On Wednesday evening, the dominant trend remained pressure on US technological companies. Against this background, Nasdaq lost another 2.7%, Dow Jones 30 decreased by 0.4%, and the S & P500 retained its intermediate position, retreating at 1.3%.

For investors, it is important that this is not a comprehensive Risk-off, which was observed in the markets exactly a year ago. The universal skepticism is associated with the fact that the profitability of state bonds began to noticeably exceed the dividend yield of the market as a whole, and especially - high-tech companies, where the dividend income is either very modest (about 0.5% from Apple (NASDAQ: AAPL)), or is not available at all (Amazon (NASDAQ: AMZN), Google (NASDAQ: GOOGL), TESLA (NASDAQ: TSLA)), despite a long history and huge capitalization.

Growth, dominant in the NASDAQ index, lose attractiveness against the background of the continued increase in the profitability of long-term bonds. The yields of 10-year-old treasuries reached 1.5%, and 30-year-old papers - 2.28%, which is close to the peaks of last week in 2.35%. This growth is not only strengthens the contrast with dividends, but also potentially tightens conditions for markets for markets.

At the same time, the strengthening of the dollar in pairs with CHF and JPY currencies continues. At the same time, the risk sensitive GBP, AUD and CAD this week stabilized in very narrow bands.

It is still maintained for gold, which yesterday descended under $ 1700, while oil managed to recover to the levels of the beginning of the week.

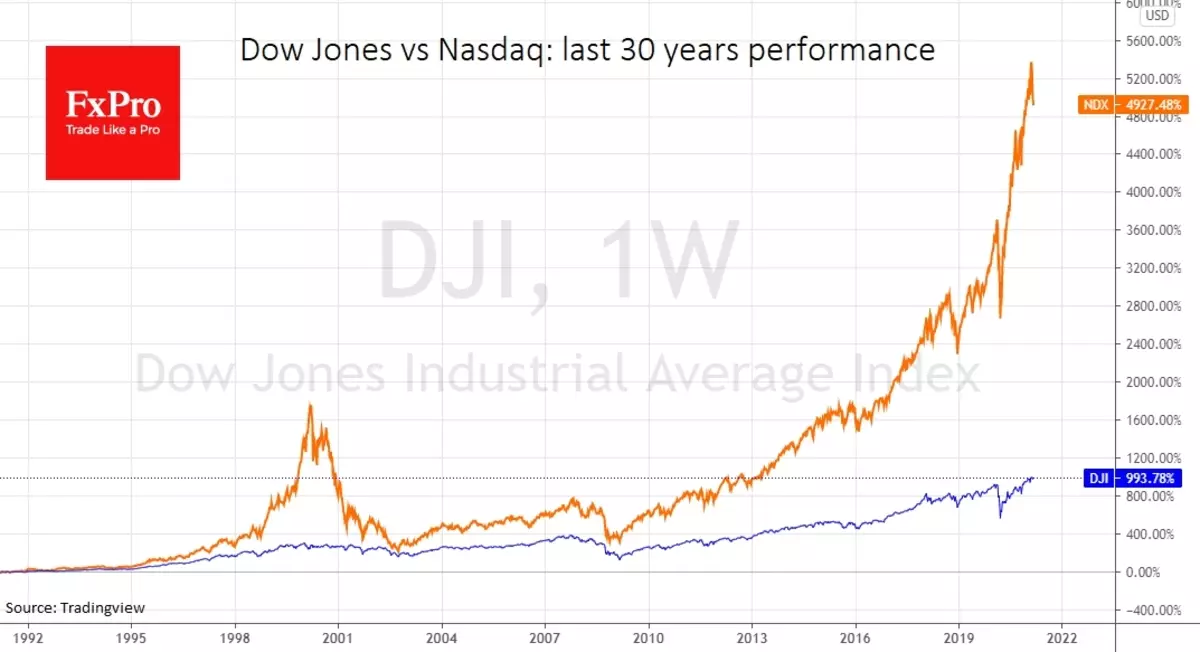

The most dangerous thing is that such an uneven weakening of stock markets will not allow the Fed to act, additionally mitigating policies. Further development of the situation may indeed be a certain repetition of the dot-comob bubble period in 2000-2002, when NASDAQ lost 83% of the peak against 38% in DJ30.

Developing and commodity markets became the first to ruin, already in 2001, it was fundamentally unfolding to growth. The Fed kept the policy of soft, which not only inflated the sails of inflation, housing boom and foreign markets, but also weakened the dollar. All this in a somewhat modified form can become a promotion of the coming months or even years.

Team of analysts FXPRO.

Read Original Articles on: Investing.com