The aggressive purchase of Gamestop video game retail seller attracted the attention of the financial market to the WallStreetBets community on the Reddit platform. Now this small group of retail buyers is suspected of involvement in pumping prices for silver up to an eight-year-old maximum

At the opening of the market on February 1, 2021, the price of precious metal jumped by 10% and almost punched the mark of $ 30 per ounce. Who actually stands for an unexpected rally on the silver market? Should I wait for similar boom for other promotions, raw materials or even cryptocompany?

Many news agencies, including Bloomberg, associate silver rapid growth with so-called rewarders, participants of the Reddit Forum, opposing the establishment. In addition to Gamestop, the WallStreetBets branch community has stolen many other shares, including Nokia, Blackberry and AMC. However, by recognizing the involvement of the stock market, users and moderators of the platform were aggressively distanced themselves from attempting to short silver compression.

Conversations about a possible short silver compression on R / WallStreetBets (abbreviated -wsb) began on January 27. In a special publication, it was argued that the cost of precious metal could grow from 25 to 1,000, dollars after a successful short compression.

However, public opinion quickly unfolded against supporters of buying silver and his derivatives. Popular publication in the branch loudly proclaimed: "No short compression of silver. No. NEVER".

Moderators of the branch also intervened and removed one of the earliest posts called for an attack on the precious metallol. However, January 30th. A small group of users separated and created the R / WallStreetsilver's own branch. But they failed to score a sufficient number of followers. At the time of publication, the number of subscribers barely exceeds 16,500. For comparison: in the R / WallStreetBets branch more than eight million users.

Reddit denies involvement in pumped silver

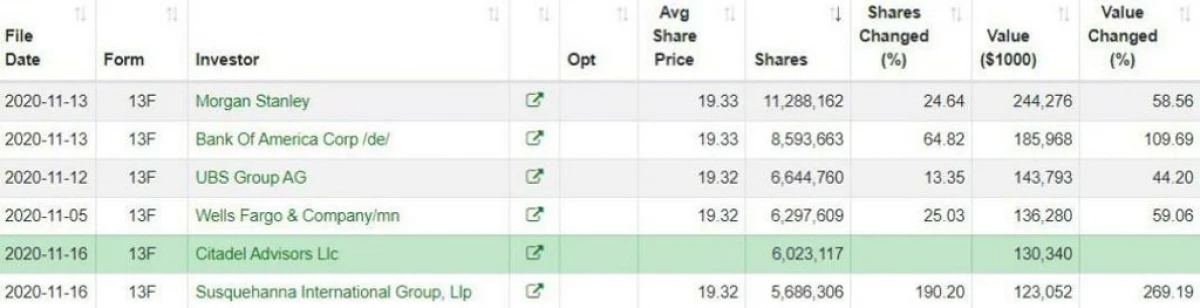

Many WallStreetBets subscribers believe that the jump in silver prices will benefit the organizations against which they ran. Indeed, large firms and hedge funds are among the largest precious metal holders.

Citadel investment company owns about six million silver shares. Investments of banks such as Morgan Stanley, Bank of America and Wells Fargo, twice as much. Citadel is one of the two firms that have invested about $ 3 billion in Melvin Capital, the infamous hedge fund, a little bit on a short position on Gamestop. WSB users reasoned that raising the price of silver will bring more benefits to these companies than in the average retail investor.

In addition, ETF such as IShares Silver Trust (SLV) is simply changing the cost of silver in time. ETF Supplier does not need to buy physical silver as new investments are received.

On the other hand, the purchase of shares provided by physical silver can cause a significant decline in the proposal, the forum inhabitants argued. This difference in demand and suggestions will lead to the physical delivery of large volumes of precious metal. Many hope that this will quickly lead to a price surge, just as the cost of Gamestop shares took off last month.

Other users also noted that calls to the short compression of silver mainly proceeded from users with new accounts. This discovery has confirmed earlier statements that provocateurs penetrated the branch. Last week, WSB members also argued that calls for silver compression could be a "coordinated attack" of firms with Wall Street.

WE'VE SEEN A LOT OF COMMENTARY ABOUT 'REDDIT TRADERS' AND SILVER, But by Our Numbers Only 3% of the Mentions of Tickers on WallStreetBets Today Were $ SLV. . Are the Mistaking Someone ELSE for US AS Usual?

- WallStreetBets MOD (@wsbmod) FEBRARY 1, 2021

Moving the attention of the community on silver, hedge funds hope to weaken the pressure of buyers on Gamestop. This will reduce the price and will allow these firms to safely close their short positions.

However, Reddit is an anonymous forum, so it is not possible to find out who these users is not possible. Whatever it was, WSB participants quickly returned to the Gamestop discussion. Already on February 2, 2021, most discussions on R / WallStreetBets were concentrated either on GME or on AMC.

According to rumors, Melvin Capital closed the position of Gamestop on January 27, however, the cumulative short position on the company's shares still exceeded 100%. However, on February 2, this figure fell to 39% of the number of shares in circulation. Reducing short interest confirms the assumption that hedge funds began to close short positions.

Cryptocurrency enters the chat

Silver ringed in price by almost 20% in three days, but there was another asset that she brought even more profit for the same period. The XRP token per day went up by more than 56% and on February 1, the region tested above $ 0.75.

IT's a Great Time to Be An $ XRP. Holder - IF You Have't Noticed Yet, Your Coins Have Gone Up Over 55% Today!

