homework

Each control panel is digging, discharges, takes with him on the weekend to read, irritating his wife. And once everything has grown hard, I decided to write you today about the ideas that remained not fired, but already charged.

TOP OF MIND.

Idea 1 - noticeable that it grows as on yeast. All real - steel, copper, zinc, palladium, tin, wood, gold and silver (2020), sugar, coffee, wheat and corn, lithium, niobium and tantalum, oil ...

There are a number of markets, where growth has not yet taken the character of parabola, but there is a medium-term potential:

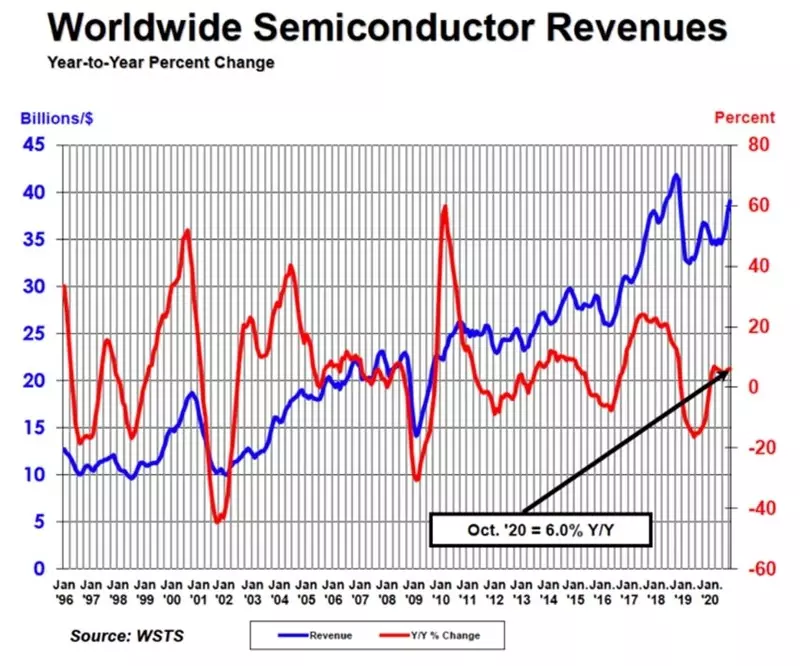

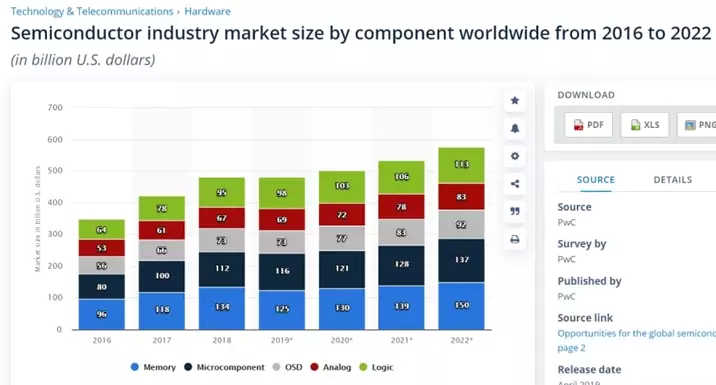

- Semiconductors - there trend in full swing, and we wrote about it yesterday. Now our analysts count the potential of several companies.

