In the morning on Tuesday, the markets are again dominated by the purchase of risky assets. The MSCI Asia-Pacific Index without Japan jumped by 1.6%, Nikkei225 rose by 1.5%. In the global press, this growth is associated with the reaction of markets for strong data from China. However, this is a very stretched explanation, because Chinese data was known during the day earlier. Then the markets met them very restrained and contradictory.

The jerk up is more like an attempt to start a shopping wave after a small recession. Confident in the prospects for restoring the global economy and impending new incentives from the United States and other countries, investors repurchase risky assets, assuming long-term preservation of ultra-low interest rates in combination with accelerating inflation.

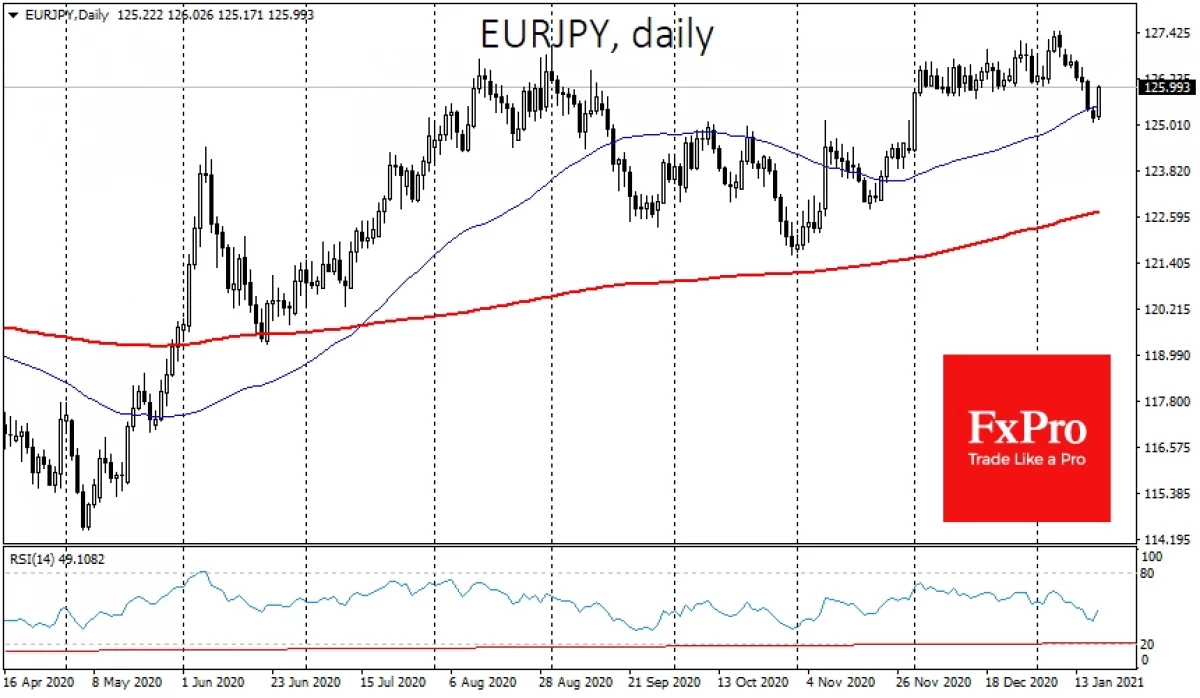

Interest in risk assets is also traced in the weakening of the yen to the main competitors. The USD / JPY pair has risen above 104 in the morning. However, this climbing should be considered as a sign of optimism of the markets, and not as a manifestation of the dollar forces, since EUR / JPY has done an even more beautiful reversal.

The single currency on Monday successfully surrendered against the onslaught of bears, remaining above the 50-day average against the dollar and the yen. According to EUR / JPY, purchases intensified at a decline to 125, returning a pair of 125.80 now.

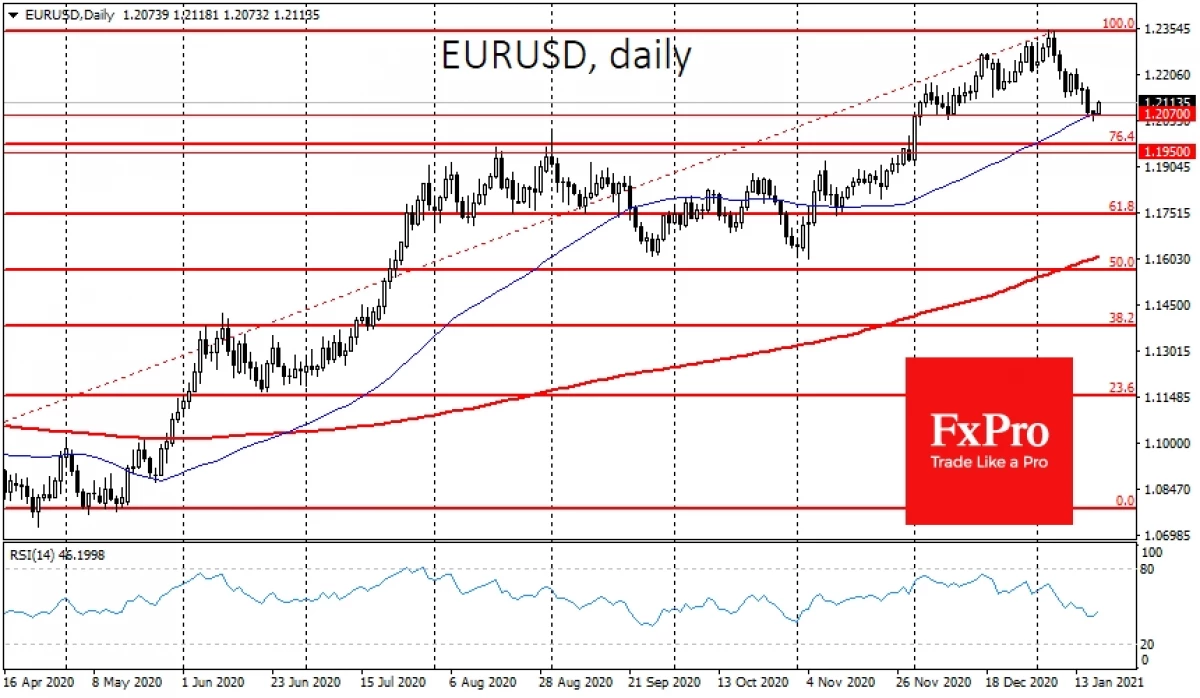

EUR / USD similarly received on Monday to the decline in the 50-day moving average, encroaching on the shopping avalanche when taking the mark of 1.2050 and sending a course above 1.2100 this morning.

GBP / USD also grows from the lower border of the ascending channel, formed at the end of September.

Markets find the strength to stay within the framework of a strong impulse up, formed in late September. The ability to fight off from the 50-day medium and stay within the framework of this impulse at the end of the day today can be an important confirmation that this bullish trend will remain with us for some time, despite the signs of the rebuilt of the stock market.

Team of analysts FXPRO.