Mass vaccination began, the market is laid on a victory over the virus. Industry is restored, the prices of raw materials assets are growing, including oil. Our forecast for oil on 1Q21 is an increase of up to $ 65 per barrel and a decrease to $ 58 per barrel in 2k21. With the growth of oil quotations, our national currency is strengthened. But there is one "but" - this is geopolitical risks (Navalny, sanctions by the United States), which make troubles into strengthening the ruble, and even on the contrary, advocate its weakening of the US dollar.

In this article we will see:

- Which currency pair is suitable in order to play oil growth;

- In which currencies can potentially earn.

And who, if not we

In this situation we wondered: what else wins from oil growth, except for our ruble? And then we remembered Canada and her dollar (CAD).

Indeed, looking at the chart of USD / RUB and USD / CAD, we will see a rather explicit correlation.

As can be seen on the chart, until July 21, the currencies moved together. And then our ruble has become a victim of geopolitics: protests in Belarus, further poisoning of Navalny, the election of the President of the United States, and the ruble naturally weakened to the dollar against the background of the risk of sanctions, while the Canadian dollar continued to strengthen. After the elections of the President of the United States (peak on schedule on November 2-3), our national currency began to strengthen, because it took part of the prize for geopolitical risk. But now the risks of sanctions are again strengthened against the background of the navalny arrest, so the ruble can again weaken how it was in the fall.

Add Brent oil to the chart.

In this graph, we are already clearly visible as RUB and CAD weakened when oil falls. At the same time, in the summer, when Canadian began to strengthen against the background of the growth of oil quotations, our ruble weakened on the reasons already known to us. And after the elections in the US, both currencies began to strengthen the dollar against the background of the oil rally.

Why canadian dollar depends on oil prices

Canada is a major oil miner. According to the results of 2019, Canada opened Top 5 in terms of oil produced, producing 200 million tons. Canada is also a key partner of the USA in energy trading, and the lion's share of oil is exported to America.

