The lack of experience, aggressive strategies, high risks, trolling, self-confidence and memes are the main features of Sabedditis by 2.5 million people who has become a noticeable event on Wall Street.

One of the main exchange events of January 2021 is a sharp increase in the value of the shares of Gamestop retail stores. Short sellers who have fallen on their fall lost $ 3.3 billion.

REDDIT R / WallStreetBets Community users caused. They decided to buy paper and take revenge on the hedge funds for the underestimation of the Gamestop and try to sink her - to take their money and try to earn themselves.

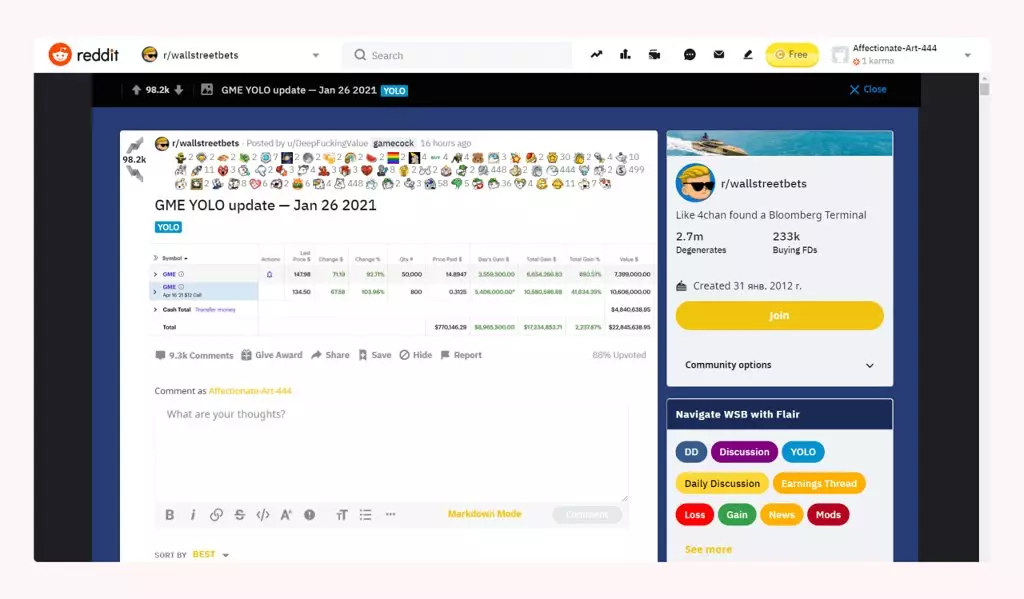

It turned into a disaster for those who played a decrease, and for R / WallStreetBets Gamestop shares became a source of earnings. For example, one of Sabedditis traders turned $ 53.5 thousand at $ 22.8 million and continues to keep shares with him.

Success with Gamestop is the first case in the history of R / WallStreetBets, when it was possible to earn all the community, known for its risky and rapid acts and losses (or earnings) hundreds of thousands of dollars in a couple of minutes.

"The rating traders do not know what they are doing, and they don't care that they do not know what they are doing," the founder of R / WallStreetBets is recognized by Khaim Rogozinski, not related to the community since 2020.

Slogan R / WallStreetBets- "As if 4Chan found the Bloomberg terminal." For them, it makes no sense to study the financial statements of companies or stock techniques - they just consider the game on the stock exchange, as a chance to have fun, label memes and experience the thrill of huge losses or earnings.

Where did R / WallStreetBets come from and how the community is arranged

Sabreddite was founded by Khaim Rogozinsky in 2012. He wanted to create a place where experienced investors could share advice on short-term high-profile strategies with quick and big profit.

"All conversations on the Reddit at the time were devoted to long-term investment and index funds, and every time I left a comment or a question, I scolded me and called a bad investor," says Rogozinsky.

Then he created Sabreddite R / WallStreetBets as a serious forum for teaching trading on the stock exchange.

But soon, the unmanaged crowd of trolls and jokers smeared on Sabreddit, and Martin Shkreli became the moderator - the former manager of the Hedge Foundation, which serves a seven-year term in prison for securities fraud, Writes Money.

