The assets management company Vaneck submitted to the US Securities and Exchange Commission (SEC) Application for the creation of "ETF digital assets". In such a course, Vaneck opens up the possibility of institutional investors - that is, large organizations - gain access to shares of companies that form most of their capital from cryptocurrency activities. These include paypal. According to a recent report of the analyst of the financial firm Btig, the Palmer Mark, the company's shares are becoming increasingly attractive for purchase because of its active participation in the life of the cryptocurrency market.

To begin with, we recall that Vaneck regularly submits an application to the US Securities and Exchange Commission. The last time this happened in early January, when representatives of the organization reaffirmed their desire to launch ETF on Bitcoin. This did not happen from September 2019, that is, the leadership clearly relies on the change of power in the United States and in particular the change in the commission's leadership.

Thanks to ETF, traders in the stock market will be able to earn money on changes in bitcoin courses and other cryptocurrency. Prior to that, all applications of the company were blocked, because coins are considered too volatile - that is, with sharp changes in courses. Well, it creates conditions for the loss of investors.

Now the situation has really changed. Yet the former chairman of SEC Jay Clayton left the organization, namely he actively opposed the launch of Bitcoin-ETF. In this regard, representatives of the company are becoming more active.

When the cryptocurrency ETF is launched

The new ETF will track the effectiveness of the so-called MVIS® Global Digital Assets Equity Index index, which displays the development of the digital assets industry. This includes companies that manage cryptocurrency exchanges, payment gateways and the mining centers. The firms owning large stocks of cryptocurrencies also correspond to their number, reports Decrypt.

That is, this tool will allow to invest in companies that are associated with cryptocoluts, but not to invest in the coins themselves. Such suitable for more conservative investors and, for example, various funds that can begged part of their customers thanks to direct investment in cryptocurrency.

To get to the index, companies should receive more than 50 percent of their income from cryptocurrency projects. Recall at least several organizations in cryptocurrency space are considering the possibility of entering the stock exchange - that is, conducting an IPO - including Coinbase and Bakkt. It is possible that the Foundation may include their promotions in futures if the IPO will be held successfully.

The list of companies that will affect the new ETF can also join the PayPal payment platform, which conducted the integration of Bitcoin and several other cryptocurrency in their services in the fall last year. According to the analyst of the financial company Btig, the Palmer Mark, the active involvement of PayPal in the cryptomyr makes the company's shares of a tempting investment. It raised the attractiveness of PayPal's securities with neutral until the recommendation for the purchase by setting the target price for shares in the 300 dollars area.

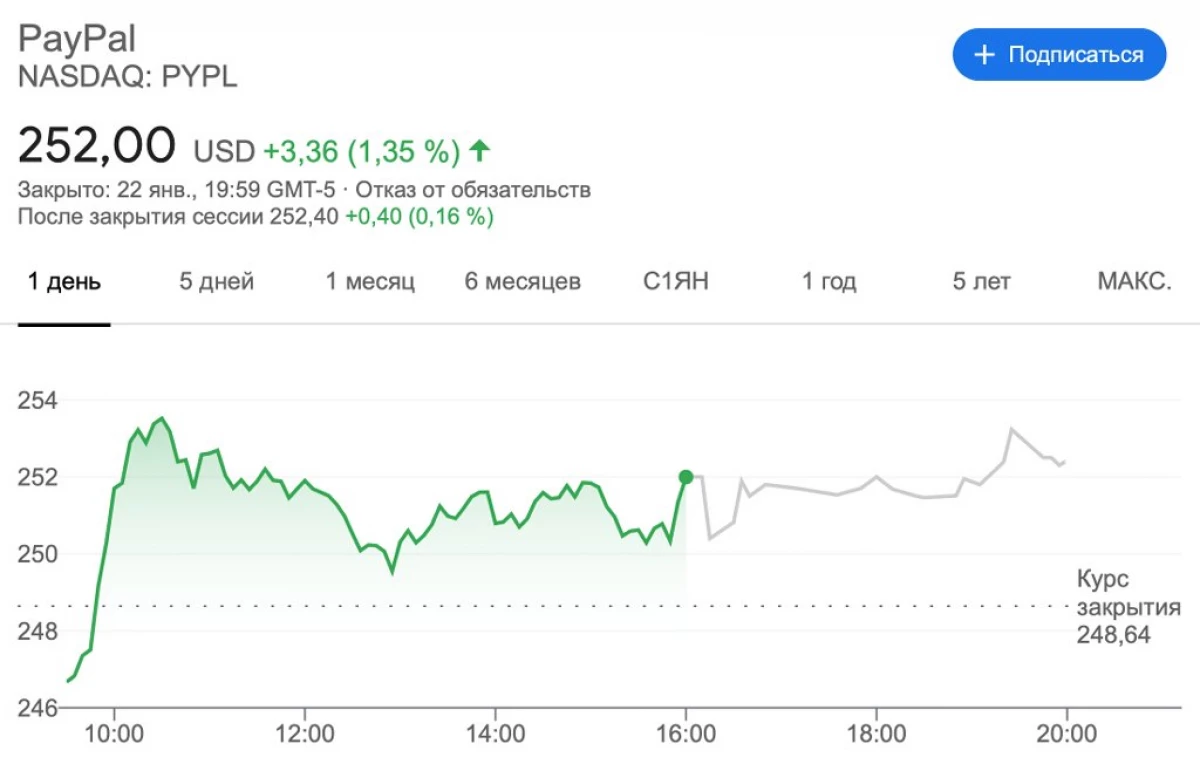

At the time of writing, PayPal is traded at 252 dollars.

In appeal to investors, at the beginning of this week, Palmer stated that strong support for PayPal their cryptocurrency initiatives could lead to an increase in the annual revenue of the Fintech-company more than a billion dollars by 2022. So as we see, the cryptomic has already ceased to be a "sandbox" for investments of individual investors of amateurs. Now large companies and organizations have been engaged in its development. With their involvement, you can safely make a bet on further improvement of Bitcoin's position and the growth of its popularity among investors.

We believe that Vaneck should succeed in this initiative. The company has long submitted an application for the launch of ETF and previously faced only with failures. Now the US leadership has changed, therefore, on this niche can look at a completely different angle. In addition, in 2020, many companies have contacted Bitcoin and invested hundreds of millions of dollars in cryptocolut - and this is well affected by BTC reputation.

What do you think about this? Share your opinion in our cryptocat of millionaires. Also be sure to look into Yandex Zen, where it will be possible to find even more interesting materials.

Subscribe to our channel in Telegraph. And do not keep cryptocurrencies on stock exchanges!