Especially for Investing.com.

The beginning of 2021 became extremely successful for energy companies; During this period, the Benchmark industry in Energy Select SECTOR SPDR ETF (NYSE: XLE) has grown by almost 18%. At the same time, the sector still retains growth potential, which indicates the positioning of investors in the options market. Many of them suggest that ETF will grow by almost 9% and reaches $ 48.50.

Recent successes are primarily due to a sharp drop in the US dollar, which supported oil prices (who met 2021 below the level of $ 50 per barrel, but have since been able to overcome the mark of $ 53). However, it is not necessary to attach victory exclusively to oil prices. Not the latter role was played by improving market sentiment; Even such "bears" as analysts JP Morgan, raised Exxon Mobil rating (NYSE: XOM).

Sector growth rates

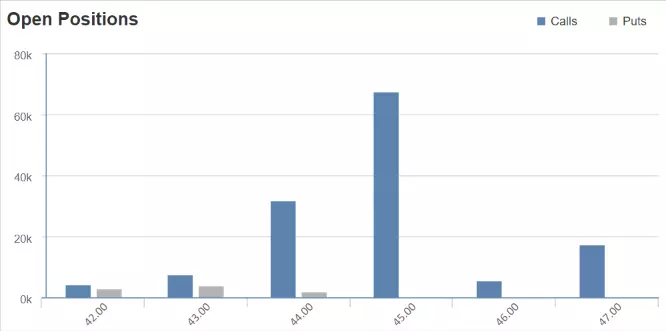

In the case of Xle etf, a lot of options were bought with a strike with a cost of 45 dollars and the expiration date on February 19. Over the past 5 trading sessions, an open interest in them grew by about 52,000 contracts. The data show that most of the call options are bought by about 1.05 dollars per contract, i.e., by the time they are expiration, the ETF must trade above $ 46.05.

In addition, some investors buy options with the rank of strike in Xle 48 dollars (for a similar date). In this case, the "collars" were bought at about 45 cents for the contract, assuming that by mid-February, ETF exceeds the level of $ 48.45. Thus, market participants expect growth by almost 9% over the next few weeks.

Exxon optimism enhances

Optimistic forecasts contributed to the shares of such companies such as Exxon Mobil (which in October were fighting from their minimum of $ 31.50). And the growth recently accelerated when the JPMorgan rating for the first time in seven years was raised to the level of "above the market", and the target level of its securities to $ 56 dollars, which implies growth potential by about 11%.

"Bullish" optimism was reflected on the Exxon chart, where the model "Cup with a handle" was currently formed. It implies a further increase in shares from the current level near $ 50. The projection hints at the potential of growth by almost 9% to $ 54.75. This point coincides with the previous peak of June 8.

The state of the economy is improving

A surge of optimism is explained as an increase in oil prices (as the dollar falls) and the restoration of the global economy. An important role is played by the expectations of further increasing fiscal-stimulating measures by the US authorities. This led to an increase in the profitability of state bonds (including 10-year-old papers) while reducing the dollar. The weakening of the national currency led to the fact that oil quotes took off to the level of February 2020.

Further weakness of the dollar will hope to restore world demand. Of course, in 2021 the energy sector may encounter new pressure factors. In the end, the past year was terrible for the industry, despite the fact that many investors switched to renewable energy sources. However, the world will not be able to abandon fossil fuels in the near future, which means that the sector can recover from terrible losses of 2020.