Networking ceases to be the lot of the Adepts of Social Networks. It deserves attention and as a tool for the timely effects of regulators on the mass behavior of economic agents, capable of destabilizing many processes and markets.

For what fought ...Ten years ago, the head of the Federal Service for Financial Markets in Russia (FSFR), in the preparation of the Russian Financial Market Development Strategy, I proposed to include in the table of its targets, the maximum number of retail investors who would have to come to the financial market in 2020, - 20 million people. Then there were less than 1 million. Now only in the Moscow stock exchange brokerage accounts have more than 9 million people. The number of those who invest in foreign securities at the St. Petersburg Exchange increased significantly. But, convinced, this is not all private investors. A bold forecast of the exponential growth of retailers market participants was not so far from the truth.

In general, to attract a private owner to the Russian stock market was a dream of almost all the heads of the financial regulator. And these dreams become reality. And what regulators? I, honestly, do not watch any euphoria. And after the private investors coming up in the WallStreetBets group staged a hunt for large hedgeons and relevant prices for shares of several companies, the attitude of regulators to private investors was not just cold, but hostile.

Revolution and counter-revolutionI have already expressed the subject that Case Gamestop became an indicator of the real transformation of the financial market model. Today it is written about it almost everywhere, and The Economist magazine made a title on the cover: "Real revolution on Wall Street." What is this revolution?

It seems to me that this is an uprising against the monopolist position of large players who can and manipulate the financial market and abuse customer confidence. This is the revolution of private disparate investors, for which the mass protest turned out to be stronger than the cash benefit. The latter was especially puzzled by the financial elite and caused her response: see how much in the end small individual investors lost and here are examples of human tragedies.

Regulators worked out at risk and began to invent ways of restrictions for private investors: the introduction of various qualifications, prohibitions for certain products, redirecting private investment demand in the scope of collective investments. In fact, two tendencies are still facing: stimulated by the regulators of "institutionalization of savings" (investment through investment institutions) and selected by private investors "securitization of savings" (individual investment in financial instruments). Which of the two trends is stronger and promising, it is difficult to say, in both cases there are risks and your benefits. In truth, they complement each other and are not antagonistic.

Cares and surprises the other. Against the background of what is happening to the far plan, there was a question about unsecured short sales, massively practitioned by large players. Let me, but after all, this practice has always been considered one of the most destructive forms of speculation and often limited to! Now it turns out that a coordinated game for increasing share prices by the mass of private traders distorts a fair market price, and large-scale unsecured short sales of securities hedgealfonds - no.

Moreover, it turns out that the tasks of attracting the financial market of a mass investor should be replaced by the tasks of all restrictions on the activities of the latter. And, of course, in the name of their good.

In response for those who have tamedAt one time, my active participation in various Internet blogs, accompanied by provocative stories, probably someone had irritated, and someone had fun. For me, it was a way to find a common language with the part of the culture of the financial market, which was represented by private traders. They did not call themselves investors, rather responding to the name "Speculant", and engaged in intraday trading mainly derivatives. It was the most nodule in the framework of the emerging and then still very small financial networks. I learned a lot from this communication and tried something to take into account in the regulation of the market.

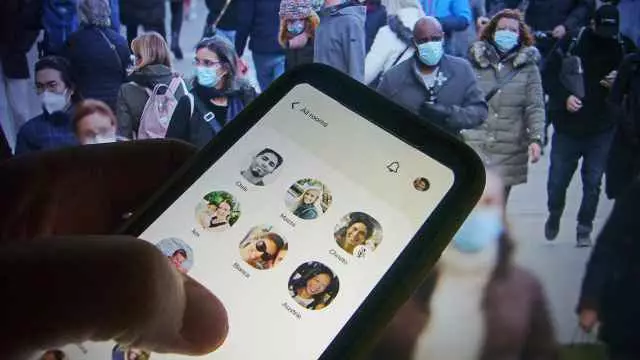

Today, network communication of private traders has become incomparably larger. In the WallStreeBets group more than 9 million people. In Russia, at one of the oldest and large traders forums - over 120,000 participants. This, of course, is an order of magnitude lower than abroad, but this is a reality. Forums for their customers create many major financial institutions and banks. They realized that this is a direct path to an increase in the clientele, which actively goes to the stock market.

It seems to me that now it's time for active regulatory nonmaturging. Not notorious openness, which is actually expressed in one-sided informing of the general public, and targeted communication. Now in general time proactive reciprocity. One-sided channels of information are rapidly obsolete. Of course, the regulators do not stand still and at the same time with the democratization of financial technologies increase their technological muscles. Along with the term Fintech, the terms of REGTECH and SUPTECH are becoming increasingly popular. But here questions about efficiency.

In 2018, for example, the US Securities and Exchange Commission (SEC) announced a competition for the provision of monitoring services for social media. And what is the result? I managed to identify the employees of the Commission, to evaluate and prevent the conspiracy of private traders on the Reddit platform? Not.

High-tech monitoring without focused policies in social networks is unlikely to give proper effect. Of course, this is a difficult task that requires training, skills, tools, and indeed more or less pronounced interest. It is more difficult than the reactive exercises on the introduction of restrictions of private financial activity, but it is its decision in line with a generally recognized paradigm - no national financial market cannot be considered developed while there is no mass private investor.

As for regulators, the regulator chat, for example, in CLUBHOUSE would be by the way.

The author's opinion may not coincide with the position of the VTIMES edition.