Especially for Investing.com.

In 2017, digital currencies flew out than the views of investors and traders rocked. However, then they confused their appeal slightly. So continued until the end of 2020. The leader of this class of assets remains bitcoin, alone providing approximately 63.6% of its market capitalization. In second place is Ethereum with a fraction of about 15.2%.

One of the factors that allowed Bitcoin to overcome the mark of $ 20,000 at the end of 2017, began the launch of the Chicago Exchange Exchange Contracts on this cryptocurrency. On February 8, the same Exchange plans to submit futures on the air (with calculations in US dollars), which can accelerate the growth of one of the leading digital currencies.

Ethereum: leading cryptocurrency

Market capitalization of more than 8,300 cryptocurrency recently overcame the maximum of the end of 2017, at the end of last week exceeding a mark of $ 930 billion. Meanwhile, now a trillion dollars is not the same as a trillion dollars a couple of years ago. The market capitalization of some technological companies has already exceeded this line. As of January 22, Apple (NASDAQ: AAPL) was estimated at 2.34 trillion, which more than twice the cost of the entire class of digital currencies.

Meanwhile, Ethereum is one of the leading cryptocurrency and keeps this position over the past years.

Source: Investing.com

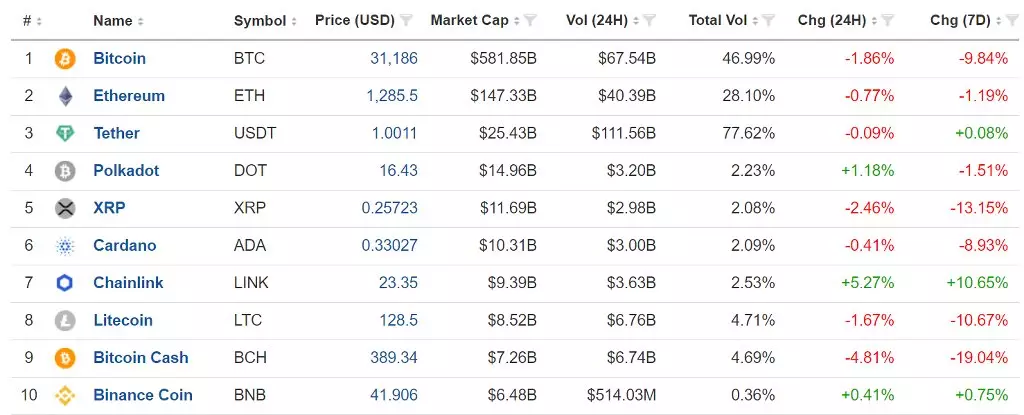

As can be seen from the table presented above, Ethereum takes the second line of the rating cryptocurrency with a market capitalization of about $ 147.33 billion. In fact, Ethereum is more than 50 billion dollars more expensive than the next eight representatives of the first tens of combined.

Powerful rally ether

In March 2020, when Bitcoin, as well as other cryptocurrency and markets, all the masters collapsed to the bottom under the severity of the global pandemic, Ethereum collapsed to $ 113.58 per coin. By the end of November, the currency was recovered to $ 602.39, and in December and January began a new round of explosive rally.

Source: coinmarketcap

On the chart you can trace the Ethereum path to the maximum of January 19 at $ 1391.01. At the time of this writing, he traded at $ 1290, which is not so far from a record peak. And soon the explosive traffic can resume.

CME futures can push prices to new tops

At the end of 2017, Futures on Bitcoin became traders. This step has grown prices until the translated 20,000 dollars. The similar potential of Ethereum can reveal in a few days.

Chicago Market Exchange is the leading global area of derivative financial instruments. Now CME expects approval of applications for Listing futures on Ethereum on February 8, 2021 by regulatory authorities. Most likely, this is a simple formality, since the Exchange is currently providing the possibility of trading similar contracts for Bitcoin.

Source: CQG.

As can be seen from the schedule, the first peak of Bitcoin was at the end of 2017, when CME launched his futures contract. Moreover, bidding and open interest in bitchin contracts grow, creating liquidity for derivative tools. Each futures contract for Bitcoin from CME contains five currency units. As of the end of 2020, the owners were changed on average 42,800 bitcoins. At the beginning of 2021, the rally led Bitcoin to a maximum of $ 42,730, in parallel increasing the volume of trading.

The CME contract on Ethereum will similarly offer additional liquidity and another way of investing in one of the leading digital currencies.

We can expect from EtherEUM movement similar to the Bitcoin surge from 2017, since CME futures open the way to the market to those who do not want to keep the currency in their own electronic wallet or trust it with unregulated exchange platforms.

Ethereum - the most used blockchain

Ethereum is a decentralized open source block that supports the "Smart Contracts" feature. Ether - own cryptocurrency platform. In essence, Ethereum is a network; A broadcast - tool for its feeding energy. Consequently, the object of trade is the ether.While the air is only the second largest cryptocurrency, yielding Bitcoin, Ethereum is the most popular blockchain. Now in circulation there is about 18.8 million bitcoins and 114,373 million units of ether. Bitcoin is the usual cryptocurrency, and Ethereum is a distributed network, on the basis of which technological companies create their own online services.

Bitcoin and air are created on the basis of the blockchain, however, as the Ethereum network is more reliable. Bitcoin is the most popular cryptocurrency, but futures on the air will strengthen his position in the eyes of the market participants.

Do not stop at one currency

Bitcoin futures were the first step. As the market matters and market, the ether has gained popularity and took the second line. Most likely, behind this will follow the release of new digital currencies on the arena derivatives of the tools.

The next stage of evolution will be stock exchange funds (ETF) and products (ETN), which will expand the market of the entire class of assets. Now there are more than 8,300 currencies on the market, and this number is growing daily, opening new opportunities to traders and investors.

Soon, the direct exchange of tokens will become commonplace for both professionals and beginner market participants. Each currency has its own history and a goal that sooner or later introduce familiar elements of the fate currency market - arbitration transactions, speculation and hedging.

One of the serious obstacles may be to enhance oversight from regulatory authorities, which consider digital currencies as a challenge of their control over the world money supply. The risk of state intervention in the decentralized system is likely to grow after the capitalization of the class of assets.

February 8 CME will make another step by submitting futures on the air. If the story is repeated, then the cost of the currency must continue to be strengthened. Derivative Tools - New Arena, which expands the basic market.

Read Original Articles on: Investing.com