Fed accelerated sales market and bonds.

If Donald Trump was on the site of the current head of the White House, he would immediately stick to Jero Powell Enemy America, looking at how after the speech of the Fed Chairman falls into the abyss of US stock indices. It seems that the Central Bank does not cause sympathy of the collapse in the stock market, and how much is it? The recovery of the economy is still far from completion, and the S & P 500 fled to come ahead for a long time. Nowadays its assessments are overestimated, why would the index do not go to the correction? Which is known to stretch the Help Help on EUR / USD.

The insecure market felt even more unprotected, after Jerome Powell stated that the position of Fedrev was right, the economy was far from employment and inflation purposes, and the Central Bank draws attention not to one component of financial conditions, but on their overall dynamics. The Chairman of the Fed would be concerned (that is, he is currently not worried) unrest in financial markets or constant tightening of financial conditions, which would threaten the fulfillment of the tasks set before the regulator. It seems that Powell wanted his rhetoric to appear in investors "Golubina", but when the market is nervous, it is not able to correctly interpret hints.

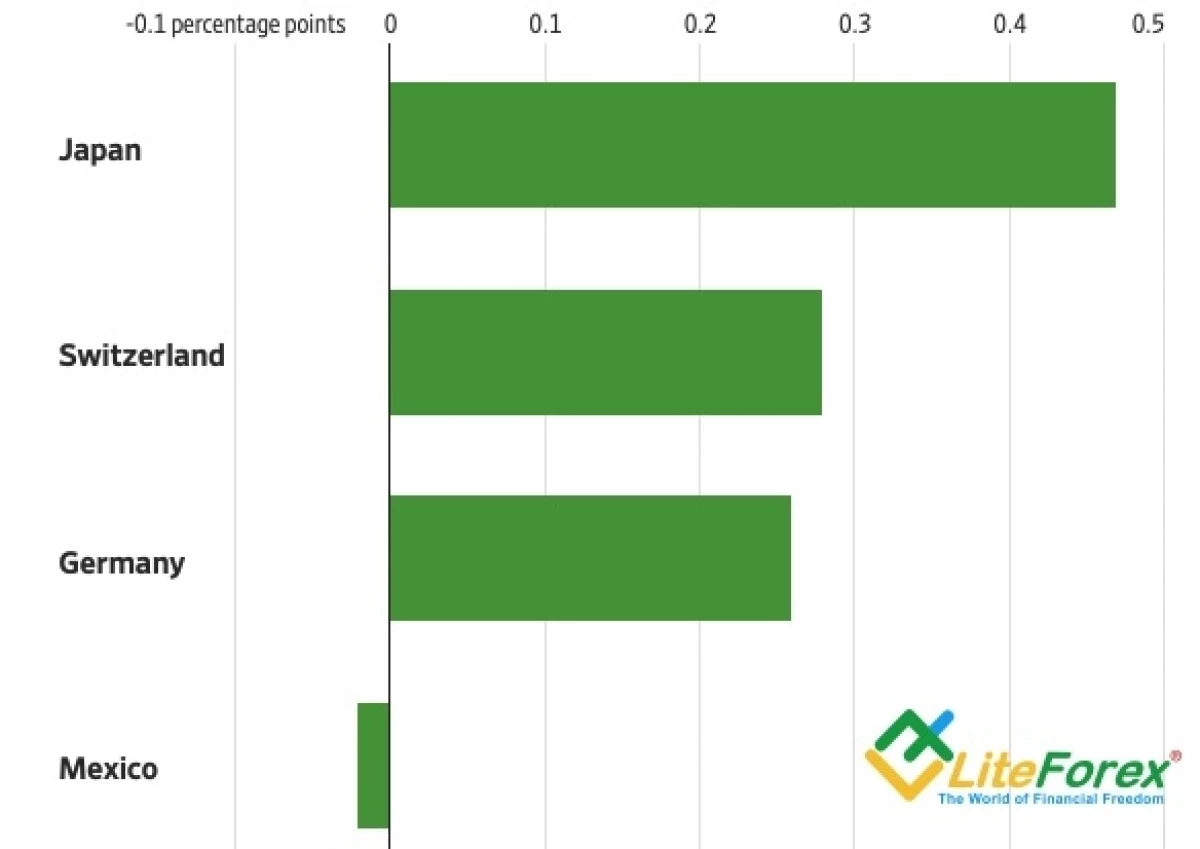

The yield of treasury bonds has grown sharply, the shares were pleased to the next wave of sales, and the US dollar strengthened. Obviously, on the side of the "bears" on EUR / USD play both the growth of the attractiveness of American assets and the increase in demand for currency-asylum during the correction period S & P 500. The spreads of the yield of treasury bonds over the past few weeks increased compared to their Japanese and European analogues , which is particularly reflected in the positions of the yen and franc.

Changing the spread of bond profitability

Source: FINANCIAL Times

Rumors are intensified on the market that rates on 10-year-old Trezeris can jump to 1.75%, and even up to 2%, which will allow Greenbek to continue the offensive.

In my opinion, the dog is buried deeper. Investors are disappointed that the restoration of the global economy turned out to be complex, diverse and uneven. Slow vaccination in the EU, where only 8 doses for every 100 people were introduced compared to 24 in the US and 32 in Britain, as well as alarming information from WHO, which is in the old world after 6 weeks to reduce the number of COVID-19 infections. , cause doubts about the ability of the global economy to stand up. The situation is exacerbated by the strengthening of Greenbek, which leads to the tightening of financial conditions in developing countries that are highly dependent on dollar financing.

The states are presented in a kind of island of stability in the ocean of international shocks. Their GDP is ready to expand almost 10% in the first quarter, but the growing yield Trezeris signals the confidence of the economy in the future.

In my opinion, without signs that the situation in Europe begins to improve, the EUR / USD pair will be extremely difficult to return to the ascending trend. As expected, the speech of Jerome Powell lowered its quotes below 1.2, and the breakthrough of support at 1.195 and 1,1935 can turn into a fall of the euro to the region of $ 1,185-1,188.

Dmitry Demidenko for LiteForex

Read Original Articles on: Investing.com