Shkreli, whom they call "the most hatred person in the world," is known for speculation in the pharmaceutical market. For example, he bought the right to Thiola's drug for the treatment of a rare disease and raised the price for it in 2000%. And then repeated it with drugs for the treatment of toxoplasmosis, raising the price of it by 5455% - from $ 13.5 to $ 750.

As a result, R / WallStreetBets turned into a place where investors are amateurs:

- exchange the ideas of "quick earnings",

- Run "advertising campaigns" with calls to support certain promotions,

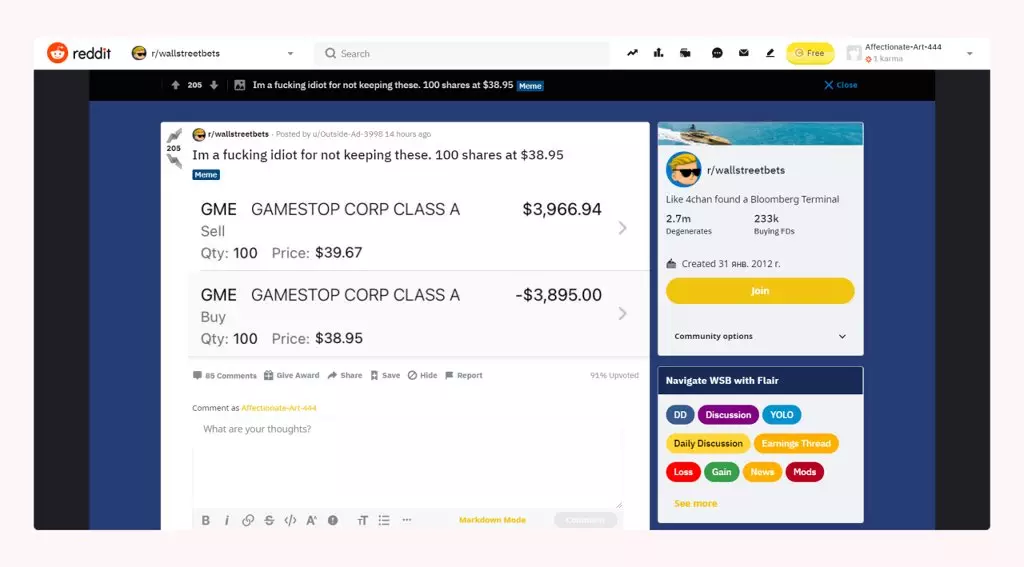

- Breasts big earnings, laying out screenshots with brokerage online accounts,

- And on the contrary - proudly demonstrate how dozens and hundreds of thousands of dollars have lost due to unsuccessful investment, and they receive the support of the type "Live once! (Yolo). "

