Investor Bill Miller, whose flagship Foundation on the eve of the second year in a row broke the S & P 500 index for profitability, stated that Bitcoin may well replace cash. Miller also noted the fact of understatement of real levels of inflation in the markets and mentioned the difficult attitude of the world-famous investor Warren Buffethe with the first cryptocurrency. We understand in a situation in more detail.

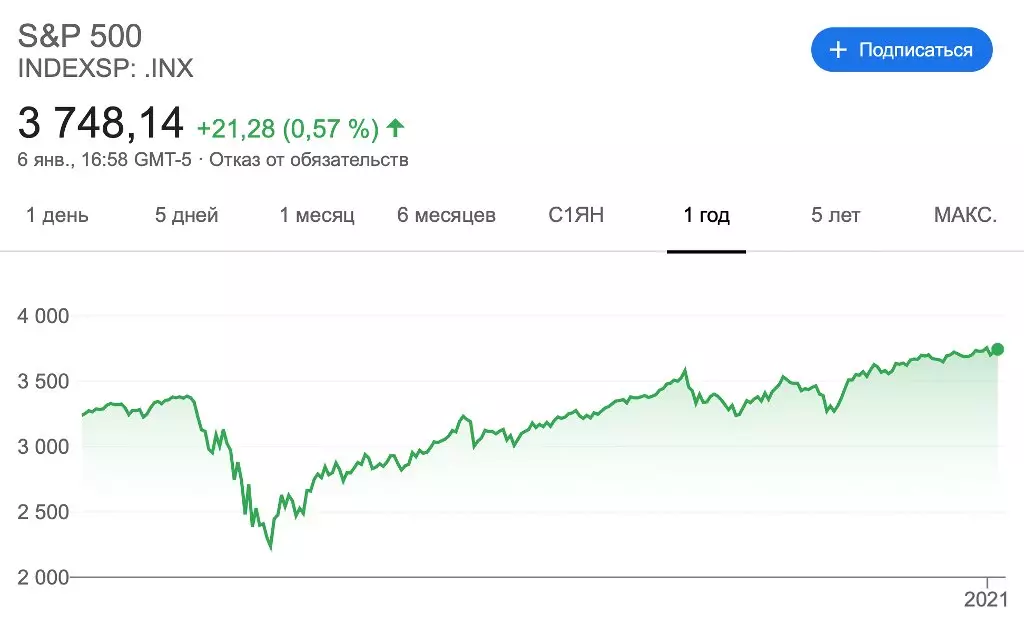

Recall, the S & P 500 index includes five hundred companies with the highest market capitalization among those traded on US stock exchanges. It is compiled by Standard & Poor's experts, and also owns this company. In general, the index has existed for more than 63 years.

Here is the index schedule for the last year.

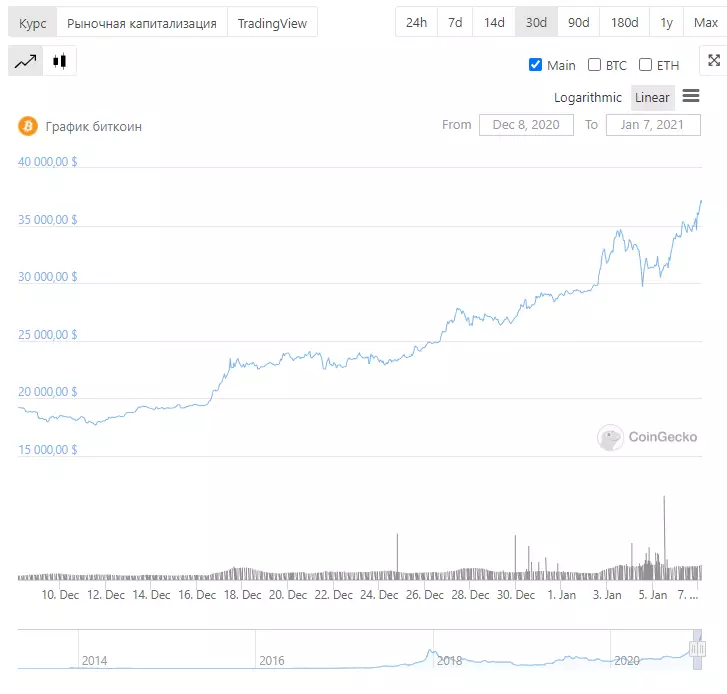

Cryptocurrency conquers world

According to Miller, Bitcoin has a lot of advantages over gold and other traditional assets. Buffett, unfortunately, does not notice or simply does not want to notice this fact. Here is a quotation of an investor in which he shared his attitude towards what is happening. A replica leads Coindesk.

Thus, he means that cryptocurrency will create problems for ordinary money. Nevertheless, it has much more advantages in the form of ease of translation, independence from governments and the impossibility of creating an additional million bitcoins at the request of some rich. Against the background of a pandemic with national currencies of various states occurs just a large-scale emission, that is, the release of a new money supply. According to economists, in the future it will negatively affect what is happening in countries.

Recall, a couple of years ago, Buffets really compared Bitcoin with rat poison. At one time, he tried to convince him the creator of the Tron Justin San project, but the attempt was not over.

And after, after the time of the word Buffetta played a cruel joke with him. To be more accurate, then not with him, but with his company that Bitcoin recently bypassed on capitalization in the ranking of world assets. Accordingly, the world population estimates BTC more expensive than the Buffett organization.

Another aspect that Miller touched upon is growing inflation in the United States against the background of emergency measures to support the economy in quarantine. The expert continues.

In such conditions, large companies that are also called institutional investors will actively look for "safe assets", not subject to inflation. Actually, they tightly took up in the second half of 2020. And therefore, there is every reason to believe that in 2021, Bitcoin will interest them even more, and the cost of cryptocurrencies will begin to grow even faster.

We believe that Bitcoin will not be able to replace cash and become a payment platform for carrying out daily transactions, since the cryptocurrency network is not valid for it. It can cope with approximately seven translations per second, and when the demand for transactions is growing significantly, the amount of commissions increases to incredible indicators. Accordingly, even if every person will know about cryptocurrency, he is unlikely to be able to use it against the background of mass popularity - it is still unlikely that someone wants to pay the conditional 50 dollars commission for the purchase of goods in a supermarket for $ 20.

However, to open the eyes of people on what is happening in the financial sphere of Bitcoin by the forces that he is doing now. Cryptocurrency is not affected by government actions and relies exclusively on its own code. In addition, the blockchain makes the system transparent, which is so lacking the current world. So BTC can be called a free and independent asset. After acquaintance with him, people hardly want to return to ordinary money.

Share your opinion on this bill in our cryptocat of millionaires. Also look to us in Yandex Zen, where there are even more interesting news.

Subscribe to our channel in Telegraph to be aware.