Bank card with free maintenance - how much is it free? Well

If you agree to put up with the conditions of the bank or with trimmed possibilities. Phintolk explains how not to pay for annual service and not run into penalties

.

Free, but ...

Can the maintenance card generally be free? In theory, the bank should carry regular losses on such cards, because each operation implies some internal costs. However, the largest Sber in Russia, and with him and other banks have been offered by credit and debit cards for several years, which are promoted as "free".

For example, not to pay for maintenance of some cards, you need to spend on purchases from 3,000 to 7,000 rubles per month or constantly keep the card at least 20,000 - 50,000 rubles.

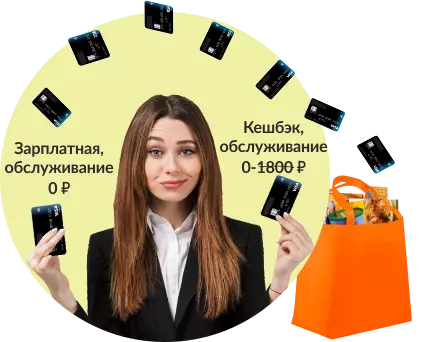

How it works? For example, Julia has a salary card, the maintenance of which she does not cost her, as the card issued an employer who concluded a salary agreement with the bank. And Julia has a debit card of the same bank with Kesbank, whose monthly service costs 150 rubles. This is for a minute, 1800 rubles per year. But Julia does not pay Julia for using this card, because SMS notifications have long disabled (saving 720 rubles per year), and for free to her money from a salary card. At the same time, she spends no less than 5,000 rubles per month on purchases from the debit card per month, fulfilling the condition supplied by the Bank.

Fast, but dead?

For those who do not plan to earn percentage from the balance, some banks still offer "instant" instant issue maps for which the fee for annual service does not take or amount to a sum of 150 to 300 rubles per year. Instant Issue cards (literally "instant issuance") are issued immediately when contacting the bank.

The name of the owner does not indicate the name of the owner, but she has all the other signs of a classic bank card:

- The number and validity period of the card are squeezed on the front side;

- There are access to basic services, including contactless payment;

- On purchases can accrue bonuses;

- You can bind the bill in any currency;

- The map is displayed in a mobile bank.

Conditions for servicing Debit Card Instant Issue can be somewhat trimmed compared to the "classic": the cash removal limit will be lower, and the Commission for its exceeding - higher, interest on the card balance may not be accrued at all, and the purchases may not be available in all Online stores. In addition, some services (push notifications, mini statements in ATMs, etc.) on the "instant" cards can be provided for a fee.

That the most "cheese"

As for free credits, including nonienneal and "instant", then everything depends on the tariff: banks often put conditions for free maintenance.

At VTB, for example, there is a credit "map of the opportunity" - initially it is free, but when it is connected to the bonus program, the annual fee will be about 500 rubles.

The banknote "you can all" Rosbank is immediately connected to Keshb, but for free maintenance, the monthly turnover on the map should be at least 15,000 rubles. In other banks "imputed", the amount of purchases on a credit card can be from 7,000 to 70,000 per month, and with smaller spending, the service is automatically included.

It happens that credit cards are issued and serviced for free and seemingly even without any conditions, but all the benefits eat high percentages (from 20% and higher), lack of cachesback and short grace period. So learn the tariffs before agreeing with "free cheese".

Recently, banks are increasingly offering free digital maps that do not have physical media. Unlike virtual cards, intended mainly to pay online purchases, such cards have almost all the possibilities of ordinary "plastic". True, they are not available to everyone.

It is impossible to lose a digital card, it is difficult to steal it, but in order to use it in offline store or remove the cash in the contactless terminal, you need a smartphone with the NFC module and the connected service of Apple Pay, or Samsung Pay, or Android Pay. Alas, not all digital cards are free of service without additional conditions, so it is worth carefully examining the requirements of the bank before completely abandon the "plastic".

In the same cases, when the card service fee is initially provided for by the tariff, it will not be possible to submit it: the bank will simply remove the required amount. At the same time, in minus, even the "zero" debit card will not leave, but the money will spike, as soon as any payment is received - and so until all the debt is paid. In the case of an overdraft connected or with a credit card, the situation is more difficult: you can be sure that there is no debt on the map, but after writing off the debt for the service, an unforeseen loan may be formed.

In short, the bank always remains with its advantage: declaring free service cards, he still gets his own - on other, more premium products, partner commissions, additional services, or percentages for cash over the limit. But the love of customers to freebies is indestructible, and the banks only support it and are successfully used. Tom and stand.