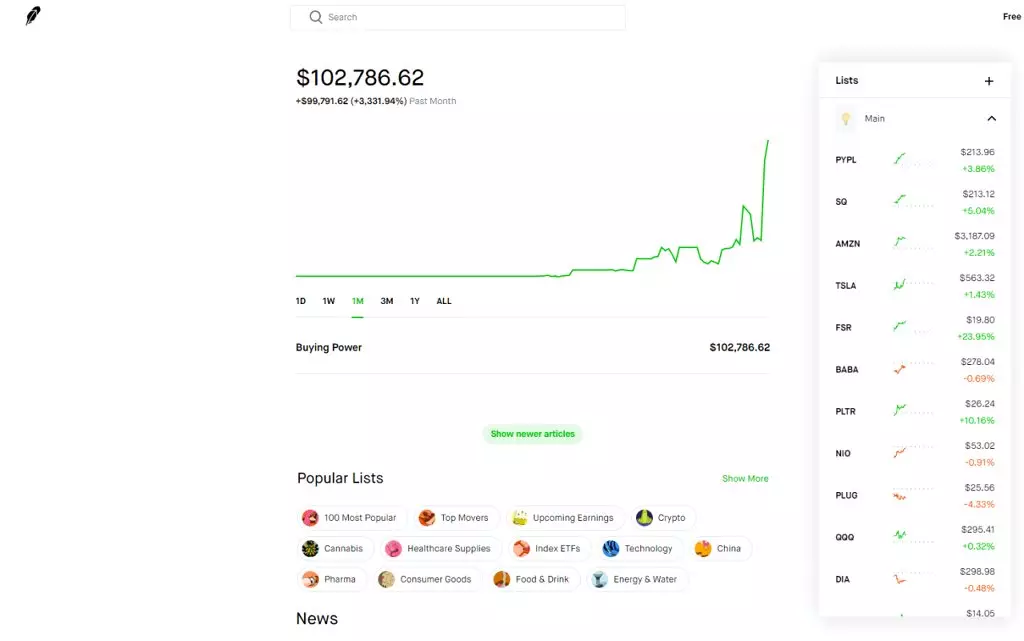

The number of investors and community subscribers is constantly growing - due to the increase in the popularity of brokers without a commission and mobile applications for online trading, such as RobinHood.

RobinHood has become the main R / WallStreetBets tool, most of the screenshots in the Treads are from this service. The community affects the service itself, finding vulnerabilities in it, for example, infinitely increasing his credit shoulder.

They also amounted to a small dictionary, for example, chosen by each other "autists", and financial benefits are called "breasts" (having in mind chicken fillet and nuggets). Those who play down, mainly designate homophobic epithets.

Typical R / WallStreetBets Situation

- The user enters Sabreddit and boasts that for the month "raised" from $ 3 thousand to $ 102 thousand, in particular on the "meamatic" Tesla and Palantir.

- And after another month, everything loses and receives 2 thousand comments about what an idiot he is.

Trading Has Been Halted, Robinhood Is Down, And Wall Street IS in Full Blown Panic Mode All From A Subreddit, Shitposters, Gamers and Degenerates from All Corners of the Internet. It's beautiful

- SLASHER (@ROD BRESLAU) 1611759223.

What do you earn and lose money in R / WallStreetBets

Despite the overall ironic mood, the losers try to comfort - offer psychological assistance and try to find support words. But not all - there are also those who ask for "to invest any other way that I put up against you and climb."

Initially, the rewarders were invested in the "membrass" shares - which cost no more than $ 5 and are issued by companies with small capitalization. They believed that despite the risks, this could earn more and faster than more reliable promotions.

"If you find something unstable and risky, then notice that people flock there. Do we encourage risks? Oh, yes! ", - spoke Rogozinski.

Thus, R / WallStreetBets raised the shares of Plug Power, Virgin Galactic, Nokia, BlackBerry. The community could participate in the increase in the cost of TESLA shares, as the mask and the company often mention the Reddit, Bloomberg writes.

Now the main topic for discussions on R / WallStreetBets is how to make money on trading options. In the opinion of the community, transactions with options allow cheap to put on an increase or decline in shares, but not to buy securities themselves.

They make bets using intermediaries who sell call-options and way options (law contracts to buy or sell an asset at a certain price).

These mediators are trying not to risk and when buying a call-option, the dealer buys shares of the company. With the increase in the cost of shares, the dealer pays the option and earns on the price difference.

And if the number of call-options is growing to reduce the risks, a massive purchase of shares occurs - and this is considered a weak trading site according to R / WallStreetBets.

The main tactics of the community - in the morning to buy call-options of a particular company in order to force dealers to buy shares, thus growing both the cost of securities and options.

At the same time, many community members admit that they do not know anything about companies where money is investing, and just follow the hype - investing in what is discussed most.

In the case of Gamestop, the R / WallStreetBets tactics was first justified completely - usually the community partially or completely loses money. But Sabrreddit has a "star" - the trader Eddie Choi. He learned to trade options thanks to R / WallStreetBets and in 2019 was able to receive 19,000% of profits on two transactions.

At first, he spent $ 766 to buy options for the sale of Rocu shares, and received a profit of $ 49,787 after the shares fell more than 19%.

And then used earned money to buy SPDR S & P 500 ETF options - their price has also fallen, and the profit of Choy has grown to $ 107,758. Despite the dislike for shorters, the community met the victory of Choi positively.

"Get rich or die, trying!"

Investments in high-adjustable crude oil futures - one of the examples, how the R / WallStreetBets community lives.

