Passion about the space takeoff of GME shares and the ruin of hedge funds. Let's figure it out in more detail who worked on it, and why participate in such dispersals is unprofitable.

The Wall Street Bets group was created in Reddit, which was headed by a user with Roaring Kitty's nickname - a 34-year-old financial consultant. He was the coordinator of all actions. The idea was to punish the hedge funds, which raise the shares (find shares with a large share of shorts in it (Short Interest)).

Having found a big short-interest (134%) in Gamestop (NYSE: GME), Roaring Kitty actively began to buy this asset. Simple retail investors "For the company" began buying, without looking at the analysis of the asset.

It helped shares to grow a month 16 times without any fundamental, simply due to the huge amount of purchases at any prices and forced closure of the shorts of hedge funds. As the stock growth grew lost the losses of the funds, and at the moments of exceeding the permissible risk parameters of the funds were forced to close at any price. And the closure of shorts is a purchase, that is, the emergency closure of shorts even more accelerated quotes.

Pump & Dump gives to earn a PAMPA organizer

PUMP & DUMP is a widely popular strategy in the 2000s in the American market, based on the manipulative increase in the price of assets with the subsequent collapse. Preferably, the scheme works on companies with low capitalization, as they do not need a lot of capital in order to strongly move the price. This scheme was widespread in the cryptocurrency market due to the lack of regulation in it. We will understand more about how Pump & Dump works.Scheme in action:

- The organizer buys in advance the asset that is going to dispersed.

- Fake recommendations appear and news to buy this asset (in our example, these are active calls for Reddit to ruin the hedge funds through Long of this promotion).

- The crowd begins to buy and thus pushes the price all higher and higher.

- When the price increased greatly, the organizer begins to merge his position on the crowd (we will never know, at what price those who began this Haip, but we dare to suggest that they closed their positions in the plus).

- When the growth fuel is over (anyone who wanted and could, bought a share), there is a massive sale of positions (first they fix the profit of those who bought down, then begin to limit the losses those who bought upstairs), which causes the opposite effect and leads to sharp drop.

Those who simply participate in Pampa, that is, acts as fuel to grow, do not receive profit guaranteed. Because most investors buy a share not on adequate, but on an already accelerated price. At the same time, the moment when the growth will end and the collapse will begin, it is impossible to predict. As a rule, the collapse begins after the biggest purchases from the crowd at the very top of the movement, because it is these volumes that begin to scare and throw out the stock at any price so as not to get a long time.

In the films "Boiler" and "Wolf with Wall Street" just showed a Pump & Dump scheme in action. Recently, Netflix (NASDAQ: NFLX) on the wave of hype Removed these films from its base.

It is important to note that Robingudovtsy chose predominantly weak companies with a huge short-interest and were not accepted against each other, but against hedge funds. Under the guidance of their leader, they began to massively buy GameStop shares and planned to close when hedge funds began to bump off their shorts. Some of it succeeded, but many speculators that came on top lost up to 75%. In turn, the Hedge Foundation (Melvin Capital), which occupied large volumes of GME shorts in January, lost up to 53% of their investments.

Consider the latest cases of dumps and estimate potential profits and losses

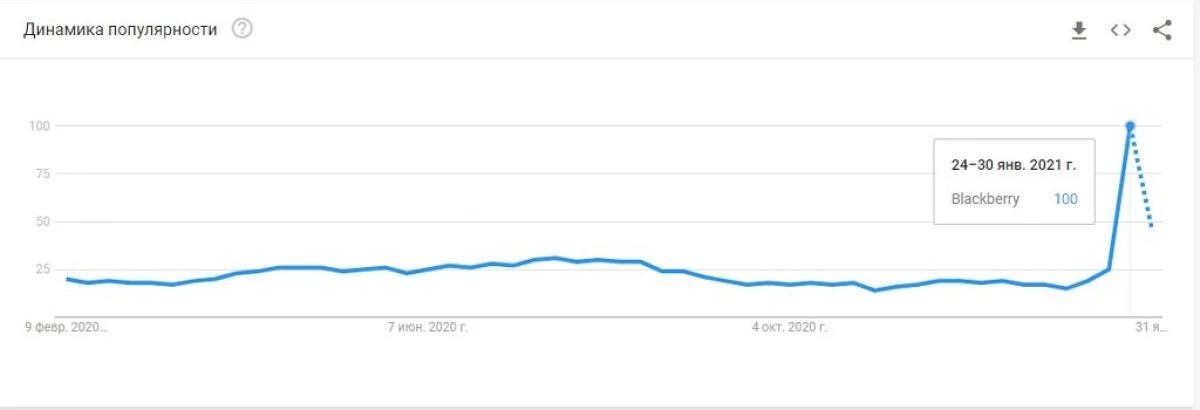

We will judge where the majority came in the peak of popularity of requests in Google Trends.

