From 2021, we all will again have to face the market, which is afraid of sanctions, as it was in 2018 and 2016, for example. It's time to turn this blurred term more clearly.

Design sanctions

With the arrival of the administration of Baiden sanctions, according to Democrats, should take a systemic nature, that is, the format of a very slow rink. Unlike Trump, who, I am not up with that leg, could not do that, I would call the sanctions by Bayden "bureaucratic", i.e., performed by a predetermined program predictable, but from this no less harmful.

I came to this point of view, comparing the actions of the Democrats with what I listened to the Senate hearings and outlined in 2018-2019.

In general, after reading the fragments of my abstract, you can make sure that the senators support the idea of little to cut off Russia from Western investments and technologies, dissolve the people and the elite, exposing corruption and justifying sanctions.

That is now doing the Navalny, ticking the power, this is what happens with the North Stream-2, and this is what happens if the United States and Europe will apply sanctions to Russia for the chimpery used against Navalny (here, in contrast to SP-2, Europe considers Russia guilty). This is what I expect, when measures are further formalized to limit investment in oil and gas projects in the Russian Federation and the State Dolg.

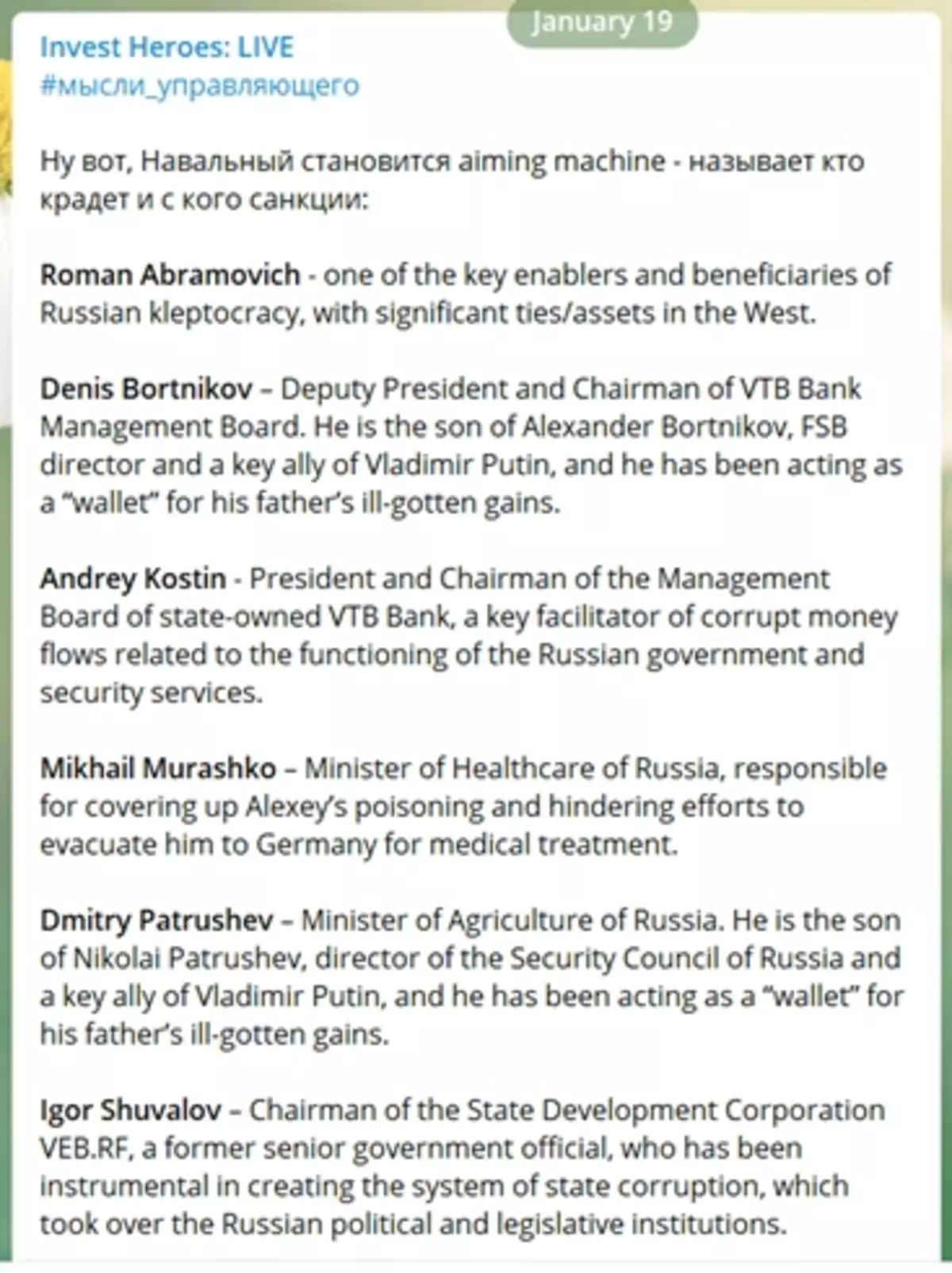

Again, from the naval lists of "Enables" corruption, as well as his film "Palace" - this is, in fact, the way to legalize the materials of Western special services / visualization of the US intelligence report on the wealth of Putin, requested by the US Senate.