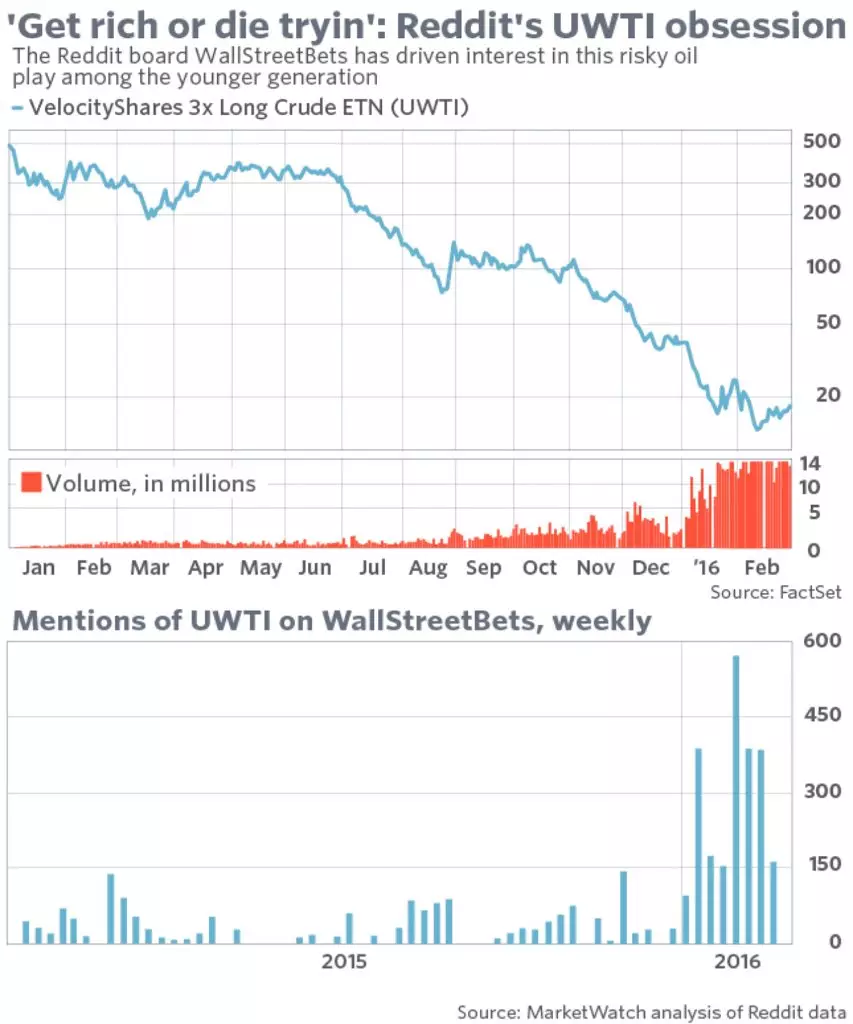

In 2015, after the conscription of the DRFRESHH subscriber, the community set on the Paper of VelocityShares 3X Long Crude ETN, which tracked the wet oil futures.

ETN - unsecured debt obligations, where investors lose everything if bankruptcy occurs. 3X - three-time increase in risk for beginners.

The number of UWTI references on Reddit in 2015 increased from 12 to 381, and in the first half of 2016, UWTI was mentioned in the title 124 of publications. Most are in R / WallStreetBets.

UWTI took the fifth place in the list of ten TD Ameritrade's best shares and became the most popular with Millennalev - the main audience R / WallStreetBets. In the top ten of the favorite shares of Russian investors, UWTI has not entered. And according to Rogozinsky, this is not a coincidence.

In 2016, sales sharply increased, while most of the time of the UWTI shares only fell, sometimes on double-digit percentages. In May 2015, the UWTI index reached $ 428. In just a year, UWTI shares fell more than 90% - to $ 21. To make money on them almost no one from the recommenders.

R / WallStreetBets became a "platform for Millennalev such as we, to learn about UWTI and lose money," says the member of the Jeffrey Community Rosansky.

He invested in UWTI $ 500 and lost $ 100 on their sale.

And then set $ 900 to the S & P 500 option and earned $ 55 thousand, once again demonstrating the Yolo-Spirit of the community.

#Reddit # investment #wallStreetBets

A source