The stock markets have long remained without positive news: since last week, we are expected to see the development of history with a new package of help from the "rewarded to complete power" of Democrats. The size of the expected support is very quickly revised: last week Goldman estimated the amount of stimulation of $ 750 billion (of which $ 300 billion in the hands of the population = stimulating payments), then there were estimates in 1 trillion, 1.3 trillion dollars, and before today, Bayden to Americans Markets are already talking about 2 trillion dollars. Of course, it limits any dollar urge to strengthen and presses the price of Trezeris, since the market expects a colossal portion of bond supply.

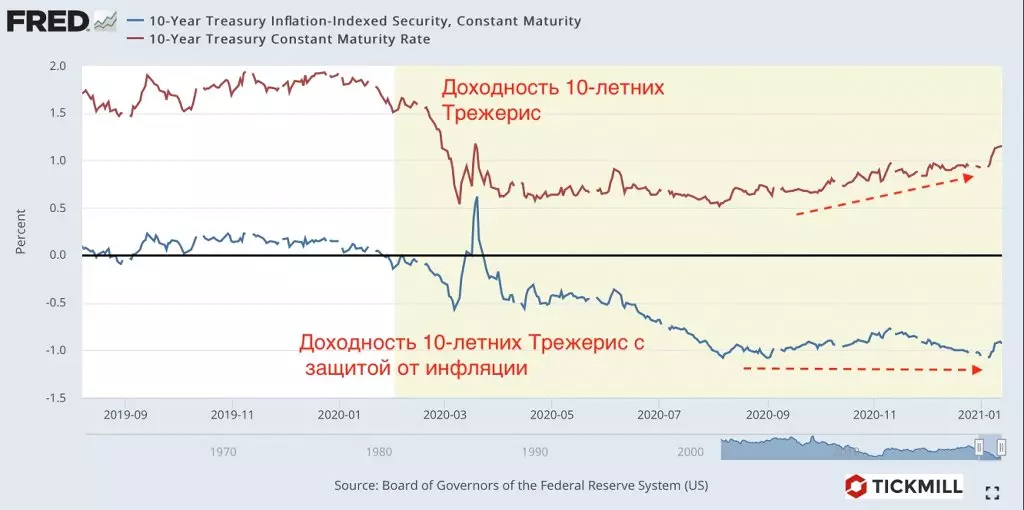

Inflation in the United States in December accelerated from 1.3% to 1.4% in annual terms, however, as we said earlier, the market's positive surprises are not surprised, since the acceleration of inflation in the coming months is already reflected in the market premium for inflation in the yield of bonds. Comparing the profitability of 10-year-old Trezeris protected and inflexible from inflation, it is clearly seen that the market does not expect anything in the interest rate, but expects inflation:

The yield of Tips has changed poorly since October, while on 10-year notes increased more than twice - from 0.5% to 1.15%.

Weak inflation would add weight to the dollar, however, and here the report played against him.

It was interesting to see the data on the economy of Japan for November and December. As it turned out, she better coped with the pandemic crisis in the fourth quarter than previously assumed. In general, the Japanese assets and yen look now undervalued, since, in general, Japan grew poorly in the past decade, forcing the Bank of Japan to manipulate rates (not very successfully, by the way). Due to the long history with stagnation, investors could have a preconceived opinion to Japanese assets.

Regarding the data, the key industrial sector has shown a good activity in December - industrial orders increased by 1.5% when forecast in -6.2%. Production inflation also accelerated - up to 0.5%, ahead of the forecast of 0.2%. If the Administration of Byyden will bow the Congress in favor of adopting new large-scale cash incentives, one of the main foreign beneficiaries of this event will be Japan, which is usually grown by a leading pace, but only at the initial stages of global reflation (lifting). So it was after the crisis of 2008, when the strengthening reached 80 yen per dollar.

Speaking of USD / JPY, from a technical point of view, we are approaching the upper border of the rising channel. Making a bet on the fact that the movement in the channel will continue (which contributes to such a powerful fundamental as a biden fiscal plans), the potential reversal area can be located in the range of 104.50-104.70:

Arthur Idiatulin, Tickmill UK Market Observer