From here I come to the conclusion that the activities of the United States on sanctions - such:

- Enter sanctions to the oligarchs entering the elite around the President of Russia / justify it through Navalny.

- Limit investments and technologies in oil / Thereby reduce the financial resources of Russia for action on the foreign policy arena.

Estimation of centuries All countries compete for land and resources, sales markets. And therefore, I believe that sanctions are a tool in this struggle, and their ultimate goal is to apply the resource of Russia, under no matter what kind of sauce it happened. And with China there is the same confrontation.

- To make Europe supported the United States in sanctions by chemical mud, swing it further, because The ban is legally fixed at the international level.

Character and exposure time

To move on, the administration of the Biden must:- Approve the system approach, goals and funds.

- Legalize through Navalny, who is to blame.

- To establish relationships with Europe, disclaimed by Trump, which Dmitry Medvedev wrote well (an article about the political split in the United States, which creates instability outside the United States).

- Enter the limitations = sanctions on some oligarchs, participants in energy projects in the Russian Federation, organizations in the Crimea may limit investments in the new OFZ of the Russian Federation (giving the opportunity to sell old one), restrictions on attracting money in debt to business.

It is logical that only the design preparation will take a couple of months, and not everything will shoot at once. Impact is designed for years, but individual shares may suffer.

An interesting role in this in China - I think this country will not support them and will remain a source of investment in the Russian Federation, although it will be a pragmatic cooperation. China already supports Iran.

Assets subject to dangers and how serious

Based on the design, which I consider it possible, I consider the following tools with probable victims:

- Gazprom Neft (MCX: SIBN) and Rosneft (MCX: ROSN), NOVATEKA (MCX: NVTK), Gazprom (MCX: GAZP) can go partners from new field development projects - Europeans and Hindus. (Expert) In my opinion, it threatens with these companies a loss of 5-20% of capitalization.

- Mail.ru Group (MCX: MailDR)) is toxic (MCX: Maildr)), since it is already in the Navalny list. This means right up to the exit of Western investors, as it was with RUSAL (MCX: RUAL), until Deripaska reduced the company's share below control.

- Abramovich has investments in Evraz (LON: EVRE) and Norilskel (MCX: GMKN), but in Norinkiel, a share of about 3-4% through the CRISPIAN offshore, so Abramovich is not a controlling shareholder, and the sanctions to the person is unlikely to turn to the company ( MMK Nickel).

- Reducing investment in the Russian Federation = decline in demand for the ruble, and, as a result, even on the strong oil, the dollar is not 65-68 rubles, as they draw some banks, and 72-76p (and benefit exporters!) In 2P 2021.

- Over time, Russia can take mirror measures and limit the amount of investments of Russians in the United States - the Central Bank already, most likely, it is concerned that the money of private investors is drown in Amazon shares (NASDAQ: AMZN), forming additional. Demand on usd.

Conclusions for practical investment

The market is now very fast, and it is likely that so far the sanction cannon will be charged, oil by April will be $ 60 +, and stocks in the Russian Federation will give + 20% and selling everything, you can miss decent money on the portfolio.

In this regard, I saw for myself several reaction strategies and risk management:

- Instead of oil and gas shares, I bought just oil futures. They are not under sanctions, and if (well, what if) will limit our deliveries to the world market, then oil will take off.

- I put on stocks not only in raw materials, but also on dividend stories, including MTS (MCX: MTSS), transneft (MCX: TRNF_P), Unipro (MCX: UPRO). Their growth to Divseason can be 10-15%, i.e. 20-30% per annum.

- At first cut the attachments, but then I decided to restore Norilskiel. I consider the factor of Abramovich not so significant, but the game of copper growth is important, and the div is 10% is also strong for such Mahina. In addition, the experience of Rusal showed that it was impossible to impose sanctions on the player with 10% and the more global production of some raw material.

- I defined that I will keep the oil and gas within the framework of the fundamental Apsuit, but on all the securities of Gazprom, Novatek, Rosneft, Tatneft (MCX: Tatn), LUKOIL (MCX: LKOH), Gazprom Neft lowered Max Size of attachments up to 5-7% of the portfolio The standard 10% / weight of the sector limited 20-25% (although without sanctions would put 40-45% on it).

I do not know what will happen before - sanctions or shares will grow up, and I will sell them with good profit. So the volume of the position is an effective way to control the risk of a portfolio.

- I checked that in the case of the devaluation of the ruble, I have at least 40% of this wins in revenue.

In general, politics is a kind of clean water of uncertainty in the market, and you need to be able to manage it / her. Share your approaches and considerations in the comments.

Good luck in the markets!

Read Original Articles on: Investing.com