PayPal is the most popular payment online system in the world. The company, after minor players in 2021, launches the opportunity to trade cryptocurrencies in the United States, which can largely increase the company's revenues.

In the article we will look at:

- how paypal it realizes;

- What distinguishes PayPal from competitors from FINTEKH;

- How much paypal will earn.

PayPal goes to the cryptocurrency market

Many central banks of various states have repeatedly expressed themselves about the recognition of the legality of cryptotransactions. Some notes that most of the traffic is cryptocurrency - a shadow economy, and they generally need to ban. Other countries, on the contrary, see the potential golden core and seek to start regulating cryptocurrency.

Such a mood of the authorities leads to the fact that all new and new sites begin to work with cryptocurrencies, and PayPal (NASDAQ: PYPL) is no exception.

Initially, PayPal decided to start the storage system, sales and purchase of the main cryptocurrency - Bitcoin, Ethereum, Bitcoin Cash and Litecoin. In essence, Paypal decided to become a new cryptoker.

Then Paypal announced that the US residents would be able to not only make trading, but also pay cryptocurrency in more than 26 million stores. And from the mid-2021, the service plans to run such operations in international markets and expand the list of digital assets using the VENMO service.

But the most important market for PayPal is the United States.

Technical implementation of cryptotogo

PayPal does not create its own service for cryptotogo, and concludes cooperation with PAXOS - an adjustable financial institution, which is already cooperating with Revolut in the United States.

Paxos will supply PayPal market prices for cryptoacivals. The exchange rate is about 0.5%, however, depending on market conditions, it may change. Also PayPal will not disclose spread prices for each transaction.

Payment in regular stores will be carried out on the basis of instant translation of cryptocurrencies in dollars, taking into account the above spread.

Make America Great Again!

Many cryptobiers and exchangers prohibited access to their platforms to customers from the United States due to the tight regulation of Americans in the field of money laundering. In this context, the Binance story is indicative - the top 1 crypto exchanger with an average daily turnover of $ 11 billion.

It all started with the fact that the US Department of Justice and Commission on Commodity Futures recently accused Bitmex and its founders in violating the rules relating to the "Know Customer" principle (KYC) and combating money laundering, among other things. In the light of this case, Bitmex forced its KYC program, demanding from all clients to verify in accelerated mode.

After that, Binance sent a message to its customers, whose IP address was most often in the USA:

Fig. oneAt the same time, the financial policy of combating money laundering (FATF) issued a report on how Binance has changed the place of basing its activities to avoid regulation by the United States. In the same style report made forbes.

The conclusion from this story is one - cryptocrokers are experiencing problems with American investors and with any tightening of regulation in the United States blocks such clients.

All this opens up opportunities to companies that have the right to legally work with investors in the United States.

Fintech does not prevent paypal

According to Q3 2020, PayPal has 361 million active customers. Of these, 44% are citizens or residents of the United States, that is, 159 million people.

Early popular Fintech-company Square (NYSE: SQ) has already gave access to Bitcoin to its customers through the Cash App application.

Square in Q3 2020 served transactions with a total of 1.6 billion dollars, and in Q2 - by $ 0.85 billion, and this is only in Bitcoin. And this is despite the fact that Square has 30 million active users in the USA, which is 5 times lower than at Paypal:

At the same time, Square, even due to the effect of a low base and access to Bitcoins since 2018, did not select the share of PayPal. Companies grow the same pace, which speaks only in favor of PayPal.

PayPal more profitable than Square

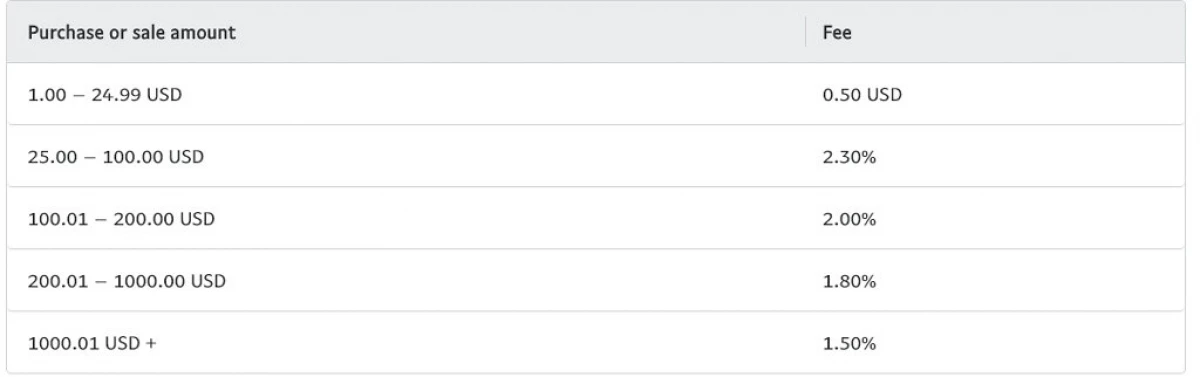

PayPal has pretty high commissions for cryptocurrency transactions:

Square on a volume of 1.6 billion dollars in Bitcoins earned about $ 32 million, which corresponds to the commission level of ~ 2%.

