The sale in the Trezeris market is enhanced by challenging the approval that the bonds are now completely unattractive compared to stock assets. The moment when the bonds begin to lure investors from stocks, it seems that the yield of 10-year treasury bonds moved over 1.3%, which became a catalyst for reducing stock indices.

The most actively decreased shares of the tech. It is saturated with growth shares, which are the closest investment alternative Trezeris. Why? As with long-term bonds, they have a big duration (the degree of "stretching" cash flows on the asset in time):

Correction of US stock indexes on Tuesday

In addition, since the distant risk-free rate (yield of 10-year-old Trezeris) is growing strongly, and short rates remain relatively recorded due to the Central Bank's policy, the current cost of long-distance payments on the asset should be actively decreasing. Consequently, the more the asset stretches the payments over time, the more it should be vulnerable to the current trend in the yield Trezeris.

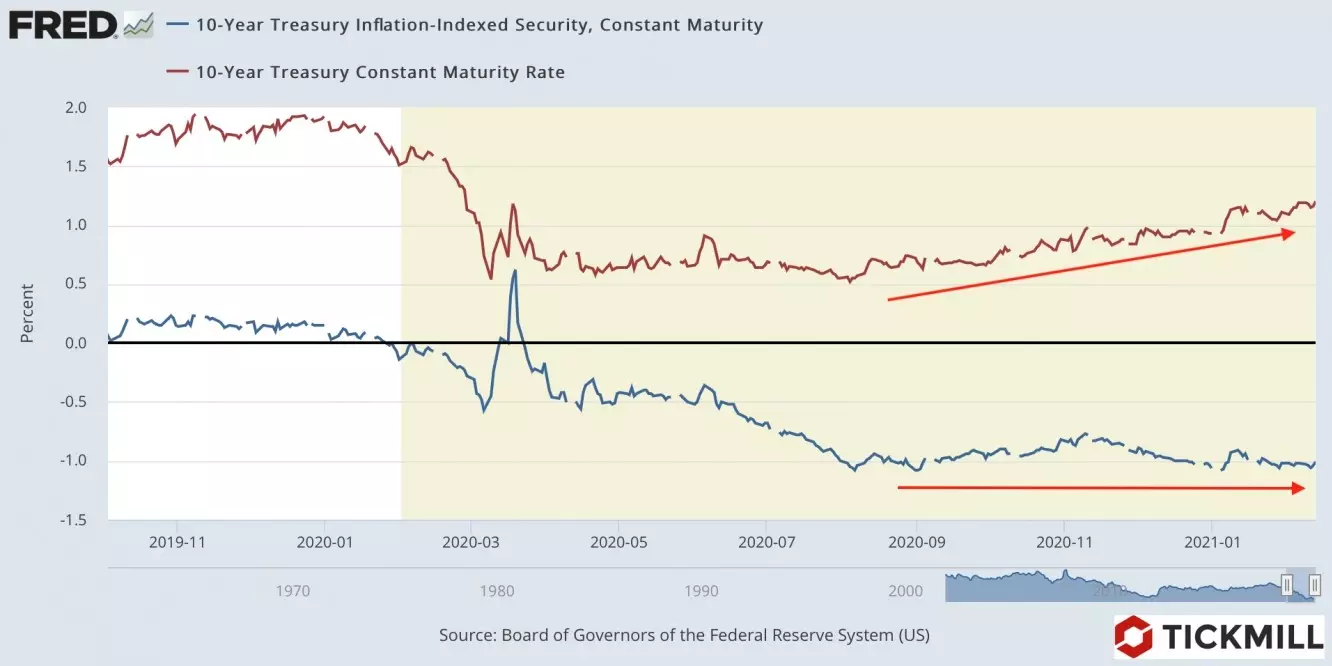

It should be noted that although the yield of 10-year-old Trezeris is growing, the yield of Trezeris with the same repayment period, but protected from inflation, practically stands on the spot (about -1%). In other words, the real rate in the United States is growing, but the market inflation expectations, hedge from which is gold. In this regard, the recent decline in gold is not very stacked in the picture of the Trezeris torn on the market:

The outflow of capital from the market of treasury bonds increased demand for dollars, which led to a large-scale strengthening of the American currency. The dollar index, bounced yesterday from 90.10, rose to 90.82 on Friday.

All attention is now on the Fed reaction to the growth of bond yields. The task of the Central Bank is to maintain a comfortable cost of borrowing, including long-term, therefore, the growth of profitability is sooner or later to meet the Fed reaction. The question is when it happens.

The main risky events scheduled for today - the release of the retail sales report in the United States in January and the minutes of the Fed meeting. The bond market should remain weak, as in retail sales, a positive surprise is likely due to stimulating checks that American households received in January. The Fed Protocol may keep the sale on the Trezeris market, as it should indicate the readiness of the Central Bank to maintain soft credit conditions.

Arthur Idiatulin, Tickmill UK Market Observer

Read Original Articles on: Investing.com