Since the beginning of the year, analysts of Investbank Wall Street seem to seek each other in bullish forecasts based on the anticipation of a rapid economic growth after the end of the pandemic and the removal of all restrictive measures. Forecasts for the first half of the Goldman Sachs $ 70 per barrel Brent, which a couple more months ago many seemed brave, were fulfilled on March 8th. Oil returned to the levels where she jumped to the levels of the beginning of January 20th, where she was trading after the murder by the Americans of General Ksir Kassem Solemani, when the world in the Middle East hung in the balance, and market participants were waiting for military escalation of the opposition of the United States and Iran. It is from those levels when it became clear that the incident would not receive development, the decrease in oil began, which had grown in the collapse in the collapse against the background of the decay of OPEC agreements and the fall in demand due to a sharp drop in oil consumption in the world caused by quarantines, first of all - With the closure of China.

What can I say about prices now? Are they justified, and whether to wait for growth in the future? Because $ 100 again becomes a reality in the long-term and medium-term (on the horizon of the year or two) forecasts. Many have believed to begin the new "raw materials supercycle". It is amused in this situation that these same people have already argued that oil will never be 100 per barrel, because the shale industry of the United States will never allow to become a reality. She will fill the oil market already 80, no matter how much Saudi and Russians together do not limit the extraction.

The topic has two dimensions: short-term - for the current year, and long-term - on the horizon of several years. Compare two points: beginning of January 2020 and current. And then, and now Brent oil was about $ 70. What was the background then, and now?

1. Then waiting for the exacerbations of conflicts in the Middle East, now the prospects for the restoration of the US nuclear transaction and Iran are becoming increasingly explicitly, which will lead to an increase in Iranian exports. The geopolitical factor is clearly not in favor of current prices.

2. And then, and now the OPEC + agreement was working, but the restrictions were then less rigid than now. Now there are more stringent quotas, and Saudi voluntarily removed another 1 million Barr / day from the market, stating that they seek to further reduce stocks. OPEC policy + is now in favor of current relatively high prices.

3. Global demand is clearly not in favor of current prices, the global demand has not recovered, the quarantine restrictions are still in Europe, worse, in recent weeks the question is about tightening them again. However, now there are expectations for the restoration of demand for pre-crisis levels after the end of the pandemic. How soon demand will be recovered - the question is open. China, which at prices below $ 50 per barrel has increased the import of oil with double-digit (in percentage terms by year) by the pace, now he has already happened his appetites - non-rubber storages. The ratio of demand is now and at the beginning of the 2020th is not in favor of current prices. But if you consider that the market lives expectations, you can "forgive" him 70 per barrel Brent, if you believe that the Pandemic will end.

