The investment fund of the famous American capitalist Bill Miller focused his attention on Bitcoin. According to the documents provided to the Securities and Exchange Commission (SEC), the investor trust and the Miller Opportunity Trust Foundation Manager Miller "may aim to invest in Bitcoin indirectly, investing in GrayScale Bitcoin Trust." Whatever it was, a gigant in any case plans to contact cryptocurrency and thus make them more popular. We tell about the situation more.

The main news of this year was the investment in Tesla's Bitcoin, which invested $ 1.5 billion in BTC. In addition, the manufacturer's representatives stated that they were planning to sell their cars for the first cryptocurracy. This news not only caused a serious growth of coins, but also dispelled all doubts about the future blockchain-industry.

It is now obvious that Bitcoin will cease to be an experiment for companies with free millions of dollars of funds. Thanks to the experience of Tesla, MicroStrategy and other organizations, investment in cryptocurrency will become a welcome event for companies with any money. It will stimulate the demand for the asset and make it even more popular.

Among investors, cryptocurrencies will also be the Bill Miller Foundation.

Who buys Bitcoin

Representatives of the company announced that the management converts up to 15 percent of their assets to the Bitcoin-Trust GRAYScale. For clarity, it is worth clarifying that Miller Opportunity Trust manages assets worth $ 2.25 billion. That is, he plans to direct more than three hundred million dollars in Bitcoin through GRAYScale.

Note that the GRAYSCALE Foundation allows large companies to invest in cryptocurrency. At the same time, their leadership does not have to deal with private keys, s-phrases and other basic concepts of the world of blockchain assets. The creators of the Fund are engaged in the security issue and other details. Thus, large investors can contact crypt without any serious risks. Especially such that may arise due to lack of experience.

This news appeared two weeks after Miller wrote a letter about the income strategy, in which Bitcoin called the "new technology on the huge available market" with a brilliant, logically serial protocol with distributed control. " That is, cryptocurrency fell into sight in advance.

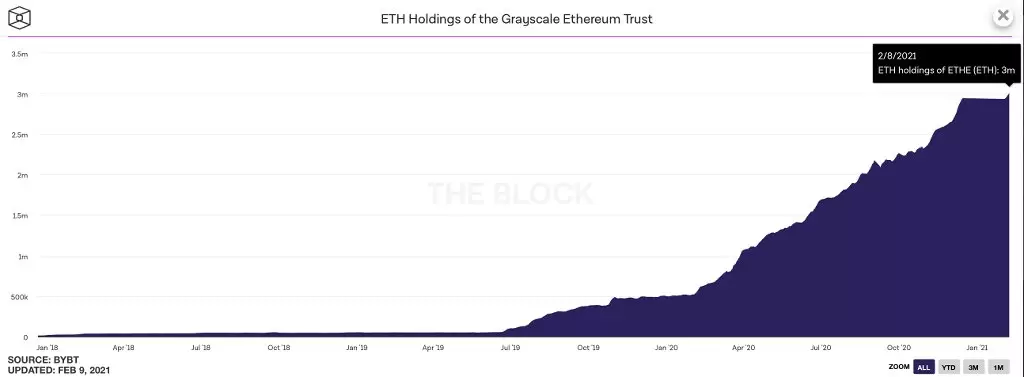

Why is the trust plans to invest in cryptocurrency through GRAYScale? As we have already noted, the trust provides the opportunity to make large investors to earn on the movement of prices of digital assets without direct purchase. Those only buy shares in the trust, the value of which fluctuates depending on the oscillations of Bitcoin. And not only bitcoin, because through GRAYScale, you can also distribute big capital to Etherumer, reports Decrypt.

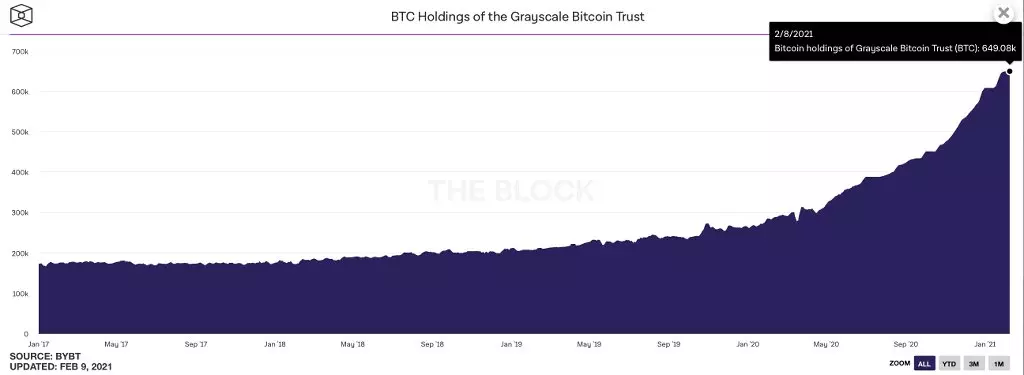

We checked fresh data: GRAYSCALE cryptocurrency reserves are just huge. In particular, the amount of bitcoins in the trust of the giant exceeds the level of 649 thousand coins. Today, they are equivalent to 31 billion dollars.

ETH ethers is also impressive. Yesterly the figure reached 3 million Eth, which is 5.4 billion dollars.

We believe that thanks to the attachment of Tesla Bitcoin and other cryptocurrencies truly will be under the sight of large companies. They will choose popular coins and insure their own funds, because due to the mass printing currency against the background of the coronavirus pandemic, the dollar will certainly continue to depreciate.

At the same time, for some investment, it may not be a desire to earn, but by insurance in case of a transition to a new financial system based on cryptocurrency. As we learned in October 2020, the same MicroStrategy does not plan to get rid of his bitcoins. The company's management is ready to store BTC "at least a hundred years." Read more about this in a separate material.

Do not forget to subscribe to our cryptoat, where it will work out how to discuss what is cryptocurrency that happens in the world and talk about new blockchain projects.

Subscribe to our channel in Telegraph to keep up to date!