Fragile Ark Investment, and why now a bad entry point in growth assets

Ark Investment is a fund that invests in promising industries. Over the past year, the Fund was very popular: the assets in management increased from 10 to 60 billion dollars, and now the fund owns at least 15% in 11 different companies. The Foundation is known for its visionary reports - in particular, we also disassemble them with a large report with investigators in the Space sectors, the development of drugs from cancer and other Vennirov Company.

If the company's research on which ARK puts is crowned with success - she will shoot, if not - the idea does not work. The approach, in principle, is working, but it implies that Ark sells a distant future, with a horizon of 5-10 years. Such shares are stronger than others depend on the sentiment of investors and, therefore, the cost of risk.

The yield of 10-year US bonds (proxy for a riskless rate) is short-term growing and a peak can achieve soon. Funds have already begun to fall, and there are a number of reasons why a short-term drop can be significant.

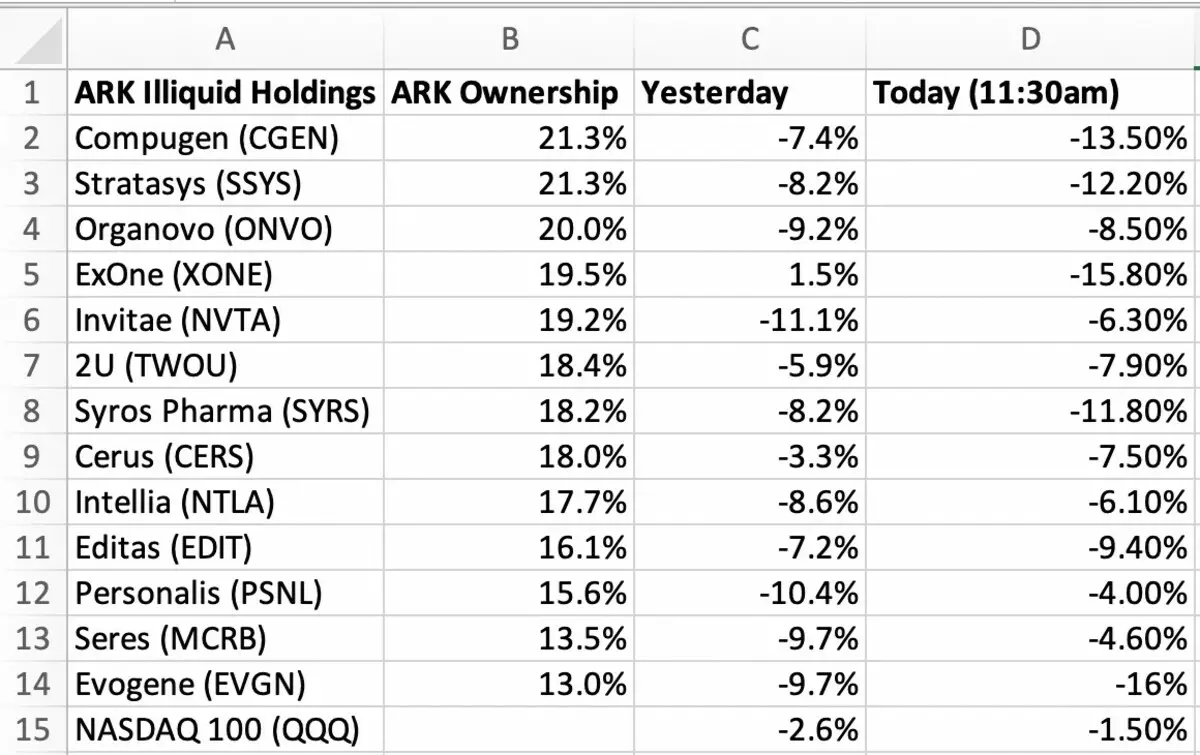

ARK scored illiquid positions - these are risks for the Foundation

15% in 11 companies are solid packages that cannot be sold by pressing one button. If you are investing as a private investor and want to sell shares - it is easily done with one clicking the button in the application. The foundation that owns 15% of the company cannot do that, because at the moment there is no such big buyer. If you sell no one, then selling shares collapse.

According to WSJ, more than half of ARK Investment assets are in such concentrated, that is, non-liquid, rates (10% of the company and more).

But Ark Investment buys after, why will they sell? To answer this question, it is important to understand how the funds work. If the influx of new investors in the Foundation is going, it will pay shares for this money. If the outflow goes, the fund must return money to investors - that is, to sell part of the available positions. It turns out if there is a sharp outflow from Ark, the foundation will be forced to engage the shares in which it sits tightly.

CATHIE WOOD CEO commented on WSJ that they have a significant "shield" in the form of a share in liquid assets (TESLA (NASDAQ: TSLA)), which they will sell to buy implications in the event of a collapse. If the Foundation really will do this, then on the market of the market it will become even more illiquid, and in the case of the outflow of investors from the ARK Investment ETF, there will be even more sharp drops in the promotions that the foundation holds.

By the way, it can give an opportunity to buy Tesla by $ 500-600 per share, which gives an interesting Aquider to our fundamental assessment.

Now the dynamics of all ETFs from Ark looks like an unfolding bubble:

Now funds fall from the maxima by 7-10%, which can still be considered the usual correction - such has already happened in September and October 2020. In case of continuing the correction, literally in the coming days we can see the acceleration of the fall of their assets - retail will be massively leaving the fund, and this will provoke even faster sales in non-liquid stocks.

Foundation's fall may contribute to other hedge funds

The market is so arranged that some fund is bad, it does not help him, but begin to fit on it, aggravating his position. Data on all trades Ark are tracked, there is even an application with the Ark portfolio tracker.

Hedge funds are unlikely to miss the opportunity to play on the decline of ETF from Ark, which provokes first the drop in their value below NAV (the cost of net assets of the Fund), and then provokes the outflow of retail investors, which constitute the entire Base of the Ark Foundation. This spiral will lead to the sale of assets and the fall of their value and even greater drop in ETF.

Short-term fragility

Ark

Investment allows long-term investors to enter promising assets at competitive prices.

Indeed, the Ark team found interesting opportunities for investment, and on the horizon for 5-10 years they will probably bring profit to investors. However, now the Foundation and its assets are overheated by attention, so it is a bad point for shopping.

Due to the growth of 10-year bonds, we can see a sharp correction in growth assets, which are now laid in the price of 5-10 years ahead.

We believe that in the summer the rate of return on 10-year-old Treasuries will be about 1.6%, and it will be a good opportunity to enter long-term growing trends at competitive prices - and in the ETF themselves from Ark, and in their illiquid assets that are short-term It can be used at competitive prices due to forced sales.

For aggressive traders, ETF shorts from Ark may be an interesting speculative opportunity.

The article is written in collaboration with analyst Alexander Saiganov

Read Original Articles on: Investing.com