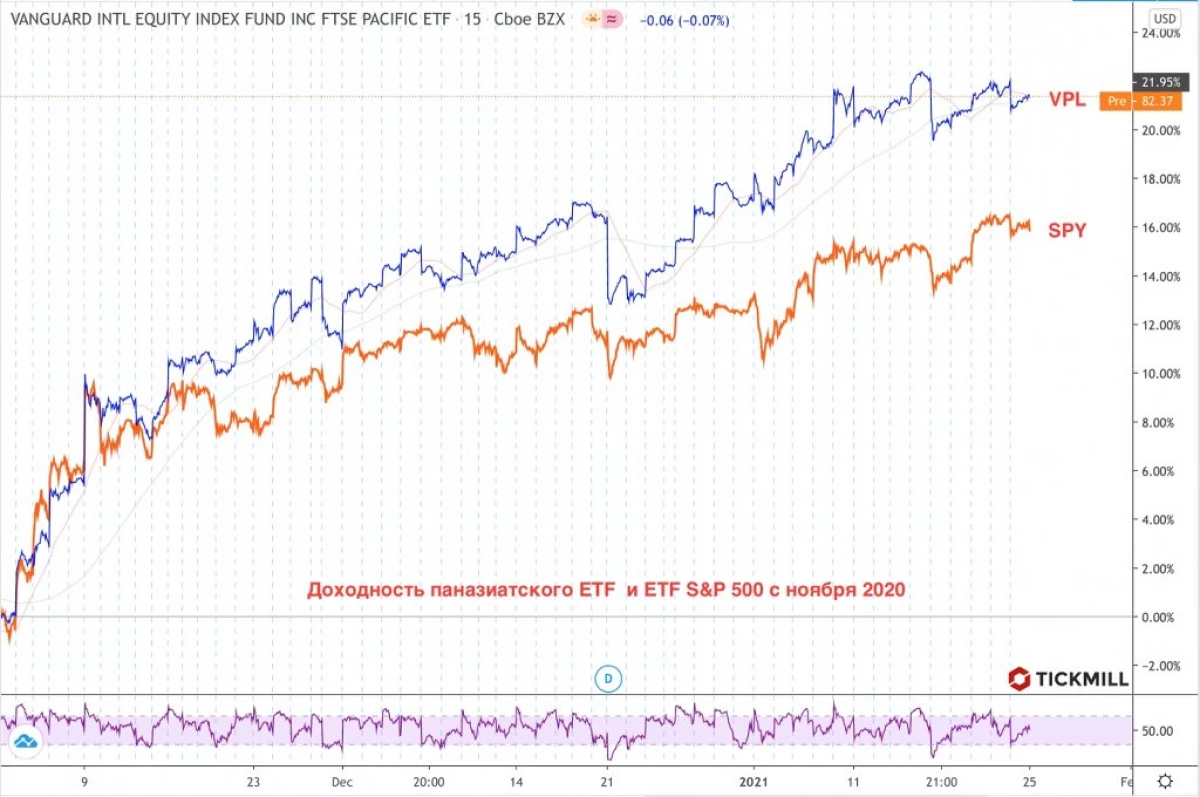

Asian stocks climbed into levels close to historical maxima on Monday due to expectations that the growth of Asian economies will continue to be ahead of Western partners. The growth of shares of Asian companies was noticeably accelerated compared to American around November 2020:

Optimism in the Asian market has warmed the UNITED NATIONS report, which showed that China bypassed the United States in 2020 in terms of direct investment. This reflected the opinion of investors that the United States is worse and for longer to cope with the sanitary crisis and, therefore, will give in China at the rate of recovery. The investment in the United States fell by 49% in annual terms, while in China, they not only avoided the fall, but also increased by 4%, despite the overall collapse of direct investment by 42%.

In general, East Asia (China, Japan, Korea, Taiwan) FDI decreased by 4% in 2020, while in advanced economies - by 69%.

China's restoration in the fourth quarter accelerated, and GDP growth exceeded expectations. The Chinese economy completed 2020 in extremely good shape and, despite the continuation of the pandemic, probably will accelerate this year.

Foreign foreign investment is an indicator of investors' expectations regarding the rate of profitability that can be expected in the economy at a distance of 5-10 years.