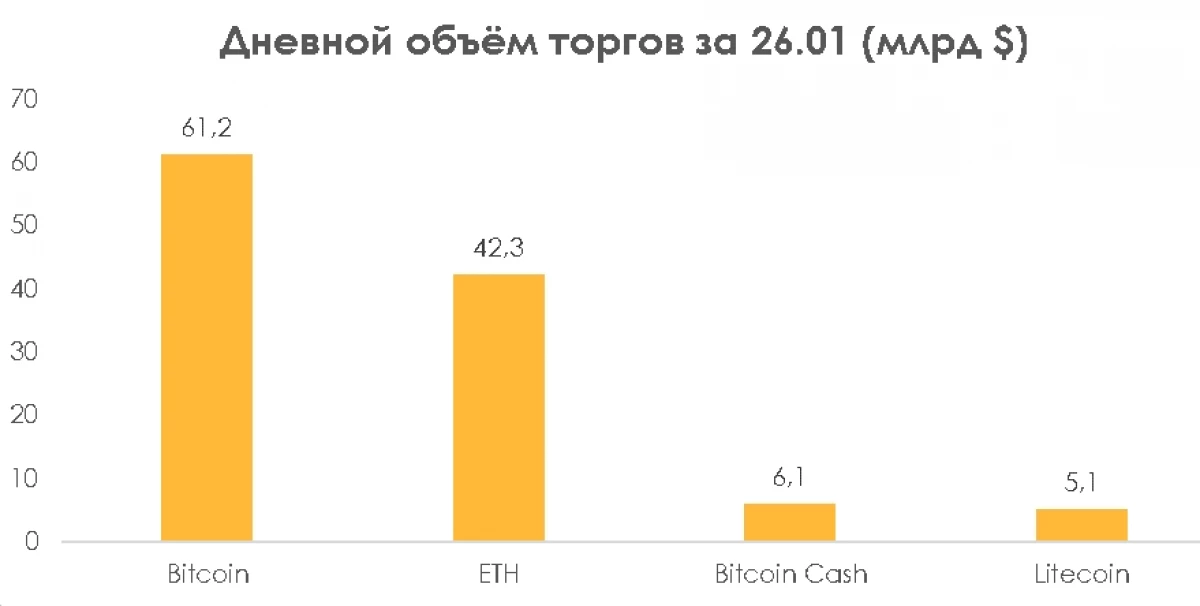

Taking into account the average value of the PayPal transaction at $ 57, one can expect that the average commission will just be approached by 2%. However, PayPal gives the right to pay to customers in 26 million stores with cryptocurrency. In addition, PayPal gives access to other popular cryptocomputes:

PayPal will increase EBITDA by 27% by cryptocurrency

Taking into account the conservative prerequisite that the turnover of the client at PayPal will be the same as Square, for 2021, the annual turnover is only from transactions in Bitcoin will be $ 34 billion.

Having access to other top 10 cryptocurrencies, PayPal can get 63.7 billion dollars of transactions in 2021, and this is excluding access to the international market since mid-2021.

For comparison, in 2019, in just a paypal, transactions were made about 712 billion dollars, that is, cryptocurrency transactions would amount to 9% of this magnitude.

63.7 billion dollars, taking into account the Middle PayPal Commission, 2% would bring the company an additional $ 1.27 billion, which would be 27% of the company's EBITDA over the past 12 months.

PayPal can be the main player in the USA in the cryptocurrency market

Due to the large current customer base, the PayPal offers additional possibilities for monetization by introducing new services:

- First, the difficulties of American investors when working with the main crypto brokers will create the influx of these PayPal users.

- Secondly, PayPal allows you to pay in traditional stores with cryptocurrency, which does not allow the main competitor - Cash App from Square.

- Thirdly, the new service can attract additional customers in PayPal, which have not enjoyed the service, which will also allow increasing income from the company's main activity.

The article is written in collaboration with analyst Dmitry Newbikov

Read Original Articles on: Investing.com