Entrepreneurship is independent activities aimed at systematic profit. So says the Civil Code of the Russian Federation.

Business should be registered, otherwise a person will be considered an illegal entrepreneur. We tell what risks is the work of the IP without registration and what to do if you need to register a business.

Not all activities that make a profit is entrepreneurial. The main thing is systemic. If you, for example, want to update the interior at home and before repairing, sell unnecessary things, it will not be entrepreneurial activity, although you will receive a profit.But if you are purchased goods, and then resell them more expensive, the tax may well consider you by an entrepreneur. In this case, the presence or absence of profit is not important - the main thing is that you have a goal to get it. That is, even if the illegal business is unprofitable, the FNS will still consider him a business, and you are an entrepreneur.

Sometimes business grows out of the hobby. In this case, it is important not to miss the moment of transition to entrepreneurs so as not to get unpleasant consequences - we will tell about them a little further.

The key point that determines entrepreneurial activity is a systematic profit.

For example. Natalia was fascinated by knitting cardigans. At first she asks friends to help - makes merchants from them and learns to knit cardigans of different sizes and styles, and finished products gives their models-comrades. Even despite the fact that Natalia gave each of his friends for three cardigan, she is still not an entrepreneur - she does not receive profits, although it knits systemically. After some time, friends begin to order from Natalia Cardigans for money, and also recommend its products with their acquaintances - new customers come to Natalia. Now Natalia sells three cardigan per month and advertises them in social networks, which means she is an entrepreneur.

Tatyana Bakuleva, lawyer

If the hobby suddenly or finally began to bring regular income, even if this income is quite small, then it's time to think about legalization. Such activities will already be considered entrepreneurial in connection with the systematic income. In practice, it is difficult to prove the systematic profit of profit and calculate such large income if people do not use bank money transfers. But now a large number of calculations occurs via the Internet banks, and the tax authorities are increasingly interested in the origin of income and there are already cases of attempts to control the costs of citizens not relevant income.

How tax learns that I have a business if you do not register

Literally like you. Documentary confirmation of business is a website, rental contracts or procurement. But it is possible to identify the entrepreneur and at oral testimony - for example, by testimony or complaints of customers.

The evidence of entrepreneurial activities of the FNS may calculate:

customer readings

extracts from bank accounts, receipt of money,

advertising goods and services,

Availability of the site

Wholesale purchases of goods,

Contracts, rental of retail space.

Not to get under the attention of the tax difficult, because Even if you keep a business without any advertising, you do not have a website and profiles in social networks, to predict that the client will not leave a complaint to your services, or that the client will not be an employee of the tax service - it is impossible.

For example. Ivan in the free from the main work time bakes to order figured cakes and advertises them through pages in social networks. Ivan did not register as IP, it seemed to him that it was unnecessary, because he had a modest hobby, and not the "real" business. Ivan received a new order for a cake in the shape of a kitotica child's birthday, and a little later - a summons and a fine for illegal entrepreneurship: the customer turned out to be a tax inspector.

The main supervisory authority that reveals illegal entrepreneurs is the FTS. But the tax service is not the only structure that can detect an unregistered IP. After a client's complaint, police, Rospotrebnadzor, Antimonopoly Service or Prosecutor's Office may be verified.

Anastasia Borodina, Head of Legal Management LLC Samkorp

FTS can learn about the implementation of entrepreneurial activities from complaints of dissatisfied customers to the inspection bodies, see the expensive purchases of an illegal entrepreneur, arrange a control purchase or advertising.

By responsibility for unregistered business, the businessman will attract the FTS - through the court. The case will be considered at the place of residence of the accused or place of activity within two months from the date of drawing up a protocol on violation.

The responsibility provided for for doing business without registration as an IP is the tax, administrative and criminal, it depends on the amount of income and the type of violation.

Can not only punish business without registration. If the amount of income from unregistered business does not reach criminal liability, the unregistered IP will finish the tax itself - by 10% of the income received, but not less than 40 thousand rubles. And if a license was needed for business, you will have to pay a fine FNS in the amount of 2000-2500 rubles. With confiscation of equipment and released products.

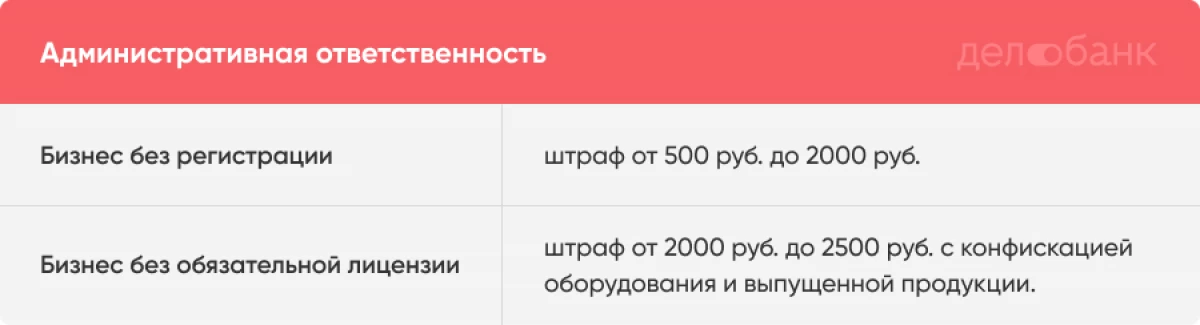

Administrative responsibility:

Business without registration - Penalty from 500 rubles. up to 2000 rubles.

Business without a mandatory license - a fine of 2000 rubles. up to 2500 rubles. With confiscation of equipment and released products.