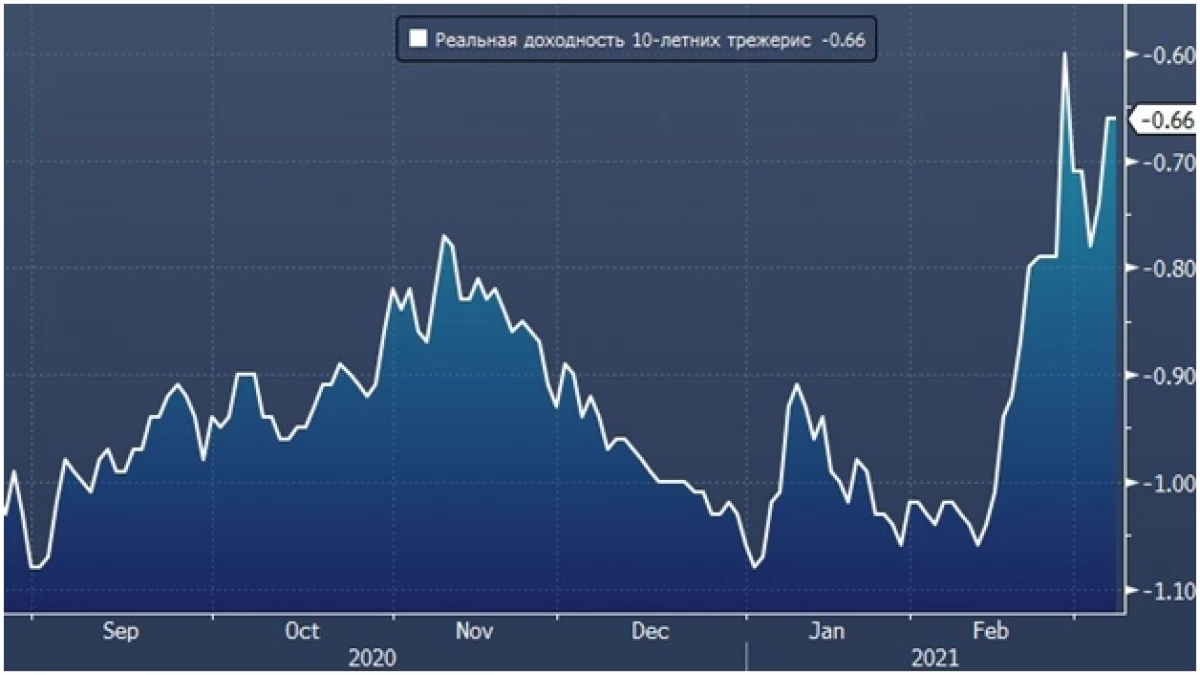

4. An important factor for the commodity market is the Fed monetary policy and the dollar index. There is definitely all factors in favor of high raw materials. Fed guarantees zero rates until inflation raises to 2%. Moreover, if in the past 2%, it was 2% at the moment, now 2%, it is a certain moving average inflation, calculated on the basis of the period of 5 years. If we consider that 2% was not in pre-crisis times, a stubborn desire for 2% on average will result in a couple of years, inflation becomes above 2%. Real rates in the United States on money market instruments are likely to remain very negative. The growth of dollar profitability, which since the beginning of the year worries investors and provoked the dollar index rollback by a couple of percent back to the level of 92, or stops, or the price increases. The dollar index is then likely to continue to decline. The weak dollar is the main monetary condition for the growth of commodity prices, it was on the weak dollar that the oil grew at the beginning of the 00s and put his historical maximum at the same time when the dollar put his cyclic minimum.

5. However, in the moment the dollar is intensified on fears of continuing the growth of dollar yield, and the real yield is growing.

Contrary to the assurances of the Fed, investors are starting to be afraid that the Fed will be forced to raise a bet before time to avoid spinning inflation. At the moment the financial conditions are tougher. The short-term growth of the dollar is not in favor of commodity prices, and if the trend does not turn in the coming days, then oil, which seems to be the only steadily growing asset, probably corrected.

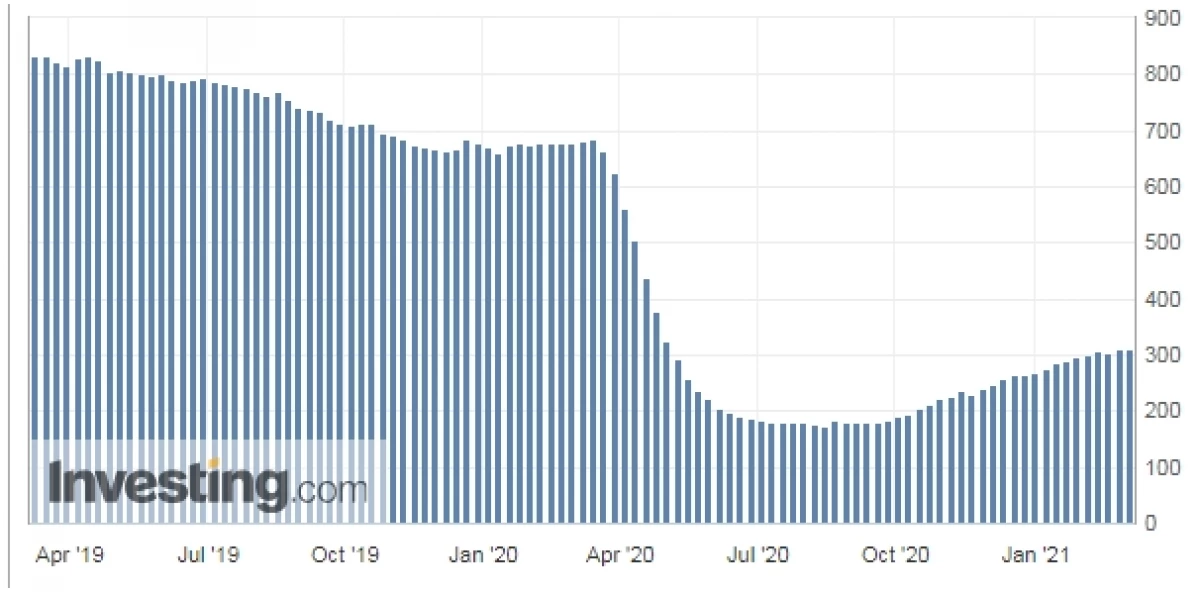

6. Shale mining, which at the beginning of the 2020, which is now remaining a constant, and at $ 70 per barrel Brent ($ 66 per barrel WTI) it will increase. The number of existing drilling rigs in the United States according to Baker Hughes, increases from summer.