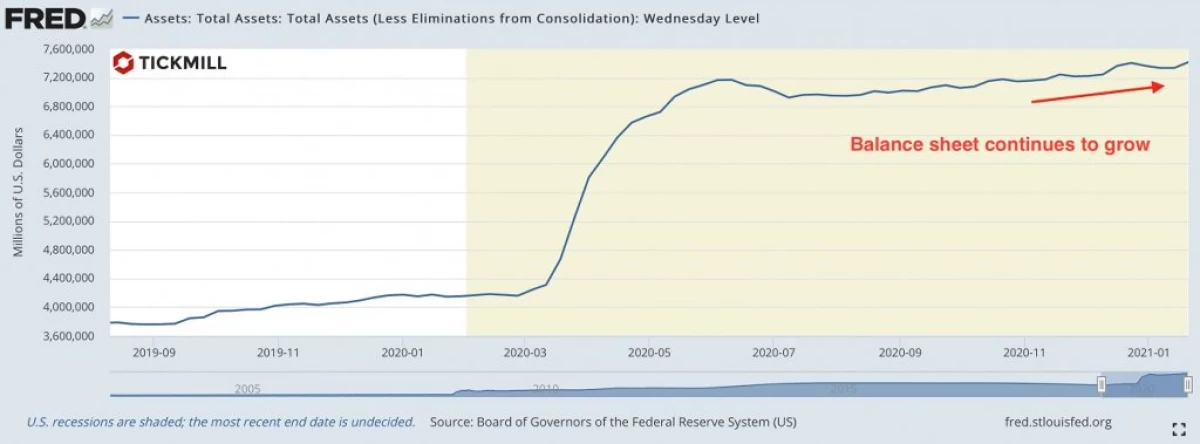

The investment report was supported by consignment currency - AUD and NZD, which through the trade channel are sensitive to prospects in Asia. They added 0.3 and 0.5% against the US dollar. In general, trade in foreign exchange markets occurs today without pronounced trends, since markets are waiting for more information on the position of the Fed, which will hold a meeting on Wednesday. The focus of investors on how the regulator commetes the plans of the government again to ask for help on the debt market (in order to finance a new package of stimulating measures). Of course, no tightening policy or hints on this speech and can not be. By the way, despite the lack of declaration of monetary mitigation, assets on the Balance of the Fed continue to grow:

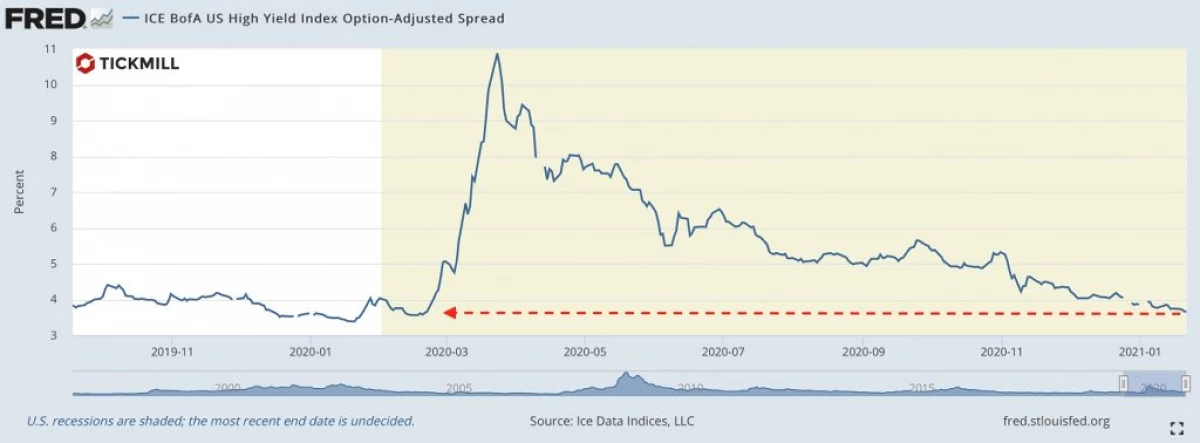

What provides support for the stock market and maintains a trend on compression of credit spreads:

In such conditions, it is difficult to imagine that it may cause a turn in revenue assets in the near future, where among positive catalysts is expected to be a new fiscal incentive in the US almost 2 trillion dollars.

The dollar index has every chance today to dive below 90 points, if the voting in Congress about the appointment of Janet Yellen to the post of Head of the Ministry of Finance will show strong support for the Republicans. The fact is that in his last speech, Yellen stated that "while there is an opportunity to occupy - it is necessary to take it," therefore, the maintenance of its candidates in Congress will actually show which level of resistance will meet a new stimulus package.

Arthur Idiatulin, Tickmill UK Market Observer

Read Original Articles on: Investing.com