The yields of long-term US government bonds continue to grow. It already has a noticeable impact on other markets. Thus, stock indexes closed Tuesday with a decline, slightly retreating from record levels. However, the most alarming shift seems to be observed in respect of gold.

For Tuesday, the price of the Troyan Oz dropped by 1.5%, the second time this month yielded under $ 1800 and continuing to bid for $ 10 below this feature in the field of minima of the retail range of the last eight months.

Although these are quite high levels of historical standards, a decrease in current levels reflects the upward trend in the last two years. Consider these signals more details.

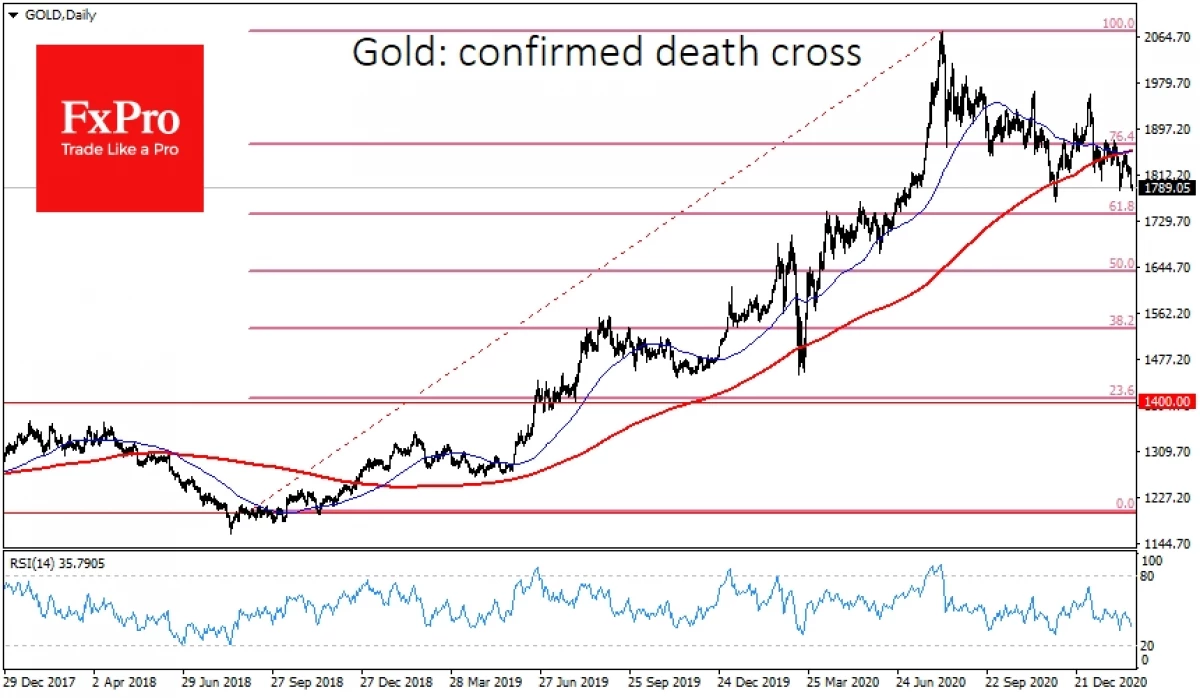

Gold gives positions to the fifth trading session in a row after an unsuccessful attempt to return the levels of 50- and 200-day medium. That is, we observed the obvious layer attempts to return to the growth trend.

Separate bearish Short-term signal is a failure of a 50-day average under a 200-day, the so-called "Cross of Death". The last time a similar figure was formed in June 2018, after which the price lost 10% in the next two months. In 2016, a decrease near such a signal reached 13% and also lasted for about two months.

The current gold growth wave started in August-September 2018 from levels near $ 1200 to $ 2075, which were achieved in August 2020. The nearest purpose of further sales looks the level of $ 1734, correction by 61.8% of the previous growth wave in Fibonacci.

This area is also noteworthy in that the price has forced around it for two months in April-June last year.

A deeper correction, by 50% of biennial growth, will return the price to $ 1630, where it was during the period of extreme volatility of markets due to a pandemic. Immersion in this area corresponds to the price dynamics after the two previous "crosses of death". In addition, gold often gives up to 50% of its growth before the resumption of the rally.

Long-term buyers can look at the current situation as short-term fluctuation. The most wide picture suggests that, giving 50% of rally 2001-2011, in 2016 gold began a new bullish cycle with potential goals for $ 3,000 in the coming years.

Team of analysts FXPRO.

Read Original Articles on: Investing.com