The recent trend inhibition can be written off on force majeure in Texas, when a significant part of the mining stopped due to extreme cold. It will be restored as soon as possible. Shale factor - against the acceleration of prices, it will, at least, inhibit their growth.

What is the summary of all the listed factors for the future before the summer? Will prices grow, or growth will stop now, and we will see the correction? It is very difficult to estimate the relative importance of all factors, especially since the consciousness of the mass of investors is one thing, then the other begins to play the most significant role. The crowd then believes in the "bright future" after a pandemic, then, on the contrary, begins to believe that after a pandemic, the inflationary apocalypse will begin. Moreover, both beliefs can peacefully take place in parallel, but in different markets, which, for example, led to the phenomenon of oil growth on the background of strengthening the dollar - while oil traders believe in the "bright future", Forex traders are terrified by the growth of profitability.

However, we will try ... Let's start with demand and OPEC +. Mighting about last year's Fiasco, OPEC + intend to exercise caution, and rather to take care than to be offended. Million barrels removed by Saudis voluntarily from the market, plays the role of whip and gingerbread at the same time. If the majority in OPEC + speaks against the Arab line, they will not get just increasing production, but also the return of this million to the market. In the short term, it is quite possible, the Arabs from such a maneuver will not lose anything, but those who insist on increasing production - will lose due to falling prices, even taking into account the extension of production. The position of Saudis in OPEC + seems strong, and they will continue to insist on their conditions of slow production. They play price rising, and this game is done, it is quite possible, on one hand with Wall Street Investbanks, which are "spinning" the topic of price increases. Why would Saudi, creating conditions for rising prices, not to make a bet on this growth on CME to earn and there? OPEC factor + compensates and continues to compensate for the factor of weak demand. We will, in connection with this, assume that items 2 and 3 in the list above now level each other.

The factors of Iranian exports, the American slate and the status of the dollar money market remain. A well-predictable factor here is only American shale mining and monetary policy in the United States on the Big Horizon. Mining will grow, and monetary policy will remain soft. On the big horizon both of these factors are likely to somehow balance each other. In 2018, the weak dollar drove oil Brent to the area of $ 80 per barrel. The dollar index, then in the first half of the year he was stable below 90. If you believe in the Fed, you can also believe that the dollar index will return to the near future below 90, and will enaches there. Then, other things being equal, you can expect to continue the growth of oil prices to $ 80 per barrel Brent. Why not, since something like this was already relatively recently? Moreover, now there is no Trump, who his tweitter could "shout" on the OPEC, encouraging them to reduce prices, intimidating, in the course of the case, Saudi reduction of military cooperation.

If the Iranian factor with a minus sign (for oil, is in the sense that Iran will increase exports in the sense that Iran will increase the export) in the mid-term perspective). The Iranian factor is equalifies a weak dollar together with the growth of shale production, and any attempts to grow oil prices will be stuck somewhere in the range of $ 70 ... 75 per barrel Brent. But if the Iranian factor will play towards the growth of tension in the Middle East, then ... then the history of the beginning of the 00s may well repeat. When the war in Iraq served as the main driver of the growth of oil prices at the initial stage of the new business cycle after the bubble burst was burst, and asked the trend that ended the maxima far over $ 100 per barrel. And, notice, oil then grew against the backdrop of a bear stock market in the United States, although, in the end, he finished together with the final fall in 2008.

So there is nothing impossible at $ 100 per barrel if global policy, one way or another, will lead to a new Middle East crisis. Against such expectations, there is a historical experience: American Democrats, who took the entire completeness of power in the USA (president and most in the Senate and Congress), as a rule, seek to play the Middle East the role of "peacekeepers". On the other hand, there is a big temptation to kill, figuratively expressing, in one oil shot of two hares: to slow down the growth of China, who Americans themselves declared an existential competitor for themselves, and to finance the close to the democratic Heart of Green Energy. If oil returns again above $ 100 per barrel, it will be the best stimulon for refusing hydrocarbon fuel in favor of other types of energy than budget subsidies.

Let's see how American foreign policy will develop. While it seems that it is political factors that determine the further development of the oil price trend, because economic, together with OPEC policies +, or have already practically bane each other, or will do it in the sooner future.

Dmitry Golubovsky analyst FG "Kalita-Finance"

Read Original Articles on: Investing.com