This year, details have changed to pay for mandatory payments. Individual entrepreneurs and legal entities in paying taxes and insurance premiums need to fill the payment orders in a new way. If you do not comply with new rules, you have to pay twice, but already taking into account the penalty and fine. We explain how to fill the wards now.

From 01/01/2021, the Federal Law No. 479-FZ came into force "On Amendments to the Budget Code of the Russian Federation in terms of treasury care and treasury payments". Briefly tell about the essence of the main innovation.All receipts to the budget from now on serves the treasury, and if more precisely, the territorial bodies of the Federal Treasury (TofK). Budget money is taken into account on treasury accounts, and the treasury, as an operator, distributes these funds. Government, including tax and insurance funds, receive money for treasury accounts. Therefore, the concept of "cash services" is replaced by "Treasury Services".

The new order was introduced in fulfillment of the principle of the Unity of the Cass. Money is credited to a single budget account, and it is distributed from it. It should speed up the flow of money in the budget and simplify their distribution.

Therefore, from 2021, the requisitions of the Treasury Accounts of the Federal Treasury and the details of the accounts that are part of the Unified Treasury Account (EKS) have changed.

The treasury score is different from the bank structure of the account. Another treasury account always begins with 0. The table of compliance with the new treasury bank accounts can be viewed on the website of the Treasury of Russia. This table will be useful to you when filling out payment orders.

According to the order of the Treasury of Russia dated 13.05.2020 No. 20N, all budget organizations from 2021 should be open accounts in Tofk. Accordingly, the accounts opened in the divisions of the Central Bank of the Russian Federation or in credit institutions will be closed. About the date of closure of old bills Let's talk a little later. If you immediately want to learn about the closing time, see the penultimate section of the article.

When you get paid to pay the tax or insurance premium, take the usual payment and carefully look at 4 requisites (column):

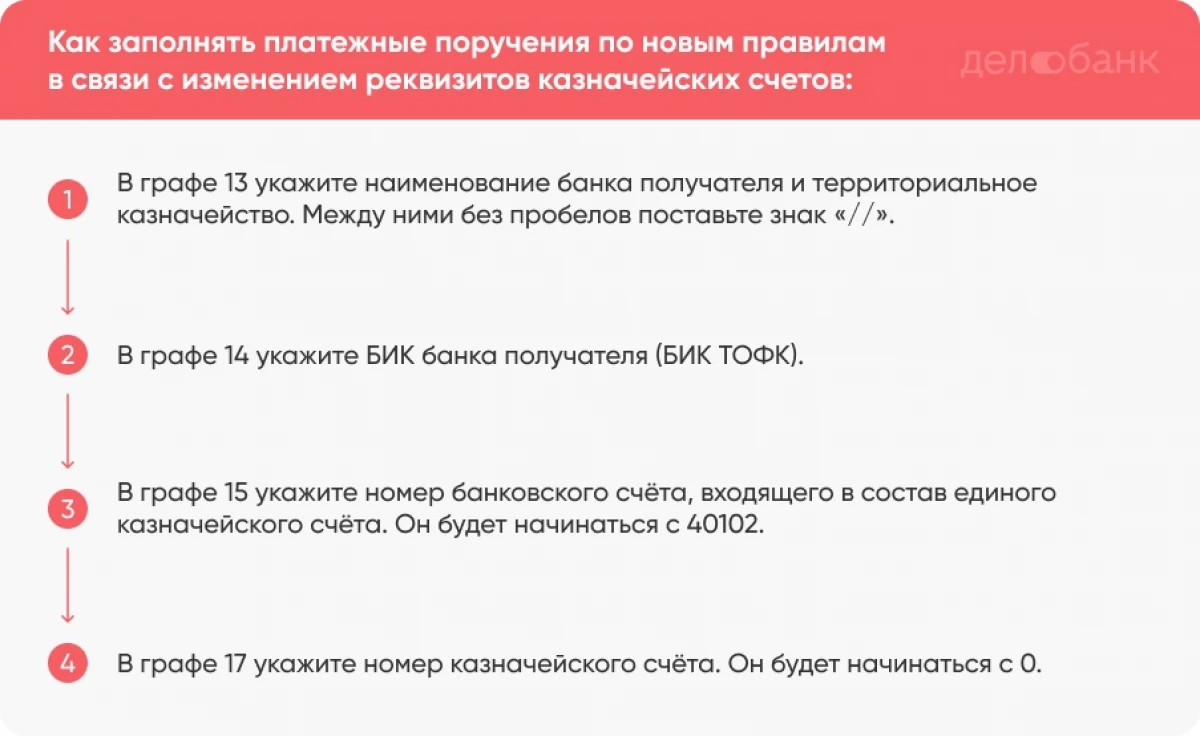

Requisites 13 - Recipient Bank. Here it is necessary to specify the name of the bank and through the sign "//" the name of the Office of the Federal Treasury (UFC).