- Bitrue (@bitrueofficial) January 31, 2021

XRP IS AT The Heart Of Bitrue and We Support It in Our Loans and #PowerPiggy. Investments. Check out how to get 5.3% APR ON XRP HERE - https://t.co/wltwr88y0k.

XRP sustainably decreased from December 2020, that is, since the US Securities Commission (SEC) filed to the company-issuer tokens, Ripple. Only in the last month several large stock exchanges, including Coinbase and Binance, were excluded token from listing, or suspended bidding.

According to numerous reports, the price increase was initiated by a group in Telegram called "Buy & Hold XRP". In one day, the channel scored 200,000 participants of Telegram, and she had to be divided into two groups.

Screenshot with Reddit, showing XRP pumpingDespite stable growth over the past week, Apogia Pampa happened on February 1. Investors on Reddit and other social platforms called on to buy and keep coins as long as possible.

The XRP pump was initiated and organized outside the WallStreetBets branches. Nevertheless, the call "BUY AND HAVE" found support in the discussions of the XRP, although there was no fundamental basis for the strategy. In now a remote post on the R / RIPPLE, the user explained: "Why will the Pamp work Monday."

Why the Pamp will work on Monday: RedditWSB investors became interested in Tokyn, but still, the idea of pumping was met very cool. After a breakthrough $ 0.75, the bullish impulse began to fade and the course of the tokeny quickly went down. Within a few minutes, the XRP failed by 20% to $ 0.60 per token. By February 2, the token fell again below $ 0.39.

Large financial companies were bogged down in short positions on Gamestop and AMC shares without coverage. There was a unique opportunity for short compression. About XRP You will not say this: the SEC claim spoiled its fundamental indicators.

A few hours after the strategy "buy and keep" failed, retail investors came to Reddit to tell about their losses. In the R / XRP branch there were several posts, where people either complained about the event, or sympathized with losses.

One user wrote: "I sincerely thought that we can launch him and keep, and now I, together with hundreds of thousands of other people, is forced to watch how the price goes down."

As cryptocurrency can attract a new generation of investors

Although the XRP really spoiled the reputation of cryptocurrency in the eyes of some retail investors, the industry still has something to offer. Bitcoin (BTC) is a fundamental shift in our understanding of money. Unlike traditional fate currencies, governments cannot manipulate Bitcoin's offer.

Decentralized finance or DEFI projects offer paradigm shift for the financial industry. In the struggle for Gamestop, retail investors learned well the main thing: intermediaries can not be trusted. With DEFI users do not need to trust such platforms as RobinHood, and hope that they will act in good faith and in their interests.

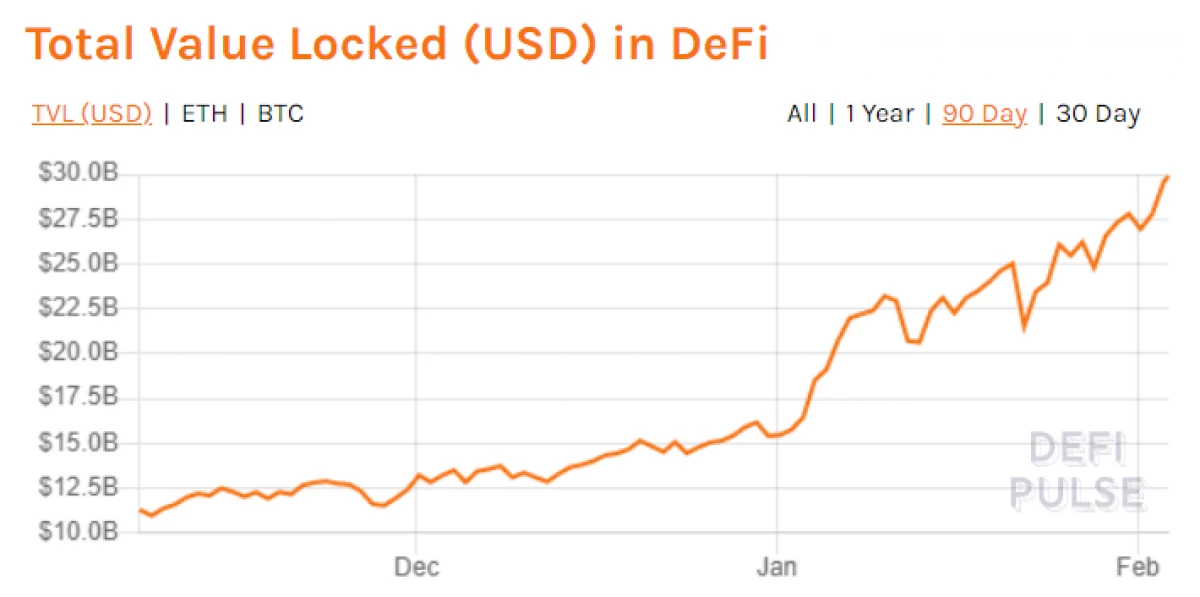

Many have imbued with this idea, as evidenced by the almost exponential growth of the ecosystem from mid-2020. According to DEFI Pulse, now in various protocols, assets worth more than $ 28 billion are blocked. They provide a variety of applications - from gaming to insurance.

The story with Gamestop has proven that the purchasing power of retail investors is the force with which you need to reckon. According to some data, sellers have lost $ 20 billion in this battle. This money switched to the hands of private investors, and from there, very soon in Crypto Industry.

The POST wallstreetbets traders did not bother XRP and silver. We tell who did the Appeared First On Beincrypto.