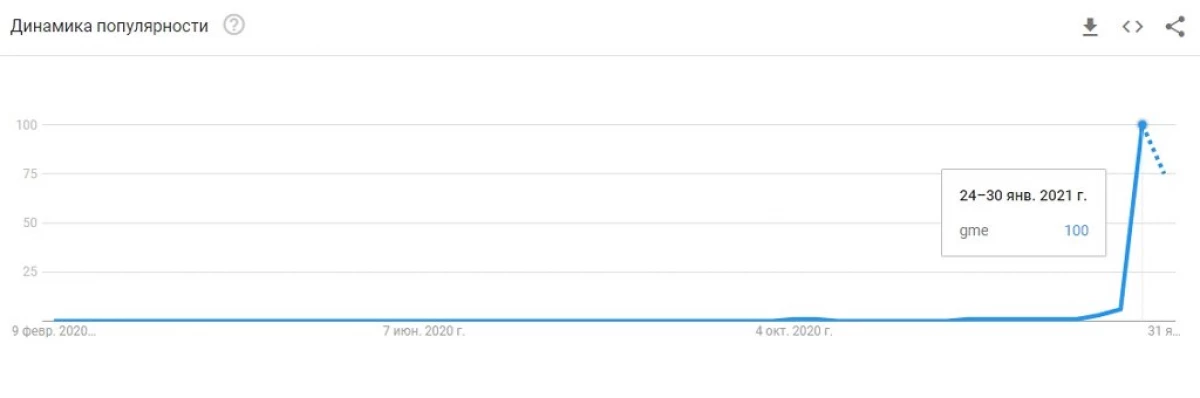

GME.

The peak of popularity fell on January 24-30:

According to the price dynamics these days the campaign came from $ 77 to $ 325.

The organizers in the plus. We note that before Pampa cost $ 20 - that is, it has already grown up to the peak of popularity 4 times, and all these days the organizers of PAMPA were logical to record the multiple profits, closing the buying crowd (and on the funds covering their shorts).

Simple traders in the minus. If we take the average price for a period of peak popularity among the crowd, we will get about $ 200. It turns out, already a week after the purchase, they lose more than 50%.

It is important to mention - not everything and every trader-novice lost on Pampa, thousands of people on it earned, who was lucky in time in his own. But most people are in the minus (if our prerequisite on the approximation of Google trends on the activity of purchases is valid). This suggests that participation in such overclocking is a game with negative matchmakers, if you are not a professional speculator.