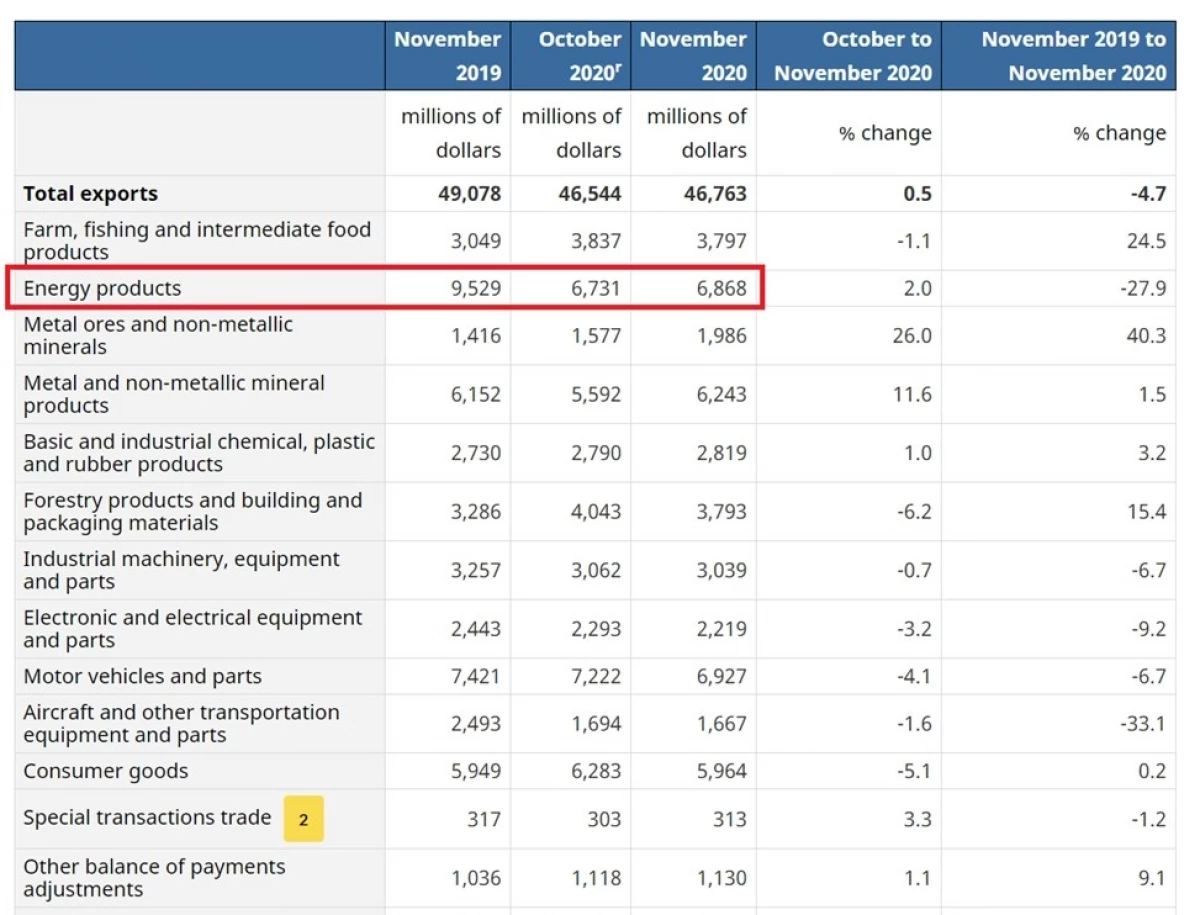

I propose to see the export structure of Canada for November 2020

We see that the Energy Products section amounted to $ 6.9 billion or 15% of the total exports for November. In October - 14%. In November 2019, the share of energy resources was 20% of exports for November 2019. This article has the highest share in the export structure, so the more expensive it is oil, the more US dollars will go into the Canadian economy, which will further be converted to Canadian dollars.

Based on the graphics and the structure of exports, we believe that to regain the growth of oil is more logical through a couple of USD / CAD, putting to strengthen the Canadian dollar, because It does not affect geopolitical risks, unlike our ruble.

P. S. Joe Biden on Wednesday recalled permission to build a Keystone XL pipeline in Calgary due to the non-compliance of the project to the economic and climate principles of his administration. This complicates the US trade relations with Canada and can pour out a local trade war. We will follow the situation and look for a suitable entry point.

What other currencies in perspective can strengthen the dollar

Turkish Lira

Idea in CARRY-TRADE strategy. This is such an arbitration strategy based on the difference between the real rates of the two countries. Today in developed markets zero and negative real rates, so money is looking for profitability in emerging markets.

The key rate of Turkey is now at the level of 17%. It is expected to maintain it at the same level at the meeting on Thursday. Following the results of 2020, inflation was 14.6%. Consensus expects an acceleration of inflation to 15.5% at the end of 1Q21, and then slow down to 10.5-11.2% by the end of 2021.

The yield of 10-year bonds of Turkey is 13.1%. Now the real rate of profitability for these bonds is negative and equal to -1.5%. But when the inflation is slowed down, the real rate at the end of 2021 may amount to ~ 2%, which will contribute to the influx of foreign capital to the Turkish market.

At the expected week (ended 17.01), according to Emerging Portfolio Fund Research (EPFR), the volume of investments in Emerging Markets funds amounted to almost $ 7 billion, whereas in the week from January 4 to 10 there was an outflow of over $ 1.5 billion. Part of these funds went to Turkey.

Also, the influx of foreign capital in Turkey can provide the tourism season, which in 2021 will be more active than in 2020.

But it is necessary to be neat and not forget about the risks of the Turkish Lyra:

- The dependence of the course from the statements of the president, which was observed by the entire 2020;

- The growth of the current account deficit to $ 4 billion in November from $ 340 million in October - the larger the current account deficit, the more LIRA is for sale;

- Currency reserves minus the obligations of the Central Bank are not enough for the regulator to intervene on the currency market and, if necessary, strengthen the LIRA.

Here you will also need to choose a point for the entrance, but it can be closer to the end of 1k21, when inflation will be released on peak.

Argentine Peso.

We see a rapid rise in prices for Soft Commodities (soy, corn, wheat, sugar) worldwide, and the rise in prices for agricultural goods (Bloomberg / DJ-UBS index) over the past 6 months (+ 40%) exceeded the rise in copper prices ( LME). UN (FAO) notes that food prices have risen to the highest level in 6 years.