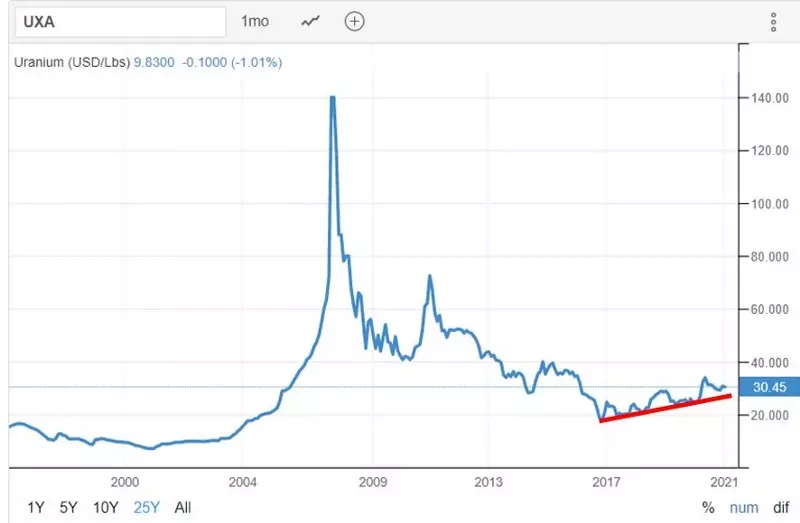

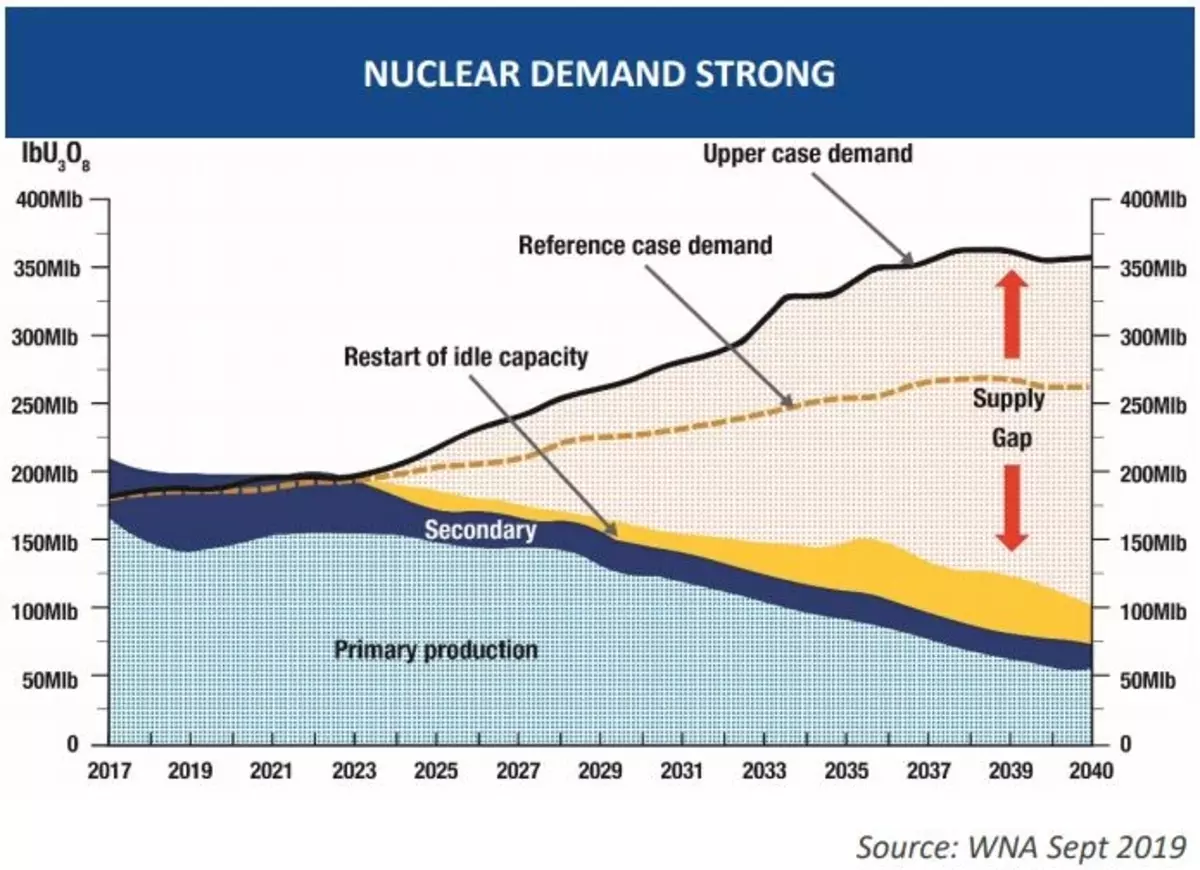

- Uranus - due to the situation with reserves and lower prices below cost.

