Warren Buffett is one of the most famous and successful investors around the world. In numerous interviews, he stated many times that he plays a long-term distance, prefers "safe" investments and is not too opened to innovation. And the proof of the last fact is also known: Buffet repeatedly stated the "uselessness" of Bitcoin, called him "rat poison" and criticized many times. It seems that even the recent growth of the main cryptocurrency could not shake faith in his belief. We tell about the position of the legend more.

And although the Bitcoin is extolled as the "best investment of the 21st century" by many famous personalities by the head of the head of Tesla Ilona Mask, the co-founder of Twitter Jack Dorsey, the billionaires of the Winclove brothers and so on, the opinion of Warren Buffethe still remains very respected on Wall Street. Therefore, it is important to understand what kind of strategy builds an investor and what global trends in his account. Today it will be about them.

What does Warren Buffett invest?

While most of others makes a bet on Bitcoin and other risky investments, Warren Buffett will adhere to stocks that are traded with discounts to their internal range of value - that is, normal cost, taking into account the previous asset behavior. Since it is assumed that the yield of US bonds will exceed 1.5 percent, growth is likely to continue to give way to the real value and shares with dividend payments.

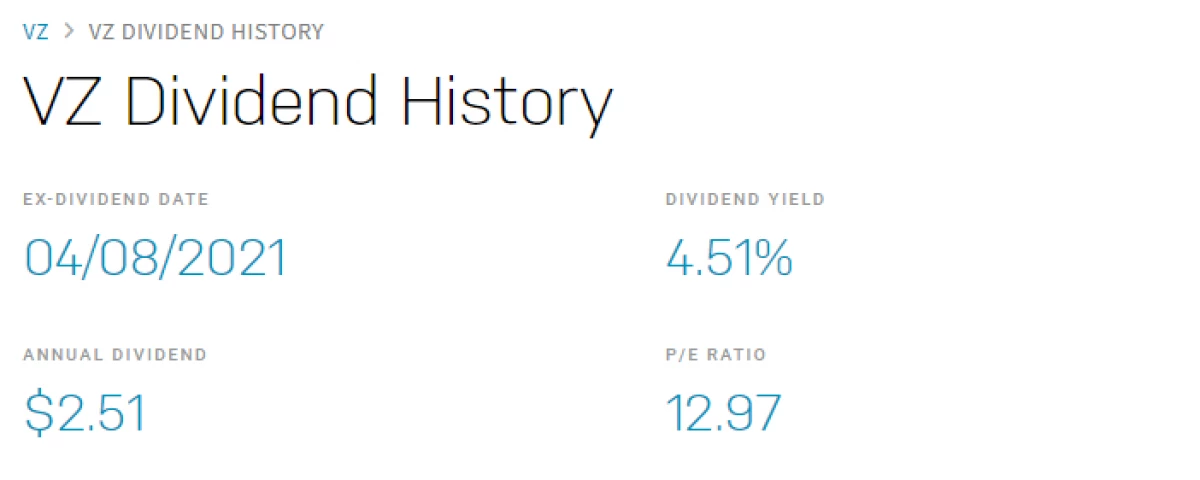

Consider the latest Buffett rates on Chevron and Verizon, the two most dividend shares with a yield above 4 percent. Both options are "classic" components of an investor strategy that looks up to funny boring in the eyes of a new class of novice market players. For example, here is the annual yield from CHEVRON dividends.

Annual Chevron DividendsThe same indicator for Verizon looks like this.

For contrast, immediately remember the cryptocurrency of DOGECOIN, which at the end of January jumped 800 percent - and this is the day. And although many investors joined the growth too late and lost money on investment, the ability to increase their deposit at times was still. And someone took advantage of her.

In the case of the choice of Buffett, the yield is calculated with only a few percentages at a long distance, but the risks are negligible compared even with the rest of the stock market, not to mention Bitcoin. Taking into account the size of the Buffett's capital under control, which has billions of dollars, this is an important factor, reports The Motley Fool. The "more" investor, the less his risk appetite - and this is quite reasonable.

The right hand of Warren Buffetta Charlie Manger earlier noted that yield in the next decade could be significantly lower than in the past. If the expected profitability is located at the lower limit, investors need to either temper their expectations of profitability, or increase their tendency to risk. Buffett and Manger chose exactly the first.

Another obstacle for Buffett attachments and other classical investors in blockchain-assets is the peculiarity of the latter. The fact is that Bitcoin, Etherumer and other coins can not touch, in addition they are "do not produce anything" in the context of ordinary plants. That is, the conservatives are difficult to realize that the value of cryptocurrency is in their blockchain, the potential for changing the modern niche of the finance and safety of assets by miners on the network. In addition, this can be attributed to the transaction to anywhere in the world without approval of financial authorities.

That is, from the point of view of Buffetta, Bitcoin does not create cars, as Tesla does, so cryptocurrency as it should not add a value product to this world. And therefore, the growth of the course is "on an empty place", that is, essentially all speculation. Naturally, in this case, the age investor can hardly be aware of the prospects for the blockchain and the value of cryptocurrency as a new accumulation tool and calculations. So change the attitude of classical investors to BTC is unlikely to succeed very quickly.

Note that exceptions happen here. For example, the Founder of Microsoft Bill Gates has changed the point of view of Bitcoin with a negative on neutral. You can read more about this in a separate material.

What conclusion can be made of all the above? Warren Buffett, because of his experience and beliefs, it is unlikely to ever change his mind about the crypton. This is a field for playing a new generation of investors from the Millennalev and Zeomers environment. In the last relatively very small capital, which they seek to increase as soon as possible. Yes, they will have to face crazy risks, but only as they can "squeeze the maximum" from their investments.

As an example, it is worth leading at least a recent Listing Alice coins on the Binance Exchange. The cryptocurrency started from the level of 10 cents, but literally in the first seconds of the auction, its cost took off one hundred times against the background of news and Haip and reached a maximum of $ 60. That is, the course rose 600 times within a few minutes - and these are incredible opportunities for earnings in the current conditions, although many of these investments are consistently lose money.

Note that now the value of Alice continues to decline - probably before the new accumulation zone by large investors.

Another important factor - many new investors will come to the markets even without their "blood money", which creates space for experiments. Now the capital for investment is allocated by the state itself, which actively distributes helicopter money - material assistance from the new US President Joe Bayden on the salvation of the American economy. In the coming years, the stock market and cryprotes can even be administered to the state of unprecedented bubbles.

Bubble or not - the main thing is that now someone can make a whole condition in huge risks. It would seem that Bitcoin has grown by 1000 percent over the year, the ceiling is achieved. But this is not the case: judging by the analysts, we are witnessing the beginning of the full phase of the bovine trend of the industry and no one in power to predict its long-term maximum. However, to see the fall of BTC to zero, as it often loves to say critics, we will not definitely.

Therefore, in this case, the existence of two polar opposite positions is possible. Some may not see anything valuable in cryptocurrencies and ignore them, while others will laugh at a 5 percent annual profitability and prefer much greater risks for the possibility of obtaining a major win. And here everyone itself decides, for which direction it is to speak.

Share your opinion on this bill in our cryptocat of millionaires. There will talk about other events that affect the blockchain-assets industry.

Subscribe to our channel in Telegraph to be aware.