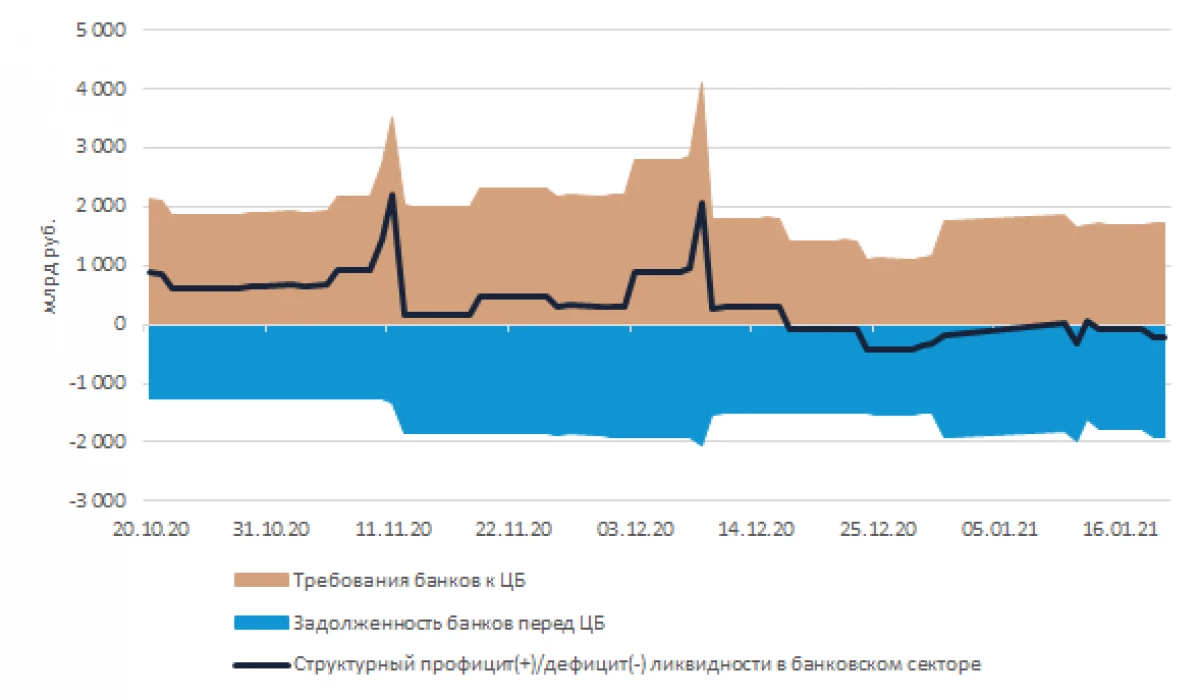

After some reduction in the magnitude of the structural deficit of the liquidity of the banking sector in the first working days of January, in recent days the deficit rate has a slightly slightly increased, making up almost 220 billion rubles for the operational day on Wednesday morning. (Recall that at the end of December the deficit value exceeded 400 billion rubles.). An indicator growth in recent days was due to an increase in bank debt on secured CB loans with a fixed rate.

