A sharp splash of the volatility of the treasury bonds of the United States, which occurred last week, subsided. The market is trying to collect his thoughts and return to the preceding state, but there are obstacles. In the coming days and weeks, the market will voluntarily wait for further action plans of central banks, fluctuating between the risky moods and the bonds' profitability (real and nominal).

Home Trading Topic: Nervous Surveillance after injury with "Trezeris"

The expression "Injury with Trezeris" is taken from the header of today's podcast Saxo Market Call. In it, we talked about where the market is looking for a new catalyst after shock due to the jump in the yield of Treasury bonds of the United States (although this jump and quiet without further manifestations of market dysfunction). Markets are trying to return to where they were before the events of last week, but I doubt that this is fully possible without solid forecasts of fiscal and monetary policy, especially from the Fed.

Can profitably rise again, but calmly, without hitting risk moods? Is it possible at current levels? It is difficult to say, but so far the movement of the market is slow, the Fed may not want to file signals, although member of the Council L. Brainard noted the latest changes in the Trezeris market: "I carefully follow the events in the market ... My attention was attracted by some movements last week and Their speed. "

On Bloomberg an article was published where the Torzing market "The Mystery of the 21-Trillion Market Trezeris" "is considered, taking into account their key role in the global situation. The main question is the desire and ability of American banks to retain large volumes of treasury papers. In the second half of the year and then it will become particularly pressing, since the volume of the bond emissions is much higher than the current pace of their buying Fed. You should not forget that the immediate reason for the fall "Trezeris" last week was low demand at the seven-year-old auction. Another question is whether the Fed will return to capital demands, temporarily filmed last year for the sake of saving the financial system from chaos. The term of removal expires at the end of this month, and Democratic Senators Warren and Brown have already written an appeal to the Fed and other institutions asking for no prolong it. This issue must be resolved, otherwise new chaotic events are inevitable, followed by either a technical solution, or Fed measures to eliminate all obstacles to fiscal policies, except inflation (that is, the implementation of the "modern monetary theory" and the domination of the fiscal theme). Already next week we will find a new test - auctions for 10- and 30-year treasury papers.

So, given the above described and the fact that the yield of 10-year-old papers for a while exceeded 1.50%, it must be assumed that the markets will be nervously shivered, waiting if the problem returns before the solution is found, or still the yield will be able to Quietly grow, without sending risky assets into a corkscrew. The latter is perhaps possible only with the sustainable growth of inflation expectations that exceeds the growth of the yield of long bonds - that is, with a decrease in real returns. Waiting can be very tense. Perhaps the situation now reached a turning point, carrying asset markets significant bilateral volatility. Supporters of the reduction of USD will not hurt to wait until it becomes clear that the Fed is increasing its impact on the treasury bond market, and / or that real yields in the United States fall faster than in the rest of the world.

Another today's news: according to the sources of Bloomberg in the ECB, the bank does not see the urgent need to reduce returns, despite the statements of some of its representatives on their dissatisfaction with their lifting. The euro on this news has slightly raised, and the State Bligrations of the EU countries were pretty steep sales. The yield of 10-year bonds of Germany increased by 2 basis points; However, it still remains below -30 B.P., and on Friday, before the performance of I. Shnabel, it reached -20 bp.

As for the pound of sterling, today the Minister of Finance of Great Britain Sunak will perform a spring report on the budget. Much information has already been leaked, and it seems that its main topic will be the maximum support of the population and jobs, and about tightening (increasing taxes on business, etc.) is hinted except for the long-term perspective.

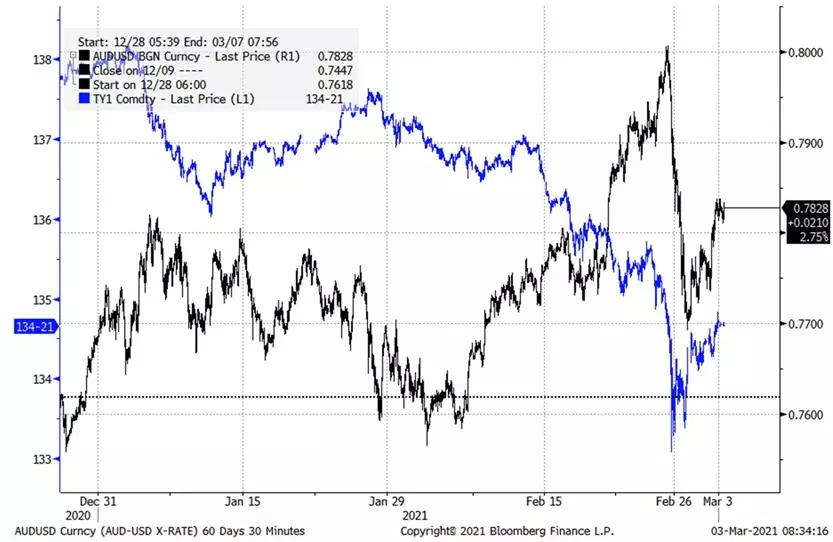

Chart: AudUSD and treasury US bonds

From the graph, it can be seen that the Aususd's confident rally for a long time did not at all harm the growth of the yield of US governmentobalities and other countries (blue shows a declining futures price of 10-year-old "Trezeris"). However, the same outbreak of volatility of American securities happened last Thursday, especially strong in terms of 2 to 7 years. As a result, everything broke out, a massive ownering began, which strongly hitting such couples as AudUSD - as-in no way, the Australian dollar was one of the fastest growing currency raw reflation. From this point on, AudUSD and futures at Trezeris entered a more positive correlation. Return to its absence is possible only if the yields in the United States will be able to slowly grow, without causing new accidents. Audusd pair to neutralize sales should be closed above 0.7900, and to return to a decrease - fall below 0.7700.

Source: Bloomberg.

The upcoming key events of the economic calendar (the time of all events is indicated by Greenwich):

- 13:15 - ADP report on the change in the level of employment in the United States in February

- 15:00 - Business Optimism Index (ISM) in the US System for February

- 15:10 - Speech by L. de Gyindos from ECB

- 15:30 - Weekly report of the US Ministry of Energy on the reserves of oil and petroleum products in the country

- 16:00 - S. Tenreiro's performance from the Bank of England on negative interest rates

- 17:00 - Speech by R. Bostik from the Fed (Voting Member FOMC)

- 18:00 - Speech by Ch. Evans from the Fed (Voting Member FOMC)

- 19:00 - Summary of the US Fed Comments on the current economic situation in the districts

- 19:30 - Speech by I. Shnabel from the ECB

- 20:15 - Speech by the head of the New Zealand Reserve Bank A. Orra

- 00:30 - Australia trade account report for January

- 03:25 - Speech by J. Kerns from Australia Reserve Bank

John Hardy, main monetary strategist Saxo Bank

Read Original Articles on: Investing.com