Requisites 14 - Beach of the recipient bank. Identification code will be new.

Props 15 - account of the bank recipient's bank (single treasury account). Until 2021, this graph was not filled at all.

Requisites 17 - recipient account number (Treasury Account number). It will start with 0. Previously indicated the banking number, which began with 40101.

To be clearer, explain on the example.

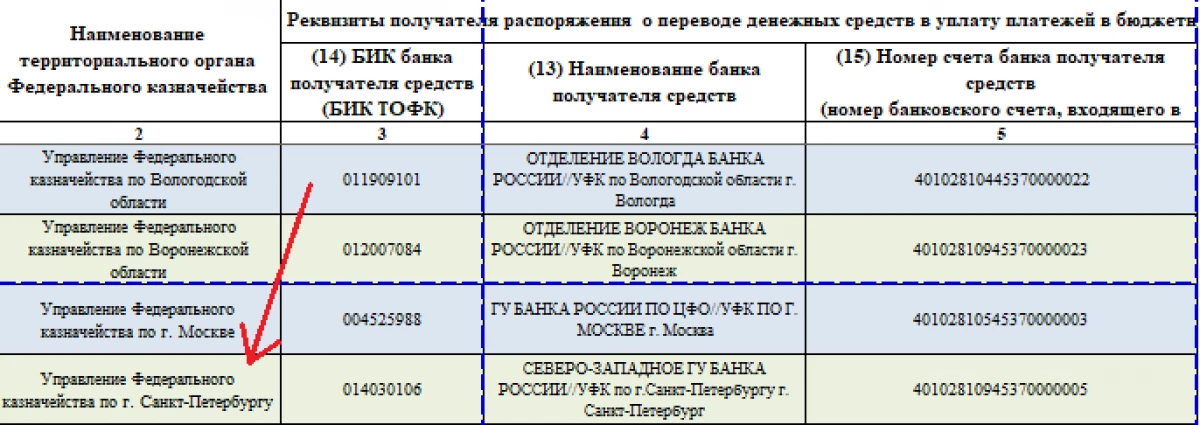

An entrepreneur Andrei works in St. Petersburg and wants to pay value added tax. Andrei knows that information on new details of treasury accounts is in the annex to the FTS letter from 08.10.2020. At first, he opens the table with details and finds in it UFK in St. Petersburg.

Then Andrei begins to fill in the wrapping:

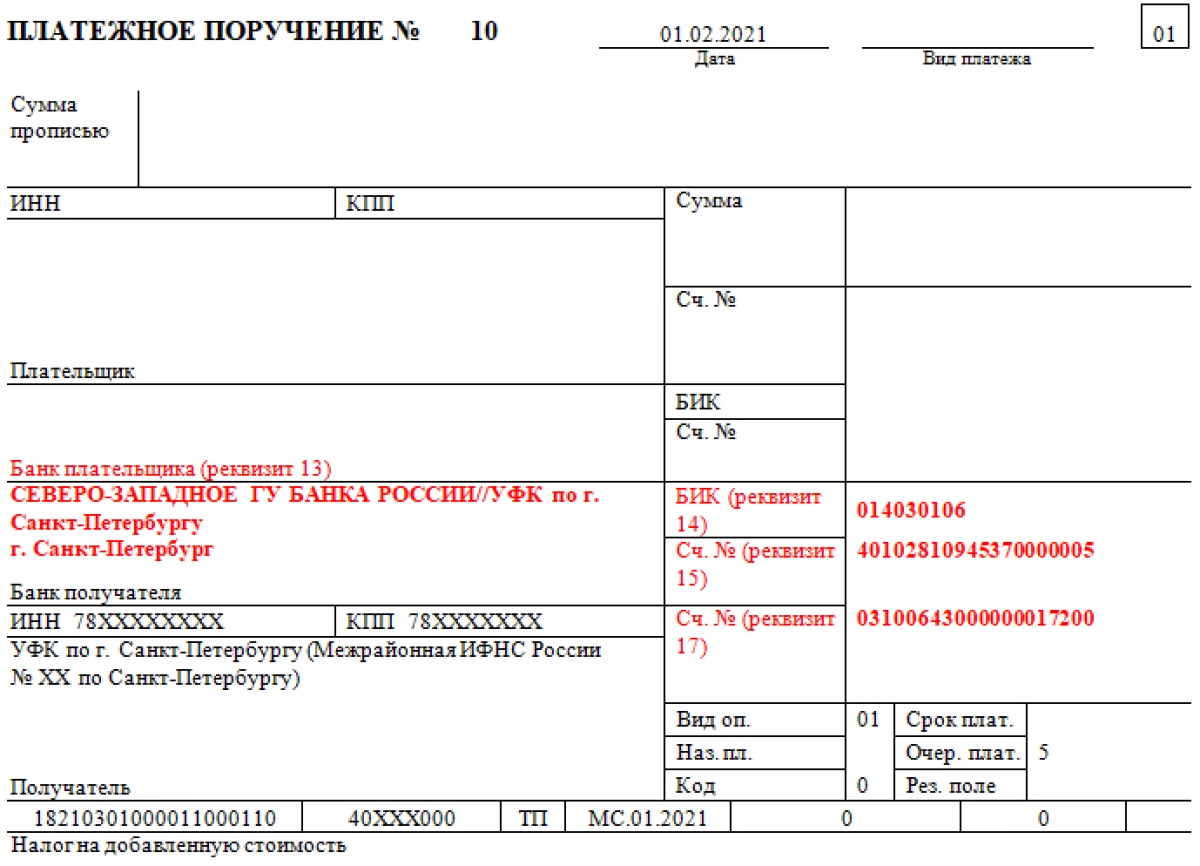

The column 13 writes the name of the recipient bank and the Office of the Federal Treasury (UFC). This is the North-West Bank of Russia // UFK in St. Petersburg St. Petersburg.

The column 14 indicates the bik of the recipient's bank (TFK BIC). New Beach for Peter - 014030106.

In column 15 introduces the number of a bank account included in the Unified Treasury Account. This is 40102810945370000005.

In column 17 indicates the updated number of the treasury account. This is 03100643000000017200.

Important. There is a sign "//" between the name of the bank and the management of the Federal Treasury without gaps.

This looks like a pattern of a ward filled according to the new rules.

That's all, nothing terrible. The main thing, be careful with the numbers.

As a general rule, from January 1 to April 30 of this year there are both old and new accounts. During this period, you can pay for any details, and the Treasury of the payment will accept. From May 1, 2021, only new details of treasury accounts will be valid.

If, after the transition period, specify the old details, the amount will fall into unclear payments. Therefore, it will have to return, and pay again, but already with fines and penalties for delay. On how to return money from the tax, read in our article "as an entrepreneur or organization to return to tax overpays."

So that there are no problems, monitor the closing dates of old accounts. They close at different times. For example, the previous accounts of the Pension Fund and the Social Insurance Fund are closed on 26.04.2021, and the accounts of the OMS Territorial Fund after 12.04.2021. The closure schedule of old bank accounts can be viewed on the Treasury website.

Important. The transitional period rule is not always working in practice. Some banks accept payments on old details once, or do not accept at all. It is better to specify the information in your bank and update the accounting program in which you work.

Delobank now accepts payments and old, and on new details. When sending a payment on old details, customers will see a prompt that new accounts have appeared. Delobank will accept payments for the same details until the Treasury will close old budget accounts.

Briefly about the main thing

From January 1, 2021, the requisitions of treasury accounts have changed. Therefore, the payment on the payment of taxes and contributions must be filling out according to the new rules.

New details must be indicated in column 13 (the name of the Bank recipients and UFK), column 14 (bik of the recipient bank), column 15 (a single treasury account) and column 17 (Treasury Account number). Details can be found in the table of compliance of banking and treasury accounts on the Treasury website and in the Appendix to the FTS letter.

Until May 1, you can fill out the wards at least on the old, at least on new details. But this rule does not always work in practice, so it is better to specify the details in your bank.

If after May 1 to pay in old, the money will fall into unexplained payments. We will have to pay again, but already taking into account the penalty and fine for delay.