EUR / USD: Parallels with a mid 2020 are appropriate.

Three in the boat. Not counting the dog. When the world's leading economies in the face of the United States, China and Eurozone are on one side of the barricades, it is difficult to expect that the acceleration of growth in one of them will lead to a significant strengthening of the national currency. Especially when this currency is the main asylum, then you mean extremely sensitive to changing global appetite for risk. The proximity of the adoption by the Congress of the new package of fiscal incentives in the States, a decrease in political risks in Europe and the passage of COVID-19 seasonal peak pushing the quotes EUR / USD.

The United States is the largest net importer in the world. The new package of help from Joe Bayden will raise domestic demand and at the same time will help the economies and stock markets of exporting countries. For example, so pronounced as the eurozone. If you have growth drivers in the States and China, which in 2021 will succeed, it will extend the hand to help everyone. In this regard, the approval of $ 1.9 trillion fiscal incentive by the Senate and consideration of the bill of the Chamber of Representatives - powerful growth catalysts not only for S & P 500, but also for euros. Yes, according to Goldman Sachs, the final amount of assistance will be $ 1.5 trillion, but this amount is so great that it is capable of overclocking American GDP to 11% in the second quarter, and up to 6.8% in 2021.

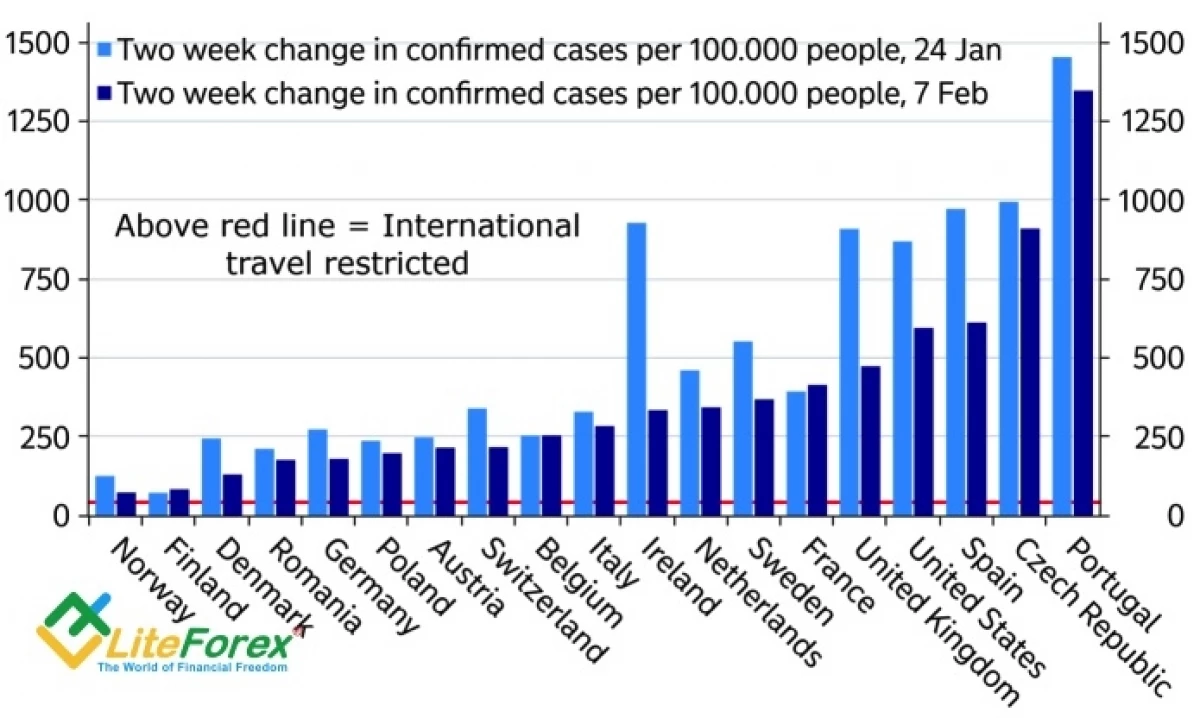

Support for "bulls" on EUR / USD provides news about the opening of the economies of the Old World. Iceland became the first swallow. For her, for sure, Denmark will follow, Belgium and other countries where the number of infected decreases and is distinguished from its extreme values.

