Is it worth buying FXCN - the most popular question of our customers. FXCN is an index foundation, that is, the bet on the wide Chinese market - therefore the answer is not so simple.

In today's article we will analyze:

- Why China overtakes other economies;

- Why yuan continues to strengthen the dollar;

- Why Chinese companies are undervalued;

- Why FXCN is attractive to shopping.

China - ahead of the rest

Since the opening for foreign trade and investment and the reforms of the free market in 1979, China has become one of the fastest growing economies of the world, while the real annual growth of gross domestic product (GDP) on average was 9.5% to 2018. The World Bank called China Country with "the fastest steady growth among large economies in history."

Such an increase allowed China on average to double his GDP every eight years and helped bring about 800 million people from poverty. China has become the world's largest economy (based on purchasing power parity), manufacturer, merchant goods and monetary reserves holder.

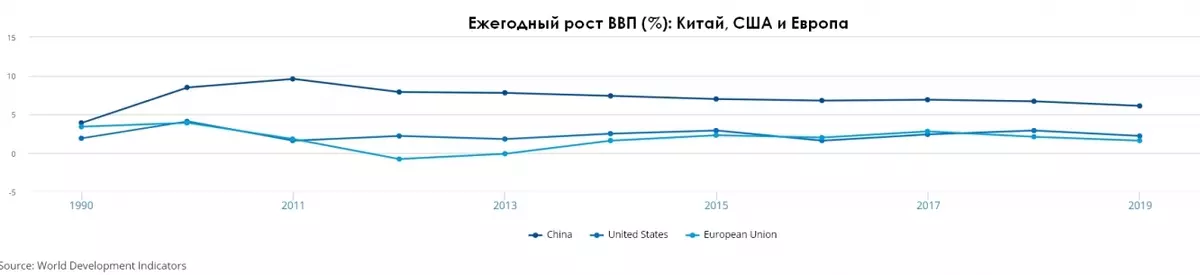

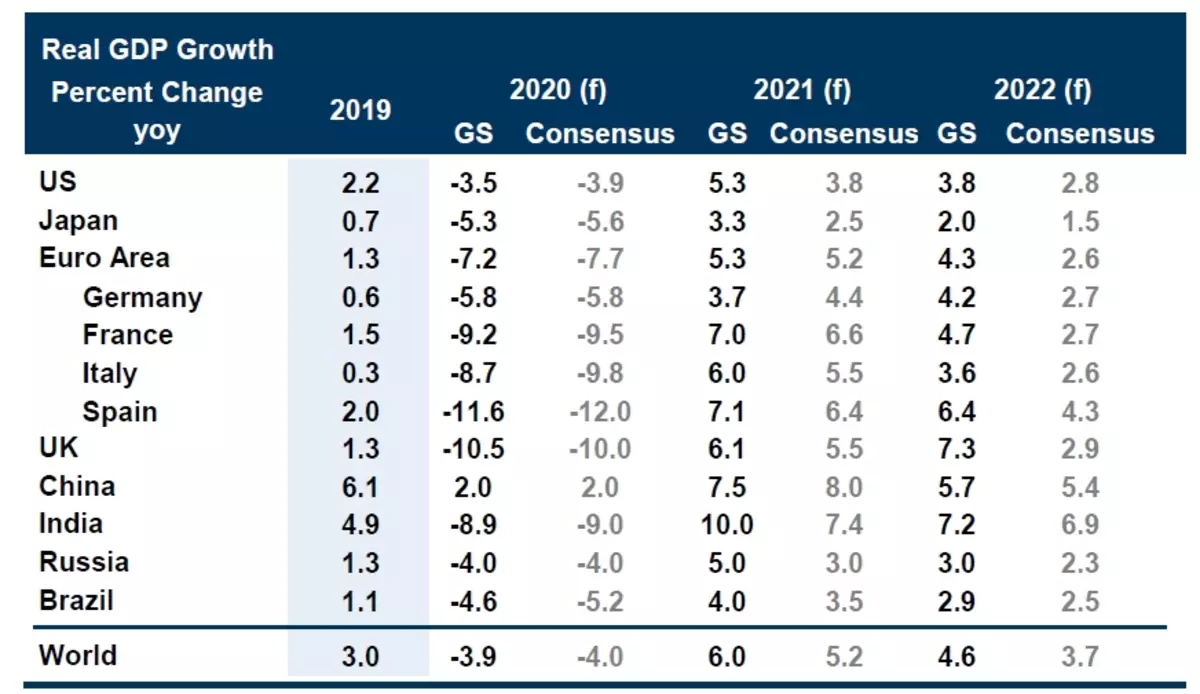

If you look at the data, China still grows 3 times faster than the United States and Europe:

We see that, despite the advance of Europe and the United States, from year to year the growth of the Ritai economy slows down. This effect is called a "medium income trap." If the country uses one growth driver for many years, then sooner or later this driver is out of itself, and the peak of an economic level is achieved.