Source: Bank of Russia; Evaluation: Veles Capital

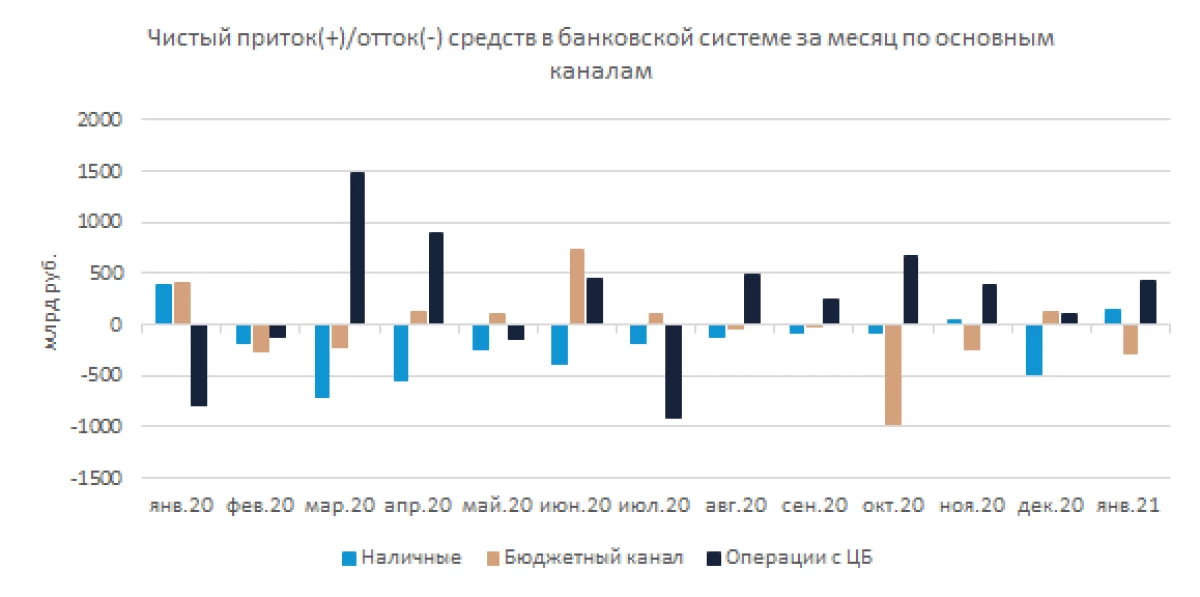

To attract additional funding from the regulator banks were forced to refund the deposits by the Federal Treasury. Thus, since the beginning of January, banks have reduced their debt for operations with the Treasury (on repositors and repo operations) by more than 1 trillion rubles. The essential part of this outflow of funds was compensated for the arrival in the system of budget expenditures, so as a whole, the outflow of liquidity on the budget channel in January looks not so impressive, although it acts as the main cavity channel. In addition to late fulfillment of budget expenditures over the past year, the outflow of liquidity to the return of funds to the Federal Treasury is compensated by refinancing to the Central Bank (mainly through one-month repo) and restoring the inflow of cash in the banking system.

Source: Bank of Russia; Evaluation: Veles Capital

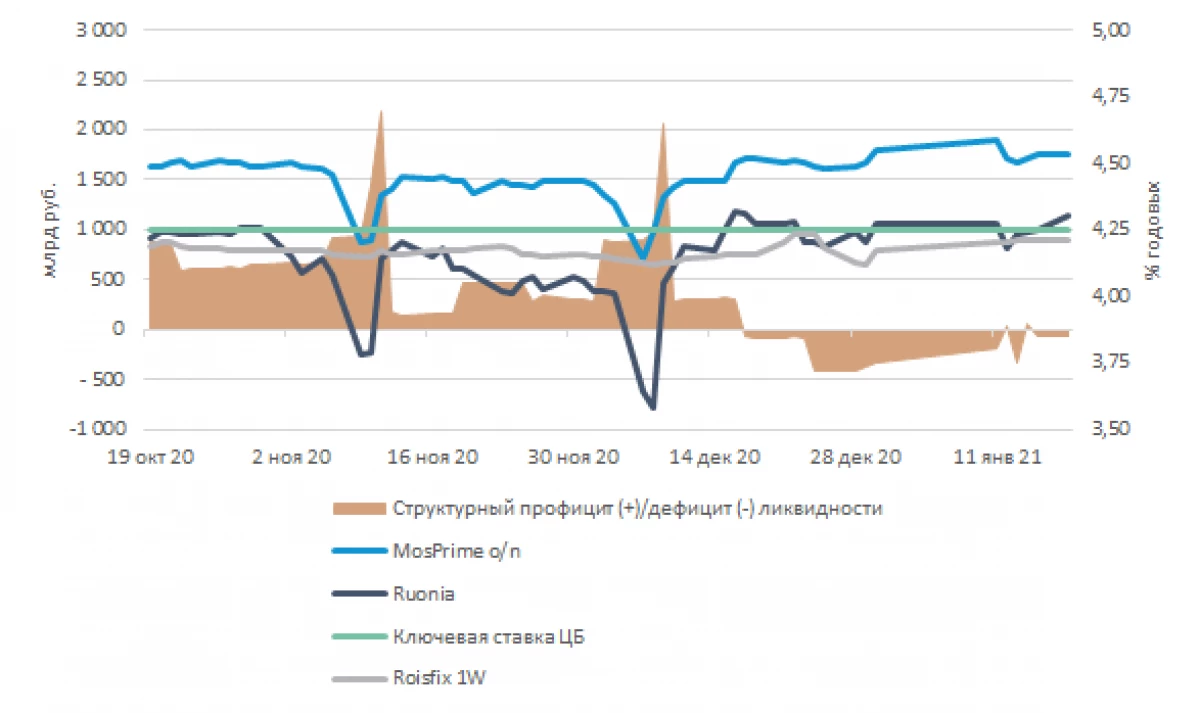

Along with the preservation of the negative liquid position of banks from the Central Bank of the Interbank market rates remain at elevated levels: RUONIA rate in recent days has been gained at the level of the key rate of the Central Bank, and the MOSPRIME O / N rate settled above the level of 4.5% per annum.

The current situation forced the Bank of Russia to significantly reduce the limit on the weekly deposit auction (from 1.1 trillion rubles, placed weeks earlier, up to 400 billion rubles), but taking into account the upcoming large tax payments, it is hardly possible to count on a tangible decline in MBK rates on Monday After returning to the funds from deposits of the Central Bank.

Source: Bank of Russia; Evaluation: Veles Capital

On the eve, the regulator clarified that the forecast of the structural surplus of liquidity at 2021 remains without significant changes - 0.7-1.3 trillion rubles. The gradual restoration of the liquidity surplus in the banking system of the Central Bank binds with the "return" to the banks of cash, which the population and business were isolated throughout almost 2020. However, the regulator does not exclude that this process can be delayed for several years. In addition, it is expected that the Federal Treasury will be able to locally place in the system larger volumes of free budget funds due to the transition this year to a single treasury account.

It should be noted that in general, at the beginning of the year, the budget traditionally takes more liquidity from the system through income, which returns to it through costs, therefore, to improve the situation with the liquid position of banks and the decline in MBC rates can be calculated only in the event of an adequate increase in the amount of funds placed in banking The system of federal treasury in the very near future.

Yuri Kravchenko, Head of the Department for the Analysis of Banks and the money market IC "Veles Capital"

Read Original Articles on: Investing.com