COVID-19 infection dynamics in Europe and USA

Source: Nordea Markets

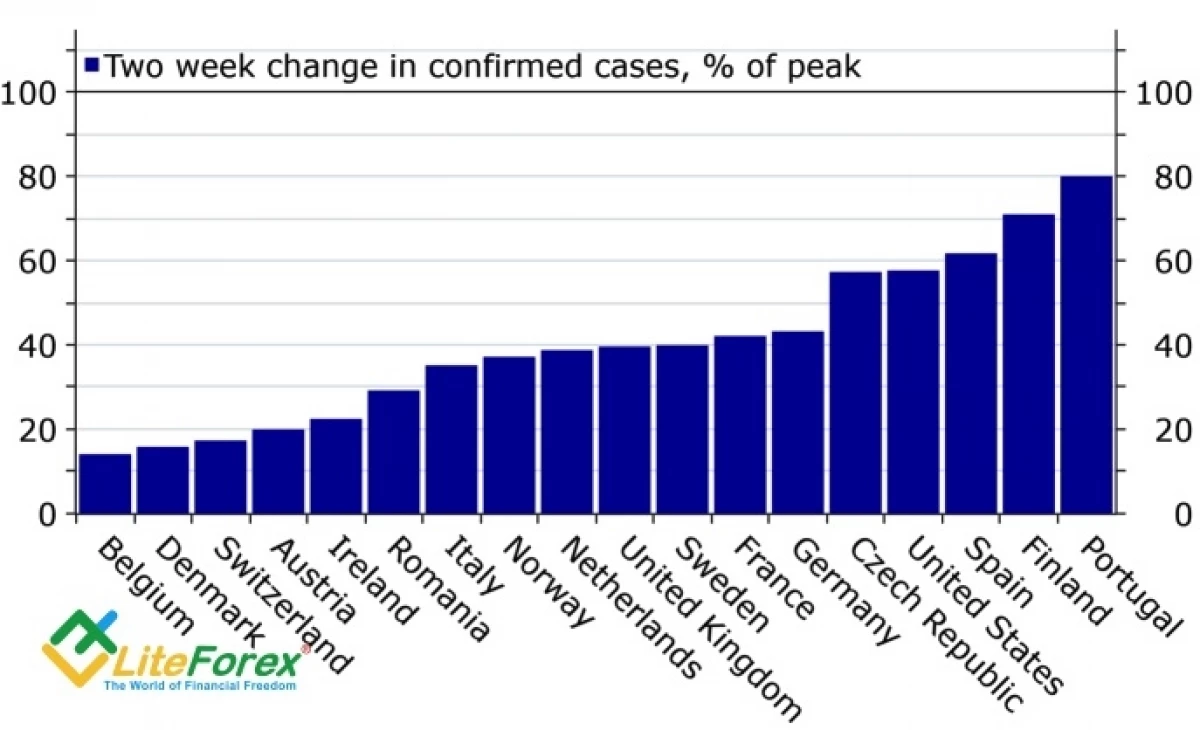

Share of current infections,% of peak

Source: Nordea Markets

His contribution to the strengthening of the euro makes a decrease in political risks. Mario Dragi said that he would make a general budget of the eurozone priority of the Politics of Italy. This idea arose in France in the height of the debt crisis of the foreign exchange unit in 2012. Her supporters argued that the total budget is necessary to stabilize the economy during recession. It is also considered as the key missing element in the architecture of the euro. Super Mario called for a general budget while the head of the ECB. Now he does it as a political leader of Italy.

Thus, the current placement of forces in the EUR / USD pair begins to resemble the events of the mid-2020. Then the opening of the economies after Lokdaunov, the rapid growth of world stock indices and global risk appetite, as well as the Unity of the EU, which created the European Salvation Fund, laid a solid foundation under the ascending trend. According to the main currency pair. Today the economy of old world is also ready for the discovery, S & P 500 is growing as on yeast due to strong corporate reporting and hopes for incentives, and Rome calls for a general budget.

Bulls on EUR / USD are ready to storm resistance at 1.208, which previously fulfilled the function of basic support. Success in this event will strengthen the risks of the continuation of the rally in the direction 1,2125, 1.215, 1.221 and 1.225. Personally, I would prefer the first test to be failed, which will give confidence in the future breakthrough. However, as you know, a person suggests, and God has.

Dmitry Demidenko for LiteForex

Read Original Articles on: Investing.com