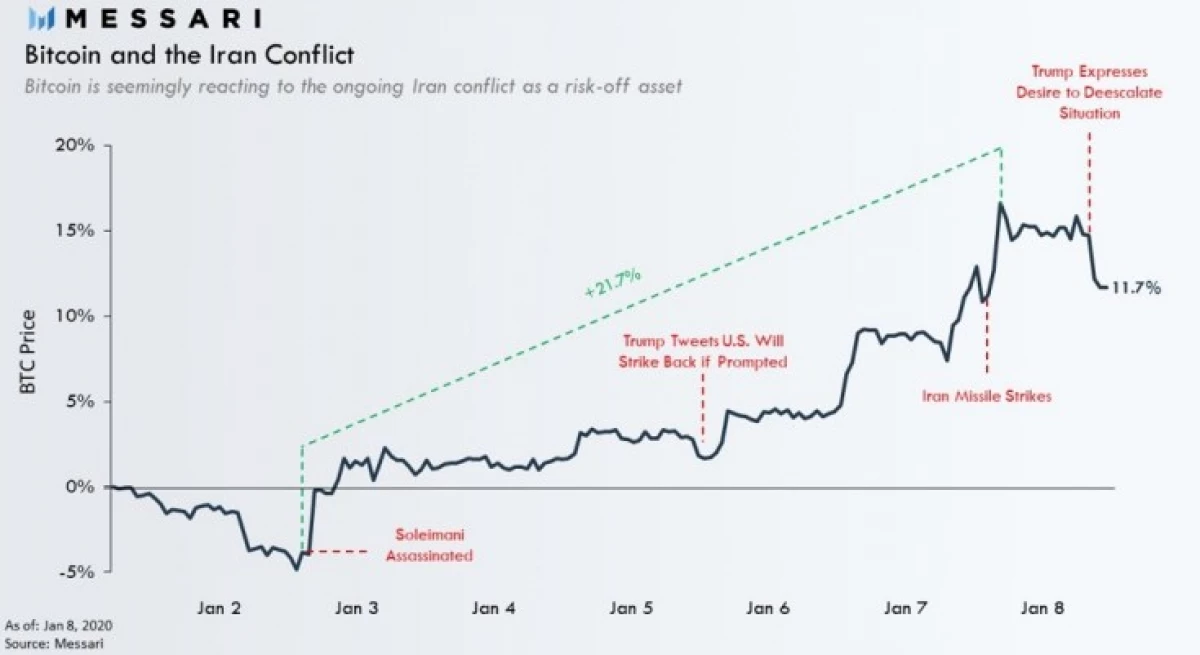

Researcher Cryptovaya Messari Ryan Watkins published a study of factors that have most influenced the cryptographic market over the past year. According to Watkins, these are institutions. Watkins believes that Bitcoin has established itself as an asylum since January 2020, when news about a possible outbreak of armed conflict between Iran and the United States. Watkins said via Twitter: three days after the beginning of the New Year, the United States killed a high-ranking General Iran Suleimani. BTC unexpectedly responded to events, acting as a safe harbor, as the risk of war increased. The events gave the first hints to the fact that BTC potentially turned into a legitimate macroactive.

From this point on, the help packages against COVID-19 Bitcoin began to establish itself as safe asylum and correlate with such assets as gold - to the first purchase of bitcoins from MicroStrategy. At that moment, Bitcoin separated from gold and began his own bull joy, as Willi Wu said and emphasized the following graph.

With this purchase, the Domino effect began, which pushed the prices of the unexplored territory. It seems that by the end of 2021 it will continue how Watkins concluded: