"I believe that those who sell shares and waiting for a more appropriate time to redeem the same shares, rarely achieve their goal. They usually expect that the decline will be greater than it seems in fact "(c) Phillip Fisher

In this article, I want to disassemble a report for the 4th quarter of JPMorgan Chase & Co (NYSE: JPM), evaluate its market price and attractiveness for investment.

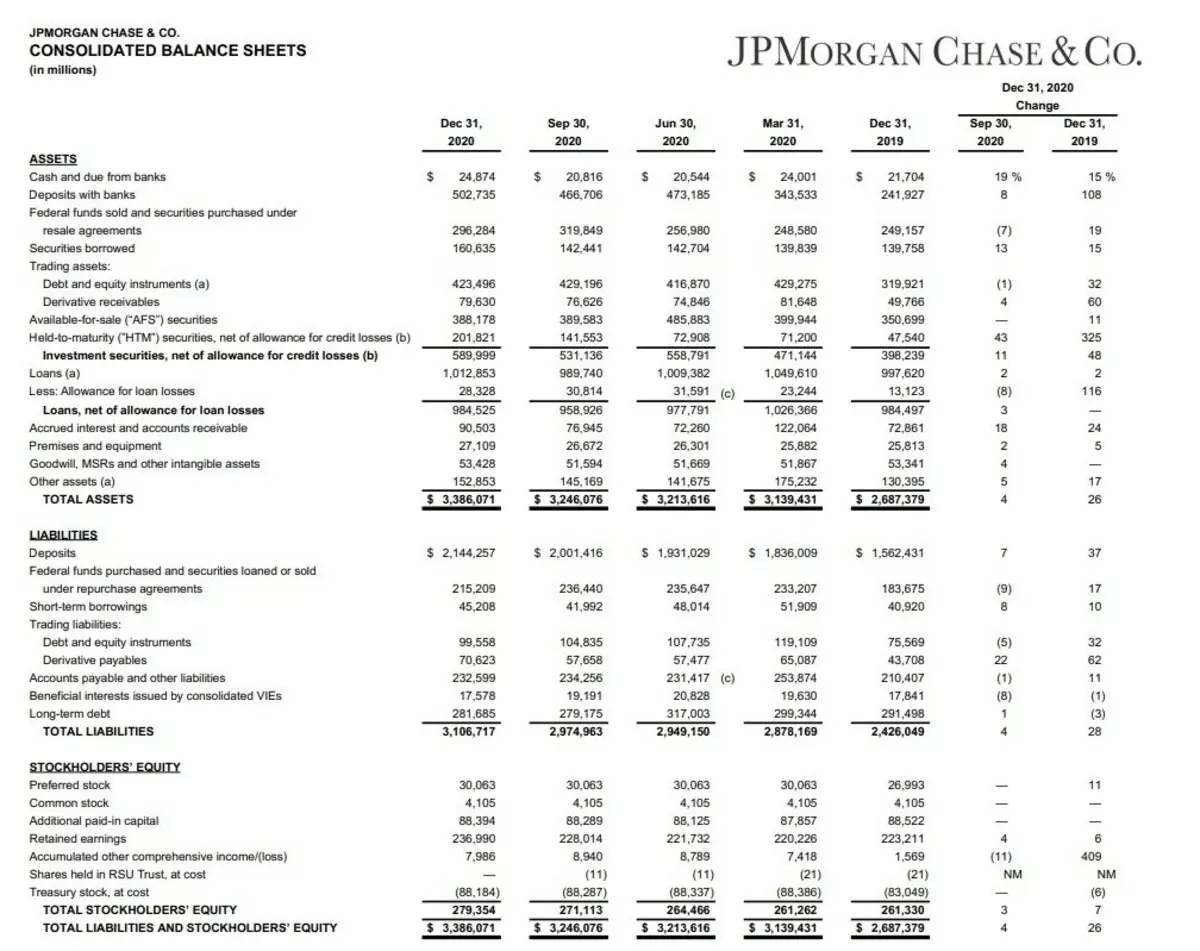

Cash stock (CASH) increased by 15% since December 2019, and money stored in banks (deposits with banks) increased by 108%. Thus, the company at the end of 2020 has a cash supply of more than $ 527 billion. Excellent result.

Due to this, by the way, the net debt of the company went to the negative zone. That is, with such a reserve the company at any time can pay off its debts.

Also, the company has increased reserves for losses on loans, loans and mortgages (Allowance for Loan Losses).

General assets of the company rose by 26%.

In the lines of obligations (Liabilities) we can see the growth of deposits (deposits).

The company notes the growth of client deposits by 37%.

Growth of short-term borrowing (Short-Term Borrowings) by 17%.

But long-term debt (Long-Term Debt) for the year the company reduced by 3%.

Such actions led to an increase in the attractiveness of the company due to the growth of share capital by 7% (Tootal Stock Holders Equity).

Now let's look at the income report.

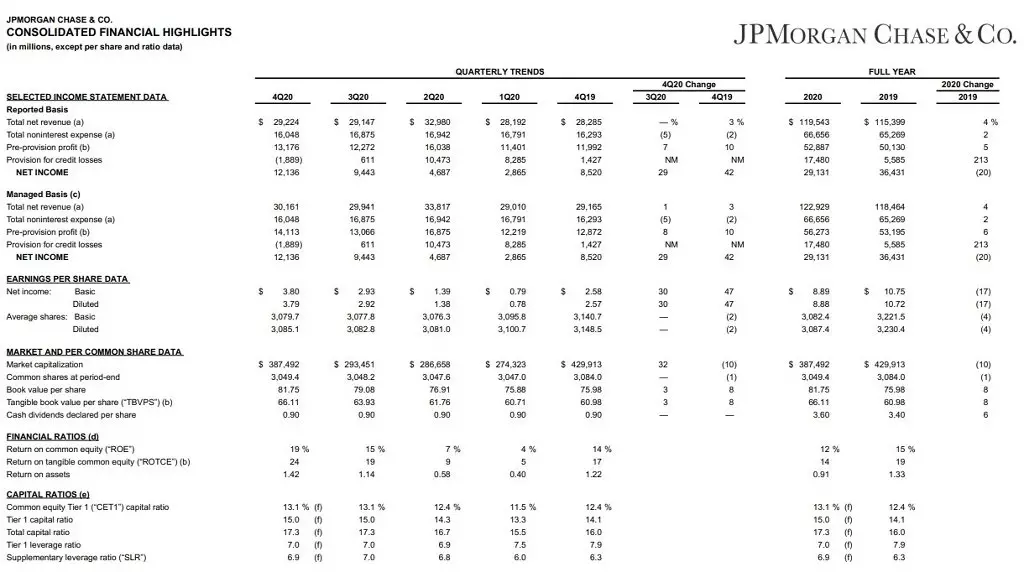

If you look at the main report (Reported Basis), it can be seen that the company's revenue increased by 4% (Total Net Revenue), and Operating expenses (Total (PA: TOTF) NonInterest Expense) increased by only 2%. What made it possible to increase the income and increase the reserves for the losses (Provision for Credit Losses).

By the way, it is due to the growth of reserves and the net income (NET INCOME) decreased by 20%. (Of course, the profit per share has decreased and profit itself.)

At the same time, the company has not felt any serious consequences on its operating activities. If you delve into this report a little, then we can see such an indicator as Book Value Per Share. It translates like the "Balance Cost of the Promotion". And here the company declares that the book value of one share is $ 81.75.

And the real value of one share at the moment - $ 135. We still talk about it a little further. This is a very important indicator.

And we will look at the next leaf.

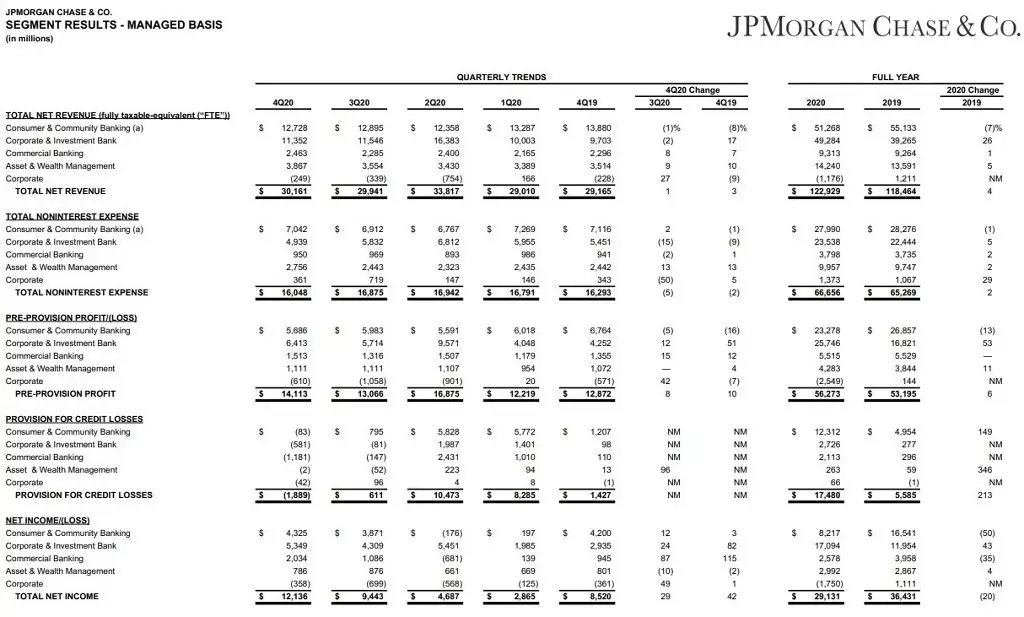

Results in segments.

Also a fairly important report for understanding the company's activities.

In fact, business is divided into 5 segments:

1. Consumer & Community Banking (Consumer & Community Banking). The most basic direction. This includes providing banking services, business service, asset management.

2. Corporate & Investment Bank (Corporate & Investment Bank). Also the main direction. Activities aimed at attracting funds, solving financial tasks and business goals.

3. Commercial banking (Commercial Banking). The direction is smaller, which refers to loans, mortgages, loans, etc.

4. Asset & Wealth Management Management (Asset & Wealth Management). Segment aimed at managing wealthy customer assets.

5. Corporate. Honestly, I do not know how to translate it into Russian. In essence, this is an investment segment of the bank aimed at finding new customers and people interested in the development of banking.

Consumer & Community Banking

This segment showed a decrease in revenue this year by 7%. Mostly due to the decline in commission income from deposits. Partially it was compensated by the growth of mortgage lending. The impact on this was provided: a decrease in the key rate and the development of a pandemic.

CORPORATE & INVESTMENT BANK

This segment, on the contrary, showed growth due to an increase in investment activity, which was greatly influenced by the United States Fed support measures.

Commercial Banking.

Showed growth, albeit less significant - by 1%.

The operating income from the main activity has grown, but the costs have increased.

Asset & Wealth Management

The segment also showed growth thanks to support from the US FRC and an increase in investment activity.

What can be said about the company?

Despite the pandemic, JPM remains the leading bank of the United States, which continues to build assets. In this case, the opportunity to create huge reserves for losses allows the bank to successfully maneuver and further even in the conditions of tension in the economy.

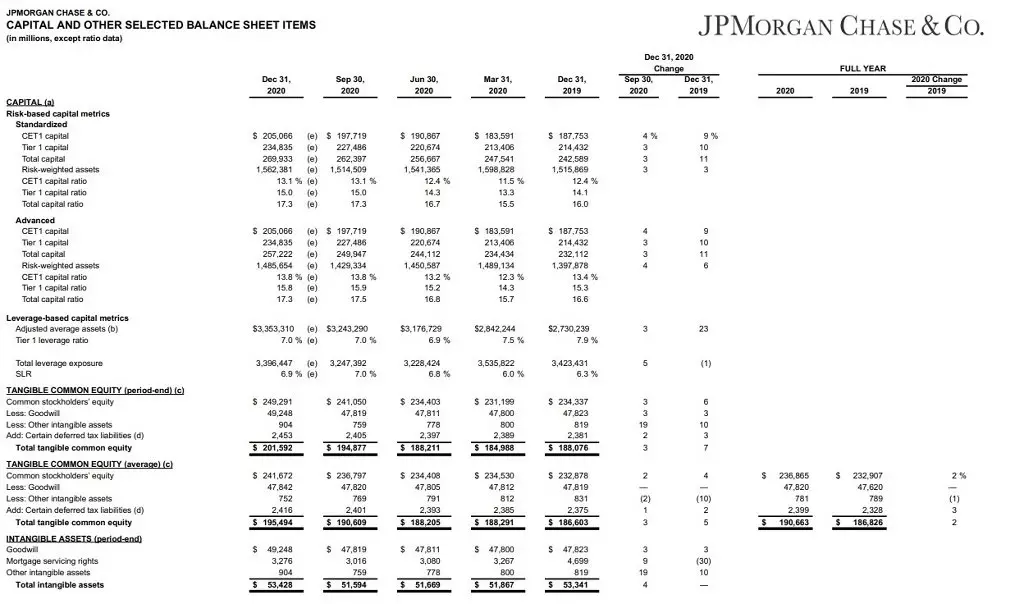

And I also want to tell about this indicator from this report as the adequacy of capital.

After 2014, a mandatory capital measure was introduced for banks as a precautionary measures of the economy from the financial crisis.

In fact, capital adequacy is the percentage of liquidity and stock of the bank (in the form of cash, deposits, shares, etc.) to the company's own capital.

In the event of a crisis, additional capital is taken from the capital of the 1st level.

If we talk simple words - this is an indicator of the available capital of the bank, which is used to protect depositors.

The minimum requirement for banks is 4.5%.

JPM this indicator is 15.5%. What, again, talks about the high stability of the bank.

And now let's talk about the company's market price.

First, the weighted average indicator P / E - 14.5.

I have already described in detail more about this indicator. Now briefly will only say that this indicator makes it possible to understand the real profitability of the company in recent years.

And this indicator has a good company.

Next, remember, I wrote at the beginning of the article that the carrying value of one share of bank estimates is $ 81.75.

This suggests us that the market price of a share of $ 135 is still overestimated. Although slight.

P / B indicator - 1.54.

Of course, the indicator L / A is high - 91.75%, but for the banking sector it is absolutely normal.

But the NetDeBT / EBITDA indicator is excellent. At the moment, he is negative due to the high reserves of the company, but also before the pandemic it was 0.86, which indicates that the company can safely cope with its debt burden.

Profitability

Capital profitability 11.15%.

This excellent indicator, however, should be borne in mind that the market price is 1.5 times higher than the book value, and it turns out that for us, as for investors, this indicator will be lower - about 7.35%.

Profitability sales at a high level - 24.37%. The pandemic was above 30%.

But the profitability of profits on the action is quite low. Total 6.57%. For a shareholder, this is a low indicator, as it displays the company's efficiency regarding the shareholder's invested funds. 6.4% little.

On the profitability of assets, I do not see the point of looking. The bank manages assets by 3.3 trillion dollars, and the profitability of assets is extremely low, but it does not say anything.

Dividends I.

BayBack

But at the same time, the company pays good dividends in the amount of 2.6%. And, taking into account the extremely stable indicators, it is likely that the growth of dividends will continue in the near future.

Let me remind you that the Fed because of the pandemic banned the companies to temporarily increase the dividends and to produce the redemption of shares. However, at the end of 2020 allowed reverse redemption under certain indicators, and the same dividend expects the same.

Comparative analysis

If you compare the company with other banks "Big Four" (Bank of America (NYSE: BAC), Citigroup (NYSE: C), Wells Fargo (NYSE: WFC)), then JPM is the most expensive company among them. Moreover, not only in terms of capitlasia, but also by multipliers.

But at the same time, JPM was stable all over the pandemic blow. Increased assets and showed the growth of operating performance. In addition, JPM has one of the best profitability indicators.

Output

Despite the overestimated market price, the company remains attractive to invest.

This is the largest bank of the United States, which manages asset more than 3.3 trillion dollars. He has a rich history and an extremely sustainable financial situation.

Thank you for attention!

Read Original Articles on: Investing.com