MAFF, together with Monolithos, continues the publication of weekly digests with a review of the main news of Defi over the past week. We tell about the earnings strategy using Frax Finance and about the new EUR pool in the CURVE project.

In this release of digest, we consider events from January 11 to January 17, 2021.

DEFI volumes per week

The growth of the total assets (TVL) of the Defi market has become one of the main news of the past week. This indicator beats new records - at the end of the week it amounted to $ 23.85 billion, which is $ 1.85 billion more than last week.

Note that TVL grows very quickly: only a week ago, this indicator reached record values, and after just 4 days - last Thursday - I installed a new record. It is now obvious that the value of $ 25 billion is achievable. Perhaps we will come to this indicator by the end of January. And according to the result of 2021, TVL may well move the mark of $ 50 billion.

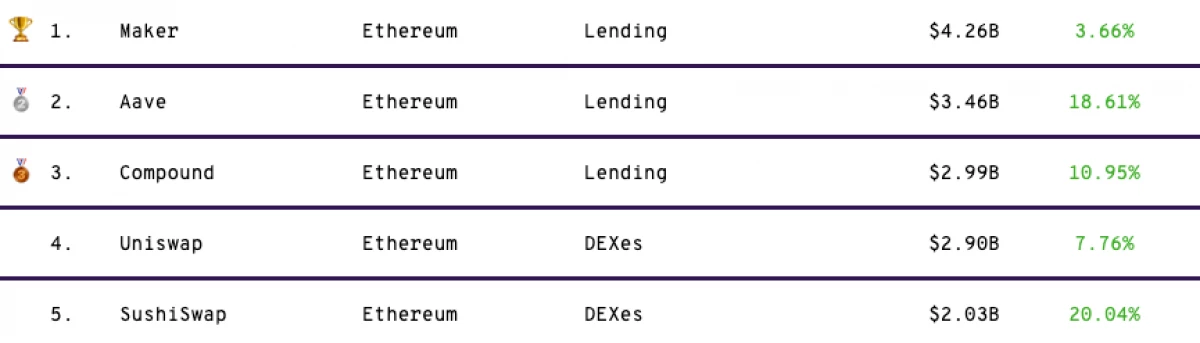

As for the main projects of DEFI this week - there are no changes in the leader position. The first place holds Maker - the first DEFI protocol, overcoming the border of $ 4 billion TVL. It follows AAVE and compound, close to $ 3 billion approached the top five uniswap and sushiswap.

Main News per week

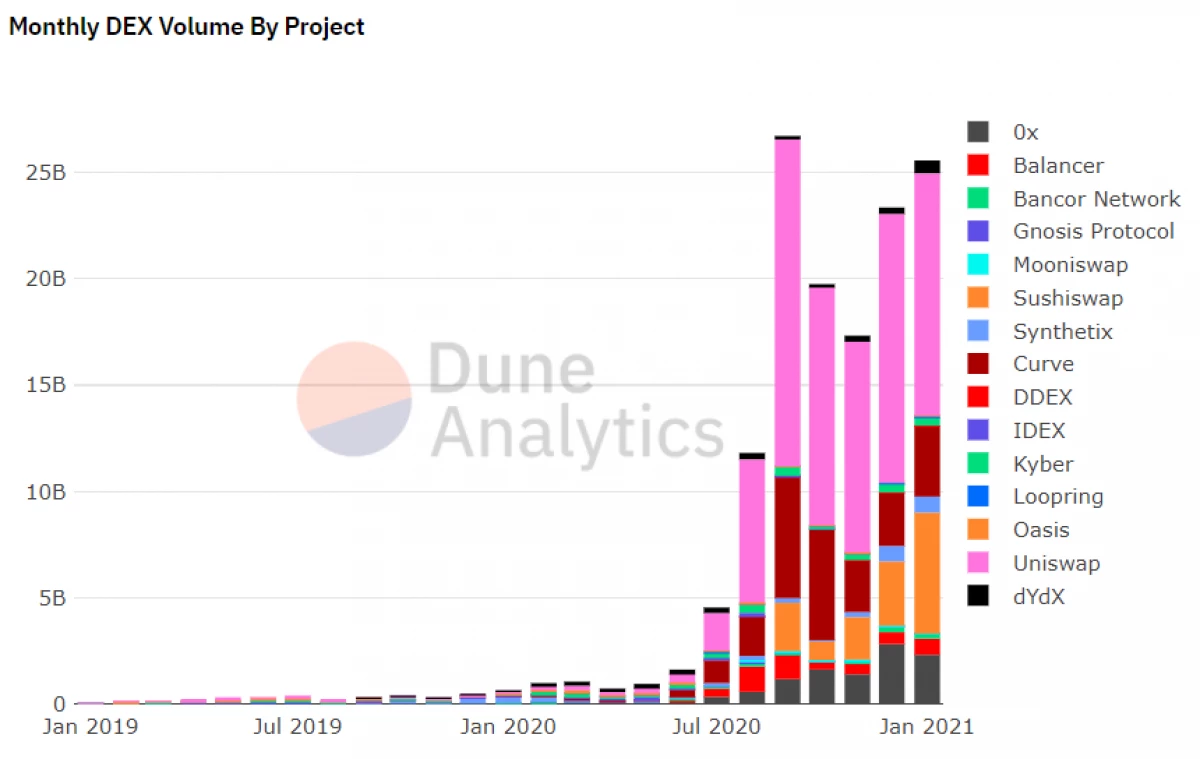

The main news of the past week was information about a sharp increase in trading volumes to DEX. It should be noted that the previous record for the monthly DEX volume was established in September 2020 and amounted to $ 15.36 billion. Now the trading volume on DEX reached $ 11.8 billion, but it reached such values in just the first two weeks of January 2021. If the current demand for DEFI continues, in the near future this indicator can grow to $ 20 billion per month.

Top Defi-Tokenes per week

Defi Pulse Index (DPI) has grown by 29.83% and is $ 229.8. The list of the most profitable projects of the week has been updated:- Perp + 80%;

- CRV + 70%;

- SUSHI + 68%;

- AAVE + 79%;

- Ren + 50%.

Stories of the week

- Soft start on MainNet. The Optimism command discloses the plans of the gradual soft launch on MainNet, among which to remove the "safety wheels" with the scaling solutions L2 - of course, only when the feasibility of this step will be proven in practice.

- Optimistic script. The synthetic project of Synthetix asset describes the transition scenario to the L2 Optimism solution.

- Introducing Iron Bank. The CREAM project revealed information about the Iron Bank system, which is part of Cream V2. It will function as support for liquidity and lending in Protocol-to-Protocol format in the field of DEFI.

- Creation in DEFI is not easy (part 2). The creator of Yearn, Andre Kronye, published a new essay. In it, he expressed his main annotations associated with the construction of modern DEFI ecosystems.

- Yam Finance: Results 2020 and plans for 2021. The Yam Finance project allocated the main achievements last year, and also identified the development plans for the next 12 months.

- Restarting Warp Finance. The LP (liquidity providers) pharmine project (liquidity providers)) Warp Finance is restarted, this time strengthened security measures - last month the platform has lost damages due to attack using instant loans.

Farming from 100% to 250% APY via Frax Finance Staking

The popularity of stelkins with the provision, such as DAI, grew throughout 2020, which we can now boldly name the year of the first boom of Defi. However, since last summer, another model of Stelkinov was published on the fore, the algorithmic projects of stelkopins.

Such projects were inspired by the basis system of Basis stelkins. They contributed to the development of DEFI and attracted the attention of traders around the world.

Both models of stelkopinov - algorithmic and tokens with the provision - have their advantages and cons. And the combination of the advantages of both types gives users a unique advantage. This is exactly what the creators of Frax Finance - the new hybrid protocol of Stelkin, which combines the elements of both secured and algorithmic systems in itself.

Frax is a Frax Finance Steel. When Frax is trading above 1 dollars, the protocol support ratio is reduced, its algorithmic mechanisms become more explicit. Conversely - the provision coefficient increases when Frax is trading below 1 dollars.

In order for this system to work, Frax Finance attracts liquidity providers and launches a liquidity increase program based on its FXS control token.

The goal is to stimulate newcomers to support the project, distributing FXS as a remuneration on the key pool of Uniswap Frax liquidity:

- FRAX / FXS (243% APY);

- Frax / Weth (221% APY);

- Frax / USDC (108% APY).

You can access these pools through Uniswap.

Users earn from ~ 325% to ~ 725% by blocking LP tokens on the FRAX STAKING control panel. Conventional APY is earned by simple placement of unlocked LP token, which can be output at any time.

To take this strategy of earnings, follow these steps:

- Go to the Frax Finance Control Panel.

- Select the desired pair from the drop-down menu and click "Add Liquidity".

- You will take on Uniswap, enter the assets you have selected.

- Return to the control panel and click the Stake button.

- Select the deposit conditions and confirm the deposit.

Frax is notable for the fact that this is the first project of this kind. But it also means that it bears more risks than existing protocols. Therefore, always conduct your own research project before investing in it.

Get up to 140% per annum with the new EUR Pill of the CURVE project

Now the DEFI dominates dollar winds. It is not surprising, since the dollar is a global reserve currency.

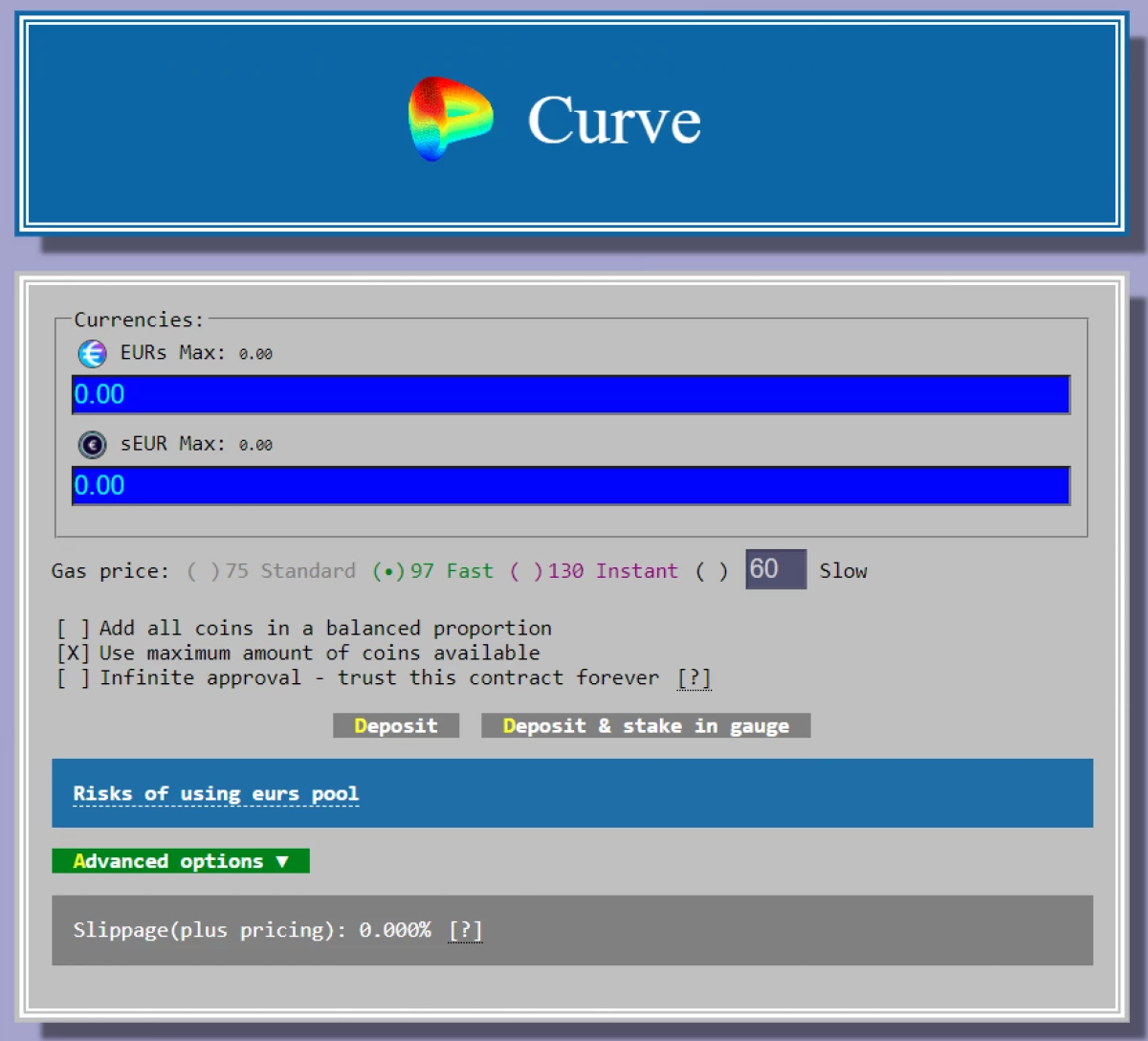

But there are other currencies in the world, which can also be tokenize on Ethereum. Let's look at EUR. Europe is increasingly becoming the center of DEFI and European traders require products related to EUR. Curve has just launched the EUR pool based on the Seur Synthetix token and the EURS Stasis token.

SEUR / EURS pair gives the user the opportunity to make money on commissions, SNX remuneration and CRV remuneration. Providing liquidity to this Pula will bring you from 50% to 124% APY.

How to put liquidity in this pool:

- Go to the Curve page to work with the euro, connect your wallet and select the SEUR and EURS amount you want to make.

- Click "Deposit & Stake In Gauge" to receive CRV Remuneration.

- Confirm the deposit.

Always spend an independent research project before investing in it.

Note: The material is the adaptation of the Defi Pulse Farmer No. 24 of the authorship of A. Provatidis and William M. Pister.