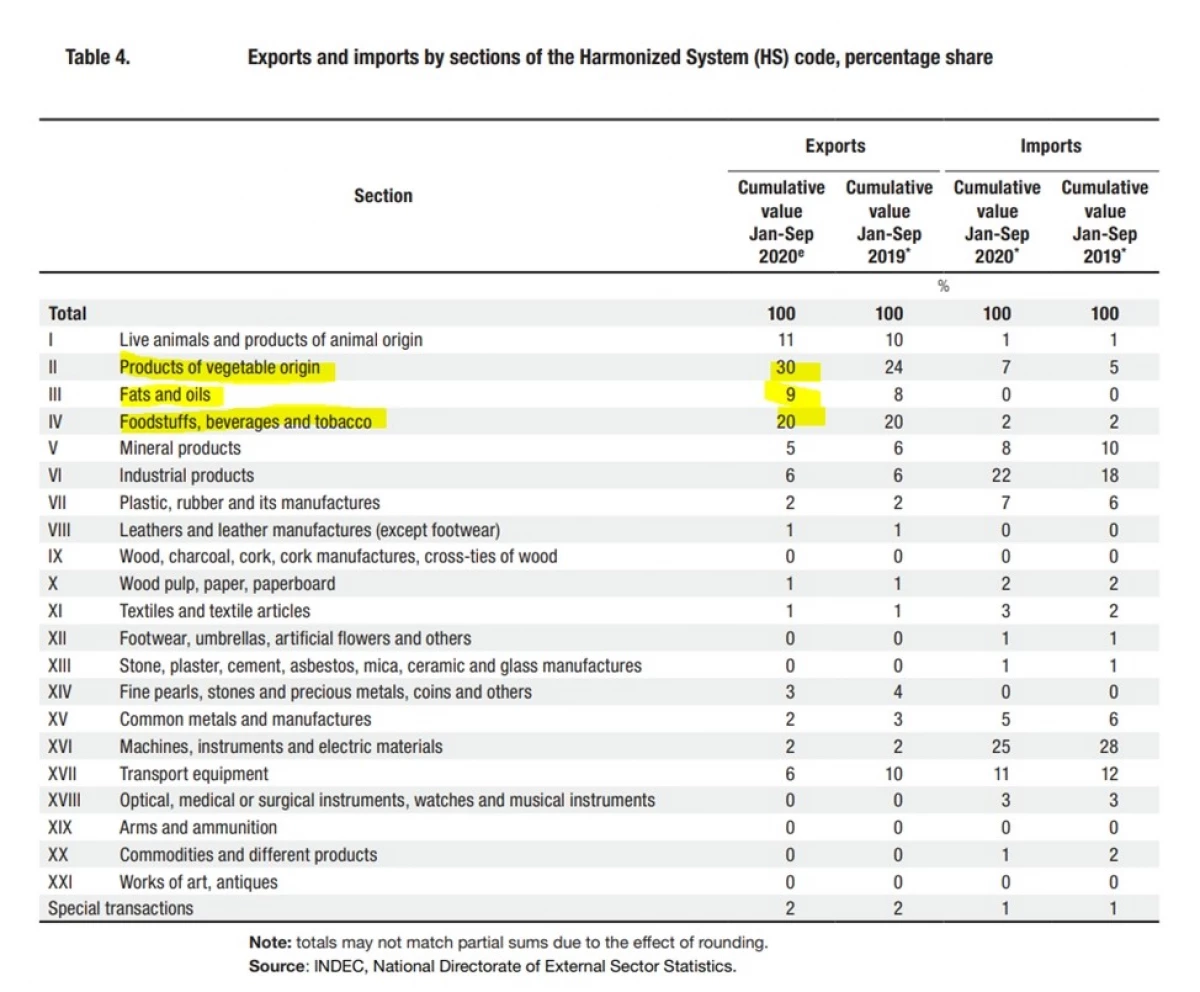

Let's look at the export structure of Argentina.

We see that Soft Commodities make up ~ 60% of exports for 9m20, so the Argentine economy should win from the rise in prices on them. We will watch this question more detailed and deeper and back to it, and this is a small food for thinking.

The article is written in collaboration with analyst Viktor Lowov

Read Original Articles on: Investing.com