Until 2015, this driver was the factory model. China offered a lot of cheap labor on the market and opened opportunities for investment. As a result, in China, many large companies opened their production - Apple (NASDAQ: AAPL), General Motors (NYSE: GM), General Electric (NYSE: GE), P & G (NYSE: PG), Coca-Cola (NYSE: KO).

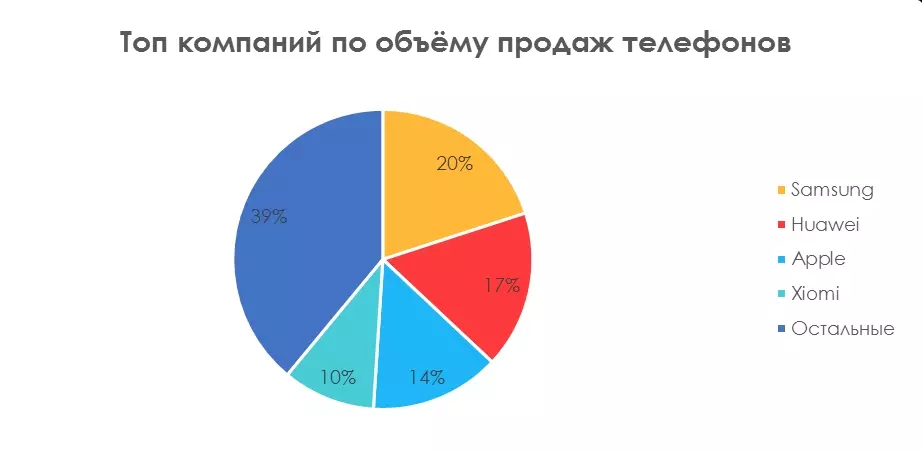

Such a policy allowed China to attract high-tech companies and gain access to their innovation. It is no secret that large brands of substitutes of familiar products appeared in China. This is excellent on the example of smartphone manufacturers. Two of the four largest companies are Chinese. And Huawei even overtakes Apple by market volume:

At the same time, such a model of the global producer of goods is already outlined by itself, so in 2015 the Chinese authorities adopted a directive with an emphasis on innovation - "Made in China-2025".

This program implies switching from the production of foreign goods to its own production through innovation. China has determined 10 sectors that will allow the country to take a solid position in the "fourth industrial revolution". 5 of them now belong to the fastest growing sectors:

1. Artificial Intellect

2. Internet things

3. Robotization

4. Machine learning

5. Green energy, including electrocars.

China and COVID-19

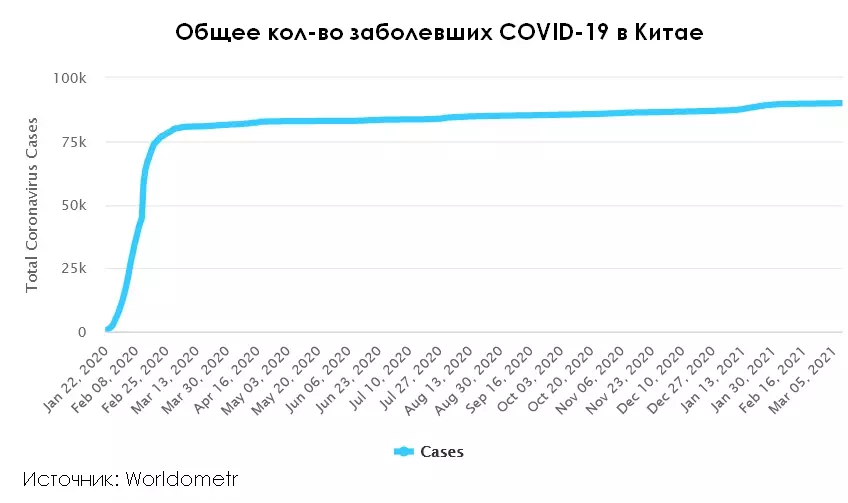

At the beginning of 2020, COVID-19 and its economic consequences were mainly considered as problems affecting only China. Now China has become one of the few countries that have successfully designed the spread of the virus, and the only economy that showed GDP growth by the end of 2020. The number of diseased coronavirus in China almost does not grow:

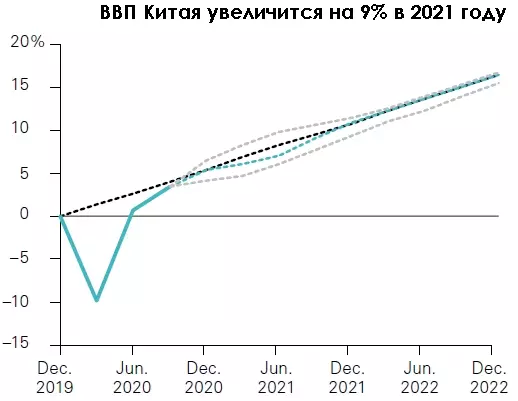

Vanguard in the basic scenario expects China's GDP growth in 2021 at the level of 9%:

With this opinion is agreed and Goldman Sachs. GS predicts the real growth of China's economy just below the consensus at 7.5%, but also in its version of China - the fastest growing economy:

For comparison, in the recent survey of Fed, professional analysts are waiting for the US GDP growth at 4.5% in 2021, and the Fed itself is at 6%, which is still much lower than the projected GDP growth of China.

Total: China's economy is the most promising in the coming years.

China controls the bubble on the stock market

The head of the Central Bank said that China will pay priority attention to monetary policy stability in 2021, and any steps to terminate stimulating measures will have a slight impact on the economy.

The People's Bank of China withdrew 78 billion yuan (12 billion dollars) of pure liquidity through its open market operations - the process by which the central bank and the banking system provide each other loans.