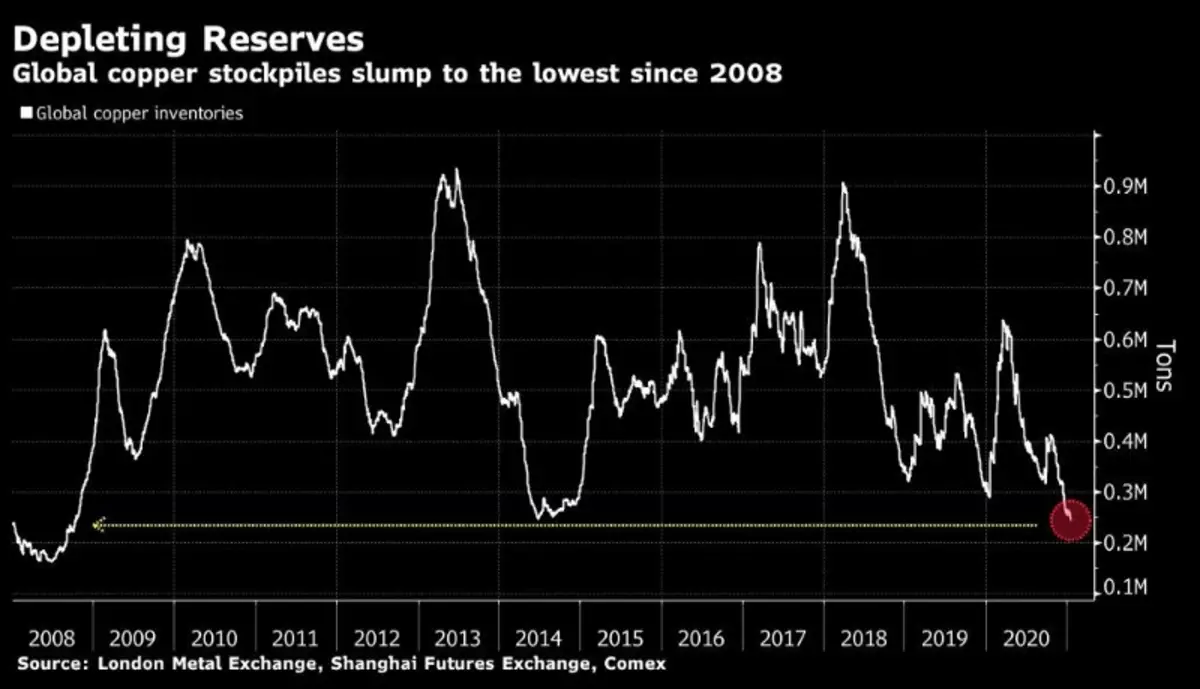

- Copper and lithium - the demand from the energy and electric vehicles trend is growing, and the reserves of the same copper on the nizakh. There is no deficit in lithium.

- Food - with increasing prices for meat and grain, it is likely that the income of grocery retailers, catering networks and agricultural companies will grow.

Uranus

Uranus is currently traded below the cost ($ 30 against $ 45 Costa), because There are quite a few stocks in the world, and manufacturers sell them and close the mines.

Demand is power plants, and there are long-term contracts. Most of them are $ 35. At the same time, the cost of uranium in the price of energy is low, and if it is needed, the price can grow vertically, but the growth may take several years.

Semiconductors

Here is the dynamics of revenue industry:

Our analysis shows that the implementation of 5G, power infrastructure and EV will lead to a new turn of growth in demand for semiconductors, which will cause a new wave of growth in this sector.

At the same time, the sector promotions look superperson.

Copper and lithium

Here copper clearly demonstrates the potential: metal reserves on the bottom, and consumption grows.

Goldman talks about growth potential to $ 10,000 or 20% or more. It says:

- On the potential of nickel growth (MCX: GMKN) above 30,000 rubles per share;

- On the growth potential of FreePort-McMoran (NYSE: FCX) Next (to $ 40?).

We have already played the idea in Livent (NYSE: LTHM) with a result of + 44% and FXC with a result of + 40-50%, but it seems, and this is not all for copper history.

Food

Here I look at McDonald's (NYSE: MCD) (+ 20% Easy), Tyson Foods (NYSE: TSN) (+ 15% is also an option, but can be + 30-40% with an increase in food cost? - Waiting for an answer from your own Teams), FozAgro (MCX: PHOR) (here 4000r is a clear potential, and do not forget about the potential of the dividend 400r and higher over the year; phosphorus is becoming more expensive in the trend of raw materials due to the growth of more rich farmers).

And what sectors are you interested in your interest? Where is height not played? Write in the comments.

Read Original Articles on: Investing.com