Foundation: Article 14.1 of the Administrative Code

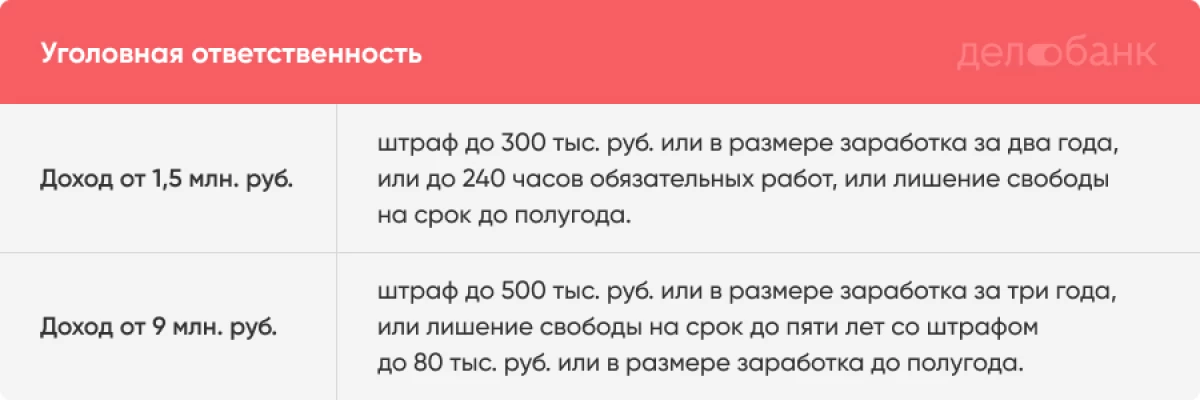

Criminal liability

Revenue from 1.5 million RUB. - Fine up to 300 thousand rubles. or in the amount of earnings in two years, or up to 240 hours of mandatory work, or imprisonment for a period of up to six months.

Revenue from 9 million rubles. - Fine up to 500 thousand rubles. or in the amount of earnings for three years, or imprisonment for up to five years with a finer up to 80 thousand rubles. or in the amount of earnings to six months.

Foundation: Article 171 of the Criminal Code of the Russian Federation

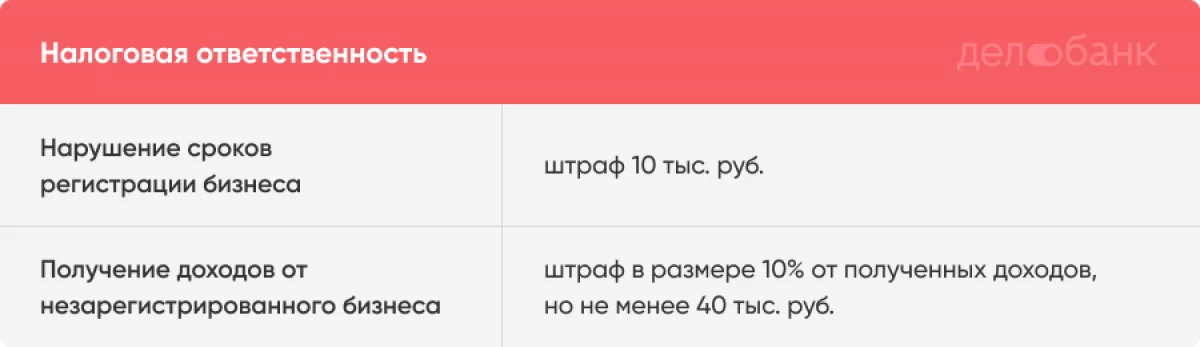

Tax liability

Violation of business registration timelines - a fine of 10 thousand rubles.

Revenue receipt of income from an unregistered business is a penalty of 10% of the income received, but not less than 40 thousand rubles.

Foundation: Art. 116 NK RF

Anastasia Borodina, Head of Legal Management LLC Samkorp

If entrepreneurial activity is associated with retail sale of alcoholic and alcohol-containing food products, you need to be ready for responsibility provided for in Part 2 of Art. 14.17.1. Administrative Code in the form of a more substantial fine in the amount of from 100,000 rubles. up to 200,000 rubles. With confiscation of products.

To register a business and become a legal entrepreneur, you need to contact the FTS. If your activity allows you to, and you suggest such a regime, for example, you do not plan to receive more than 2.4 million income per year. Or hire workers, you can register as self-employed. Here are our texts on how to open an IP, and how to become self-employed, the registration schemes are described in detail.

Important. No need to be afraid to register a business if you suddenly realized that already conduct business activities. It is better to come to the tax independently, and not wait until she calculates you. Business registration is not an obequarious turnout, negative consequences of a visit to the FTS will not suffer.

Maria Tatartseva, consultant of freelancers and artisans on the legalization of their activities

Many fear that as soon as they register in the tax, they will immediately come with check and finish over past incomes. But everything is exactly the opposite: so far the tax has not calculated violations, you can avoid fines and punishments, if you come and "surrender" yourself. You will simply begin the work "Wheel" from scratch and do not pay for past pregnursions. And if the tax authorities calculate you during the inspection or control procurement, it will have to pay in full - not only for those income on which you will be caught, but also for the previous three years. If the FTS does not receive accurate data on your income during this period, then the average number of markets will take place and detaculate the unpaid taxes plus fines.

Article for 30 seconds

If you are systematic (at least twice a year), you receive a fee for your services - you are an entrepreneur.

Tax can identify an illegal entrepreneur with many ways - according to advertising, complaint from the client, contracts with counterparties or receipt of money.

For doing business without registration, be fined, and for receiving income from illegal business in a large or especially large size - not only fined, but also to punish liberty.

It is better not to wait until the FTS will calculate you and register a business on your own - so safer and cheaper.

- Maria Voronov