EUR / USD couple with enthusiasm met the reassembly of Super Mario to a large policy.

Financial markets trade with reflation, and they like it! S & P 500 eight times rewrote historical maxima in 2021 due to hopes for vaccines and fiscal incentives from Joe Bayden, as well as due to strong corporate reporting. According to FactSet, out of 295 reported companies included in the database of the stock index, 81% surpassed the expectations of analysts regarding profit growth. And if in January the path of the American stock market and EUR / USD broke out due to concerns about too slow vaccination in Europe, then in February S & P 500 as in the old days re-serve "bulls" by euros.

Dynamics EUR / USD and S & P 500

Source: Trading Economics

According to Citi, the achievement of the stock index of 4000 may provoke the desire of buyers to fix profits and lead to a rollback. Nevertheless, the risks of short compression hang on the US stock market: the positions of $ 21 billion are unprofitable, and their closure will give a new impulse "bull" attacks.

At the same time, say that the Rally American stock indexes and the associated improvement in global risk appetite is the only EUR / USD growth driver, incorrectly. Against the background of a decrease in the number of infected COVID-19 due to a pandemic departure from a seasonal peak, investors have come with the idea that vaccination in Europe is slower than in the United States. Ultimately, the discovery of coronavirus is required to open the economies, which currently takes place without vaccinations. Factor Mario Dragi plays on the euro side.

The identity value in history is difficult to overestimate. The return of the ex-head of the ECB to a large policy was enthusiastically met by the financial markets of the old world. The yield of 10-year-old Bonds of Italy for the first time in history fell below 0.5%, Spain attracted € 5 billion during the first grades of 50-year-old debt issues. Then buyers demanded 3.45%, now they were satisfied with a number of 1.45%. The excitement takes place against the background of a decrease in the monthly scales of assets to € 15 billion on the part of the ECB, which allows you to talk with confidence about the drag effect. The government led by Super Mario, conducting pro-European reforms, can increase the prospects of comprehensive changes in the EU fiscal Rules, which, in turn, will accelerate the economic growth of Italy.

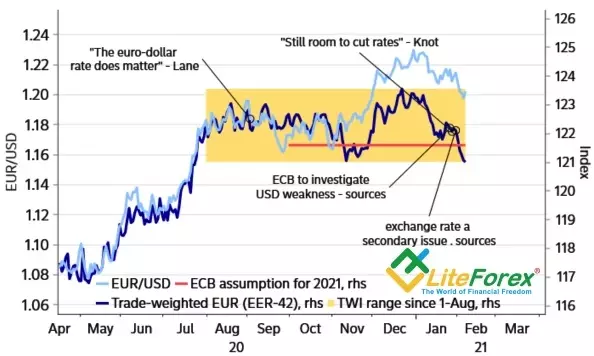

We will not forget that the rollback of the main currency pair reduced the risks of verbal interventions of the ECB. Weighted euro exchange rate asked even deeper than EUR / USD.

Dynamics EUR / USD and Weighted Euro Trade

Source: Nordea Markets

Thus, the growth of S & P 500, the seasonal decline in COVID-19 and the effect of drags managed to throw "bulls" on the united European currency a lifebuoy. Investors are missing by the ears of a slower vaccination in the EU, where the vaccinations were made by 4% of the population, compared with the United States (13.5%) and increasingly remember the rapid growth of the global economy.

Resistance breakthrough per 1,208 allowed EUR / USD pair to achieve the first of the levels marked in the previous material - 1,2125. The queue is 1.215, 1,221 and 1.225. If the S & P 500 does not let, "bulls" will get to them for several days. We continue to focus on Long.

Dmitry Demidenko for LiteForex

Read Original Articles on: Investing.com