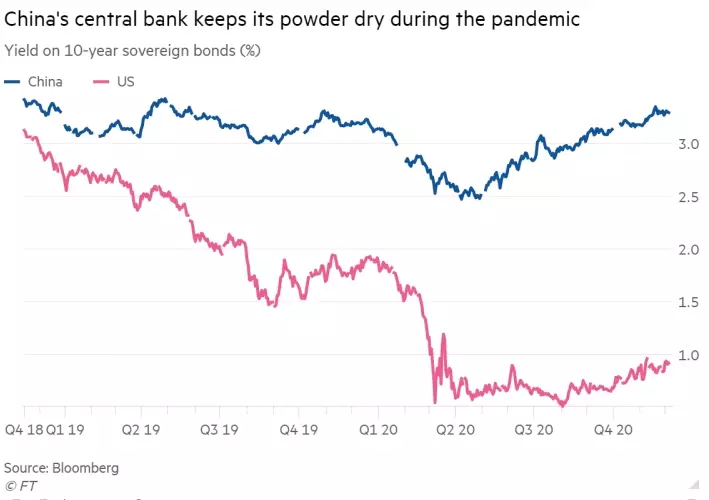

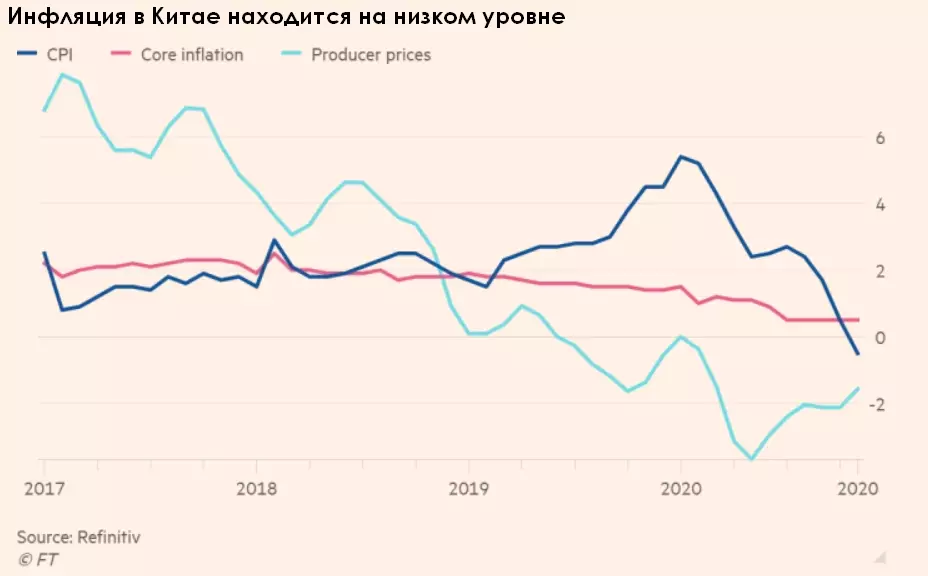

The Central Bank of China is trying to restrain the unfounded growth of the market. The reference Chinese CSI 300 index achieved the highest marks since the 2008 global financial crisis. This happened because of the strong influx of investors' money seekers from the consequences of coronavirus. In total, from March 2020, according to Financial Times, $ 150 billion flushed to China, a sharp influx is caused not only by strong economic conditions, but also by the Central Bank of Central Bank, which maintained inflation at a low level. As a result, money came not only in stocks, but also bonds:

Thanks to this, the Chinese index has grown by 10% since the beginning of the year, but after targeting liquidity decreased from the maxima by more than 15%. At the same time, the NASDAQ 100 index decreased by 7% from the maximum level due to the increase in the yield of 10-year bonds:

However, it is important to understand that the decline in the Chinese index is associated with the targeted activity of the Chinese regulator. The Central Bank simply returns to the "normal" financial conditions after their weakening in 2020 due to COVID-19. That is, this is a one-time expected decline due to the "normalization" of the rules of the game. Further the growth of the market will go after the restoration of China's economy.

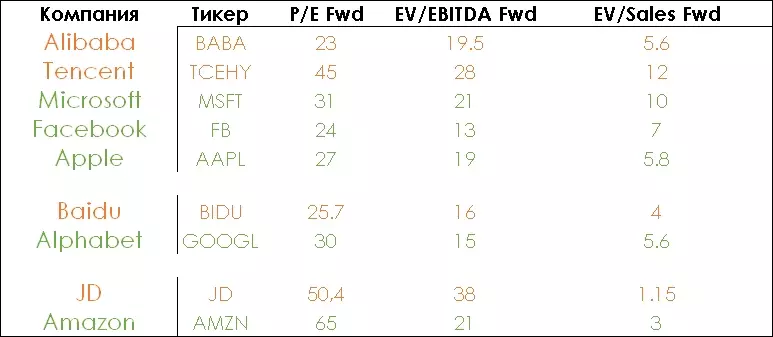

As a result, we are now getting a good entry point in Chinese companies, as they are cheaper analogs in the USA:

The only one who knocks out is Tencent.

Total: Chinese blue chips are cheaper than American analogs.

Yuan will strengthen the dollar

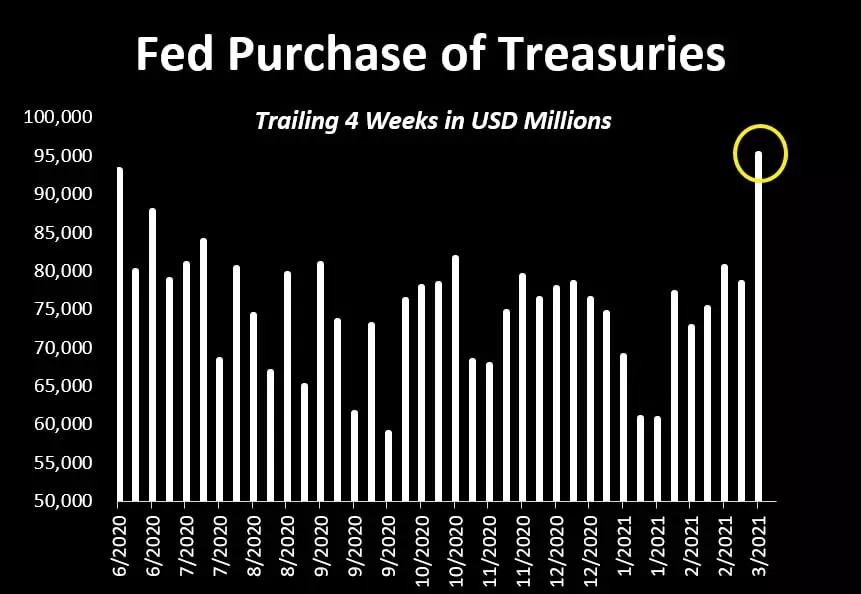

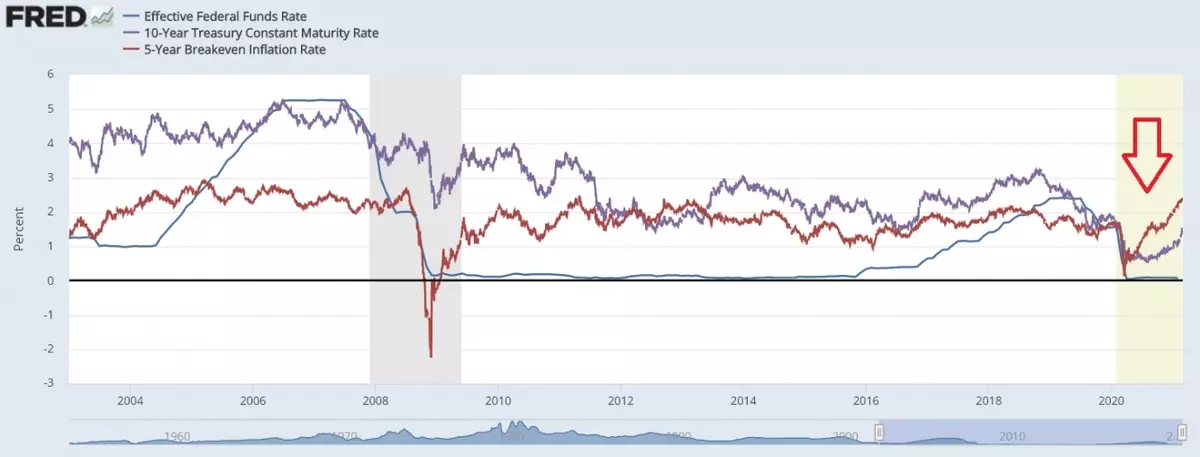

The Fed of the United States continues to conduct a soft monetary policy and is trying to keep the increase in the profitability of 10-year US bonds:

If briefly, then in the financial theory of 10-year US bonds are a risk-free asset and the base for calculating the required profitability of other assets, including shares. Shares are a more risky asset than bonds, therefore, if the yield of bonds is growing, it should also grow and the required yield for shares. The "profitability" for stock is determined by the E / P indicator, since E denotes a profit for the last 12 months, only P can change the value of the action. The growth of the required yield E / P is equivalent to a decrease in the P / E indicator - that is, the reassessment of shares down.

As a result, the Fed is trying to avoid a sharp fall in the stock market, printing money and buying bonds. It is important to understand that the expected high inflation is associated with uncontrolled printing of money and the distribution of their population. At the same time, the yield and yield of 10-year bonds is growing due to the growth of inflation:

In China, such a problem is not observed. China, on the contrary, reduces liquidity on the market, and inflation stagnates:

High inflation in the USA in aggregate with mass printing of money and stagflation in China will come to strengthen the yuan to the dollar. As a result, the cost of these companies will also grow in dollar equivalent, which is attractive for investors.

Total: Yuan will continue to strengthen the dollar.

Who is included in FXCN?

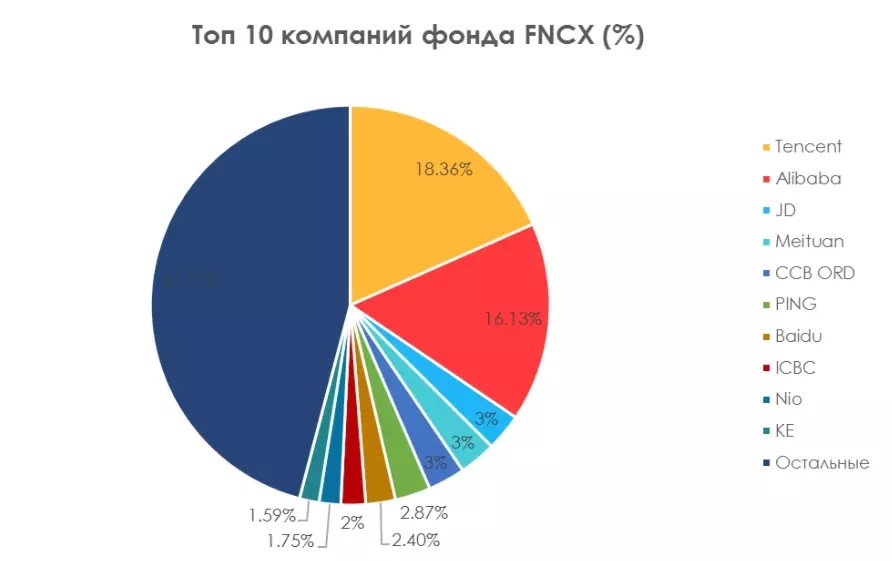

Finex MSCI CHINA UCITS ETF USD Share Class (MCX: FXCN) is a Fund from the Russian Finex provider to Chinese companies. In total, the fund of 210 companies, and the main weight is occupied by three sectors: goods of everyday demand, telecom and finance. The Foundation Commission is 0.9% per annum.

There are 2 companies in the Fund, total aggregating 34% of the index - Tencent and Alibaba:

Tencent

(OTC: TCEHY) is one of the world's largest IT companies. Tencent manages a large number of different services: mobile games, messengers, music, web portals, e-commerce shops. In the world, Tencent is known at the expense of Wechat - the largest Chinese messenger and Riot Games - a subsidiary who created League of Legends. Shares are available on the SPb Stock Exchange only by qualified investors.

Alibaba.

(NYSE: BABA) -

Also one of the largest technological companies in the world. Alibaba is engaged in e-commerce (Taobao, Aliexpress), cloud computing (AliBaba Cloud Computing) provides financial services (Alipay) and owns many Internet services and film companies.

Alibaba and Tencent are two major Chinese players. They are actively involved in the absorption of small players and thereby increasing their portfolio of strategic investment. All other companies in China do not have such strength, so these two players are key bets on China.

Jd.com.

(NASDAQ: JD) is one of the largest trade of companies from the e-commerce sector.

Meituan.

-Dianping.

—

The company formed by MEITUAN (OTC: MPNGF) (Delivery of goods from the Internet) and Dianping (Restaurants and other services aggregator). The company trades only in the Hong Kong Stock Exchange.

China Construction Bank.

(OTC: Cichy) - one of the largest banks in China and the world, since 2015 included in the list of global systemically significant banks. Available only by qualified investors.

Ping An Insurance

(OTC: PNGay) is the largest insurance group in the world. In addition to insurance, the Holding is engaged in the management of asset and banking services. Available only by qualified investors.

Baidu.

(NASDAQ: BIDU) - IT company who owns the largest search engine in China, in the global search Baidu ranks 4th. 98% of the company's revenue falls on China.

Icbc.

(HK: 1398) - China's largest commercial bank, is included in the top 4 of China's largest banks. The action is traded at Shanghai and Hong Kong stock exchanges.

NiO.

(NYSE: NIO) - Chinese manufacturer of electrocars. Also NiO is engaged in servicing their own cars and sells electronic recharging stations for electric vehicles. Available only by qualified investors.

Ke Holdings.

(NYSE: BEKE) - Online and Offline Platform Service Services for the Real Estate Market. Shares are available on New York Stock Exchange.

As a result, the Russian investor who does not have qualifications can only buy 3 shares from Top-10: Alibaba, JD and Baidu. There is no Tencent in this list - one of the main players of the Chinese market, also three players do not give proper diversification.

FXCN is the best way to make money on China

As a result, we have three macroprishes to put on Chinese companies:

1. The fastest growing economy in 2021.

2. Strengthening yuan to the dollar.

3. The underestimation towards similar companies in the United States.

But there are also several microprishes in favor of FXCN:

1. Most Chinese companies are not available to unqualified investors.

2. The fund gives diversification to 210 companies.

FXCN is a convenient tool for most Russian investors, as, on the one hand, allows the investor to make a bet on China through a diversified portfolio, on the other hand, allows you to invest in rubles, which protects it from the weakening of the ruble to the dollar.

The article is written in collaboration with analyst Dmitry Newbikov

Read Original Articles on: Investing.com