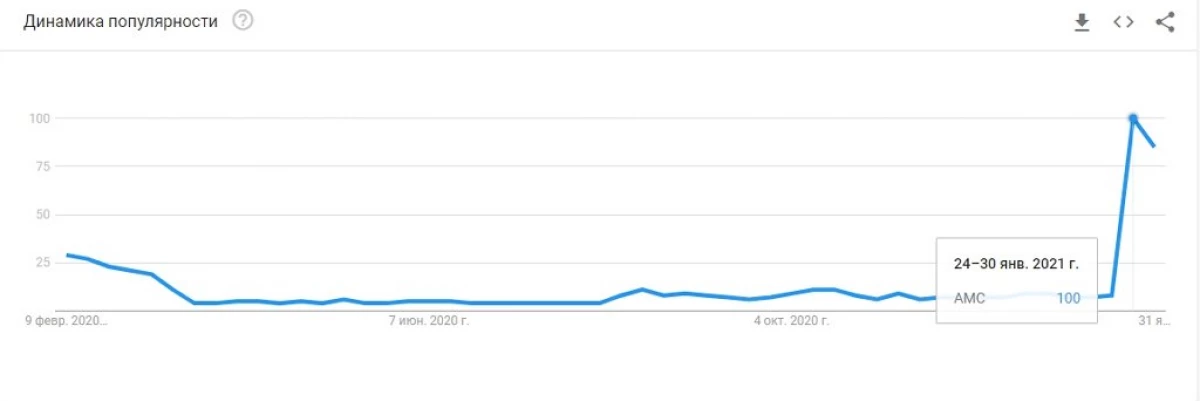

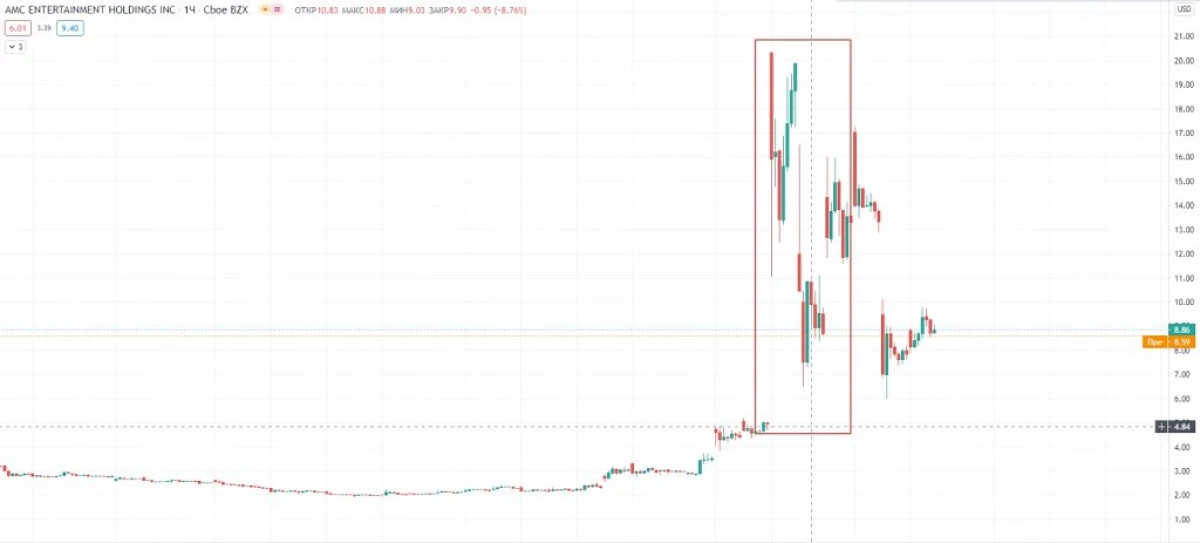

The price before the start of overclocking was $ 2.3, and during the excitement itself rose almost 9 times ($ 20.35). The promotion has already increased 1.75 times to the peak of popularity. The average price of the peak period was about $ 11.5. The price of the end of the peak of popularity was $ 13.3. Thus, the organizers could earn about 473%, and the crowd an average of 14%. However, the price is currently adjusted to $ 8.9, which would lead to losses in -24% of the average income price of the crowd.

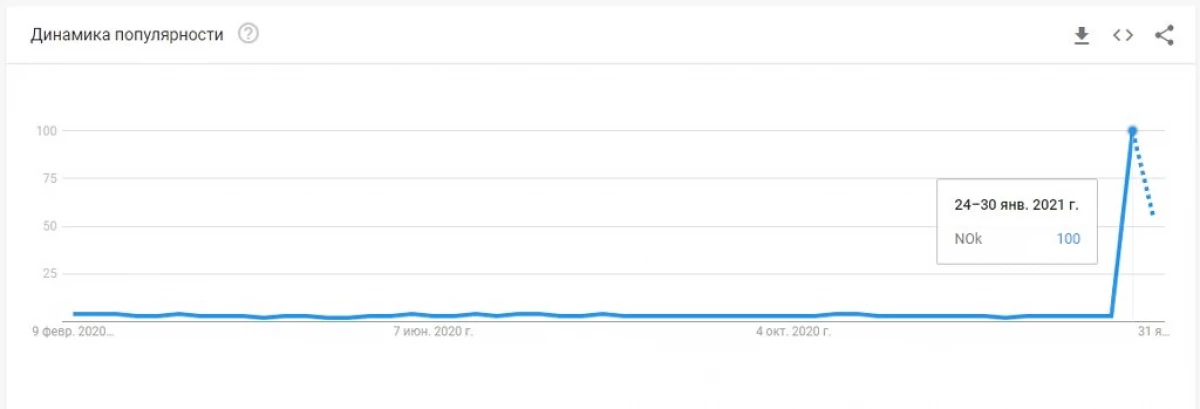

Nokia.

Until the Nokia Pampa (NYSE: NOK) traded in the $ 4 area. The first PAPD raised the price to $ 4.5, and in the peak point the price was in the area of $ 8.8 per share. Thus, the average price of the crowd input roughly wasf $ 6. Closing on January 29, the organizers could earn about 15%, while the main crowd would lose from a third to half of their speculation.

BlackBerry.

The price of Shares is BlackBerry (NYSE: BB) to the PAMPA approximately been $ 7.4. The first burst raised the price to $ 19.5, and in the peak the value of the action grew to $ 28.7. The estimated average crowd price was $ 24. Closing on January 29 (the last peak day), on average, the crowd would lose about 40%, and the organizers would have been able to earn 90%. The next week, the shares continued to adjust to $ 12.

Participate in Pampakh means paying profits for their organizers due to their risk

It would be possible to earn when you jumped into the rocket at the very beginning. However, with a greater probability, you would buy shares of the above-described companies on the Haya (at the very very popular idea of the acceleration of quotes), when the fuel ended, and would lose up to 60-80% of their investments.

The graphs show that Nokia and Blackberry almost fell to their previous values, they will soon be pulled up and GME with AMC, that is, there is a reverse effect in action (DUMP). Thus, we do not recommend participating in similar stories due to the risk of large losses.

Surride pampus is dangerous, but still profitable if on fundamental, because The price cannot be thrown forever, although drawdown can be up to hundreds% of the bet.

For this reason, investors bypass all such cases, and shorts or long on them - like a gambling. You can pamper your ego, if intic, but it is better not to risk capital.

To earn a multiple profit on stocks, you need to rely on a strong fundamental in the form of a rapid growth of the market, which employs a company and the growth of the company in the company's market due to some competitive advantages. To find such stories, analytical work is required - and it is rewarded with long-term high yield.

The article is written in collaboration with analyst Alexander Saiganov

Read Original Articles on: Investing.com